Today's Top Supply Chain and Logistics News From WSJ

June 28 2016 - 7:08AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Home Depot Inc.'s supply chain chief is telling store operators

to get used to "days of inventory, not weeks." The home-improvement

giant is joining a growing retail industry drive to slash stocks at

stores and in warehouses as companies try to boost sales, improve

margins and respond to changes in the marketplace. Companies

including Home Depot, Target Corp. and Wal-Mart Stores are trying

to figure out how to profitably serve the growing needs of online

shoppers even as they make their network of stores less of a

financial burden, the WSJ's Paul Ziobro writes. Home Depot calls

its plan "Project Sync," which includes a steadier flow of

deliveries from suppliers into its network of 18 sorting centers.

Instead of being slammed with five trucks twice a week, for

instance, Home Depot now wants to have suppliers send two trucks

five days a week. Retailer lean-inventory efforts have been roiling

the logistics world, with operators reporting fewer goods in

distribution channels even as consumer sales tick upward. For

retailers, though, that's how supply-chain math is supposed to add

up.

EZ Worldwide Express is finding out why tying too much business

to a single customer isn't very fashionable in logistics. The New

Jersey-based operator is dropping Forever 21 as a customer after

saying the retailer's diminishing business pushed the company into

bankruptcy protection, the WSJ's Katy Stech reports. The January

bankruptcy filing and the decision in recent days to walk away from

the service contract point to the changes coursing through the

"fast fashion" trade and to the impact the upheaval is having on

logistics providers. EZ Worldwide laid off 200 workers and is

selling equipment it had used to serve a client that had provided

some half of the company's revenue. EZ Worldwide points to sharply

declining revenues, a sign of the scale of the toll that changing

consumer tastes and the sales shift toward e-commerce are taking on

Forever 21.

The world-wide business serving apparel retailers is creating a

kind of vast shadow supply chain from castoffs. The business of

recycling used clothing stretches from Western stores to sorting

shops in India and has built its own logistics eco-system, the

WSJ's Eric Bellman reports. It now faces a glut of goods that is so

large it is affecting retailers and regional economic policies. The

surplus springs from the rise of fast fashion, which has flooded

the world with inexpensive clothing, often produced in the same

low-wage countries where it later ends up sold or reprocessed into

goods like blankets or pillow stuffing. It may seem a virtuous

circle, but some clothing makers in emerging markets say the flood

of used apparel stifles the growth of local textile industries. And

there are signs the global recycling system is having trouble

keeping up with the relentless march of new production.

TRANSPORTATION

New U.S. rules on drone operations break new ground on the

devices even if they don't go as far as delivery companies would

like. The long-awaited regulations the Federal Aviation

Administration issued permit low-altitude, daylight flights of

unmanned vehicles weighing less than 55 pounds, although the WSJ's

Andy Pasztor reports they will continue to stick to requirement

that drones can't fly outside the sight of an operator. That puts a

heavy lid over studies Amazon.com Inc. and other companies have

undertaken on the use of drones to deliver parcels. The FAA rules

will open the skies to far more private-sector use of drones,

however, and the growing commercial use will likely spur more

investment and research on the technology. Setting the industry

parameters may open the door to using drones for remote or

emergency deliveries, which some parcel carriers believe that they

are most likely to fit.

QUOTABLE

IN OTHER NEWS

More British companies are issuing profit warnings as they

digest the impact of the U.K. vote to withdraw from the European

Union. (WSJ)

Intensifying pressure on the British pound pushed sterling to

its lowest level against the dollar in 31 years. (WSJ)

Oakland's city council voted to ban exports of coal from the

city's terminals. (WSJ)

The Chinese yuan fell to its lowest level against the dollar

since late 2010 after China's central bank acted in response to

volatile global currency markets. (WSJ)

The U.S. plans "informal, technical discussions" with the United

Arab Emirates and Qatar about Persian Gulf airlines' funding and

access to the U.S. market. (WSJ)

The U.S. trade gap widened slightly in May on a small increase

in imports. (MarketWatch)

Medical-device maker Medtronic Plc agreed to acquire HeartWare

International Inc., adding more heart-failure products to its

portfolio. (WSJ)

The Brexit vote may endanger efforts to expand London Heathrow

Airport. (The Guardian)

Perdue Farms Inc. is retooling its sourcing to ensure that its

chickens are raised in a humane manner. (The New York Times)

English authorities are asking port workers to look for signs of

slave labor on ships arriving at terminals. (BBC)

Worldwide raw steel production expanded 3.2% from April to May.

(American Machinist)

Amazon,com has the greatest overall web traffic among e-commerce

companies in India. (Forbes)

A new report says Canadian retailers are about two years behind

U.S. companies in adopting e-commerce technology. (Toronto

Star)

China's No. 2 steel maker and a smaller rival are planning a

strategic partnership that could lead to a merger. (South China

Morning Post)

South Korean shipyard Daewoo Shipbuilding & Marine

Engineering must raise $871 million to meet September bond

payments. (Splash 24/7)

The head of the U.S. government's Strategic National Stockpile

says the program's series of warehouses hold $7 billion in supplies

in case of national disaster. (NPR)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @lorettachao, @RWhelanWSJ and @EEPhillips_WSJ, and

follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

(END) Dow Jones Newswires

June 28, 2016 06:53 ET (10:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

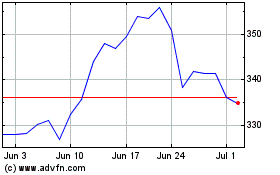

Home Depot (NYSE:HD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Sep 2023 to Sep 2024