ICU Medical, Inc. (Nasdaq:ICUI), a leader in the development,

manufacture and sale of innovative medical devices used in infusion

therapy and critical care applications, today announced financial

results for the quarter and fiscal year ended December 31, 2017.

Fourth Quarter 2017 Results

Fourth quarter 2017 revenue was $370.1 million, compared to

$95.7 million in the same period last year. GAAP gross profit for

the fourth quarter of 2017 was $137.5 million, as compared to $50.8

million in the same period last year. GAAP gross margin for

the fourth quarter of 2017 was 37%, as compared to 53% in the same

period last year. GAAP net income for the fourth quarter of

2017 was $49.7 million, or $2.33 per diluted share, as compared to

GAAP net income of $9.5 million, or $0.54 per diluted share, for

the fourth quarter of 2016. Adjusted diluted earnings per

share for the fourth quarter of 2017 were $2.98 as compared to

$1.20 for the fourth quarter of 2016. Also, adjusted EBITDA

was $70.1 million for the fourth quarter of 2017 as compared to

$34.3 million for the fourth quarter of 2016.

Full Fiscal Year 2017 Results

Fiscal year 2017 revenue was $1.3 billion, compared to $379.4

million in the same period last year. GAAP net income for fiscal

year 2017 was $68.6 million, or $3.29 per diluted share, as

compared to GAAP net income of $63.1 million, or $3.66 per diluted

share, for fiscal year 2016. Adjusted diluted earnings per share

for fiscal year 2017 were $6.45 as compared to $4.88 for fiscal

year 2016. Also, adjusted EBITDA was $222.5 million for fiscal year

2017 as compared to $134.1 million for fiscal year 2016.

Adjusted EBITDA and adjusted diluted earnings per share are

measures calculated and presented on the basis of methodologies

other than in accordance with GAAP. Please refer to the Use of

Non-GAAP Financial Information following the financial statements

herein for further discussion and reconciliations of these measures

to GAAP measures.

Vivek Jain, ICU Medical's Chief Executive Officer, said, "Fourth

quarter revenues, adjusted EBITDA and adjusted diluted earnings per

share were slightly above our expectations.”

Form 10-K Filing

The Annual Report on Form 10-K for the year ended December 31,

2017 (the "Form 10-K"), will be the Company's first annual filing

since the completion of the Hospira Infusion Systems business (the

"HIS Acquisition"). The complexity of matters related

thereto, including the scale of the HIS Acquisition, have required

substantial management attention and the Company has experienced

unforeseen delays in collecting and compiling certain financial and

other related data that would be included in the Form 10-K in

connection with the HIS Acquisition. Accordingly, the Company

requires additional time to complete certain disclosures and

analyses to be included in the Form 10-K and is therefore unable to

file its Form 10-K within the prescribed time period without

unreasonable effort or expense. The Company does not expect

any material changes to the financial results from the press

release to be reflected in the Form 10-K when filed. The

Company intends to file the Form 10-K within the fifteen day

extension period provided by Rule 12b-25.

Revenues by market segment for the three and twelve

months ended December 31, 2017 and 2016 were as follows (in

millions):

