AVAX Soars 9% As Avalanche And Chainlink Announce Partnership For Global Asset Circulation

March 25 2024 - 9:00PM

NEWSBTC

According to a recent announcement from blockchain platform

Avalanche (AVAX), Australia and New Zealand Banking Group (ANZ) has

partnered with Chainlink (LINK) Labs to explore the potential of

on-chain digital assets for global movement and settlement.

Using Chainlink’s Cross-Chain Interoperability Protocol (CCIP), the

collaboration aims to connect the Avalanche and Ethereum (ETH)

blockchains to enable uninterrupted delivery versus payment (DvP)

settlement of tokenized assets across networks in multiple

currencies. Tokenized Asset Transaction Across Avalanche And

Ethereum Using Chainlink ANZ, a provider of banking products and

services to millions of customers in nearly 30 markets, has

reportedly taken an unusual approach to exploring the world of

on-chain digital assets. By leveraging Chainlink’s CCIP, ANZ

is validating how customers can access, trade, and settle tokenized

assets across multiple networks and currencies using Delivery vs.

Payment. This approach aims to improve settlement efficiency and

risk management for digital assets that fall under the

classification of “securities” and their transactions. Related

Reading: Social Media Storm Gives Dogecoin 14% Price Boost –

Details According to Avalanche, Chainlink’s CCIP has been “crucial”

in abstracting the complexities of moving tokenized assets across

various blockchains, ensuring “atomic” cross-chain Delivery vs.

Payment settlement. Notably, within the collaboration, ANZ

simulated a transaction where a customer used ANZ’s Digital Asset

Services (DAS) portal to purchase tokenized ANZ-issued New Zealand

dollar stablecoins (NZ$DC) on Avalanche. Subsequently, the

customer purchased tokenized Australian nature-based assets issued

as non-fungible tokens (NFTs), denominated in tokenized ANZ-issued

Australian dollar stablecoins (A$DC), on Ethereum.

Furthermore, ANZ facilitated the FX conversion between the two

currencies, while CCIP provided the necessary infrastructure to

transfer tokens and data between Ethereum and Avalanche. ANZ

Harnesses Avalanche’s Evergreen Subnet Monday’s announcement also

revealed that ANZ used its Avalanche Evergreen Subnet for the

project, leveraging its Ethereum Virtual Machine (EVM)

compatibility, permissioning, and custom gas token features.

The Evergreen Subnet allowed ANZ to explore new use cases and

business models using customizable networks like Avalanche. ANZ’s

collaboration with Chainlink and Avalanche showcases how

traditional financial institutions embrace blockchain technology to

enhance capital markets. Ultimately, Avalanche revealed that

the initial results of the test transactions were promising, and

the initiative could change how the financial services industry

approaches tokenized assets. The next steps include deploying

the solution on blockchain mainnets and extending the workflows to

include communication between different blockchain networks for

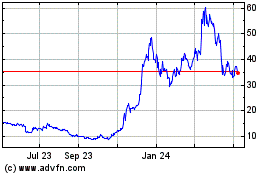

different use cases. AVAX Nears 22-Month High At the time of

writing, Avalanche’s token AVAX has been on a steady uptrend,

resulting in a remarkable increase of over 60% in the last 30 days.

Currently, the token is trading at $58.31, just below its 22-month

high of $65 set on Monday the 18th. Within the last 24 hours, AVAX

experienced a 9% increase after the announcement of the

collaboration with Chainlink and ANZ Group. This surge allowed the

token to break through the $55 resistance level. However, the $60

level is expected to be another obstacle that could lead to a

consolidation period between $55 and $60 should the bullish

momentum fade. Related Reading: Why Is The Price Of LUNC And USTC

Up Today? Further demonstrating the interest in AVAX, the token’s

trading volume in the last 24 hours reached $1,135,122,192,

indicating a significant increase of 127.20% compared to the

previous day. Featured image from Shutterstock, chart from

TradingView.com

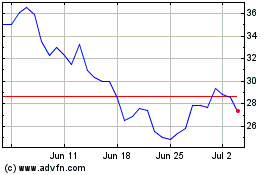

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024