Revenues Rise 7%, 6%

Organic;

EPS up 23%, up 10% Excluding Current

Quarter Gain on Sale of Assets

Automatic Data Processing, Inc. (Nasdaq:ADP) reported revenue

growth of 7%, 6% organic, to $2.6 billion for the second fiscal

quarter ended December 31, 2011, Carlos A. Rodriguez, president and

chief executive officer, announced today. Pretax earnings and net

earnings increased 20% and 21%, respectively, and included a pretax

gain of $66 million, $41 million after tax, on the sale of assets

related to rights and obligations to resell a third-party expense

management platform. Diluted earnings per share of $0.76 increased

23% from $0.62 a year ago on fewer shares outstanding, including

$0.08 per share related to the gain on the sale. Excluding this

gain, pretax earnings and net earnings increased 6% and 8%,

respectively, and diluted earnings per share of $0.68 increased

10%. ADP acquired 6.3 million shares of its stock for treasury at a

cost of about $305 million fiscal year-to-date. Cash and marketable

securities were $1.5 billion at December 31, 2011.

Second Quarter Discussion

Commenting on the results, Mr. Rodriguez said, "ADP's results

were solid for the second quarter. I am particularly pleased

with our sales execution that drove strong new business sales

growth for Employer Services and PEO Services for the

quarter. As anticipated, ADP's year-over-year pretax margin

comparison continued to be negatively impacted by the decline in

high-margin client interest revenues resulting from lower interest

rates, and the impact of recent acquisitions. New business

sales for Dealer Services were also strong and better than

anticipated during the quarter.

Employer Services

"Employer Services' revenues grew 7% for the second quarter, 5%

organically, compared to last year's second quarter. The

number of employees on our clients' payrolls in the United States

increased 2.8% for the quarter as measured on a same-store-sales

basis for our clients on our AutoPay platform. Worldwide

client retention remained at excellent levels, but declined 0.2

percentage points fiscal year-to-date through December 31, 2011

compared to the same period a year ago. Employer Services'

pretax margin declined 120 basis points for the quarter, primarily

due to a drag of about 80 basis points from

acquisitions. Additionally, pretax margin was pressured by

higher sales and implementation expense, as well as investments in

service and product innovation.

"Combined Employer Services and PEO Services worldwide new

business sales increased 14% for the quarter. New business sales

represent annualized recurring revenues anticipated from new

orders.

PEO Services

"PEO Services' revenues increased 16% for the second quarter,

all organic, compared to last year's second quarter. PEO

Services' pretax margin improved 20 basis points for the

quarter. Average worksite employees paid by PEO Services

increased 13% for the quarter to approximately 251,000.

Dealer Services

"Dealer Services' revenues grew 7% for the second quarter, all

organic, compared to last year's second quarter. Dealer

Services' pretax margin improved 220 basis points for the quarter

due in large part to easier year-over-year comparisons as well as a

favorable grow-over impact of last year's acquisition-related costs

of 70 basis points.

Interest on Funds Held for Clients

"The safety, liquidity, and diversification of our clients'

funds are the foremost objectives of our investment strategy.

Client funds are invested in accordance with ADP's prudent and

conservative investment guidelines and the credit quality of the

investment portfolio is predominantly AAA/AA.

"For the second quarter, interest on funds held for clients

declined $11.1 million, or 9%, from $129.0 million a year ago to

$117.9 million, due to a decline of 50 basis points in the average

interest yield to 3.0%, partially offset by an increase of 6% in

average client funds balances from $14.7 billion to $15.6

billion.

Fiscal 2012 Forecast

"We moved into the second half of fiscal 2012 with solid

performance and good key business metrics in a somewhat mixed

economic environment. We anticipate that continued low

interest rates will further pressure margins and earnings

throughout the remainder of the fiscal year. Our forecasts

have been updated as noted below and exclude the gain realized in

the second quarter on the sale of assets, and reflect the

related lost revenue and earnings streams for the remainder of the

year:

- Total revenues – continue to anticipate 7% to 9% growth

- We continue to anticipate that the impact from foreign exchange

rates will become unfavorable during the second half of the year

and will be about neutral for the full year

- Diluted earnings per share – we anticipate an increase of 8% to

9% from $2.52 earnings per share in fiscal 2011, compared with our

prior forecasted range of an 8% to 10% increase. Our updated

forecast reflects $0.02 lost earnings per share for the remainder

of the year from the sale of assets

- Employer Services – continue to anticipate revenue growth of

about 7% with up to 30 basis points expansion in pretax margin

compared to our prior forecast of about 50 basis points expansion;

updated pretax margin expansion includes higher sales expense from

the increased sales growth forecast, slightly lower than

anticipated growth in average client funds balances as discussed

below, lost earnings from the sale of assets discussed above, and

the impact of acquisitions closed since our last update

- Pays per control – up about 2.5% for the year compared with our

prior estimate of up about 2%

- PEO Services – continue to anticipate revenue growth of about

17% with slight improvement in pretax margin compared to our prior

forecast for flat margins

- Employer Services and PEO Services new business sales – we

anticipate about 12% growth compared to $1.1 billion sold in fiscal

2011; this is up from our prior forecast of 8% to 10% growth

- Dealer Services – we anticipate revenue growth of 9% to 10%, up

from our prior forecast of 8% to 9% growth due to additional

revenues from the acquisition closed in the second quarter; about 3

percentage points of revenue growth is expected to result from

current year acquisitions and the full-year effect of last year's

acquisitions; we anticipate pretax margin expansion of at least 50

basis points compared to our prior forecast of about 50 basis

points.

"Interest on funds held for clients is expected to decline $45

to $55 million, or 8% to 10%, from $540.1 million in fiscal 2011,

and is based on 6% to 7% anticipated growth in average client funds

balances. This is updated from our previously forecasted decline of

$40 to $50 million, or 7% to 9%, which was based on 7% to 8% growth

in average client funds balances. Our forecast continues to

anticipate a decline of 40 to 50 basis points in the expected

average interest yield to 2.7% to 2.8%. The interest

assumptions in our forecasts are based on Fed Funds futures

contracts and forward yield curves as of January 23, 2012. The Fed

Funds futures contracts do not anticipate any changes during the

fiscal year in the Fed Funds target rate. The three-and-a-half

and five-year U.S. government agency rates based on the forward

yield curves as of January 23, 2012 were used to forecast new

purchase rates for the client extended and client long portfolios,

respectively.

"I am pleased with the strength in our key business metrics and

with our solid execution. Our business model is strong and we are

focused on enhancing our market leadership position by continuing

to invest in product innovation, as well as our distribution and

service capabilities. I am confident in our ability to achieve

our fiscal 2012 forecast and am optimistic about ADP's growth

opportunities," Mr. Rodriguez concluded.

Website Schedules

The schedules of quarterly and full-year revenue and pretax

earnings by reportable segment for fiscal years 2010, 2011, and

2012 have been updated for the second quarter of fiscal 2012 and

posted to the Investor Relations home page

(http://www.investquest.com/iq/a/adp/index.htm) of our website

www.ADP.com under Reportable Segments Financial Data.

An analyst conference call will be held today, Wednesday,

January 25 at 8:30 a.m. EST. A live webcast of the call

will be available to the public on a listen-only basis. To

listen to the webcast and view the slide presentation, go to ADP's

home page, www.ADP.com, or ADP's Investor Relations home page,

http://www.investquest.com/iq/a/adp/index.htm, and click on the

webcast icon. Please note, this webcast will be broadcast in

two streams: Windows Media and Flash. You may switch streams

by selecting "Windows Media" or "Flash" from the gear-setup symbol

located to the right-hand side of the volume control on the webcast

player. Please check your system 10 minutes prior to the

webcast. The presentation will be available to download and

print about 60 minutes before the webcast at the ADP Investor

Relations home page at

http://www.investquest.com/iq/a/adp/index.htm. ADP's news

releases, current financial information, SEC filings and Investor

Relations presentations are accessible at the same Web site.

About ADP

Automatic Data Processing, Inc. (Nasdaq:ADP), with about $10

billion in revenues and approximately 570,000 clients, is one of

the world's largest providers of business outsourcing solutions.