| |

|

Three months endedDecember

31, |

|

|

|

|

|

Year endedDecember

31, |

|

|

|

Market Segment |

|

2017 |

|

2016 |

|

$Change |

|

%Change |

|

2017 |

|

2016 |

|

$Change |

|

%Change |

| Infusion

Consumables |

|

$ |

119.7 |

|

|

$ |

82.1 |

|

|

$ |

37.6 |

|

|

45.8 |

% |

|

$ |

365.6 |

|

|

$ |

324.9 |

|

|

$ |

40.7 |

|

|

12.5 |

% |

| IV Solutions** |

|

146.5 |

|

|

— |

|

|

146.5 |

|

|

* |

|

522.0 |

|

|

— |

|

|

522.0 |

|

|

* |

| Infusion Systems |

|

87.6 |

|

|

— |

|

|

87.6 |

|

|

* |

|

290.2 |

|

|

— |

|

|

290.2 |

|

|

* |

| Critical Care |

|

12.8 |

|

|

13.4 |

|

|

(0.6 |

) |

|

(4.5 |

)% |

|

50.0 |

|

|

53.6 |

|

|

(3.6 |

) |

|

(6.7 |

)% |

| Other |

|

3.6 |

|

|

0.2 |

|

|

3.4 |

|

|

1,700.0 |

% |

|

64.8 |

|

|

0.9 |

|

|

63.9 |

|

|

7,100.0 |

% |

| |

|

$ |

370.2 |

|

|

$ |

95.7 |

|

|

$ |

274.5 |

|

|

286.8 |

% |

|

$ |

1,292.6 |

|

|

$ |

379.4 |

|

|

$ |

913.2 |

|

|

240.7 |

% |

* Not Applicable**IV Solutions includes $17.0 million and $68.9

million of contract manufacturing to Pfizer for the three and

twelve months ended December 31, 2017, respectively.

Fiscal 2018 Guidance

The Company is modifying its full year 2018 adjusted earnings

per share from a range of $6.05 to $6.65 to a range of $6.60 to

$7.30.

Conference Call

The Company will host a conference call to discuss fourth

quarter and fiscal year 2017 financial results today at 4:30 p.m.

EST (1:30 p.m. PST). The call can be accessed at (800)

936-9761, international (408) 774-4587, conference ID

5885838. The conference call will be simultaneously available

by webcast, which can be accessed by going to the Company's website

at www.icumed.com, clicking on the Investors tab, clicking on the

Webcast icon and following the prompts. The webcast will also be

available by replay.

About ICU Medical, Inc.

ICU Medical, Inc. (Nasdaq:ICUI) develops, manufactures and sells

innovative medical devices used in vascular therapy, and critical

care applications. ICU Medical's product portfolio includes IV

smart pumps, sets, connectors, closed transfer devices for

hazardous drugs, cardiac monitoring systems, along with pain

management and safety software technology designed to help meet

clinical, safety and workflow goals. ICU Medical is headquartered

in San Clemente, California. More information about ICU Medical,

Inc. can be found at www.icumed.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements contain words such as ''will,''

''expect,'' ''believe,'' ''could,'' ''would,'' ''estimate,''

''continue,'' ''build,'' ''expand'' or the negative thereof or

comparable terminology, and may include (without limitation)

information regarding the Company's expectations, goals or

intentions regarding the future, including our full year 2018

guidance and that the Company does not expect any material changes

to the financial results and that the Form 10-K will be timely

filed. These forward-looking statements are based on management's

current expectations, estimates, forecasts and projections about

the Company and assumptions management believes are reasonable, all

of which are subject to risks and uncertainties that could cause

actual results and events to differ materially from those stated in

the forward-looking statements. These risks and uncertainties

include, but are not limited to, decreased demand for the Company's

products, decreased free cash flow, the inability to recapture

conversion delays or part/resource shortages on anticipated timing,

or at all, changes in product mix, increased competition from

competitors, lack of continued growth or improving efficiencies,

unexpected changes in the Company's arrangements with its largest

customers and the Company’s ability to meet expectations regarding

the integration of the Hospira infusion systems business. Future

results are subject to risks and uncertainties, including the risk

factors, and other risks and uncertainties, described in the

Company's filings with the Securities and Exchange Commission,

which include those in the Annual Report on Form 10-K for the year

ended December 31, 2016 and our subsequent filings. Forward-looking

statements contained in this press release are made only as of the

date hereof, and the Company undertakes no obligation to update or

revise the forward-looking statements, whether as a result of new

information, future events or otherwise.

| ICU MEDICAL, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)(In thousands, except per share data) |

