TIDMWSP

RNS Number : 6046C

Wynnstay Properties PLC

14 June 2023

The information communicated within this announcement is deemed

to constitute inside information for the purposes of the Market

Abuse Regulation (EU) No. 596/2014 as it forms part of UK domestic

law by virtue of the European Union (Withdrawal) Act 2018. Upon the

publication of this announcement, this information is considered to

be in the public domain.

WYNNSTAY PROPERTIES PLC

("Wynnstay" or the "Company")

AUDITED RESULTS FOR YEARED 25 MARCH 2023 AND NOTICE OF AGM

14 June 2023

Wynnstay Properties PLC is pleased to announce the publication

of its audited results for the year ended 25 March 2023.

The Annual Report and Financial Statements is available on the

Company's website www.wynnstayproperties.co.uk and will shortly be

posted to those shareholders who have elected to receive documents

by post, when a further announcement will be made.

This announcement contains three sections from the Annual Report

and Financial Statements: Introduction to Wynnstay, Chairman's

Statement and Managing Director's Review. It also contains the four

Financial Statements contained in the Annual Report and Financial

Statements together with the notes to those statements.

As stated in the note at the end of this announcement, the

financial information set out in the announcement does not

constitute statutory accounts as defined in section 435 of the

Companies Act 2006.

The Company's Annual General Meeting ("AGM") will be held on

Tuesday 18 July 2023. Details of the arrangements for the meeting

are set out in the notice of meeting in the Annual Report and

Financial Statements.

This announcement was approved by the Board on 13 June 2023

For further information please contact:

Wynnstay Properties plc

Philip Collins (Chairman)

020 7554 8766

WH Ireland Limited (Nominated Adviser and Broker):

Chris Hardie, Hugh Morgan, Sarah Mather

020 7220 1666

LEI number is 2138006MASI24JYW5076.

For more information on Wynnstay visit:

www.wynnstayproperties.co.uk

WYNNSTAY PROPERTIES PLC

INTRODUCTION TO WYNNSTAY

A distinctive approach to commercial property investment

primarily for private investors

Wynnstay is an AIM listed property investment and development

business. Its principal shareholders are private investors wishing

to invest in a portfolio of good quality secondary commercial

properties for medium to long-term capital and income growth. The

portfolio is currently focused on industrial, including trade

counter, units.

Strategy

Wynnstay aims to achieve capital appreciation and generate

rising dividend income for shareholders from a diversified and

resilient commercial property portfolio in Central and Southern

England, with diversity and resilience being reflected in the

location, number and nature of the properties, and the mix of lease

terms, tenants and uses.

For location, the focus is on areas where there is strong

occupational demand. While many tenants have been in occupation for

a considerable time, where a tenant leaves, voids can be managed

and re-lettings can be achieved.

The majority of properties are multi-let, resulting in a number

of individual tenancies in most locations, reducing exposure to any

single tenant and risk of loss of rental income in the case of

defaults and voids.

Leases are mainly for terms of five years or more with

relatively few short-term agreements (two years or less), and

usually with upward only rent reviews based on market rates.

Flexibility in addressing tenant needs and requirements generally

mean that the terms agreed result in a mutually beneficial outcome

for both parties.

Tenants comprise a broad spread of occupiers, also reducing risk

exposure: national and local government, international businesses,

national trading chains and regional and local businesses. Uses

include manufacturing and services; storage and distribution; and

trade counter and out-of-town retail.

Active direct management and close engagement and constructive

business relationships with tenants, together with refurbishment

and selective development over time, underpin capital value and

increase income.

Managed for shareholders

The portfolio is directly, rather than externally, managed.

Finance and administrative operations are largely outsourced to

external providers to meet specific needs. All report to the Board,

the majority of whom are non-executive directors.

Management remuneration comprises salary and, where appropriate,

a cash bonus. Wynnstay does not offer incentive schemes, such as

share plans, share options or share bonuses.

As a result, both management and the Board are focused on

Wynnstay's performance for the benefit of shareholders, operational

costs are closely controlled and dilution of shareholders'

investment and potential conflicts of interest are minimised.

Incremental growth

The portfolio has been built incrementally, with opportunities

being taken to dispose of assets as and when the time is

appropriate and to reinvest in assets that offer better long-term

returns.

This is achieved gradually over time, without the need for

deal-driven activity in pursuit of corporate or portfolio

expansion.

Funding

Wynnstay adopts a prudent, pragmatic approach to funding.

Investments are funded in part by retained profits and recycling

capital receipts from disposals and in part from borrowings, the

majority at a fixed rate and held at a modest loan-to-value level,

from an experienced and supportive property lender. This provides

security at times of uncertainty in debt markets.

