Paychex's New Tax Solution for SMB - Analyst Blog

December 28 2011 - 4:45AM

Zacks

Paychex Inc.

(PAYX) has recently introduced two new tools that aim at solving

certain tax credit related problems for the small and medium

businesses (SMBs). The tools, namely Small Business Tax Credit

Estimator and Small Business Tax Credit Package, have been

innovated by Paychex Insurance Agency, a wholly owned subsidiary of

Paychex.

SMBs offering health insurance to

their employees are likely to receive certain tax benefits by way

of tax credits. These tools will be of immense importance for them

to calculate tax credits arising from payment of health insurance

premiums.

The first tool is a free web-based

tool and can be accessed through the website PaychexInsurance.com.

The tool follows the IRS (Internal revenue Service) guidelines and

based on employees’ hours, wages, premiums, and employer

contributions, it helps to calculate the estimated credit.

Using the second tool, small

business owners can assess their eligibility to receive the tax

credit and thereby they can file for the same, if found eligible.

However, to reap the benefits of the package for the 2012 calendar

tax year, business owners have to be a Paychex payroll and Paychex

Insurance Agency client for the entire 2012 calendar year.

It can be seen that both the tools

are not directly linked to revenue generation. But this might bring

a light of hope for the company by way of winning new businesses

from the SMB sector.

The SMB sector is being hit hard by

lackluster demand due to high unemployment and inflation rates.

Paychex is highly dependent on the performance of the SMB sector

and this is the reason the company may not see much revenue growth

in the near term.

Despite the concern in the SMB

sector, Paychex delivered modest second quarter results by

marginally beating the Zacks Consensus Estimate on bottom line.

Moreover, we are encouraged by Paychex’ endeavour to introduce a

software-as-a-service (SaaS) application that is tailor-made for

Apple Inc.’s (AAPL) iPad. With this, the ace

payroll, human resource, and benefits outsourcing solutions

provider will be able to compete its rivals, Automated Data

Processing Inc. (ADP) and Intuit Inc.

(INTU), whose SaaS-based mobile solutions have already gained

decent market share.

Paychex has a Zacks # 3 Rank,

implying a short-term Hold recommendation.

APPLE INC (AAPL): Free Stock Analysis Report

AUTOMATIC DATA (ADP): Free Stock Analysis Report

INTUIT INC (INTU): Free Stock Analysis Report

PAYCHEX INC (PAYX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

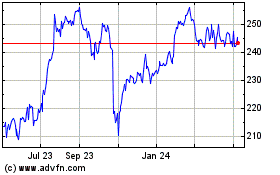

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Oct 2024 to Nov 2024

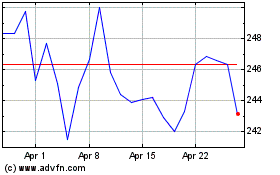

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Nov 2023 to Nov 2024