Donaldson Company, Inc. (NYSE: DCI) announced its financial

results for its fiscal 2012 second quarter. Summarized financial

results are as follows (dollars in millions, except per share

data):

Three Months Ended Six Months Ended

January 31 January 31

2012

2011 Change

2012 2011

Change Net sales $ 581 $ 537 8 % $ 1,189 $ 1,074 11 %

Operating income 75 67 11 % 165 142 16 % Net earnings 54 45 21 %

122 98 25 % Diluted EPS $ 0.70 $ 0.56 25 % $ 1.60 $ 1.24 29

%

“We are very pleased to reach the midpoint of our year with

another strong performance as we established second quarter records

in sales, operating margin, and EPS,” said Bill Cook,

Chairman, President and CEO. “Sales in our Engine Products segment

increased 12 percent as new equipment build rates at our global

Off-Road and On-Road OEM Customers remained healthy. Within our

Industrial Products segment, sales of our Torit® dust collectors

were strong this quarter.”

“Our operating margin performance was very good at 12.9 percent.

Our ongoing Continuous Improvement initiatives helped us again. We

also continue to leverage our fixed cost base as our sales grow.

The combination of our solid revenue growth, our strong margin

performance, and a lower tax rate drove second quarter net income

and EPS up 21 percent and 25 percent, respectively.”

“We now forecast our full year sales to grow between 7 and 12

percent over last year. Forecasted business conditions in our end

markets vary: strong in the Americas, stable in Europe, and

improving in China. Currency translation is now projected to be

unfavorable during the second half of our year due to the

strengthening of the U.S. dollar, with an estimated reduction of

our full year EPS estimate of $0.05 from our previous forecast. As

a result, we now forecast our FY12 EPS to be between $3.25 and

$3.45, which would be another new record, and would be up 13

percent to 20 percent over last year.”

Financial Statement

Discussion

The impact of foreign currency translation decreased sales by

$4.2 million, or 0.8 percent, during the second quarter and

increased sales by $9.2 million, or 0.9 percent, year-to-date,

compared to the same periods last year. The impact of foreign

currency translation decreased reported net earnings by $0.6

million, or 1.3 percent, during the second quarter and increased

reported net earnings by $0.7 million, or 0.8 percent, for the

year.

Gross margin was 34.6 percent for the quarter and 35.0 percent

year-to-date, compared to prior year margins of 35.3 percent and

35.2 percent, respectively. The decrease in the quarter was due to

lower absorption of fixed costs resulting from the Thai floods and

from fewer shipping days compared to last year’s second quarter.

These were partially offset by cost reductions from our ongoing

Continuous Improvement initiatives.

Operating expenses for the quarter were $126.0 million, up 3.2

percent from $122.1 million last year primarily due to the

increased sales volume. As a percent of sales, operating expenses

were 21.7 percent compared to last year’s 22.7 percent for the

second quarter. Operating expenses year-to-date were $250.7

million, or 21.1 percent of sales, compared to $235.7 million, or

21.9 percent of sales, last year.

The effective tax rate for the quarter was 29.6 percent,

compared to a prior year rate of 34.4 percent. The prior

year’s quarter included a $4.0 million tax charge related to the

reorganization of our subsidiary holdings to improve our global

business and legal entity structure, partially offset by $0.9

million in tax benefits primarily from the retroactive

reinstatement of the Research and Experimentation Credit in the

U.S. The year-to-date effective tax rate was 27.3 percent compared

to a prior year rate of 30.2 percent.

We did not repurchase any shares during the second quarter, and

year-to-date we have repurchased 1,376,000 shares, or 1.8 percent

of our diluted outstanding shares, for $73.6 million.

FY12 Outlook

We forecast our FY12 sales to be between $2.45 and $2.55

billion, or up about 7 to 12 percent from the prior year. Our

current forecast is based on the Euro at US$1.32 and 76 Yen to the

US$, which, in aggregate, is less favorable than our previous

currency guidance issued in November.

- Our full year operating margin is

forecast to be 13.7 to 14.5 percent.

- Our full year FY12 tax rate is

anticipated to be between 27 and 30 percent.

- Cash generated by operating activities

is projected to be between $250 and $280 million. Capital spending

is now estimated to be approximately $85 million.

Engine Products: We

expect full year sales to increase 8 to 12 percent, including the

impact of foreign currency translation.