Valuation

Properties are valued on a cautious basis, based upon

professional advice from expert external valuers, recognising that

commercial property is a cyclical market that can exhibit

significant upward and downward movements over time and that

steadiness and progression are most likely to be in shareholders'

interests.

Wynnstay on AIM

Wynnstay's shares were quoted on its AIM introduction in 1995 at

a mid-market price of 150p. On the day prior to the approval of

this report, the mid-market price was 675p, an increase of 350%.

The dividend paid in 1995 was 4p per share. The dividend paid and

proposed for the current year will be 24p per share, an increase of

500%.

Performance

Wynnstay's distinctive approach has delivered on its strategy

over both the medium and long term. Shareholders have benefitted

from substantial increases in net asset value per share and

dividends as the portfolio and its management have delivered strong

results.

Corporate Performance over 5 years

Year Ended 25 March 2023 2022 2021 2020 2019

pence pence pence pence pence

------ ------- ------- ------ ------ ------

Net Asset Value per share 1,110p 1,090p 911p 792p 807p

------ ------- ------- ------ ------ ------

Five Year Net Asset Value

Growth 37.5%

------ ------- ------- ------ ------ ------

Dividends per share, paid

and proposed 24.0p 22.5p 21.0p 15.0p 19.0p

------ ------- ------- ------ ------ ------

Five Year Dividend Growth 26.3%

------ ------- ------- ------ ------ ------

Portfolio Performance

Year ended 25 March 2023 2022 2021 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------ -------- -------- -------- -------- --------

Property Income 2,312* 2,308 2,438 2,271 2,216

------ -------- -------- -------- -------- --------

Rental Income 2,304 2,252 2,140 2,271 2,216

------ -------- -------- -------- -------- --------

Underlying 5 Year Rental

Income Growth 25.5% 2,179 1,730

------ -------- -------- -------- -------- --------

Portfolio Value 39,320 38,975 34,005 34,260 35,095

------ -------- -------- -------- -------- --------

Underlying 5 Year Portfolio

Value Growth 31.2% 37,220 28,365

------ -------- -------- -------- -------- --------

% % % % %

------ -------- -------- -------- -------- --------

Loan-to-value ratio 25.3% 25.5% 29.4% 36.5% 35.6%

------ -------- -------- -------- -------- --------

Gearing ratio 22.3% 21.8% 32.4% 52.2% 52.7%

------ -------- -------- -------- -------- --------

Occupancy at year-end 100% 100% 99% 94% 100%

------ -------- -------- -------- -------- --------

Rent Collection for year 100% 100% 99% 100% 100%

------ -------- -------- -------- -------- --------

Operating Costs/Income 31.1% 32.0% 34.8% 30.3% 28.2%

------ -------- -------- -------- -------- --------

Operating Costs/Portfolio

Value 1.8% 1.9% 2.5% 2.0% 1.8%

------ -------- -------- -------- -------- --------

years years years years years

------ -------- -------- -------- -------- --------

Weighted average unexpired

lease term:

* to lease break 3.1 3.0 2.8 3.6 2.8

4.4 4.4 4.5 4.8 4.2

* to lease expiry

------ -------- -------- -------- -------- --------

* Includes GBP8,000 of Other Property Income. See note 2 of the Financial Statements.

Underlying Rental Income and Portfolio Value are for properties

that have been held in the portfolio throughout the five year

period. As a result, a property purchased in September 2019 with

Rental Income of GBP111,000 and valuation of GBP1,840,000 and

properties sold in the period with an aggregate Rental Income of

GBP351,000 and an aggregate valuation of GBP5,920,000 have been

excluded.

Excludes rent concessions of GBP29,000 granted to tenants as a

result of the Covid-19 pandemic.

After rounding for GBP8,000 bad debt (0.3%).

Excludes GBP81,000 of non-recurring costs incurred in 2023

relating to new Board appointments.

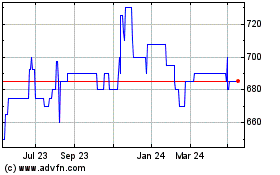

Share Price Performance

Although Wynnstay is quoted on AIM, and therefore is not a

constituent of the FTSE 350 Real Estate Investment Trusts Index,

the index contains a good cross-section of quoted property

companies of various forms, all much larger than Wynnstay.

Wynnstay's share price relative to the FTSE 350 Real Estate

Investment Trusts Index is shown in the chart below. Wynnstay's

share price has substantially outperformed the index over the

ten-year period.

WYNNSTAY PROPERTIES PLC

CHAIRMAN'S STATEMENT

Against the background of considerable economic and political

uncertainty, which has affected the financial and property markets

as well as the personal finances of all of us, I am pleased to

report on another successful year for Wynnstay and its

shareholders.

