Oil ETFs Jump on Syria Turmoil - ETF News And Commentary

August 29 2013 - 11:04AM

Zacks

Crude oil prices

rebounded to the triple-digit mark at the start of the second half

of the year after being stuck in a relatively tight range for much

of the first half.

The commodity gained luster from encouraging economic data from the

U.S., China and Euro zone as well as supply disruptions in the

North Sea, Egypt and Libya (read: Oil ETFs Surge on Strong Data).

Additionally, the commodity benefitted from the minutes of the

latest Fed meeting, which suggested that QE3 tapering may not start

soon.

Moreover, the ongoing tension in Syria has pushed the oil prices

even higher this week. Brent oil hit a six month high and is

currently hovering around $117 per barrel while crude oil reached

its two-year high to about $112 per barrel.

Syria Threatens Oil Supply

The threat of military action in Syria could not only disrupt oil

supplies in the rest of the Middle East including Nigeria, Libya

and Sudan but raise alarms in the other oil exporting neighboring

countries such as Iran and Iraq. Middle East accounts for about

one-third of the world’s total

oil’s production.

As such, any supply disruptions in the region may lead to further

rise in the oil prices. Moreover, rising global demand on the back

of improving economies continues to act as a catalyst to the oil

price surge (read: Bet on an Oil Surge with these 3 ETFs).

Market Impact

Growing concern over Syria outweighed the negative inventory data

report from Energy Information Administration (EIA) for last week.

According to the report, the U.S. crude stockpiles rose 3 million

barrels to 362 million barrels last week (ending August 23) against

the market expectation of a decline of 0.3 million

barrels.

The impressive jump in crude and Brent prices also had a big impact

on oil ETFs this week, helping these to gains as well. Below,

we have highlighted a few popular oil ETFs that could be

interesting plays in the coming days, given the intensifying

worries over Syria (see: all the energy ETFs here).

United States Brent Oil Fund (BNO)

This fund provides direct exposure to the spot price of Brent crude

oil on a daily basis through future contracts. It has amassed $39.7

million in its asset base and trades in small volume of roughly

35,000 shares a day.

The ETF charges 96 bps in annual fees and expenses. BNO added about

4.5% this week and 15.2% since the start of the second half.

United States Oil Fund (USO)

This is the most popular and liquid ETF in the oil space with AUM

of over $1.5 billion and average daily volume of over 5.7 million

shares. The fund seeks to match the performance of the spot price

of light sweet crude oil West Texas Intermediate (WTI). The ETF has

0.74% in expense ratio.

The ETF gained nearly 3% in the last three trading days and is up

over 14% at the start of the second half (read: 3 Metal ETFs to Buy

on the Commodity Upswing).

PowerShares DB Oil Fund (DBO)

This product also provides exposure to crude oil through WTI

futures contracts and follows the DBIQ Optimum Yield Crude Oil

Index Excess Return. The fund sees solid average daily volume of

more than 233,000 shares and AUM of $350 million. It charges an

expense ratio of 79 bps.

DBO gained 1.4% so far this week and is up 8.7% in the first two

months of the second half of the year.

iPath S&P GSCI Crude Oil Index ETN (OIL)

This is an ETN option for oil investors and delivers returns

through an unleveraged investment in the West Texas Intermediate

(WTI) crude oil futures contract. The product follows the S&P

GSCI Crude Oil Total Return Index, a subset of the S&P GSCI

Commodity Index (read: 2 Commodity ETFs Offering Investors Sweet

Returns).

The note has amassed $415 million in AUM so far and does volume of

roughly 555,000 shares a day. It charges 75 bps in fees per year

from investors. The ETN is up 3.4% this week and 16% since the

start of the second half.

Bottom

Line

Oil climbed nearly 27% from this year’s lows reached in mid April

thanks to solid global data reports and dovish Fed comments. The

more recent surge was propelled by political unrest in Egypt and

the threat of U.S. intervention in Syria's civil war, suggesting

that the trend could continue in the near future (see more in the

Zacks ETF Center).

If it does, investors could consider any of the aforementioned oil

ETFs for exposure. These could be solid ways to play the trend, and

may be better performers compared to some of the sluggish oil

companies for a continued run in crude oil prices in the near

term.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

US BRENT OIL FD (BNO): ETF Research Reports

PWRSH-DB OIL FD (DBO): ETF Research Reports

IPATH-GS CRUDE (OIL): ETF Research Reports

US-OIL FUND LP (USO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

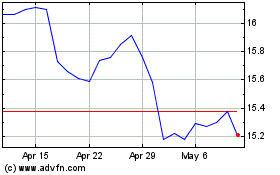

Invesco DB Oil (AMEX:DBO)

Historical Stock Chart

From Apr 2024 to May 2024

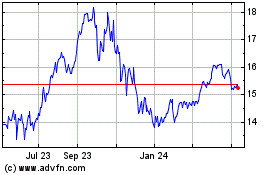

Invesco DB Oil (AMEX:DBO)

Historical Stock Chart

From May 2023 to May 2024