| |

|

| |

Year endedDecember

31, |

| |

2017 |

|

2016 |

|

2015 |

| REVENUES: |

|

|

|

|

|

| Net

sales |

$ |

1,292,166 |

|

|

$ |

379,339 |

|

|

$ |

341,254 |

|

|

Other |

447 |

|

|

33 |

|

|

414 |

|

| TOTAL REVENUE |

1,292,613 |

|

|

379,372 |

|

|

341,668 |

|

| COST OF GOODS SOLD |

866,518 |

|

|

177,974 |

|

|

160,871 |

|

| GROSS

PROFIT |

426,095 |

|

|

201,398 |

|

|

180,797 |

|

| OPERATING

EXPENSES: |

|

|

|

|

|

| Selling,

general and administrative |

303,953 |

|

|

89,426 |

|

|

83,216 |

|

| Research

and development |

51,253 |

|

|

12,955 |

|

|

15,714 |

|

|

Restructuring, strategic transaction and integration |

77,967 |

|

|

15,348 |

|

|

8,451 |

|

| Change in

fair value of contingent earn-out |

8,000 |

|

|

— |

|

|

— |

|

| Gain on

sale of building |

— |

|

|

— |

|

|

(1,086 |

) |

| Legal

settlements |

— |

|

|

— |

|

|

1,798 |

|

|

Impairment of assets held for sale |

— |

|

|

728 |

|

|

4,139 |

|

| TOTAL OPERATING

EXPENSES |

441,173 |

|

|

118,457 |

|

|

112,232 |

|

| (LOSS) INCOME FROM

OPERATIONS |

(15,078 |

) |

|

82,941 |

|

|

68,565 |

|

| BARGAIN PURCHASE

GAIN* |

70,890 |

|

|

1,456 |

|

|

— |

|

| INTEREST EXPENSE |

(2,047 |

) |

|

(118 |

) |

|

(39 |

) |

| OTHER (EXPENSE) INCOME,

net |

(2,482 |

) |

|

885 |

|

|

1,173 |

|

| INCOME BEFORE INCOME

TAXES |

51,283 |

|

|

85,164 |

|

|

69,699 |

|

| BENEFIT (PROVISION) FOR

INCOME TAXES* |

17,361 |

|

|

(22,080 |

) |

|

(24,714 |

) |

| NET INCOME |

$ |

68,644 |

|

|

$ |

63,084 |

|

|

$ |

44,985 |

|

| NET INCOME PER

SHARE* |

|

|

|

|

|

|

Basic |

$ |

3.50 |

|

|

$ |

3.90 |

|

|

$ |

2.84 |

|

|

Diluted |

$ |

3.29 |

|

|

$ |

3.66 |

|

|

$ |

2.73 |

|

| WEIGHTED AVERAGE NUMBER

OF SHARES |

|

|

|

|

|

|

Basic |

19,614 |

|

|

16,168 |

|

|

15,848 |

|

|

Diluted |

20,858 |

|

|

17,254 |

|

|

16,496 |

|

________________________________________

* Unaudited balances are subject to change based on final

purchase accounting adjustments. A bargain purchase gain

adjustment of approximately $10 million would impact income tax up

to $1.4 million and net income per diluted share up to $0.48.

| ICU MEDICAL, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)(In thousands, except per share data) |