Last year's report introduced a new section, entitled

Introduction to Wynnstay. This described Wynnstay's distinctive

approach to commercial property investment primarily for private

shareholders and provided information both on the Company's

performance and its share price performance over time. The section

has been retained and updated in this report and continues to

highlight Wynnstay's continued strength over time across a range of

measures. I encourage all shareholders to read it.

The past year has also been significant for Wynnstay as we have

planned and been preparing for succession on the Board, including

the appointment of two new Non-executive Directors and the

appointment of a new Managing Director to succeed Paul Williams. I

will report further on these appointments later in this

statement.

Returning to the past year, Wynnstay's financial performance is

summarised in the following overview table.

Overview of financial performance

Change 2023 2022

-- Rental Income

Annual* 2.3% GBP2,304,000 GBP2,252,000

Underlying* 10.4% GBP2,304,000 GBP2,087,000

--------- --------------- ---------------

(4.6)% GBP1,497,000 GBP1,569,000

* Net Property Income **

--------- --------------- ---------------

(75.7)% GBP1,842,000 GBP7,581,000

* Operating Income

--------- --------------- ---------------

-- Income before Taxation (80.1)% GBP1,430,000 GBP7,202,000

--------- --------------- ---------------

-- Earnings per share (weighted

average) (78.9)% 42.2p 199.8p

--------- --------------- ---------------

* Dividends per share, paid and proposed 6.7% 24.0p 22.5p

--------- --------------- ---------------

* Net asset value per share 2.0% 1,110p 1,090p

--------- --------------- ---------------

* Loan to value ratio 25.3% 25.5%

--------- --------------- ---------------

* Gearing ratio 22.3% 21.8%

--------- --------------- ---------------

* Annual Rental Income is shown in note 2 of the Financial

Statements and Underlying Rental Income is the like-for-like income

from properties held in the portfolio throughout both years and

thus excludes rental income in 2022 of GBP165,000 from the Surbiton

property sold in February 2022.

** Excludes GBP81,000 of non-recurring costs incurred in 2023

relating to new Board appointments.

An innovation in this Annual Report is that our Managing

Director, Paul Williams, has prepared a separate review of the

management activity within the portfolio during the year, including

some market context for this activity, the revaluation and the

financial results. His review, which follows this statement, also

gives a retrospective review of the evolution of the portfolio over

his time at Wynnstay. He also comments on the important focus given

over the past two years to improving the energy efficiency of our

properties.

Portfolio and Valuation

There were no changes in the portfolio in the year. We continued

actively to identify and pursue suitable additions to the

portfolio. Opportunities at acceptable prices proved difficult for

most of the year and we considered that it was prudent to retain

cash until conditions for acquisitions improved. Late in the year

negotiations commenced for the GBP2.5m acquisition of Riverdale

Industrial Estate, Tonbridge and the transaction was eventually

completed after the year-end. Further details are contained in the

Managing Director's Review.

Whilst annual rental income increased by 2.3% to GBP2,304,000

compared to the prior year (2022: GBP2,252,000), the underlying

rental income on a like-for-like basis, excluding the Surbiton

property sold late in the prior year, increased by 10.4% to

GBP2,304,000 (2022: GBP2,087,000). This significant increase in

income reflects the benefits of the active management of the

portfolio described in the Managing Director's Review.

Our Independent Valuers, BNP Paribas Real Estate, undertook the

annual revaluation as at 25 March 2023 valuing the Company's

portfolio at GBP39,320,000. This represents a 0.9% increase of

GBP345,000 on the valuation as at 25 March 2022 and again reflects

the benefits of the active management of the portfolio.

Although the increase in the valuation this year (0.9%) is

modest compared to last year (2022: 23.7%), it should be recalled

that last year's impressive increase reflected conditions in late

2021 and early 2022 and it was self evident that the market was

likely to turn - as was indeed the case in the third and fourth

quarters of 2022. This reversal resulted in significant valuation

reductions in the commercial property sector, including for other

quoted property companies with industrial portfolios. The

reductions followed changes in the market after March 2022 as

successive significant rate increases, rising inflation and

economic uncertainty impacted yields. So it is worth reflecting on

some reasons why the Wynnstay portfolio has performed well compared

to some others.

Wynnstay's portfolio stands apart from other quoted property

companies with industrial portfolios in that our assets are located

in areas where there is robust occupational demand and limited

supply, where modest rents generally provide opportunity for

further rental growth over time as rent reviews arise and new

lettings are achieved. The relatively small lot sizes of our assets

also appeal, when marketed for sale, to a wide range of private

investors.

