More Good News on Jobs - Real Time Insight

March 07 2013 - 4:10AM

Zacks

It looks like yesterday’s February ADP numbers are no

fluke. Last week’s unemployment claims data, which add the

weight of the first week of March to the overall data, came in

positive.

More signs the economy is picking up steam.

In the week ending March 2, the advance figure for seasonally

adjusted initial claims was 340,000, a decrease of

-7,000 from the previous week's revised figure of 347,000. The

4-week moving average was 348,750, a decrease of -7,000 from the

previous week's revised average of 355,750.

Here was the important background data in the big states…

STATES WITH A DECREASE OF MORE THAN 1,000

- California had a -40,352 decrease in claims. It says that

there are fewer layoffs in all sectors, with the largest decrease

coming from the services industry.

- New York had a much smaller -2,070 decrease. It says fewer

layoffs in construction, retail, healthcare, and the social

services industry contributed.

- In Texas, with its -1,334 decrease, there was no note.

Any thoughts?

Do you agree that this is another leading indicator of

coming improvement in jobs data tomorrow and next

month?

SPDR-DJ IND AVG (DIA): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

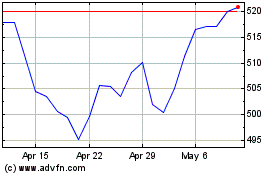

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Aug 2024 to Sep 2024

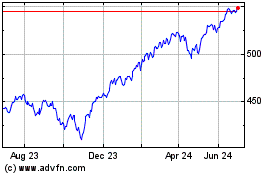

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Sep 2023 to Sep 2024