Current Report Filing (8-k)

September 19 2014 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2014

AMERICAN AIRLINES GROUP INC.

AMERICAN AIRLINES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-8400 |

|

75-1825172 |

| Delaware |

|

1-2691 |

|

13-1502798 |

| (State or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 4333 Amon Carter Blvd., Fort Worth, Texas |

|

76155 |

| 4333 Amon Carter Blvd., Fort Worth, Texas |

|

76155 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(817) 963-1234

(817)

963-1234

N/A

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events.

On September 18, 2014, the Company issued a press release announcing the pricing of its private offering of $750 million aggregate

principal amount of unsecured senior notes due 2019. As required by Rule 135c under the Securities Act, a copy of the Company’s press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Press Release, dated September 18, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines Group Inc. has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN AIRLINES GROUP INC. |

|

|

|

|

| Date: September 19, 2014 |

|

|

|

By: |

|

/s/ Derek J. Kerr |

|

|

|

|

|

|

Derek J. Kerr |

|

|

|

|

|

|

Executive Vice President and |

|

|

|

|

|

|

Chief Financial Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines, Inc. has duly caused this report to be

signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN AIRLINES, INC. |

|

|

|

|

| Date: September 19, 2014 |

|

|

|

By: |

|

/s/ Derek J. Kerr |

|

|

|

|

|

|

Derek J. Kerr |

|

|

|

|

|

|

Executive Vice President and |

|

|

|

|

|

|

Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Press Release, dated September 18, 2014 |

Exhibit 99.1

|

|

|

|

|

|

|

|

|

Corporate Communications

817-967-1577

mediarelations@aa.com |

FOR IMMEDIATE RELEASE

AMERICAN AIRLINES GROUP

ANNOUNCES PRICING OF UNSECURED SENIOR NOTES

FORT WORTH, Texas, September 18, 2014—American Airlines Group Inc. (NASDAQ: AAL) (the “Company”) today announced that it priced $750.0

million aggregate principal amount of unsecured senior notes due 2019. The offering was increased from a previously announced size of $500.0 million aggregate principal amount of notes. The notes will have an interest rate of 5.50% per annum

and are being issued at a price equal to 100% of their face value. The notes will be guaranteed on a senior unsecured basis by the Company’s direct wholly-owned subsidiaries, American Airlines, Inc. and US Airways Group, Inc., and its indirect

wholly-owned subsidiary, US Airways, Inc.

The Company estimates that the net proceeds from the offering will be approximately $738.0

million after deducting discounts and estimated offering expenses. The Company intends to use the net proceeds from the offering for general corporate purposes.

The notes are being offered and sold only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under

the Securities Act of 1933, as amended (the “Securities Act”) and to certain non-U.S. persons in transactions outside the United States in reliance on Regulation S under the Securities Act. The notes will not be registered under the

Securities Act or any other securities laws of any jurisdiction and will not have the benefit of any exchange offer or other registration rights. The notes may not be offered or sold in the United States absent registration or an applicable

exemption from registration requirements.

This press release does not constitute an offer to sell or the solicitation of an offer to buy

any of the notes nor shall there be any sale of the notes in any jurisdiction in which such offer, solicitation or sale would be unlawful. This news release is being issued pursuant to and in accordance with Rule 135c under the Securities Act.

Forward-Looking Statements

Certain of the statements contained or referred to herein, including those regarding the proposed offering of the notes, represent the

Company’s expectations or beliefs concerning future events and should be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These

– more –

forward-looking statements are subject to a number of factors that could cause actual results to differ from the Company’s expectations, including but not limited to, factors described in

the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2014, the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and the Company’s other filings with the Securities and Exchange

Commission. Any forward-looking statements speak only as of the date of this release or as of the dates indicated in the statements. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect

actual results, changes in assumptions or changes in other factors affecting such statements other than as required by law.

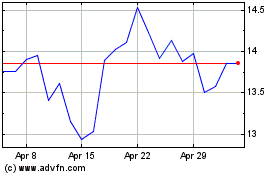

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2024 to May 2024

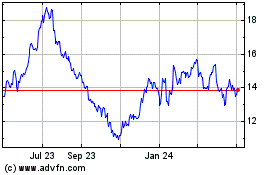

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From May 2023 to May 2024