The nature of the property valuation process means that there

will always be a range within which the valuers work to reach a

final valuation figure. Wynnstay has always valued its portfolio on

a cautious basis based on professional advice from expert external

valuers, recognising that commercial property is a cyclical market

that can exhibit significant upward and downward movements over

time and that steadiness and progression are most likely to be in

shareholders' interests.

While this year the yields used by our valuers in determining

the investment value of the assets generally moved out by between

0.25% and 0.5%, and in one case by 1%, the valuation benefitted

overall from the management activity described in the Managing

Director's Review which delivered increases in rental income and

these increases, together with other market data, underpinned the

estimated rental values used in the valuation.

The annual valuation is undertaken under accounting standards

for use in our financial statements in accordance with RICS Global

Standards and values each property as a separate asset on the basis

of a sale of that property in the open market. Therefore, the

valuation does not take account of any additional value that might

be realised if the portfolio were to be offered on the open market

or any other special factors that may be relevant in the case of

individual potential purchasers, such as sales to other property

investors, existing tenants or adjoining owners.

Income (Profit) and Costs

Income (Profit) for the year is shown in the Statement of

Comprehensive Income.

Net Property Income, before the fair value adjustment of

investment properties, property sales and taxation, for the year

was GBP1,497,000 (2022: GBP1,569,000).

Operating Income after the fair value adjustment and property

sales before taxation fell to GBP1,842,000 (2022: GBP7,581,000)

principally as a result of the fact that no assets were sold in the

year to generate profits on disposal and the valuation surplus for

the year of GBP345,000 was much lower that the exceptional increase

in the prior year (2022: GBP5,887,000).

The combined result is Income before Taxation for the year of

GBP1,430,000 (2022: GBP7,202,000).

We continue our policy of exercising tight control over

administrative costs. Non-recurring costs of GBP81,000 were

incurred on succession matters, described further below. Property

costs were lower than in the prior year at GBP96,000 (2022:

GBP125,000) as no significant void or refurbishment costs were

incurred.

Finance, Borrowings and Gearing

Wynnstay remains in a strong financial position.

At the year-end, we held cash of GBP3.3 million (2022: GBP3.5

million), our core borrowing was unchanged at GBP10.0 million

(2022: GBP10.0 million) and our interest rate is fixed at 3.61%

until December 2026. Net gearing was 22.3% (2022: 21.8%). In

addition to our available cash balance and positive cash flow from

our property activities, our GBP5m revolving credit facility

remained undrawn.

As already mentioned above, since the year-end we have invested

GBP2.5m of our year-end cash resources on the acquisition in

Tonbridge described in the Managing Director's Review.

Dividend

Over recent years we have sought to pursue a progressive

dividend policy that aims to provide shareholders with a rising

income commensurate with Wynnstay's underlying growth and

finances.

In the light of the satisfactory results for the year, the Board

recommends a final dividend of 15.0p per share (2022: 14.0p). An

interim dividend of 9.0p per share (2022: 8.5p) was paid in

December 2022. Hence, the total dividend for this year of 24.0p per

share (2022: 22.5p) represents an increase of 6.7% on the prior

year.

Over the past five years, dividends have increased by 26.3% from

19.0p to 24.0p.

Subject to shareholder approval, the final dividend will be paid

on 26 July 2023 to shareholders on the register at the close of

business on 30 June 2023.

Board Succession

In the course of reviewing the composition of the Board and

succession planning, Charles Delevingne expressed his wish to

retire from the Board. Accordingly, we appointed a firm

specialising in non-executive appointments to identify suitable

candidates. Our external recruitment process attracted keen

interest from a good range of qualified candidates and, in March

2023, we announced the appointment of two new Non-executive

Directors, Hugh Ford and Ross Owen.

Hugh is a solicitor who has practiced in a major city firm and

in industry, latterly in a major listed property company. Ross is a

chartered surveyor with extensive commercial property investment

management experience both as a partner in private practice and as

a consultant and adviser. Further information on their careers is

provided in the biographies at the end of this report. Their

complementary backgrounds, experience and skills in business and

commercial property will bring fresh insight and perspective to our

Board deliberations on the evolution of Wynnstay's portfolio and

the Company's future direction.

I am sure that I speak on behalf of all shareholders in thanking

Charles Delevingne for his contribution to Wynnstay's success over

the past twenty years during which his wisdom and guidance have

been invaluable in implementing the major changes we have made to

the portfolio which have underpinned delivery of our successful

results for shareholders.

Management Succession

Paul Williams was appointed as Managing Director in 2006 and,

having reached normal retirement age late last year, he indicated

his wish to stand down when a suitable successor had been

identified. Accordingly, we appointed a firm specialising in senior

recruitment in the commercial property sector to carry out a search

and announced a few weeks ago the appointment of Christopher Betts

as Paul's successor. He will join Wynnstay next month as Managing

Director designate and will join the Board, following a short

handover period, later this summer.