| |

|

| |

Three months endedDecember

31, |

| |

2017 |

|

2016 |

| REVENUES: |

|

|

|

| Net

sales |

$ |

370,622 |

|

|

$ |

95,680 |

|

|

Other |

(498 |

) |

|

8 |

|

| TOTAL REVENUE |

370,124 |

|

|

95,688 |

|

| COST OF GOODS SOLD |

232,634 |

|

|

44,928 |

|

| GROSS

PROFIT |

137,490 |

|

|

50,760 |

|

| OPERATING

EXPENSES: |

|

|

|

| Selling,

general and administrative |

77,141 |

|

|

22,598 |

|

| Research

and development |

13,876 |

|

|

2,654 |

|

|

Restructuring, strategic transaction and integration |

9,934 |

|

|

11,009 |

|

| Change in

fair value of contingent earn-out |

(5,000 |

) |

|

— |

|

|

Impairment of assets held for sale |

— |

|

|

728 |

|

| TOTAL OPERATING

EXPENSES |

95,951 |

|

|

36,989 |

|

| INCOME FROM

OPERATIONS |

41,539 |

|

|

13,771 |

|

| BARGAIN PURCHASE

GAIN* |

(881 |

) |

|

— |

|

| INTEREST EXPENSE |

(304 |

) |

|

17 |

|

| OTHER (EXPENSE) INCOME,

net |

(452 |

) |

|

301 |

|

| INCOME BEFORE INCOME

TAXES |

39,902 |

|

|

14,089 |

|

| BENEFIT (PROVISION) FOR

INCOME TAXES* |

9,803 |

|

|

(4,577 |

) |

| NET INCOME |

$ |

49,705 |

|

|

$ |

9,512 |

|

| NET INCOME PER

SHARE* |

|

|

|

|

Basic |

$ |

2.47 |

|

|

$ |

0.58 |

|

|

Diluted |

$ |

2.33 |

|

|

$ |

0.54 |

|

| WEIGHTED AVERAGE NUMBER

OF SHARES |

|

|

|

|

Basic |

20,152 |

|

|

16,330 |

|

|

Diluted |

21,342 |

|

|

17,551 |

|

________________________________________

* Unaudited balances are subject to change based on final

purchase accounting adjustments. A bargain purchase gain

adjustment of approximately $10 million would impact income tax up

to $1.4 million and net income per diluted share up to $0.48.

Use of Non-GAAP Financial Information

This press release contains financial measures that are not

calculated in accordance with U.S. generally accepted accounting

principles ("GAAP"). The non-GAAP financial measures should

be considered supplemental to, and not as a substitute for, or

superior to, financial measures calculated in accordance with

GAAP. There are material limitations in using these non-GAAP

financial measures because they are not prepared in accordance with

GAAP and may not be comparable to similarly titled non-GAAP

financial measures used by other companies, including peer

companies. Our management believes that the non-GAAP data

provides useful supplemental information to management and

investors regarding our performance and facilitates a more

meaningful comparison of results of operations between current and

prior periods. We use non-GAAP financial measures in addition

to and in conjunction with GAAP financial measures to analyze and

assess the overall performance of our business, in making

financial, operating and planning decisions, and in determining

executive incentive compensation. The non-GAAP financial

measures included in this press release are adjusted net sales,

adjusted gross profit, adjusted gross profit margin, adjusted

EBITDA and adjusted diluted earnings per share ("Adjusted Diluted

EPS").

Adjusted EBITDA excludes the following items from net

income:

Interest, net: We exclude interest in deriving adjusted

EBITDA as interest can vary significantly among companies depending

on a company's level of income generating instruments and/or level

of debt.

Stock compensation expense: Stock-based compensation is

generally fixed at the time the stock-based instrument is granted

and amortized over a period of several years. The value of

stock options is determined using a complex formula that

incorporates factors, such as market volatility, that are beyond

our control. The value of our restricted stock awards is

determined using the grant date stock price, which may not be

indicative of our operational performance over the expense

period. Additionally, in order to establish the fair value of

performance-based stock awards, which are currently an element of

our ongoing stock-based compensation, we are required to apply

judgment to estimate the probability of the extent to which

performance objectives will be achieved. Based on the above

factors, we believe it is useful to exclude stock-based

compensation in order to better understand our operating

performance.

Intangible asset amortization expense: We do not acquire

businesses or capitalize certain patent costs on a predictable

cycle. The amount of purchase price allocated to intangible

assets and the term of amortization can vary significantly and are

unique to each acquisition. Capitalized patent costs can vary

significantly based on our current level of development

activities. We believe that excluding amortization of

intangible assets provides the users of our financial statements

with a consistent basis for comparison across accounting

periods.

Depreciation expense: We exclude depreciation expense in

deriving adjusted EBITDA because companies utilize productive

assets of different ages and the depreciable lives can vary

significantly resulting in considerable variability in depreciation

expense among companies.

Restructuring, strategic transaction and integration: We

incur restructuring and strategic transaction charges that result

from events, which arise from unforeseen circumstances and/or often

occur outside of the ordinary course of our ongoing business.

Although these events are reflected in our GAAP financial

statements, these unique transactions may limit the comparability

of our ongoing operations with prior and future periods.

Adjustment to reverse the cost recognition related to the

purchase accounting write-up of inventory to fair market value: The

inventory step-up represents the expense recognition of fair value

adjustments in excess of the historical cost basis of inventory

obtained through acquisition, these charges are outside of our

normal operations and are excluded.

Legal settlement: Occasionally, we are involved in legal

proceedings that may result in one-time settlements. We exclude

these settlements as they have no direct correlation to the

operation of our ongoing business.