Leveraging over 60 years of experience, ADP offers a wide range

of human resource, payroll, tax and benefits

administration solutions from a single source. ADP's

easy-to-use solutions for employers provide superior value to

companies of all types and sizes. ADP is also a leading provider of

integrated computing solutions to auto, truck, motorcycle,

marine, recreational vehicle, and heavy equipment

dealers throughout the world. For more information about

ADP or to contact a local ADP sales office, reach us at

1.800.225.5237 or visit the company's Web site

at www.ADP.com.

| Automatic Data Processing, Inc. and

Subsidiaries |

|

|

| Condensed Consolidated Balance

Sheets |

|

|

| (In millions) |

|

|

| (Unaudited) |

|

|

| |

December 31, |

June 30, |

| |

2011 |

2011 |

| Assets |

|

|

| Cash and cash equivalents/Short-term |

|

|

| marketable securities |

$ 1,355.2 |

$ 1,425.7 |

| Other current assets |

2,022.4 |

2,022.2 |

| Total current assets before funds held

for clients |

3,377.6 |

3,447.9 |

| |

|

|

| Funds held for clients |

23,349.5 |

25,135.6 |

| Total current assets |

26,727.1 |

28,583.5 |

| |

|

|

| Long-term marketable securities |

98.7 |

98.0 |

| Property, plant and equipment, net |

707.9 |

716.2 |

| Other non-current assets |

4,950.7 |

4,840.6 |

| Total assets |

$ 32,484.4 |

$ 34,238.3 |

| |

|

|

| Liabilities and Stockholders'

Equity |

|

|

| Other current liabilities |

2,107.3 |

2,195.7 |

| Client funds obligations |

22,690.2 |

24,591.1 |

| Total current liabilities |

24,797.5 |

26,786.8 |

| |

|

|

| Long-term debt |

25.5 |

34.2 |

| Other non-current liabilities |

1,479.0 |

1,406.9 |

| Total liabilities |

26,302.0 |

28,227.9 |

| |

|

|

| Total stockholders' equity |

6,182.4 |

6,010.4 |

| Total liabilities and stockholders'