During Paul's tenure as Managing Director the Company's

portfolio has been transformed, as he reflects in his review below.

When he was appointed, the portfolio comprised, in the main, small

single-tenanted assets with a mix of industrial, office and retail

uses. Under his leadership, Wynnstay has concentrated its

investments into larger, multi-let, assets predominantly in the

industrial, including trade-counter, sector. He has focused

acquisitions on higher quality assets let to tenants with better

covenants as well as identifying sites suitable for development

adjacent to existing assets and planning small-scale developments

that enhance the value of those assets.

In managing the portfolio to bring about this transformation,

Paul has displayed the benefit of his wide experience in commercial

property and his personal skills in dealing with people and the

issues and challenges that arise, some in the ordinary course and

others in unusual circumstances. He has built strong relationships

with many of our tenants that has been invaluable in understanding

their needs and maintaining them as longstanding occupiers and

ensuring that they respect their lease obligations to us.

These strong relationships combined with Paul's patience and

tenacity have resulted in few bad debts and few voids in the

portfolio over his seventeen years at Wynnstay. Where tenants have

faced difficulties, he has been sympathetic in dealing with them

unless, of course, he was dealing with those who might wish to

avoid their obligations through their own business failings.

Wynnstay's scale and structure in which the Managing Director is

the only full-time employee mean that Paul has had to turn his hand

to many different tasks and challenges, including several office

moves and technological changes as the Company adapted to new ways

of operating, including the sudden change to virtual working as a

result of Covid-19.

On behalf of shareholders, I thank Paul for his significant

contribution to the Company's evolution over this period and wish

him a long and happy retirement.

Our Managing Director designate, Christopher Betts, has been a

Chartered Surveyor for over 30 years. After graduating from Oxford

Brookes University with a BSc in Estate Management, he joined

Cluttons as a graduate trainee where he spent his first ten years

in professional practice.

Subsequently, he has worked for various commercial property

businesses including British Land, Frogmore and Romulus. Latterly

he has been advising on and implementing a strategy and management

programme at Peabody Trust for their London and South-East

corporate office portfolio following significant recent mergers

with other social housing providers.

Shareholder Matters

In my statement last year, I reported on the Board's review of

the liquidity and marketability of Wynnstay shares and on the

actions being taken as a result.

You will recall that Wynnstay has a small, and rather unusual,

share register on which there are under 250 accounts, a significant

number of which are connected through family relationships, with

private investors rather than funds or institutions as

shareholders. In the main, they are long-term investors with some

holdings having passed from generation to generation since the

company was founded in 1886. These long-term investors provide

stability and continuity within the shareholder base. As a result

of this base the volume and proportion of Wynnstay shares traded in

the market is less than for many quoted companies with larger share

registers and more dispersed holdings. Fewer Wynnstay shares tend

to be available to trade and then only usually in modest quantities

and with a sizeable "spread" between the bid and offer price.

Shares are typically traded at a significant discount to the net

asset value per share. However, both these features are also seen

in other, much larger, quoted property companies.

Among the actions we decided to take was the provision of

further succinct information on Wynnstay, its business and

performance and to demonstrate Wynnstay has performed well for its

investors, both against its objectives and relative to other quoted

property companies, in the medium to long-term. The information

provided last year has been updated and is contained in the

Introduction to Wynnstay section above. The Company specific

information demonstrates, in the Board's view, the benefits of

Wynnstay's distinctive approach and the share price comparison

shows that Wynnstay's share price has continued substantially to

outperform the comparative real estate sector.

Share prices in the sector were buoyant during the first half of

the last calendar year, but then declined substantially as concerns

about the economy, inflation and interest rates affected both

valuations and market sentiment towards the sector. While

Wynnstay's share price has not been immune from this decline, the

impact on Wynnstay has been significantly less than on the sector

as a whole. The chart in the Introduction to Wynnstay section above

shows that over the past ten years, while Wynnstay's share price

has more than doubled, the performance of the comparative real

estate sector has remained flat.

We also decided to ask shareholders to give Wynnstay authority

to purchase its own shares so that the Company can act as a

purchaser in the market where it is appropriate, and in the

interests of shareholders generally, to do so. Other quoted

property and investment companies, as well as other quoted

companies, use share buybacks on a routine basis to enhance

earnings and net asset value per share. Where shares are bought

back dividends cease to be payable, thus conserving cash in the

business and benefitting continuing shareholders and with the

present intention being to hold any shares bought back in treasury

so that they are available for reissue where there is market demand

for shares or to facilitate individual property acquisitions.

