Is Bitcoin Gearing Up For A Bigger Rally? Here’s What On-Chain Data Reveals

September 30 2024 - 10:30PM

NEWSBTC

Bitcoin has seen an uptick in price enough to recover from the

losses in value from August. So far, the asset has surged by nearly

10% in the past two weeks alone, registering a 24-hour high of

$66,000 earlier today, although BTC has now seen a slight

retracement, currently trading at $63,508. Amid this price

performance, Axel Adler Jr, an analyst from the on-chain analytics

platform CryptoQuant, has shed light on the potential for Bitcoin

to see a bigger rally shortly based on key indicators. Related

Reading: Bitcoin Set For Biggest September Gains In A Decade:

Here’s Why Bitcoin Key Indicator Pointing To A Bigger Rally

According to Adler, a significant shift observed in Bitcoin’s

market activity appears to suggest that the crypto market might be

gearing up for a bullish momentum soon. One of the focal points of

Adler’s analysis is the “Exchange Flow Multiple,” which plays a

crucial role in understanding the movement of Bitcoin on exchanges.

This indicator measures the ratio between short-term (30-day) and

long-term (365-day) Bitcoin inflows and outflows on exchanges. When

this multiple declines, short-term exchange movements are

considerably lower than long-term ones, which could point to

decreased volatility. Adler Jr elaborates on this by highlighting

two primary factors that influence the decline of Bitcoin Exchange

Flow Multiple. The CryptoQuant analyst mentioned Long-Term Holders

Retaining Assets as the first factor. Also referred to as

“HODLers,” long-term Bitcoin holders when not actively trading

their assets, preferring to hold onto them with the expectation of

future price increases, can lead to a decline in exchange flow

multiple. The analyst also draws attention to the natural market

correction and recovery process. The market typically needs time to

stabilize after significant drops in Bitcoin’s price. This

stabilization period reduces exchange activity as investors wait

for a clearer price direction. Adler Jr noted that a low exchange

flow multiple in such contexts might reflect a “wait-and-see”

attitude among investors, anticipating a favorable price shift

before they re-enter the market actively. Drawing Parallels To

2023’s Bull Market Adler Jr’s analysis further indicates that the

current behavior of the Exchange Flow Multiple resembles patterns

seen before previous rallies. Notably, similar low levels of the

indicator were observed before the major market uptrend in 2023.

Related Reading: Bitcoin Breaks $66,000, But Analyst Warns Against

Fresh Longs—Here’s Why The CryptoQuant analyst disclosed that if

history were to repeat itself, the current situation might set the

stage for the next significant upward movement in Bitcoin’s price.

Featured image created with DALL-E, Chart from TradingView

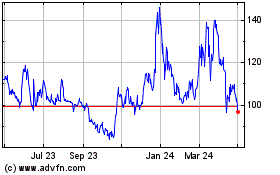

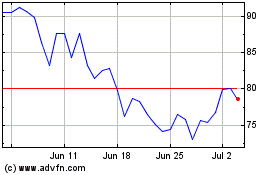

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024