Wynnstay Group PLC Trading Update

October 02 2024 - 2:00AM

RNS Regulatory News

RNS Number : 5569G

Wynnstay Group PLC

02 October 2024

AIM: WYN

Wynnstay Group

plc

("Wynnstay" or the "Group" or the "Company")

Trading

Update

The Board of Wynnstay, the

agricultural supplies and specialist merchanting group, provides an

update on trading for the financial year ended 31 October 2024

("FY24").

As highlighted in the Group's

interim results, reported on 25 June 2024, the outturn for the

financial year was expected to be driven by the Group's performance

in the second half. With more challenging conditions being

experienced in seasonally important months, it is now clear that

results for the financial year will be materially lower than

current market expectations and lower than the previous financial

year.

There are two main factors behind

this shortfall, the underperformance of the Feed division and of

the fertiliser blending operation, the principal activity at

Glasson Grain. The Feed division is experiencing a weaker

second-half performance, driven by lower volumes relative to a

market that has only grown marginally year-on-year. This mainly

reflects decreased poultry feed volumes as this activity

transitions away from manufacturing poultry feed at Twyford; these

lower volumes are currently expected to persist for a further

period.

While Glasson's fertiliser blending

operation has improved from a challenging FY23, margins have been

significantly impacted as market prices have fallen during the

later summer and autumn months. This has been further compounded by

reduced volumes in the last two months as farmers have taken a

cautious approach to product purchases, pending harvest and

planting outcomes, which like last year, are being impacted by

heavy rains.

Other areas of the Group's arable

activities have performed in line with management expectations

overall. As expected, the Specialist Merchanting Division has

continued to see constrained farmer spending although it has

modestly outperformed the prior year to date. The contribution from

Joint Ventures is below the record levels seen in the previous

financial year, but in line with expectations.

Outlook

The Group

has a well-established market position and benefits from a strong

balance sheet and good cash flows. While there are a number of

headwinds in the short-term, the Board expects a better outlook for

the livestock and dairy sectors and anticipates an improved

financial performance in FY25 compared to FY24. The Group will

continue to focus on operational improvements and efficiencies and

continue to invest for the future.

The Board expects to announce its

trading results for the year ended 31 October 2024 towards the end

of January 2025 and will provide a further update on current

trading at that time.

Enquiries:

|

Wynnstay Group plc

|

Steve Ellwood, Chairman

Alk Brand, Chief Executive

Officer

Rob Thomas, Chief Financial

Officer

|

T: 01691 827 142

|

|

KTZ Communications

|

Katie Tzouliadis / Robert

Morton

|

T: 020 3178 6378

|

|

Shore Capital (Nomad and

Broker)

|

Stephane Auton / Tom Knibbs / Rachel

Goldstein (Corporate Advisory)

Henry Willcocks (Corporate

Broking)

|

T: 020 7408 4090

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

TSTFSDEFFELSEDS

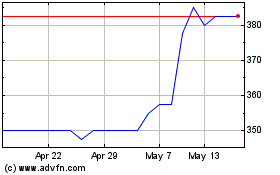

Wynnstay (LSE:WYN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Wynnstay (LSE:WYN)

Historical Stock Chart

From Dec 2023 to Dec 2024