Shareholders granted this authority at the Annual General

Meeting in July 2022. The volume of shares traded since then has

been relatively small and the market has generally been able to

absorb most of the shares offered. However, the authority was used

to acquire 15,000 Ordinary Shares at 710p in September 2022. The

Board keeps the position under review and may exercise the

authority when shares are available in the market and it is in the

interests of shareholders generally to do so.

We also considered that Wynnstay's future development would be

assisted if authority continued to be granted by shareholders, as

has been the case for many years, to issue a limited number of

shares without first offering them to existing shareholders. This

gives Wynnstay flexibility, for instance, to issue shares for small

fundraisings which might support a larger acquisition and allow the

issue of shares as part consideration on individual property

acquisitions to vendors, where the vendors wish to retain in

interest in a broader portfolio of assets in a quoted company.

Bringing in new investors with an interest in commercial property

and in Wynnstay's distinctive approach to the share register would

broaden the shareholder base and support its future

development.

Outlook

At this time last year, I noted that the UK had entered a

further period of uncertainty, following Brexit and the Covid

pandemic, as a result of the effects of the Russian invasion of

Ukraine and of rising inflation imposing real pressure on business

costs and household incomes with consequent potential impacts on

the economy.

This uncertainty continued throughout the year, not least as a

result of the several changes of administration in government.

Inflation reached levels not seen for forty years, with a major

contributor being huge increases in energy prices which have

affected both businesses and consumers although government measures

have provided some relief. However, recent economic news has been

more positive than might have been expected last autumn, when a

long economic recession was forecast and inflation was continuing

to rise.

Despite these conditions, Wynnstay remains in a very healthy

position. We have a focused, stable and well-let portfolio which

has been enhanced through acquisitions and disposals over the

years. It is delivering, and is capable of continuing to deliver,

growth of capital and income for shareholders in the medium and

long-term. The main risks to continued growth are economic and

political, such as significant disruption caused by events beyond

our control or the UK economy suffering a significant downturn

which affects the ability or willingness of businesses to invest or

of consumers to spend.

The commercial property market is cyclical. Asset values can

move up and down over time as a result, as we have seen over the

past several years. Wynnstay has always adopted a cautious and

realistic approach in valuing our assets and to the management and

development of the business. As noted above, our annual revaluation

is undertaken for accounting purposes and values our individual

assets, not the portfolio as a whole.

Within the Wynnstay portfolio, the first few months of this

financial year have been encouraging in terms of rental growth as

the update in the Managing Director's Review describes.

Accordingly, despite the broader uncertainties in the economy and

elsewhere, the Board is optimistic about the current outlook for

Wynnstay's business.

Colleagues and Advisers

Our Managing Director, Paul Williams, and our finance and

company secretarial colleagues have continued to work effectively

to deliver for shareholders. I would like to thank them, as well as

my colleagues on the Board and our professional advisers, for their

support over the year.

This support has been especially evident over the past year in

addressing Board succession, and also in the prior year when we

changed both our auditors and our nominated advisers and corporate

brokers.

Shareholding Enquiries

From time to time we receive enquiries from shareholders with

questions about their shareholdings or about buying or selling

Wynnstay shares or transferring them, typically to relatives.

All enquiries about shareholdings, including changes of address

and bank details and about such transfers of shares, should be

directed to our Registrars, Link Group.

As regards buying or selling shares, this can be carried out by

registering the holding online with our Registrars, Link Group, via

their secure share portal www.signalshares.com, which also enables

shareholdings to be managed quickly and easily. Shares can, of

course, also be bought and sold in the usual way through a

stockbroker or an online platform.

Annual General Meeting

The AGM provides an important and valued opportunity for the

Board to engage with shareholders.

Our AGM this year will be held at 2.30pm on Tuesday 18 July 2023

at the Royal Automobile Club, 89 Pall Mall, London SW1Y 5HS. The

Notice of Meeting is to be found at the end of this Annual

Report.

I urge all shareholders to complete and return their proxy forms

so that their votes on the resolutions being put to the meeting can

be counted.

Shareholders who have registered for Link services online can

also benefit from the ability to cast their proxy votes

electronically, rather than by post. Shareholders not already

registered for Link services online will need their investor code,

which can be found on their share certificate or dividend tax

voucher, in order to register.

To maximise shareholder engagement, shareholders who are unable

to attend the AGM are encouraged to submit in writing those

questions that they might have wished to ask in person at the

meeting. Questions should be emailed to

company.secretary@wynnstayproperties.co.uk at least 48 hours in

advance of the AGM. You will receive a written response and, if

there are common themes raised by a number of shareholders, we aim

to provide a summary for all shareholders, grouping themes and

topics together where appropriate, on the Company's website

following the AGM.