equity |

$ 32,484.4 |

$ 34,238.3 |

| |

|

|

| |

|

|

| Automatic Data

Processing, Inc. and Subsidiaries |

|

|

| Statements of

Consolidated Earnings |

|

|

|

| (In millions, except per

share amounts) |

|

|

|

| (Unaudited) |

|

|

|

|

| |

|

|

| |

Three Months Ended |

Six Months Ended |

| |

December 31, |

December 31, |

| |

2011 |

2010 |

2011 |

2010 |

| Revenues: |

|

|

|

|

| Revenues, other than interest

on funds |

|

|

|

| held for clients and PEO revenues |

$ 2,054.0 |

$ 1,921.0 |

$ 4,056.7 |

$ 3,684.8 |

| Interest on funds held for clients |

117.9 |

129.0 |

239.8 |

255.8 |

| PEO revenues (A) |

411.1 |

355.7 |

809.0 |

694.6 |

| Total revenues |

2,583.0 |

2,405.7 |

5,105.5 |

4,635.2 |

| |

|

|

|

|

| Expenses: |

|

|

|

|

| Costs of revenues: |

|

|

|

|

| Operating expenses |

1,307.7 |

1,173.6 |

2,600.3 |

2,290.3 |

| Systems development & programming

costs |

149.1 |

142.1 |

298.8 |

277.0 |

| Depreciation & amortization |

63.1 |

64.6 |

126.9 |

124.9 |

| Total costs of revenues |

1,519.9 |

1,380.3 |

3,026.0 |

2,692.2 |

| |

|

|

|

|

| Selling, general & administrative

expenses |

577.5 |

570.1 |

1,166.7 |

1,085.7 |

| Interest expense |

2.1 |

2.8 |

4.2 |

5.6 |

| Total expenses |

2,099.5 |

1,953.2 |

4,196.9 |

3,783.5 |

| |

|

|

|

|

| Other income, net (B) |

(96.2) |

(32.1) |

(130.4) |

(69.3) |

| |

|

|

|

|

| Earnings before income

taxes |

579.7 |

484.6 |

1,039.0 |

921.0 |

| |

|

|

|

|

| Provision for income taxes |

204.7 |

174.5 |

361.3 |

332.4 |

| |

|

|

|

|

| Net earnings |

$ 375.0 |

$ 310.1 |

$ 677.7 |

$ 588.6 |

| |

|

|

|

|

| Basic earnings per share |

$ 0.77 |

$ 0.63 |

$ 1.39 |

$ 1.20 |

| |

|

|

|

|

| Diluted earnings per share |

$ 0.76 |

$ 0.62 |

$ 1.38 |

$ 1.19 |

| |

|

|

|

|

| Dividends declared per common share |

$ 0.3950 |

$ 0.3600 |

$ 0.7550 |

$ 0.7000 |

| |

|

|

|

|

| (A) Professional Employer

Organization ("PEO") revenues are net of direct pass-through costs,

primarily consisting of payroll wages and payroll taxes, of

$4,810.4 and $4,231.3 for the three months ended December 31, 2011

and 2010, respectively, and $8,745.7 and $7,582.7 for the six

months ended December 31, 2011 and 2010, respectively. |

| (B) Includes a gain of $66.0

in the three and six months ended December 31, 2011 on the sale of

assets related to rights and obligations to resell a third-party

expense management platform. |

| |

|

|

|

|

| |

|

|

|

|

| Automatic Data Processing, Inc. and

Subsidiaries |

|

|

|

|

| Other Selected Financial

Data |

|

|

|

|

| (Dollars in millions, except per

share amounts) |

|

|

|

|

| (Unaudited) |

|

|

|

|

| |

Three Months Ended |

|

|

| |

December 31, |

|

|

|

| |

2011 |

2010 |

Change |

% Change |

| Revenues (A) |

|

|

|

|

| Employer Services |

$ 1,827.1 |

$ 1,707.2 |

$ 119.9 |

7% |

| PEO Services |

413.8 |

358.2 |

55.6 |

16% |

| Dealer Services |

412.6 |

386.0 |

26.6 |

7% |

| Other |

(70.5) |

(45.7) |

(24.8) |

(54)% |

| |

$ 2,583.0 |

$ 2,405.7 |

$ 177.3 |

7% |

| Pre-tax earnings from continuing

operations (A) |

|

|

|

|

| Employer Services |

$ 447.0 |

$ 438.0 |

$ 9.0 |

2% |

| PEO Services |

42.4 |

35.9 |

6.5 |

18% |

| Dealer Services |

70.5 |

57.5 |

13.0 |

23% |

| Other (B) |

19.8 |

(46.8) |

66.6 |

n/m |

| |

$ 579.7 |

$ 484.6 |

$ 95.1 |

20% |

| Pre-tax margin (A) |

|

|

|

|

| Employer Services |

24.5% |

25.7% |

(1.2)% |

|

| PEO Services |

10.2% |

10.0% |

0.2% |

|

| Dealer Services |

17.1% |

14.9% |

2.2% |

|

| Other |

n/m |

n/m |

n/m |

|

| |

22.4% |

20.1% |

2.3% |

|

| |

|

|

|

|

| |

Six Months Ended |

|

|

| |

December 31, |

|