- We anticipate sales to both our

Off-Road and On-Road OEM Customers will remain strong in the second

half of FY12. We will continue to benefit from increased market

share on our Customers’ new Tier IV equipment platforms.

- Sales of our Aftermarket Products are

expected to increase moderately based on current utilization rates

for both off-road equipment and on-road heavy trucks. We should

also benefit from our continued expansion into the emerging

economies and from the increasing number of systems installed in

the field with our proprietary filtration systems, such as our

PowerCore® products.

- We forecast Aerospace and Defense

Products’ sales to be level with the prior year as the continued

slowdown in military spending is anticipated to be offset by

increased commercial aerospace sales.

Industrial Products:

We forecast full year sales to increase 7 to 11 percent, including

the impact of foreign currency translation.

- Our Industrial Filtration Solutions’

sales are projected to increase 7 to 11 percent and assume a

continuing improvement in general manufacturing activity in the

U.S., stable conditions in Europe, and improving conditions in

Asia.

- We anticipate our Gas Turbine Products’

sales to be up 18 to 22 percent due to the recent strengthening in

the large turbine power generation market and ongoing strength in

the oil and gas market segment.

- Special Applications Products’ sales

are forecast to be level with the prior year as growth in our

membrane and venting product sales should offset the reduction in

our disk drive filter sales related to the Thai floods last

fall.

About Donaldson Company

Donaldson is a leading worldwide provider of filtration systems

that improve people’s lives, enhance our Customers’ equipment

performance, and protect our environment. We are a

technology-driven Company committed to satisfying our Customers’

needs for filtration solutions through innovative research and

development, application expertise, and global presence. Our nearly

13,000 employees contribute to the Company’s success by supporting

our Customers at our more than 100 sales, manufacturing, and

distribution locations around the world.

Donaldson is a member of the S&P MidCap 400 and Russell 1000

indices, and our shares trade on the NYSE under the symbol DCI.

Additional information is available at www.donaldson.com.

SAFE HARBOR STATEMENT UNDER THE SECURITIES REFORM ACT OF

1995

The Company desires to take advantage of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995

(the “Act”) and is making this cautionary statement in connection

with such safe harbor legislation. This announcement contains

forward-looking statements, including forecasts, plans, and

projections relating to our business and financial performance and

global economic conditions, which involve uncertainties that could

materially impact results.

The Company wishes to caution investors that any forward-looking

statements are subject to uncertainties and other risk factors that

could cause actual results to differ materially from such

statements, including but not limited to risks associated with:

world economic factors and the ongoing economic uncertainty,

reduced demand for hard disk drive products with the increased use

of flash memory, the potential for some Customers to increase their

reliance on their own filtration capabilities, currency

fluctuations, commodity prices, political factors, the Company’s

international operations, highly competitive markets, governmental

laws and regulations including the impact of various economic

stimulus and financial reform measures, the implementation of our

new information technology systems, potential global events

resulting in market instability including financial bailouts and

defaults of sovereign nations, military and terrorist activities,

health outbreaks, natural disasters, and other factors included in

our Annual and Quarterly Reports. We undertake no obligation to

publicly update or revise any forward-looking statements.

CONDENSED STATEMENTS OF CONSOLIDATED EARNINGS DONALDSON

COMPANY, INC. AND SUBSIDIARIES (Thousands of dollars, except share

and per share amounts) (Unaudited)

Three Months Ended

Six Months Ended

January 31 January 31 2012 2011 2012

2011 Net sales $ 580,883 $ 537,105 $ 1,189,178 $ 1,074,014

Cost of sales 380,066 347,562

773,427 696,381 Gross margin

200,817 189,543 415,751 377,633 Operating expenses

126,049 122,102 250,656

235,689 Operating income 74,768 67,441 165,095

141,944 Other income, net (4,550 ) (3,502 ) (9,410 ) (4,609

) Interest expense 2,899 2,936

6,069 6,589 Earnings before

income taxes 76,419 68,007 168,436 139,964 Income taxes

22,598 23,428 46,062

42,251 Net earnings $ 53,821 $ 44,579

$ 122,374 $ 97,713 Weighted average

shares outstanding* 75,052,805 77,580,064 75,154,873 77,375,086

Diluted shares outstanding* 76,412,785 78,977,509 76,480,673

78,766,895 Net earnings per share* $ 0.72 $ 0.57 $ 1.63 $

1.26 Net earnings per share assuming dilution* $ 0.70 $ 0.56

$ 1.60 $ 1.24 Dividends paid per share* $

0.150 $ 0.130 $ 0.300

$ 0.255

* Earnings and dividends declared per share and weighted average

shares outstanding are presented before the effect of a 100 percent

stock dividend declared on January 27, 2012, to be distributed on

March 23, 2012 to shareholders of record on March 2, 2012.