Finally, on behalf of the Board, I would like to thank all

shareholders, whether they have held shares for many years or have

recently acquired shares, for their interest in and support for

Wynnstay.

Philip Collins

Chairman

13 June 2023

WYNNSTAY PROPERTIES PLC

MANAGING DIRECTOR'S REVIEW

In my final full year at Wynnstay I am pleased to have the

opportunity to report on the management activity within the

portfolio during the year and to reflect on the evolution of the

Wynnstay portfolio over the last seventeen years while I have been

Managing Director.

The Portfolio during 2022-23

I will focus primarily on the portfolio which, as at the

year-end, comprised 83 units and a development site in 15

locations.

Due to the number of leases, in most years there is inevitably a

reasonable level of lease negotiation activity. However, the year

just ended has been one of the most active that I can remember with

ten lease renewals, five rent reviews, two leases being varied and

one new letting. In addition, there were extended negotiations on

one acquisition completed following the year-end to which I refer

below.

Of the lease renewals that completed during the year, four were

at Aylesford, two at Lichfield, two at Hailsham and one each at

Ipswich and Uckfield. It is always pleasing to retain tenants on

renewal and as a consequence of the ten renewed leases the rents

receivable under these leases have increased by over 16% which will

be reflected in future rental income. We completed five rent

reviews, three at Petersfield and two at Aylesford and as a result

of these five reviews the rents receivable under these leases have

increased by over 17%.

With the good level of tenant retention through lease renewals,

there are fortunately fewer vacant properties arising and hence

less expenditure on empty property rates and refurbishment costs

and inevitably less new letting activity. However, at Liphook one

tenant did vacate early in the year and the unit was very quickly

relet at a rent which is over 33% higher than previously received.

This new letting creates excellent evidence to support rental

increases elsewhere on the estate where further reviews are due in

the next year or two.

During the year we completed two variations of existing leases.

The first was at Cosham where we removed a tenant break clause thus

securing annual rental income from the tenant for a further five

years. The second was at Lichfield where a tenant break option that

would have been due in 2026 was removed such that the rent will now

continue until at least 2031 and will remain subject to an upward

only rent review in 2026.

Portfolio in the current year

Compared with the active year I have described above, in the

current year there will be a smaller number of lease negotiation

transactions overall. However, there are some significant leases

where renewals or reviews are due and where useful evidence for the

level of market rents has been established in transactions

completed in the prior year described above or in the early months

of current year. Hence, I am optimistic about the outlook for the

current year.

Portfolio Valuation

The lease activity described above has had a significant

positive effect on the March valuation. As already noted in the

Chairman's Statement, our Independent Valuers, BNP Paribas Real

Estate, undertook the annual revaluation as at 25 March 2023

valuing the Company's portfolio at GBP39,320,000. This represents a

0.9% increase of GBP345,000 on the valuation as at 25 March

2022.

The Chairman has pointed out in his statement that while this

percentage increase is modest compared to last year (2022: 23.7%),

it should be considered against the background of significant

valuation reductions in the commercial property sector and he has

commented on some of the reasons for this. I hope that the lease

negotiation activity of the past year and in the current year to

date, together with the further activity over the course of the

rest of the year to which I have referred above will assist in

underpinning the valuation in March 2024.

Post year-end acquisition

As announced on 28 April 2023, we exchanged contracts for the

purchase of Riverdale Industrial Estate, Tonbridge and completion

took place in May 2023. We had agreed terms for this acquisition in

mid-December 2022, but for various reasons the legal due diligence

took several months. The total acquisition cost of approximately

GBP2.5 million was funded entirely from the Company's existing cash

resources.

This freehold property comprises of five industrial units

arranged as two terraces with a central service yard. The estate is

fully let to four tenants with a range of lease expiry dates. The

current rent from the estate is GBP140,350 per annum and is subject

to three outstanding upward only rent reviews effective from 29

September 2022 and a pending lease expiry effective from 30

November 2023. The net initial yield is 5.6%, which is anticipated

to rise to around 6.9% when the outstanding rent reviews and lease

renewal have been concluded.

The acquisition provides a good strategic fit with the existing

portfolio in the south-east of England, including Quarry Wood

Industrial Estate at Aylesford.

Energy efficiency in the portfolio

Over the past two years we have focused on improving the energy

efficiency of all the properties in the portfolio. To achieve

net-zero carbon by 2050 the UK government is setting and reviewing

targets and regulations for the continual improvement of

properties' Energy Performance Certificate (EPC) ratings as key to

achieving this goal. Current EPC ratings for commercial properties

run from A to G, with buildings that are rated A considered the

most, and those rated G the least, energy-efficient. The latest

government target is that, from 1 April 2023, all new lettings of

non-domestic private rented property must have an EPC rating of E

or above.