|

| |

2011 |

2010 |

Change |

% Change |

| Revenues (A) |

|

|

|

|

| Employer Services |

$ 3,577.5 |

$ 3,306.5 |

$ 271.0 |

8% |

| PEO Services |

814.4 |

699.5 |

114.9 |

16% |

| Dealer Services |

820.4 |

732.2 |

88.2 |

12% |

| Other |

(106.8) |

(103.0) |

(3.8) |

(4)% |

| |

$ 5,105.5 |

$ 4,635.2 |

$ 470.3 |

10% |

| Pre-tax earnings from continuing

operations (A) |

|

|

|

|

| Employer Services |

$ 857.0 |

$ 820.4 |

$ 36.6 |

4% |

| PEO Services |

78.9 |

64.0 |

14.9 |

23% |

| Dealer Services |

133.6 |

107.2 |

26.4 |

25% |

| Other (B) |

(30.5) |

(70.6) |

40.1 |

57% |

| |

$ 1,039.0 |

$ 921.0 |

$ 118.0 |

13% |

| Pre-tax margin (A) |

|

|

|

|

| Employer Services |

24.0% |

24.8% |

(0.9)% |

|

| PEO Services |

9.7% |

9.1% |

0.5% |

|

| Dealer Services |

16.3% |

14.6% |

1.6% |

|

| Other |

n/m |

n/m |

n/m |

|

| |

20.4% |

19.9% |

0.5% |

|

| |

|

|

|

|

| (A) Prior year's segment results

were adjusted to reflect fiscal year 2012 budgeted foreign exchange

rates. |

| (B) Includes a gain of $66.0

in the three and six months ended December 31, 2011 on the sale of

assets related to rights and obligations to resell a third-party

expense management platform. |

| n/m - not meaningful |

| |

|

|

|

|

| |

Three Months Ended |

|

|

| |

December 31, |

Change in other |

|

| |

2011 |

2010 |

income, net |

|

| Components of other income, net: |

|

|

|

|

| Interest income on corporate funds |

$ (27.2) |

$ (27.9) |

$ (0.7) |

|

| Realized gains on available-for-sale

securities |

(14.8) |

(5.4) |

9.4 |

|

| Realized losses on available-for-sale

securities |

6.6 |

1.8 |

(4.8) |

|

| Impairment losses on available-for-sale

securities |

5.8 |

-- |

(5.8) |

|

| Gain on sale of assets |

(66.0) |

-- |

66.0 |

|

| Other, net |

(0.6) |

(0.6) |

-- |

|

| Total other income, net |

$ (96.2) |

$ (32.1) |

$ 64.1 |

|

| |

|

|

|

|

| |

Six Months Ended |

|

|

| |

December 31, |

Change in other |

|

| |

2011 |

2010 |

income, net |

|

| Components of other income, net: |

|

|

|

|

| Interest income on corporate funds |

$ (56.8) |

$ (58.7) |

$ (1.9) |

|

| Realized gains on available-for-sale

securities |

(19.1) |

(17.6) |

1.5 |

|

| Realized losses on available-for-sale

securities |

6.9 |

2.2 |

(4.7) |

|

| Impairment losses on available-for-sale

securities |

5.8 |

-- |

(5.8) |

|

| Impairment losses on assets held for

sale |

-- |

8.6 |

8.6 |

|

| Gain on disposal of intangible assets |

(66.0) |

-- |

66.0 |

|

| Gain on sale of assets |

-- |

(1.8) |

(1.8) |

|

| Other, net |

(1.2) |

(2.0) |

(0.8) |

|

| Total other income, net |

$ (130.4) |

$ (69.3) |

$ 61.1 |

|

| |

|

|

|

|

| |

|

|

|

|

| Automatic Data Processing, Inc. and

Subsidiaries |

|

|

|

|

| Other Selected Financial Data,

Continued |

|

|

|

|

| (Dollars in millions,

except per share amounts or where otherwise stated) |

|

|

|

| (Unaudited) |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

|

|

| |

December 31, |

|

|

| |

2011 |

2010 |

Change |

% Change |

| Earnings per share information: |

|

|

|

|

| Net earnings |

$ 375.0 |

$ 310.1 |

$ 64.9 |

21% |

| Basic weighted average shares

outstanding |

486.7 |

492.0 |

(5.3) |

(1)% |

| Basic earnings per share |

$ 0.77 |

$ 0.63 |

$ 0.14 |

22% |

| |

|

|

|

|

| Net earnings |

$ 375.0 |

$ 310.1 |

$ 64.9 |

21% |

| Diluted weighted average shares

outstanding |

492.4 |

496.9 |

(4.5) |

1% |

| Diluted earnings per share |

$ 0.76 |

$ 0.62 |

$ 0.14 |

23% |

| |

|

|

|

|

| |

Six Months Ended |

|

|

| |

December 31, |

|

|

|

| |

2011 |

2010 |

Change |

% Change |

| Earnings per share information: |

|

|

|

|

| Net earnings |