DONALDSON COMPANY, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Thousands of dollars) (Unaudited)

January 31 July 31 2012 2011

ASSETS Cash, cash equivalents and short-term investments $

272,315 $ 273,494 Accounts receivable – net 408,462 445,700

Inventories – net 270,212 271,476 Prepaids and other current assets

78,697 75,912 Total current assets 1,029,686

1,066,582 Other assets and deferred taxes 268,746 268,009

Property, plant and equipment – net 382,957 391,502

Total assets $ 1,681,389 $ 1,726,093 LIABILITIES AND

SHAREHOLDERS’ EQUITY Trade accounts payable $ 190,076 $

215,918 Employee compensation and other liabilities 176,030 219,326

Short-term borrowings 92,728 13,129 Current maturity long-term debt

2,356 47,871 Total current liabilities 461,190

496,244 Long-term debt 205,217 205,748 Other long-term

liabilities 99,569 89,390 Total liabilities

765,976 791,382 Equity 915,413 934,711

Total liabilities and equity $ 1,681,389 $ 1,726,093

DONALDSON COMPANY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Thousands of dollars) (Unaudited)

Six Months Ended January 31 2012 2011

OPERATING ACTIVITIES Net earnings $ 122,374 $ 97,713

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization 30,896 30,478 Changes in operating

assets and liabilities (43,485 ) (19,947 ) Tax benefit of equity

plans (7,576 ) (7,445 ) Stock compensation plan expense 6,440 6,089

Other, net

(6,451 ) (13,828 ) Net cash provided by operating

activities 102,198 93,060 INVESTING ACTIVITIES Net

expenditures on property and equipment (36,349 ) (24,051 )

Purchases of short-term investments (93,455 ) (66,494 )

Acquisitions and divestitures, net - 3,613

Net cash used in investing activities (129,804 ) (86,932 )

FINANCING ACTIVITIES Purchase of treasury stock

(73,558 ) (6,491 ) Net change in debt and short-term borrowings

33,452 (21,254 ) Dividends paid (22,342 ) (19,542 ) Tax benefit of

equity plans 7,576 7,445 Exercise of stock options 9,791

12,113 Net cash used in financing activities

(45,081 ) (27,729 )

Effect of exchange rate changes on

cash

(19,877

)

9,236

Decrease in cash and cash equivalents

(92,564

)

(12,365

)

Cash and cash equivalents – beginning of

year

273,494

232,000

Cash and cash equivalents – end of

period

$

180,930

$

219,635

SEGMENT DETAIL (Thousands of dollars)

(Unaudited) Engine Industrial

Corporate &

Total

Products Products Unallocated

Company

3 Months Ended January 31, 2012: Net sales $ 370,834 $ 210,049 ---

$ 580,883 Earnings before income taxes 48,418 30,597 (2,596 )

76,419 3 Months Ended January 31, 2011: Net sales $ 331,122

$ 205,983 --- $ 537,105 Earnings before income taxes 44,203 29,127

(5,323 ) 68,007 6 Months Ended January 31, 2012: Net

sales $ 764,559 $ 424,619 --- $ 1,189,178 Earnings before income

taxes 108,296 64,896 (4,756 ) 168,436 6 Months Ended January

31, 2011: Net sales $ 664,891 $ 409,123 --- $ 1,074,014 Earnings

before income taxes 92,654 59,162 (11,852 ) 139,964

NET SALES BY PRODUCT (Thousands of dollars) (Unaudited)

