inTEST Corporation (NASDAQ: INTT), an independent designer,

manufacturer and marketer of semiconductor automatic test equipment

(ATE) interface solutions and temperature management products,

today announced results for the 2011 second quarter ended June 30,

2011.

2011 Second Quarter Highlights:

- Second quarter bookings of $13.5 million marked the Company's

third sequential quarter of bookings growth fueled by strong

contributions from its Thermal Products segment; and increased 3%

as compared with first quarter bookings of $13.1 million.

- Second quarter net revenues of $13.8 million increased 18% as

compared with first quarter net revenues of $11.7 million and

decreased 10% from second quarter 2010 net revenues of $15.3

million.

- Second quarter gross margin was $6.8 million, or 49%, as

compared with $5.1 million, or 44%, in the first quarter of 2011

and $7.4 million, or 48%, in the second quarter of 2010.

- Second quarter net earnings of $2.7 million, or $0.26 per

diluted share, increased over first quarter net earnings of $1.3

million, or $0.12 per diluted share, and decreased as compared with

second quarter 2010 net earnings of $3.2 million, or $0.31 per

diluted share. First quarter 2011 net earnings reflect the effect

of approximately $128,000 in non-recurring costs related to the

first quarter relocation of both the Company's corporate

headquarters and the operations of Temptronic Corporation. Second

quarter 2011 net earnings reflect the effect of approximately

$64,000 of non-recurring costs associated with the preparation and

filing of the Company's Registration Statement on Form S-3 on May

3, 2011.

Robert E. Matthiessen, inTEST Corporation's President and Chief

Executive Officer, commented, "We again reported solid results for

the second quarter. Bookings, net revenues and net earnings all

improved on a sequential basis, fueled by continued strong

contributions from our Thermal Products segment, which we have

strategically diversified to address growth markets in both the

semiconductor and non-semiconductor areas, including aerospace,

defense, automotive, telecommunications and medical pharmaceutical.

During the second quarter our non-semiconductor related bookings

grew to 28% from 18% in the first quarter, which places the Company

in a position to somewhat offset the softening order rate that has

recently impacted the overall semiconductor industry." Mr.

Matthiessen concluded, "Although we are experiencing some near term

softness in demand, our customers continue to strategically

increase their overall test capacity as they seek to meet end

market demand for a broad range of products. Accordingly, we are

confident that the long-term growth prospects for inTEST

Corporation remain positive."

Third Quarter 2011 Financial Outlook: The

Company expects that net revenue for the third quarter ended

September 30, 2011 will be in the range of $12.0 to $13.0 million

and that net earnings will be in the range of $0.13 to $0.18 per

diluted share. The third quarter net earnings guidance provided is

before giving effect to a possible reversal of our deferred tax

asset valuation allowances. The third quarter outlook is based on

the Company's current views with respect to operating and market

conditions and customers' forecasts, which are subject to

change.

Second Quarter 2011 Investor Conference Call /

Webcast Details: There will be a conference call with

investors and analysts this evening at 5:00 p.m. EDT to discuss the

Company's second quarter 2011 results and management's current

expectations and views of the industry. The call may also include

discussion of strategic, operating, product initiatives or

developments, or other matters relating to the Company's current or

future performance.

The dial-in number for the live audio call beginning at 5 p.m.

EDT on August 3, 2011 is +1- (480) 629-9857. The Passcode for the

conference call is 4461548. Please reference inTEST Q2 2011

Financial Results Conference Call. A live webcast of the conference

call will be available on inTEST's website at www.intest.com, under

the 'Investors' section.

A replay of the call will be available 2 hours following the

call through midnight on August 12, 2011 by telephone at

+1-303-590-3030. The conference ID number to access the replay is

4461548. Additionally, an archive of the webcast is available for a

period of one year at inTEST's website at www.intest.com, under the

'Investors' section.

