Ethereum Targets $3,000 After Market Shakeout, CryptoQuant Sees Impulsive Bull Run Ahead

August 13 2024 - 5:00AM

NEWSBTC

After enduring a significant downturn at the beginning of the past

week, Ethereum (ETH), the second-largest cryptocurrency, has staged

a modest recovery, reclaiming the crucial $2,600 level and setting

its sights on the $3,000 milestone once again. The August 5 crash,

which saw Ethereum’s price plummet to $2,112, marked the year’s

largest market slump. However, the digital asset has since bounced

back, 8% in the last seven days, hinting at the possibility of a

more sustained bullish trend. Massive Ethereum Liquidations Trigger

Bullish Signals According to a recent report by market analytics

firm CryptoQuant on the ETH’s price action, the chart below

highlights a substantial liquidation of long perpetual positions on

the futures market experienced during last week’s crash. The

firm notes that in sustained bull markets, such a significant

liquidation event is often followed by a major price rally as the

futures market stabilizes and spot buying pressure takes over.

Related Reading: Legendary Fibonacci Extension Reveals When Bitcoin

Will Reach $109,000 “The recent cascade has triggered massive long

liquidations, reaching levels not seen since November 2022,” the

firm noted. “This substantial liquidation likely indicates a

cooling of the futures market, where many leveraged positions have

been flushed out. Such a development can set the stage for renewed

interest in the futures market.” With the futures market

potentially resetting, CryptoQuant believes that if demand returns,

Ethereum could be poised for another impulsive bullish surge in the

longer term that could send prices above previous all-time high

levels. ETH’s Price Path To $3,000 Crypto analyst Caleb

Franzen echoed a similar prediction for ETH’s price in a social

media post on the X platform (formerly Twitter), suggesting that if

Ethereum can take out the $2,725 level, it could signal a strong

move higher. Franzen’s analysis of the 4-hour candles and

market structure indicates a series of higher lows and a bullish

reading on the supertrend indicators, further fueling the optimism

surrounding Ethereum’s future performance. Related Reading: Bitcoin

Investors Again Show Extreme Fear As BTC Slips To $59,000 However,

with ETH currently trading at $2,645, the first resistance on the

ETH/USDT weekly chart, located at the $2,700 level, has proven to

be the first hurdle for the second-largest cryptocurrency to

overcome in recent days. In a scenario where the current rally

extends into the coming weeks and the ETH price tackles the level

highlighted by Franzen, the $2,900 and $2,990 resistance walls

would be the last obstacles to reclaim the $3,000 level.

Conversely, the token will need to secure and consolidate above the

$2,550 level to prevent further declines toward the next support on

the daily chart, currently located at the $2,345 level following

its 25% correction. Featured image from DALL-E, chart from

TradingView.com

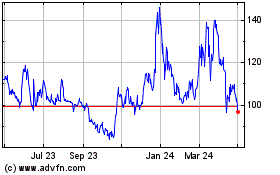

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Oct 2024

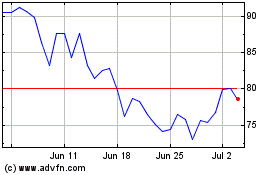

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024