Three Months Ended Six Months Ended

January 31 January 31 2012 2011 2012

2011 Engine Products segment: Off-Road Products $ 87,035 $ 73,852 $

181,143 $ 146,498 On-Road Products 39,376 28,747 82,001 57,802

Aftermarket Products 214,070 199,891 440,967 401,758 Retrofit

Emissions Products 4,651 4,908 9,288 8,255 Aerospace and Defense

Products 25,702 23,724 51,160 50,578

Total Engine Products segment $ 370,834 $ 331,122 $ 764,559 $

664,891 Industrial Products segment: Industrial Filtration

Solutions Products $ 132,041 $ 123,430 $ 265,440 $ 242,783 Gas

Turbine Products 37,011 34,871 72,592 70,376 Special Applications

Products 40,997 47,682 86,587 95,964

Total Industrial Products segment $ 210,049 $ 205,983 $ 424,619 $

409,123 Total Company $ 580,883 $ 537,105 $ 1,189,178 $

1,074,014

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

(Thousands of dollars, except per share amounts) (Unaudited)

Three Months Ended Six Months Ended

January 31 January 31 2012 2011 2012

2011 Free cash flow $ 26,654 $ 16,294 $ 65,849 $ 69,009 Net

capital expenditures 17,858 14,003

36,349 24,051 Net cash provided by

operating activities $ 44,512 $ 30,297 $ 102,198

$ 93,060 EBITDA $ 93,530 $ 85,911 $ 203,492 $

175,919 Income taxes (22,598 ) (23,428 ) (46,062 ) (42,251 )

Interest expense (net) (1,789 ) (2,344 ) (4,160 ) (5,477 )

Depreciation and amortization (15,322 ) (15,560 )

(30,896 ) (30,478 ) Net earnings $ 53,821

$ 44,579 $ 122,374 $ 97,713 Net

sales, excluding foreign currency translation $ 585,085 $ 540,594 $

1,179,960 $ 1,081,230 Foreign currency translation (4,202 )

(3,489 ) 9,218 (7,216 ) Net

sales $ 580,883 $ 537,105 $ 1,189,178 $

1,074,014 Net earnings, excluding foreign currency

translation $ 54,408 $ 44,417 $ 121,630 $ 97,432 Foreign currency

translation (587 ) 162 744

281 Net earnings $ 53,821 $ 44,579

$ 122,374 $ 97,713

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (CONTINUED)

(Thousands of dollars, except per share amounts) (Unaudited)

Three Months Ended Six Months Ended January 31

January 31 2012 2011 2012 2011

Net earnings, excluding special items

$ 53,821 $ 44,579 $ 122,374 $ 98,279

Restructuring charges, net of tax

-

-

-

(566 ) Net earnings $ 53,821 $ 44,579 $ 122,374 $

97,713

Net earnings per share assuming dilution,

excluding special items

$ 0.70 $ 0.56 $ 1.60 $ 1.25

Restructuring charges per share, net of

tax

-

-

-

(0.01 )

Net earnings per share assuming

dilution

$ 0.70 $ 0.56 $ 1.60 $ 1.24

Although free cash flow, EBITDA, net sales excluding foreign

currency translation, net earnings excluding foreign currency

translation, net earnings excluding restructuring charges and net

earnings per share assuming dilution excluding restructuring

charges are not measures of financial performance under GAAP, the

Company believes they are useful in understanding its financial

results. Free cash flow is a commonly used measure of a company’s

ability to generate cash in excess of its operating needs. EBITDA

is a commonly used measure of operating earnings less non-cash

expenses. Both net sales and net earnings excluding foreign

currency translation provide a comparable measure for understanding

the operating results of the company’s foreign entities excluding

the impact of foreign exchange. Both net earnings excluding

restructuring charges and earnings per share excluding

restructuring charges provide a comparable measure for

understanding the results of the Company as compared to prior

periods. A shortcoming of these financial measures is that they do

not reflect the company’s actual results under GAAP. Management

does not intend these items to be considered in isolation or as a

substitute for the related GAAP measures.

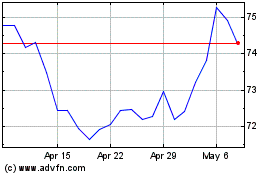

Donaldson (NYSE:DCI)

Historical Stock Chart

From Apr 2024 to May 2024

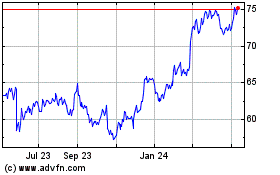

Donaldson (NYSE:DCI)

Historical Stock Chart

From May 2023 to May 2024