This Is The On-Chain Level That Made The Bitcoin Crash Bottom

August 15 2024 - 12:00AM

NEWSBTC

On-chain data suggests the Bitcoin price found its bottom following

the recent crash around this important investor cost basis level.

Bitcoin Found Its Bottom Near Active Investor’s Cost Basis

According to the latest weekly report from Glassnode, Bitcoin

formed its recent bottom near the cost basis of the “active

investors.” To understand what this level represents, two other

indicators need to be looked at first: the Realized Price and the

Liveliness. Related Reading: Bitcoin ETFs Are “Important, But Not

The Drivers,” On-Chain Analyst Argues The Realized Price refers to

the cost basis or acquisition price of the average investor on the

BTC network. The metric determines this by going through the

transaction history of each token in circulation to find what price

it was last moved at. It then works with the assumption that this

previous transfer was the last time that the coin changed hands and

so, takes the price at its time to be its current cost basis.

Finally, it averages this value out for the entire supply,

producing a price that’s often considered to be BTC’s “fair value.”

The other indicator, the Liveliness, basically keeps track of the

spending/HODLing behavior of the investors. This metric makes use

of the concept of “coin days” to calculate its value. A coin day is

a quantity that 1 BTC is said to accumulate after staying dormant

on the blockchain for 1 day. Thus, when HODLing occurs on the

network, new coin days are “created” each day, while when spending

occurs, coin days that had been accumulated earlier are

“destroyed.” The Liveliness measures the ratio between the

cumulative sum of coin days destroyed and the cumulative sum of

coin days created over the cryptocurrency’s history. As such,

whenever the market is showing a HODLing dominant behavior, the

metric’s value tends towards the zero mark, as a low amount of coin

days are seeing destruction. Similarly, it leans towards 1 when

distribution is high. Now, the actual indicator of focus in the

current discussion is the “Realized Price-to-Liveliness Ratio,”

also known as the Active Investor’s Cost Basis. This indicator adds

a weightage factor to Bitcoin’s Realized price (that is, its fair

value) using the Liveliness. Related Reading: Bitcoin Whales

Participate In $588 Million Selloff: Is There More To Come? With

this modification, BTC’s fair value is estimated higher when

HODLing is dominant and lower when distribution is happening. The

below chart shows the trend in the Bitcoin Realized

Price-to-Liveliness Ratio over the past decade: As displayed in the

above graph, the Bitcoin Realized Price-to-Liveliness Ratio is

currently at a value of $51,300. In The recent price crash, BTC

ended up finding a bottom not too far from this mark. “The Active

Investor’s Cost-Basis can be considered as a key threshold

delineating bullish and bearish investor sentiment,” notes

Glassnode. “Since the market managed to find support near this

level speaks to a degree of underlying strength, suggesting

investors are generally still anticipating positive market momentum

in the short-to-medium-term.” BTC Price Bitcoin has seen a jump of

almost 4% during the last 24 hours, which has taken its price above

$61,000. Featured image from Dall-E, Glassnode.com, chart from

TradingView.com

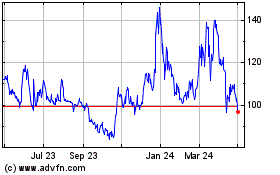

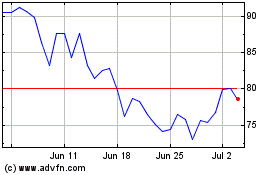

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Oct 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024