Ameristar Casinos Completes $2.2 Billion Financing to Repay Existing Debt and Fund Stock Repurchase From the Estate of Craig H.

April 14 2011 - 1:20PM

Marketwired

Ameristar Casinos, Inc. (NASDAQ: ASCA) today announced that it has

obtained $2.2 billion of new debt financing that has been or will

be used (i) to repurchase its outstanding 9¼% Senior Notes due 2014

tendered pursuant to the tender offer announced on March 29, 2011,

including payment of the tender premium and accrued interest, (ii)

to prepay and permanently retire all of the indebtedness under

Ameristar's existing senior secured credit facilities, (iii) to

repurchase 26,150,000 shares of Ameristar common stock from the

Estate of Craig H. Neilsen as previously announced, (iv) to pay

related fees and expenses and (v) for Ameristar's general corporate

and working capital purposes. Ameristar expects to close the stock

repurchase transaction on April 19, 2011. Approximately 99.9% of

the $650 million aggregate principal amount of 9¼% Senior Notes due

2014 were tendered and repurchased pursuant to an early settlement

date under the tender offer, and the tender offer will remain open

until April 25, 2011.

"We are extremely pleased with this refinancing, which should

allow Ameristar to quickly complete the stock repurchase from the

Neilsen Estate," said Thomas Steinbauer, Ameristar's Chief

Financial Officer. "Excluding certain one-time costs, we expect the

repurchase to be immediately accretive to Ameristar's earnings per

share. The refinancing also reduces the weighted-average interest

rate on the Company's outstanding debt from approximately 6.7% to

approximately 5.4% based on current LIBOR rates and provides

flexibility in the near term to retire significant amounts of debt,

while preserving Ameristar's ability to take advantage of

appropriate growth opportunities that may arise in the future."

The new financing consists of $800 million principal amount of

unsecured 7.50% Senior Notes due 2021 and $1.4 billion of new

senior secured credit facilities. The new senior secured credit

facilities include (i) a $200 million A term loan that was fully

borrowed at closing and matures in 2016, (ii) a $700 million B term

loan that was fully borrowed at closing and matures in 2018 and

(iii) a $500 million revolving credit facility, $368 million of

which was borrowed at closing and which matures in 2016. Upon the

satisfaction of certain conditions, Ameristar will have the option

to increase the total amount available under the credit facilities

by up to the greater of an additional $200 million or an amount

determined by reference to Ameristar's total net leverage

ratio.

The A term loan and the revolving loan facility currently bear

interest at the London Interbank Offered Rate (LIBOR) plus 275

basis points or the base rate plus 175 basis points, at Ameristar's

option. The B term loan bears interest at LIBOR (subject to a LIBOR

floor of 1%) plus 300 basis points or the base rate (subject to a

base rate floor of 2%) plus 200 basis points, at Ameristar's

option. The LIBOR margin for the A term loan and the revolving loan

facility is subject to reduction based on Ameristar's total net

leverage ratio. The commitment fee on the revolving loan facility

is 50 basis points, subject to reduction based on the total net

leverage ratio.

Wells Fargo Securities, LLC, Deutsche Bank Securities Inc.,

Merrill Lynch, Pierce, Fenner & Smith Incorporated, J.P. Morgan

Securities LLC and Credit Agricole Securities (USA) Inc. acted as

joint book-running managers for the notes offering. Wells Fargo

Securities, LLC, Deutsche Bank Securities Inc., Merrill Lynch,

Pierce, Fenner & Smith Incorporated and J.P. Morgan Securities

Inc. acted as joint lead arrangers and joint book-runners for the

credit facilities. Deutsche Bank Trust Company Americas is acting

as administrative agent for a group of commercial banks and other

institutional lenders under the credit facilities.

The notes have not initially been registered under the

Securities Act of 1933 or any state securities law and may not be

offered or sold in the United States absent registration or an

applicable exemption from registration under the Securities Act and

applicable state securities laws. This press release does not

constitute an offer to sell any security and shall not constitute

an offer, solicitation or sale in any jurisdiction in which such

offer or sale would be unlawful.

Forward-Looking Information This release

contains certain forward-looking information that generally can be

identified by the context of the statement or the use of

forward-looking terminology, such as "believes," "estimates,"

"anticipates," "intends," "expects," "plans," "is confident that,"

"should" or words of similar meaning, with reference to Ameristar

or our management. Similarly, statements that describe our future

plans, objectives, strategies, financial results or position,

operational expectations or goals are forward-looking statements.

It is possible that our expectations may not be met due to various

factors, many of which are beyond our control, and we therefore

cannot give any assurance that such expectations will prove to be

correct. For a discussion of relevant factors, risks and

uncertainties that could materially affect our future results,

attention is directed to "Item 1A. Risk Factors" and "Item 7.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Annual Report on Form 10-K for the

year ended December 31, 2010.

About Ameristar Ameristar Casinos, Inc. is

a leading Las Vegas-based gaming and entertainment company known

for its premier properties characterized by state-of-the-art casino

floors and superior dining, lodging and entertainment offerings.

Ameristar's focus on the highest quality gaming experience and

exceptional guest service has earned it leading positions in the

markets in which it operates. Founded in 1954 in Jackpot, Nev.,

Ameristar has been a public company since November 1993. The

Company has a portfolio of eight casinos in seven markets:

Ameristar Casino Resort Spa St. Charles (greater St. Louis);

Ameristar Casino Hotel East Chicago (Chicagoland area); Ameristar

Casino Hotel Kansas City; Ameristar Casino Hotel Council Bluffs

(Omaha, Neb., and southwestern Iowa); Ameristar Casino Hotel

Vicksburg (Jackson, Miss., and Monroe, La.); Ameristar Casino

Resort Spa Black Hawk (Denver metropolitan area); and Cactus Petes

Resort Casino and The Horseshu Hotel and Casino in Jackpot, Nev.

(Idaho and the Pacific Northwest).

Visit Ameristar Casinos' website at www.ameristar.com (which

shall not be deemed to be incorporated in or a part of this news

release).

CONTACT: Tom Steinbauer Senior Vice President, Chief

Financial Officer Ameristar Casinos, Inc. 702-567-7000

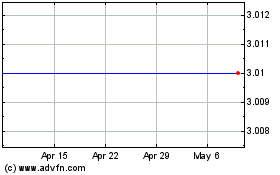

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Apr 2024 to May 2024

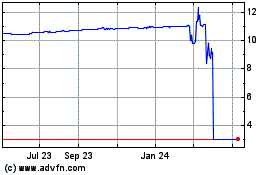

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2023 to May 2024