$ 677.7 |

$ 588.6 |

$ 89.1 |

15% |

| Basic weighted average shares

outstanding |

487.3 |

491.7 |

(4.4) |

(1)% |

| Basic earnings per share |

$ 1.39 |

$ 1.20 |

$ 0.19 |

16% |

| |

|

|

|

|

| Net earnings |

$ 677.7 |

$ 588.6 |

$ 89.1 |

15% |

| Diluted weighted average shares

outstanding |

492.8 |

495.9 |

(3.1) |

(1)% |

| Diluted earnings per share |

$ 1.38 |

$ 1.19 |

$ 0.19 |

16% |

| |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

|

|

| |

December 31, |

|

|

| |

2011 |

2010 |

|

|

| Key Statistics: |

|

|

|

|

| Internal revenue growth: |

|

|

|

|

| Employer Services |

5% |

5% |

|

|

| PEO Services |

16% |

15% |

|

|

| Dealer Services |

7% |

4% |

|

|

| |

|

|

|

|

| Employer Services: |

|

|

|

|

| Change in pays per control - AutoPay

product |

2.8% |

2.4% |

|

|

| Change in client revenue retention

percentage - worldwide |

(0.5) pts |

0.8 pts |

|

|

| Employer Services/PEO new business sales

growth - worldwide |

14% |

16% |

|

|

| |

|

|

|

|

| PEO Services: |

|

|

|

|

| Paid PEO worksite employees at end of

period |

253,000 |

224,000 |

|

|

| Average paid PEO worksite employees

during the period |

251,000 |

221,000 |

|

|

| |

|

|

|

|

| |

Six Months Ended |

|

|

| |

December 31, |

|

|

|

| |

2011 |

2010 |

|

|

| Key Statistics: |

|

|

|

|

| Internal revenue growth: |

|

|

|

|

| Employer Services |

6% |

5% |

|

|

| PEO Services |

16% |

15% |

|

|

| Dealer Services |

6% |

2% |

|

|

| |

|

|

|

|

| Employer Services: |

|

|

|

|

| Change in pays per control - AutoPay

product |

2.8% |

2.1% |

|

|

| Change in client revenue retention

percentage - worldwide |

(0.2) pts |

1.2 pts |

|

|

| Employer Services/PEO new business sales

growth - worldwide |

11% |

8% |

|

|

| |

|

|

|

|

| PEO Services: |

|

|

|

|

| Paid PEO worksite employees at end of

period |

253,000 |

224,000 |

|

|

| Average paid PEO worksite employees

during the period |

247,000 |

218,000 |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Automatic Data Processing, Inc. and

Subsidiaries |

|

|

|

|

| Other Selected Financial Data,

Continued |

|

|

|

|

| (Dollars in millions,

except per share amounts or where otherwise stated) |

|

|

|

| (Unaudited) |

|

|

|

|

| |

Three Months Ended |

|

|

| |

December 31, |

|

|

| |

2011 |

2010 |

Change |

% Change |

| Average investment balances at cost (in

billions): |

|

|

|

|

| Corporate, other than corporate

extended |

$ 1.3 |

$ 1.1 |

$ 0.1 |

11% |

| Corporate extended |

3.6 |

2.9 |

0.7 |

23% |

| Total corporate |

4.8 |

4.0 |

0.8 |

20% |

| Funds held for clients |

15.6 |

14.7 |

0.9 |

6% |

| Total |

$ 20.4 |

$ 18.7 |

$ 1.7 |

9% |

| |

|

|

|

|

| Average interest rates earned exclusive

of |

|

|

|

|

| realized losses (gains) on: |

|

|

|

|

| Corporate, other than corporate

extended |

0.9% |

1.0% |

|

|

| Corporate extended |

2.6% |

3.3% |

|

|

| Total corporate |

2.2% |

2.8% |

|

|

| Funds held for clients |

3.0% |

3.5% |

|

|

| Total |

2.8% |

3.4% |

|

|

| |

|

|

|

|

| Net unrealized gain position at end of

period |

$ 685.1 |

$ 557.9 |

|

|

| |

|

|

|

|

| Average short-term financing (in

billions): |

|

|

|

|

| U.S. commercial paper borrowings |

$ 3.3 |

$ 2.4 |

|

|

| U.S. & Canadian reverse repurchase

agreement borrowings |

0.3 |

0.5 |

|

|

| |

$ 3.6 |

$ 2.9 |

|

|

| |

|

|

|

|

| Average interest rates paid on: |

|

|

|

|

| U.S. commercial paper borrowings |

0.1% |

0.2% |

|

|

| U.S. & Canadian reverse repurchase

agreement borrowings |

0.7% |

0.5% |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Interest on funds held for clients |

