Ameristar Casinos, Inc. (NASDAQ: ASCA) announced today that it has

commenced a cash tender offer (the "Offer") for any and all of the

outstanding $650,000,000 aggregate principal amount of its 9 1/4%

Senior Notes due 2014 (CUSIP Nos. 03070QAL5 and 03070QAK7) (the

"Notes") and a solicitation of consents to certain proposed

amendments to the indenture governing the Notes (the "Indenture").

The Offer is scheduled to expire at 11:59 p.m., New York City

time, on April 25, 2011, unless extended or earlier terminated (the

"Expiration Time"). Holders who validly tender their Notes and

provide their consents to the amendments to the Indenture before

5:00 p.m., New York City time, on April 11, 2011, unless extended

(the "Consent Expiration"), will be eligible to receive the total

consideration (as discussed below). The Offer contemplates an early

settlement option, so that holders whose Notes are validly tendered

prior to the Consent Expiration and accepted for purchase could

receive payment prior to the Expiration Time. Tenders of Notes may

be validly withdrawn and consents may be validly revoked until the

Withdrawal Time (defined below).

The total consideration for each $1,000 principal amount of

Notes validly tendered and not validly withdrawn prior to the

Consent Expiration is $1,100.14, which includes a consent payment

of $30.00 per $1,000 principal amount of Notes. Holders tendering

after the Consent Expiration will be eligible to receive only the

tender offer consideration, which is $1,070.14 for each $1,000

principal amount of Notes, and does not include a consent payment.

Holders whose Notes are purchased in the Offer will also receive

accrued and unpaid interest from the most recent interest payment

date for the Notes to, but not including, the applicable settlement

date.

In connection with the Offer, Ameristar is soliciting consents

to certain proposed amendments to the Indenture. Holders may not

tender their Notes without delivering consents or deliver consents

without tendering their Notes. No consent payments will be made in

respect of Notes tendered after the Consent Expiration. Following

receipt of the consent of holders of at least a majority in

aggregate principal amount of the Notes, Ameristar will execute a

supplemental indenture to amend the Indenture to eliminate

substantially all of the restrictive covenants and certain events

of default in the Indenture.

Tendered Notes may be withdrawn and consents may be revoked

before 5:00 p.m., New York City time, on April 11, 2011, unless

extended (the "Withdrawal Time"), but generally not later. Any

extension, termination or material amendment of the Offer will be

followed as promptly as practicable by a public announcement

thereof.

The Offer is subject to the satisfaction of certain conditions,

including: (1) receipt of consents to the amendments to the

Indenture from holders of a majority in principal amount of the

outstanding Notes, (2) execution of a supplemental indenture

effecting the amendments, (3) consummation of new debt financing

raising net proceeds in an amount sufficient to fund, among other

things, the Offer and (4) certain other customary conditions.

The complete terms and conditions of the Offer are described in

the Offer to Purchase and Consent Solicitation Statement dated

March 29, 2011, copies of which may be obtained from D.F. King

& Co., Inc., the depositary and information agent for the

Offer, at (800) 829-6551 (US toll free) or, for banks and brokers,

(212) 269-5550.

Ameristar has engaged Wells Fargo Securities, LLC and Deutsche

Bank Securities Inc. to act as the exclusive dealer managers and

solicitation agents in connection with the Offer. Questions

regarding the terms of the Offer may be directed to Wells Fargo

Securities, Liability Management Group, at (866) 309-6316 (US

toll-free) and (704) 715-8341 (collect) or to Deutsche Bank

Securities, Liability Management Group, at (855) 287-1922 (US

toll-free) and (212) 250-7527 (collect).

This announcement is not an offer to purchase, a solicitation of

an offer to purchase or a solicitation of consents with respect to

any securities. The Offer is being made solely by the Offer to

Purchase and Consent Solicitation Statement dated March 29, 2011.

The Offer is not being made to holders of Notes in any jurisdiction

in which the making or acceptance thereof would not be in

compliance with the securities, blue sky or other laws of such

jurisdiction.

Forward-Looking Information

This release contains certain forward-looking information that

generally can be identified by the context of the statement or the

use of forward-looking terminology, such as "believes,"

"estimates," "anticipates," "intends," "expects," "plans," "is

confident that," "should" or words of similar meaning, with

reference to Ameristar or our management. Similarly, statements

that describe our future plans, objectives, strategies, financial

results or position, operational expectations or goals, including

with respect to the Offer and consent solicitation and related

financing plans, are forward-looking statements. It is possible

that our expectations may not be met due to various factors, many

of which are beyond our control, including uncertainties concerning

the availability of acceptable financing, and we therefore cannot

give any assurance that such expectations will prove to be correct.

For a discussion of relevant factors, risks and uncertainties that

could materially affect our future results, attention is directed

to "Item 1A. Risk Factors" and "Item 7. Management's Discussion and

Analysis of Financial Condition and Results of Operations" in our

Annual Report on Form 10-K for the year ended December 31,

2010.

About Ameristar Ameristar Casinos, Inc. is

a leading Las Vegas-based gaming and entertainment company known

for its premier properties characterized by state-of-the-art casino

floors and superior dining, lodging and entertainment offerings.

Ameristar's focus on the highest quality gaming experience and

exceptional guest service has earned it leading positions in the

markets in which it operates. Founded in 1954 in Jackpot, Nev.,

Ameristar has been a public company since November 1993. The

Company has a portfolio of eight casinos in seven markets:

Ameristar Casino Resort Spa St. Charles (greater St. Louis);

Ameristar Casino Hotel East Chicago (Chicagoland area); Ameristar

Casino Hotel Kansas City; Ameristar Casino Hotel Council Bluffs

(Omaha, Neb., and southwestern Iowa); Ameristar Casino Hotel

Vicksburg (Jackson, Miss., and Monroe, La.); Ameristar Casino

Resort Spa Black Hawk (Denver metropolitan area); and Cactus Petes

Resort Casino and The Horseshu Hotel and Casino in Jackpot, Nev.

(Idaho and the Pacific Northwest).

Visit Ameristar Casinos' website at www.ameristar.com (which

shall not be deemed to be incorporated in or a part of this news

release).

CONTACT: Tom Steinbauer Senior Vice President, Chief

Financial Officer Ameristar Casinos, Inc. 702-567-7000

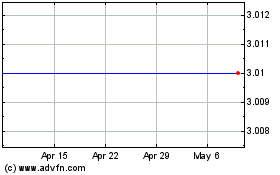

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Apr 2024 to May 2024

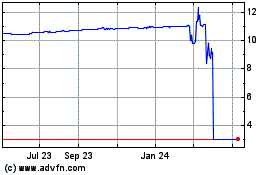

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2023 to May 2024