About inTEST Corporation inTEST

Corporation is an independent designer, manufacturer and marketer

of ATE interface solutions and temperature management products,

which are used by semiconductor manufacturers to perform final

testing of integrated circuits (ICs) and wafers. The Company's

high-performance products are designed to enable semiconductor

manufacturers to improve the speed, reliability, efficiency and

profitability of IC test processes. Specific products include

positioner and docking hardware products, temperature management

systems and customized interface solutions. The Company has

established strong relationships with semiconductor manufacturers

globally, which it supports through a network of local offices. For

more information visit www.intest.com.

Forward-Looking Statements: This press

release includes forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements do not convey historical information, but relate to

predicted or potential future events that are based upon

management's current expectations. These statements are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. In

addition to the factors mentioned in this press release, such risks

and uncertainties include, but are not limited to, changes in

business conditions and the economy; changes in the demand for

semiconductors; changes in the rates of, and timing of, capital

expenditures by semiconductor manufacturers; progress of product

development programs; increases in raw material and fabrication

costs associated with our products; implementation of restructuring

initiatives and other risk factors set forth from time to time in

our SEC filings, including, but not limited to, our periodic

reports on Form 10-K and Form 10-Q. The Company undertakes no

obligation to update the information in this press release to

reflect events or circumstances after the date hereof or to reflect

the occurrence of anticipated or unanticipated events.

- Tables Follow -

SELECTED FINANCIAL DATA

(Unaudited)

(In thousands, except per share data)

Condensed Consolidated Statements of Operations Data:

Three Months Ended Six Months Ended

------------------------------ -------------------

6/30/2011 6/30/2010 3/31/2011 6/30/2011 6/30/2010

--------- --------- --------- --------- ---------

Net revenues $ 13,800 $ 15,260 $ 11,704 $ 25,504 $ 24,789

Gross margin 6,798 7,368 5,093 11,891 11,905

Operating expenses:

Selling expense 1,587 1,754 1,385 2,972 2,983

Engineering and product

development expense 822 787 813 1,635 1,488

General and

administrative expense 1,666 1,653 1,634 3,300 3,134

Operating income 2,723 3,174 1,261 3,984 4,300

Other income (expense) 10 (8) 56 66 (19)

Earnings before income

tax expense (benefit) 2,733 3,166 1,317 4,050 4,281

Income tax expense

(benefit) 78 (2) 60 138 1

Net earnings 2,655 3,168 1,257 3,912 4,280

Net earnings per share -

basic $ 0.26 $ 0.32 $ 0.13 $ 0.39 $ 0.43

Weighted average shares

outstanding - basic 10,147 10,007 10,068 10,107 10,000

Net earnings per share -

diluted $ 0.26 $ 0.31 $ 0.12 $ 0.38 $ 0.42

Weighted average shares

outstanding - diluted 10,297 10,186 10,267 10,282 10,093

Condensed Consolidated Balance Sheets Data:

As of:

--------------------------------

6/30/2011 3/31/2011 12/31/2010

---------- ---------- ----------

Cash and cash equivalents $ 8,879 $ 5,248 $ 6,895

Trade accounts receivable, net 8,278 8,833 6,244

Inventories 4,267 4,003 3,489

Total current assets 21,590 18,351 17,058

Net property and equipment 1,137 1,243 718

Total assets 26,274 23,204 21,408

Accounts payable 2,105 2,325 1,672

Accrued expenses 3,717 3,217 3,445

Total current liabilities 5,979 5,693 5,265

Noncurrent liabilities - 10 39

Total stockholders' equity 20,295 17,501 16,104

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contacts: inTEST Corporation Hugh T. Regan, Jr. Treasurer

and Chief Financial Officer Tel: 856-505-8999 Investors: Laura

Guerrant-Oiye Principal Guerrant Associates Email Contact Tel:

(808) 882-1467

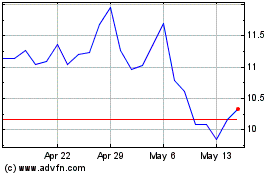

inTest (AMEX:INTT)

Historical Stock Chart

From Oct 2024 to Nov 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Nov 2023 to Nov 2024