$ 117.9 |

$ 129.0 |

$ (11.1) |

(9)% |

| Corporate extended interest income (C) |

23.5 |

24.6 |

(1.1) |

(4)% |

| Corporate interest expense-short-term

financing (C) |

(1.4) |

(2.1) |

0.7 |

35% |

| |

$ 140.0 |

$ 151.5 |

$ (11.5) |

(8)% |

| |

|

|

|

|

| |

Six Months Ended |

|

|

| |

December 31, |

|

|

|

| |

2011 |

2010 |

Change |

% Change |

| Average investment balances at cost (in

billions): |

|

|

|

|

| Corporate, other than corporate

extended |

$ 1.3 |

$ 1.3 |

$ 0.0 |

3% |

| Corporate extended |

3.5 |

2.9 |

0.7 |

24% |

| Total corporate |

4.9 |

4.1 |

0.7 |

18% |

| Funds held for clients |

15.4 |

14.2 |

1.1 |

8% |

| Total |

$ 20.2 |

$ 18.4 |

$ 1.9 |

10% |

| |

|

|

|

|

| Average interest rates earned exclusive

of |

|

|

|

|

| realized losses (gains) on: |

|

|

|

|

| Corporate, other than corporate

extended |

0.9% |

1.0% |

|

|

| Corporate extended |

2.8% |

3.6% |

|

|

| Total corporate |

2.3% |

2.8% |

|

|

| Funds held for clients |

3.1% |

3.6% |

|

|

| Total |

2.9% |

3.4% |

|

|

| |

|

|

|

|

| Net unrealized gain position at end of

period |

$ 685.1 |

$ 557.9 |

|

|

| |

|

|

|

|

| Average short-term financing (in

billions): |

|

|

|

|

| U.S. commercial paper borrowings |

$ 3.2 |

$ 2.3 |

|

|

| U.S. & Canadian reverse repurchase

agreement borrowings |

0.4 |

0.6 |

|

|

| |

$ 3.5 |

$ 2.9 |

|

|

| |

|

|

|

|

| Average interest rates paid on: |

|

|

|

|

| U.S. commercial paper borrowings |

0.1% |

0.3% |

|

|

| U.S. & Canadian reverse repurchase

agreement borrowings |

0.5% |

0.4% |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Interest on funds held for clients |

