Lingering economic conditions and still high unemployment rates

are weighing on domestic equity markets. The market chaos is

compelling investors to look for other investments beyond equities.

At present, fixed-income markets, high yield bonds in particular,

look attractive.

The global high yield bond ETF market has grown to a

multi-billion dollar segment. While part of this reason is due to

high yields and low default rates, outperformance on a broader

perspective is also a key reason as well (Read: Seven Biggest Bond

ETFs By Assets Under Management).

These trends have been especially important due to anemic stock

returns and low yields from traditional investments. Broad equity

indexes have remained flat, while ten year Treasury bonds remain

depressed below 2%, well under their historical averages.

Furthermore, although default rates are expected to rise, many

are looking for just a modest increase in defaults, but one that is

still below the long-term average of 4%. Given this and the

likelihood of low rates for the near future, it could be a very

interesting time to make a play on the high yield bond ETF

market.

These bond ETFs also often cost investors less in fees than

their mutual fund counterparts while also allowing for better

control of tax issues. Additionally, the greater trading

flexibility and transparency of the ETF structure helps to give

investors a better picture of the investing landscape and could cut

down on risk and volatility when compared to single issues of high

yield bonds (read: Three Impressive High Yield Junk Bond ETFs).

While there are a number of options in this segment, we have

taken a closer look at four of our favorite domestic high yield

bond ETFs below. In a low rate environment, these funds could

provide investors with income potential and relatively stable

returns while remaining low correlated assets. With these benefits

in focus, any of the following funds could be interesting picks for

investors seeking to make a play on this market corner at this

time:

Peritus High Yield ETF

(HYLD)

Investors seeking capital appreciation in addition to high

yields may find AdvisorShares entrant in December 2010, an

attractive play in the bond market. This is an actively managed

fund that invests in a focused portfolio of high yield debt

securities, which include senior and subordinated corporate debt

obligations (such as bonds, debentures, notes and commercial paper)

and loans.

Having total assets of $91.3 million in its portfolio, the

product does not have any limitation on maturity and includes

short-term, medium-term and long-term maturities. It also looks to

avoid new issues of debt while it also has the ability to cycle

into U.S. T-Bills when the high yield market is crumbling.

The fund represents the junk corporate bonds with the lower

effective duration of roughly 3.32 years, higher average yield to

maturity of 10.81% and higher average coupon rate of 9.85%. In

terms of credit quality, HYLD focuses on low-investment grade bonds

(B+ and lower) and holds about 37 securities.

The ETF is widely diversified across sectors. Healthcare bonds

take the top position in the basket followed by transportation and

oil & gas. (Read: Could The Small Cap Healthcare ETF Be A Great

Pick?)

The product has shown a nice run-up in its prices this year,

surging about 3.7% year-to-date. However, in the past one year

period, the fund is flat from a capital gains perspective.

Nevertheless, the fund charges fees of 1.35% per year, which looks

expensive, and has a higher turnover ratio of 81% on average.

SPDR Barclays Capital High Yield Bond ETF

(JNK)

For another option in the high yield bond ETF space, investors

have the ultra-popular JNK, initiated in November 2007. With assets

of $11.1 billion under its management, the fund tracks the overall

performance of the Barclays Capital High Yield Very Liquid Index,

which includes fixed-rate, taxable, low rated corporate bonds

usually ‘BBB’ and below.

With lower fees of 40 bps per year, the fund is heavily exposed

to the industrial sector and holds around 228 bonds in its basket.

The product has an average duration of 4.56 years and average yield

to maturity of 7.87%. (Read: iShares Debuts Two High Yield Bond

ETFs)

JNK provides an attractive dividend yield of 6.35%, much like

other high yield junk bond ETFs. It has generated annual returns of

3.9% in the last one-year period from a capital gains look.

iBoxx $ High Yield Corporate Bond Fund

(HYG)

The fund, issued by iShares in April 2007, seeks to match the

performance of the iBoxx $ Liquid High Yield Index, before fees and

expenses. The product holds 601 junk bonds with heavy focus on

short and intermediate term corporates.

With an effective duration of 4.28 years and average yield to

maturity of 7.14%, the product has an attractive coupon rate of

7.95%. In terms of credit quality, it focuses on lower grade bonds

that have ratings of ‘BBB’ and lower.

Consumer service, financials, and oil & gas constitute the

large part of the fund’s assets with Blackrock notes on top,

followed by Sprint Nextel’s notes due in 2018 and Citigroup notes

due in 2017. (See more ETFs in the Zacks ETF

Center)

This ETF with AUM of $14.6 billion is cheap, charging only 50

bps a year in fees. HYG delivers a huge dividend of 5.53% per annum

and excellent annual returns of 5.5% over the past one year

period.

PowerShares Fundamental High Yield Corporate Bond

Portfolio (PHB)

This ETF seeks to replicate the price and yield of the RAFI High

Yield Bond Index, holding 220 securities. The fund holds U.S. bonds

registered for sale in the U.S. that have at least one year until

maturity and focus on B to BBB rated bonds.

Unlike other products in the space, this ETF weights securities

by a combination of fundamental factors (Read: Are the Fundamental

Bond ETFs Better Fixed Income Picks?). With total assets of $937.6

million, the fund has a low effective duration of 3.98 years and

targets only mid-term corporate bonds. The average yield to

maturity and average coupon rate is 5.60% and 7.51%,

respectively.

Consumer discretionary constitutes the top spot in the basket,

followed by energy and financials. The product is light on

utilities and information technology (Read: Utility ETFs: Slumping

Sector in Rebounding Market). PHB yields 5.46% per annum and

delivered an impressive 5.7% annual return over the last year. It

also looks cheap as it charges only 50 bps in fees a year, which

isn’t the lowest but is at a very respectable level.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-IBX HYCB (HYG): ETF Research Reports

PERITUS-HIGH YL (HYLD): ETF Research Reports

SPDR-BC HY BD (JNK): ETF Research Reports

PWRSH-FUN HY CP (PHB): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

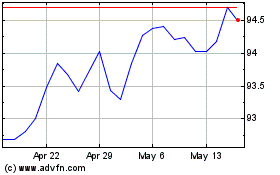

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From Apr 2024 to May 2024

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From May 2023 to May 2024