Bargain purchase gain: We may incur a bargain purchase

gain on certain acquisitions if the fair market value of the

identifiable assets acquired and liabilities assumed, net of

deferred taxes exceeds the total consideration paid. We

exclude such gains as they are related to acquisitions and have no

direct correlation to the operation of our ongoing business.

Change in fair value of contingent earn-out: We exclude

the impact of certain amounts recorded in connection with business

combinations. We exclude items that are either non-cash or

not normal, recurring operating expenses due to their nature,

variability of amounts, and lack of predictability as to occurrence

and/or timing.

Disposition of certain assets: Occasionally, we may

dispose of certain assets if no longer needed for current

operations. We exclude any gains or losses recognized on the sale

of these assets in determining our non-GAAP financial measures as

they may limit the comparability of our ongoing operations with

prior and future periods and distort the evaluation of our normal

operating performance.

Impairment of assets held for sale: We have excluded the effect

of the impairment on assets held for sale in calculating our

non-GAAP adjusted EBITDA and non-GAAP adjusted earnings per share.

Impairments on assets no longer used in operations are not

reflective of our ongoing business and operating results.

Adjusted Diluted EPS excludes from diluted EPS, net of tax,

interest, net, intangible asset amortization expense, stock

compensation expense, restructuring, strategic transaction and

integration, adjustment to reverse the cost recognition related to

the purchase accounting write-up of inventory to fair market value,

legal settlement, disposition of certain assets, change in fair

value of earn-out, impairment of assets held for sale, bargain

purchase gain, which was tax free and the impact of tax reform.

We apply our GAAP consolidated effective tax rate to our

non-GAAP financial measures, other than when the underlying item

has a materially different tax treatment.

From time to time in the future, there may be other items that

we may exclude if we believe that doing so is consistent with the

goal of providing useful information to investors and

management.

The following tables reconcile our GAAP and non-GAAP financial

measures:

| ICU MEDICAL, INC. AND

SUBSIDIARIESReconciliation of GAAP to Non-GAAP

Financial Measures (Unaudited)(In thousands) |

| |

|

| |

Adjusted EBITDA |

| |

Three months EndedDecember

31, |

|

Year EndedDecember

31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| GAAP net income |

$ |

49,705 |

|

|

$ |

9,512 |

|

|

$ |

68,644 |

|

|

$ |

63,084 |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

| Interest,

net |

(638 |

) |

|

— |

|

|

221 |

|

|

— |

|

| Stock

compensation expense |

5,965 |

|

|

3,778 |

|

|

19,352 |

|

|

15,242 |

|

|

Depreciation and amortization expense |

19,057 |

|

|

4,699 |

|

|

66,569 |

|

|

19,050 |

|

|

Restructuring, strategic transaction and integration |

9,934 |

|

|

11,009 |

|

|

77,967 |

|

|

15,348 |

|

|

Adjustment to reverse the cost recognition related to the purchase

accounting write-up of inventory to fair market value |

— |

|

|

— |

|

|

66,313 |

|

|

— |

|

| Legal

settlement |

— |

|

|

— |

|

|

809 |

|

|

— |

|

| Bargain

purchase gain |

881 |

|

|

— |

|

|

(70,890 |

) |

|

(1,456 |

) |

| Change in

fair value of contingent earn-out |

(5,000 |

) |

|

— |

|

|

8,000 |

|

|

— |

|

|

Disposition of certain assets |

— |

|

|

— |

|

|

2,880 |

|

|

— |

|

|

Impairment of assets held for sale |

— |

|

|

728 |

|

|

— |

|

|

728 |

|

| Benefit

(Provision) for income taxes |

(9,803 |

) |

|

4,577 |

|

|

(17,361 |

) |

|

22,080 |

|

| Total non-GAAP

adjustments |

20,396 |

|

|

24,791 |

|

|

153,860 |

|

|

70,992 |

|

| |

|

|

|

|

|

|

|

| Adjusted

EBITDA |

$ |

70,101 |

|

|

$ |

34,303 |

|

|

$ |

222,504 |

|

|

$ |

134,076 |

|

| |

Adjusted diluted earnings per

share |

| |

Three months endedDecember

31, |

|

Year endedDecember

31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| GAAP diluted

earnings per share |

$ |

2.33 |

|

|

$ |

0.54 |

|

|

$ |

3.29 |

|

|

$ |

3.66 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

| Interest,

net |

$ |

(0.03 |

) |

|

$ |

— |

|

|

$ |

0.01 |

|

|

$ |

— |

|

| Stock

compensation expense |

$ |

0.28 |

|

|

$ |

0.22 |

|

|

$ |

0.93 |

|

|

$ |

0.88 |

|

|

Amortization expense |

$ |

0.19 |

|

|

$ |

0.04 |

|

|

$ |

0.72 |

|

|

$ |

0.16 |

|

|

Restructuring, strategic transaction and integration |

$ |

0.47 |

|

|

$ |

0.63 |

|

|

$ |

3.74 |

|

|

$ |

0.89 |

|

|

Adjustment to reverse the cost recognition related to the purchase

accounting write-up of inventory to fair market value |

$ |

— |

|

|

$ |

— |

|

|

$ |

3.18 |

|

|

$ |

— |

|

| Legal

settlement |

$ |

— |

|

|

$ |

— |

|

|

$ |

0.04 |

|

|

$ |

— |

|

| Bargain

purchase gain |

$ |

0.04 |

|

|

$ |

— |

|

|

$ |

(3.4 |

) |

|

$ |

(0.08 |

) |

| Change in

fair value of contingent earn-out |

$ |

(0.23 |

) |

|

$ |

— |

|

|

$ |

0.38 |

|

|

$ |

— |

|

|

Disposition of certain assets |

$ |

— |

|

|

$ |

— |

|

|

$ |

0.14 |

|

|

$ |

— |

|

|

Impairment of assets held for sale |

$ |

— |

|

|

$ |

0.04 |

|

|

$ |

— |

|

|

$ |

0.04 |

|

| Estimated

income tax impact from adjustments and impact from tax reform

(1) |

$ |

(0.07 |

) |

|

$ |

(0.27 |

) |

|

$ |

(2.58 |

) |

|

$ |

(0.67 |

) |

| Adjusted diluted

earnings per share |

$ |

2.98 |

|

|

$ |

1.20 |

|

|

$ |

6.45 |

|

|

$ |

4.88 |

|

_______________________________________________

(1) Includes additional tax expense of $3.1 million for

both the three months and year ended December 31, 2017 relating to

new U.S. tax legislation. The additional tax expense includes

an estimated one-time transition tax payable of $2.0 million,

payable over an eight year period with 8% due in each of the first

five years and a tax expense of $1.1 million related to the

remeasurement of deferred tax balances due to the lower corporate

tax rate at which they are expected to reverse in the future.

| ICU Medical, Inc. and

SubsidiariesReconciliation of GAAP to Non-GAAP

Financial Measures - Fiscal Year 2018 Outlook

(Unaudited)(In millions, except per share data) |

| |

| |

Low End of Guidance |

|

High End of Guidance |

| GAAP diluted

earnings per share |

$ |

2.94 |

|

|

$ |

3.64 |

|

| |

|

|

|

| Non-GAAP

adjustments: |

|

|

|

| Stock

compensation expense |

$ |

1.09 |

|

|

$ |

1.09 |

|

| Amortization

expense |

$ |

0.75 |

|

|

$ |

0.75 |

|

|

Restructuring, strategic transaction and integration |

$ |

2.79 |

|

|

$ |

2.79 |

|

| Estimated income

tax impact from adjustments |

$ |

(0.97 |

) |

|

$ |

(0.97 |

) |

| Adjusted diluted

earnings per share |

$ |

6.60 |

|

|

$ |

7.30 |

|

| |

|

|

|

|

|

|

|

CONTACT:ICU Medical, Inc.Scott Lamb, Chief Financial

Officer(949) 366-2183

ICR, Inc.John Mills, Partner(646) 277-1254

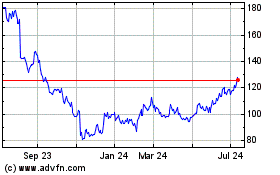

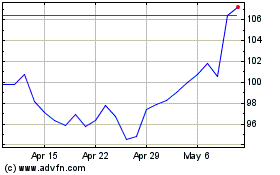

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Aug 2024 to Sep 2024

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Sep 2023 to Sep 2024