$ 239.8 |

$ 255.8 |

$ (16.0) |

(6)% |

| Corporate extended interest income (C) |

49.1 |

51.9 |

(2.8) |

(5)% |

| Corporate interest expense-short-term

financing (C) |

(2.8) |

(4.1) |

1.3 |

32% |

| |

$ 286.0 |

$ 303.6 |

$ (17.6) |

(6)% |

| |

|

|

|

|

| (C) While "Corporate

extended interest income" and "Corporate interest expense

-short-term financing" are non-GAAP disclosures, management

believes this information is beneficial to reviewing the financial

statements of ADP. Management believes this information is

beneficial as it allows the reader to understand the extended

investment strategy for ADP's client funds assets, corporate

investments and short-term borrowings. A reconciliation of the

non-GAAP measures to GAAP measures is as follows: |

| |

| |

|

|

|

|

| Automatic Data Processing, Inc. and

Subsidiaries |

|

|

|

|

| Other Selected Financial Data,

Continued |

|

|

|

|

| (Dollars in millions,

except per share amounts or where otherwise stated) |

|

|

|

| (Unaudited) |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

|

|

| |

December 31, |

|

|

| |

2011 |

2010 |

|

|

| |

|

|

|

|

| Corporate extended interest income |

$ 23.5 |

$ 24.6 |

|

|

| All other interest income |

3.7 |

3.3 |

|

|

| Total interest income on corporate

funds |

$ 27.2 |

$ 27.9 |

|

|

| |

|

|

|

|

| Corporate interest expense - short-term

financing |

$ 1.4 |

$ 2.1 |

|

|

| All other interest expense |

0.7 |

0.7 |

|

|

| Total interest expense |

$ 2.1 |

$ 2.8 |

|

|

| |

|

|

|

|

| |

Six Months Ended |

|

|

| |

December 31, |

|

|

| |

2011 |

2010 |

|

|

| |

|

|

|

|

| Corporate extended interest income |

$ 49.1 |

$ 51.9 |

|

|

| All other interest income |

7.7 |

6.8 |

|

|

| Total interest income on corporate

funds |

$ 56.8 |

$ 58.7 |

|

|

| |

|

|

|

|

| Corporate interest expense - short-term

financing |

$ 2.8 |

$ 4.1 |

|

|

| All other interest expense |

1.4 |

1.5 |

|

|

| Total interest expense |

$ 4.2 |

$ 5.6 |

|

|

| |

|

| |

|

| Automatic Data

Processing, Inc. and Subsidiaries |

|

| Consolidated Statements

of Adjusted / Non-GAAP Financial Information |

| (In millions, except per

share amounts) |

|

|

| (Unaudited) |

|

|

|

| |

|

|

|

|

| The following table reconciles

the Company's results for the three and six months ended December

31, 2011 to adjusted results that exclude the sale of assets

related to rights and obligations to resell a third-party expense

management platform. The Company uses certain adjusted results,

among other measures, to evaluate the Company's operating

performance in the absence of certain items and for planning and

forecasting of future periods. The Company believes that the

adjusted results provide relevant and useful information for

investors because it allows investors to view performance in a

manner similar to the method used by the Company's management and

improves their ability to understand the Company's operating

performance. Since adjusted earnings and adjusted diluted EPS

are not measures of performance calculated in accordance with U.S.

GAAP, they should not be considered in isolation of, or as a

substitute for, earnings and diluted EPS and they may not be

comparable to similarly titled measures employed by other

companies. |

| |

|

|

|

|

| |

Three months ended

December 31, 2011 |

| |

Earnings before income taxes |

Provision for income taxes |

Net earnings |

Diluted EPS |

| |

|

|

|

|

| As Reported |

$ 579.7 |

$ 204.7 |

$ 375.0 |

$ 0.76 |

| |

|

|

|

|

| Less Adjustments: |

|

|

|

| Gain on sale of assets |

66.0 |

24.8 |

41.2 |

0.08 |

| |

|

|

|

|

| As Adjusted |

$ 513.7 |

$ 179.9 |

$ 333.8 |

$ 0.68 |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

Six months ended December

31, 2011 |

| |

Earnings before income taxes |

Provision for income taxes |

Net earnings |

Diluted EPS |

| |

|

|

|

|

| As Reported |

$ 1,039.0 |

$ 361.3 |

$ 677.7 |

$ 1.38 |

| |

|

|

|

|

| Less Adjustments: |

|

|

|

| Gain on sale of assets |

66.0 |

24.8 |

41.2 |

0.08 |

| |

|

|

|

|

| As Adjusted |

$ 973.0 |

$ 336.5 |

$ 636.5 |

$ 1.29 |

This document and other written or oral statements made from

time to time by ADP may contain "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995. Statements that are not historical in nature and which may be

identified by the use of words like "expects," "assumes,"

"projects," "anticipates," "estimates," "we believe," "could be"

and other words of similar meaning, are forward-looking statements.

These statements are based on management's expectations and

assumptions and are subject to risks and uncertainties that may

cause actual results to differ materially from those expressed.

Factors that could cause actual results to differ materially from

those contemplated by the forward-looking statements include: ADP's

success in obtaining, retaining and selling additional services to

clients; the pricing of products and services; changes in laws

regulating payroll taxes, professional employer organizations and

employee benefits; overall market and economic conditions,

including interest rate and foreign currency trends; competitive

conditions; auto sales and related industry changes; employment and

wage levels; changes in technology; availability of skilled

technical associates and the impact of new acquisitions and

divestitures. ADP disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise. These risks and uncertainties, along

with the risk factors discussed under "Item 1A. - Risk Factors" in

our Annual Report on Form 10-K for the fiscal year ended June 30,

2011 should be considered in evaluating any forward-looking

statements contained herein.

CONTACT: Automatic Data Processing, Inc.

ADP Investor Relations

Elena Charles, 973.974.4077

Debbie Morris, 973.974.7821

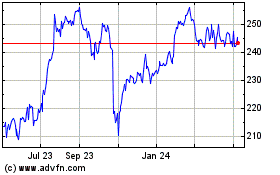

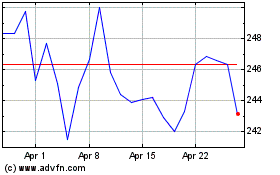

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Nov 2023 to Nov 2024