During the year there has been considerable activity, working

with our tenants at various individual properties generally at

modest cost and often undertaken where tenants wish to make other

changes to suit their business needs, to achieve or improve upon

existing EPC ratings to ensure we meet the Government's target.

I am pleased to report that the target of having all properties

in the portfolio with EPC ratings of E and above by 1 April 2023

was exceeded, with many of the properties achieving an EPC rating

of C and above. The Government's latest proposal is that all new

lettings of commercial buildings should achieve an EPC rating of C

or above by April 2025 and Wynnstay continues to work towards

achieving this goal across its portfolio in advance of this

deadline .

Reflections on the evolution of the portfolio

I have been Managing Director of Wynnstay for over seventeen

years, having been appointed in February 2006. On my appointment,

the portfolio comprised, in the main, small single-tenanted assets

with a mix of industrial, office and retail uses. Since then,

Wynnstay has concentrated its investment principally into larger,

multi-let, assets predominantly in the industrial, including

trade-counter, sector. I am pleased to have been able to take the

lead in bringing about this transformation, upgrading the quality

of the assets and the tenant covenants. I am particularly proud of

delivering our successful development at Petersfield last year

which had to be undertaken against the challenges of Covid-19 and

its effects on the construction industry. It has proved to be an

excellent addition to the portfolio.

At the time of my appointment the portfolio comprised 55 units

in 20 locations with a value of just over GBP20 million producing a

rental income of just over GBP1.5 million per annum. The current

portfolio, following the recent acquisition at Tonbridge, comprises

88 units and a development site in 16 locations with a value of

close to GBP42 million and a rental income of about GBP2.5 million

per annum. In total, the portfolio now comprises over 250,000

square feet of lettable space.

Looking back over the past seventeen years, I have sold 16 of

the 23 assets that I inherited in 2006 and have added 11 assets to

the portfolio. Of the original 23 assets only 7 remain in the

portfolio, with the offices in Surbiton having been bought and sold

during my tenure.

The assets sold comprised mainly small, single-tenanted,

properties including retail shops and small offices divided into

suites, often with individuals as tenants and single industrial

units. Where there have been redevelopment opportunities, typically

for residential use, the assets have been sold at prices that

reflected the higher value use or the greater value for development

to a neighbour.

The funds realised from these disposals have been redeployed

into larger, better quality, assets including several multi-let

industrial estates such as those at Aylesford, our largest asset,

Ipswich, Lichfield, Liphook and Petersfield. The tenants now

include well-known national brands, often owned by quoted

companies, with stronger covenants than those of our historic small

business tenants. Some assets offered opportunities for

development, such as at Aylesford, Liphook and Petersfield.

During the same period Wynnstay's net asset value and dividends

have increased from 418p and 8.3p per share to 1,110p and 24.0p per

share respectively. Wynnstay's share price has substantially

outperformed the FTSE 350 Real Estate Investment Trusts Index over

the last ten years as shown in the Introduction to Wynnstay section

above. I am pleased to have played my part in delivering these

results to shareholders.

This performance has been achieved despite various major hurdles

ranging from the global financial crisis of 2008-9 to the Covid-19

crisis of 2020-22 and now to the gloomy world economic outlook that

has developed since Covid-19 notably as a result of the Russian

invasion of Ukraine and several other regional conflicts and

geopolitical tensions. Over the period, the commercial property

market in the UK has been through several cycles of upturns and

downturns, the latest arising from the impact of rising inflation

and interest rates over the past year.

I have certainly enjoyed my time at Wynnstay dealing with the

many and varied tenants and their businesses, meeting and trying to

work with them, on a principal-to-principal basis, to achieve the

optimum result for them and their businesses as well as, of course,

for Wynnstay shareholders. Maintaining positive and constructive

relations with tenants is essential in a commercial property

business and especially so in difficult times whether due to

general economic conditions or to specific trading difficulties in

a tenant's business and even when I have not been the giver of good

news to a tenant.

As with all commercial property portfolios, tenants sometimes

produce unexpected challenges. For instance, in Wynnstay's case, I

recall the meat pie-making tenant who went into liquidation just

before Christmas, leaving freezers full of ingredients at our unit.

The electricity supplier had disconnected the power supply and the

staff had vacated the unit. I was faced on repossession of the unit

in January with arranging the disposal of considerable volumes of

rotting meat which was a most unpleasant experience. On a more

positive note, another tenant on liquidation left the premises full

of racking and a large volume of motor spare parts which I was able

to sell by auction over time, realising not only sufficient funds

to cover the outstanding rent, but also the refurbishment of the

premises for reletting at an increased rent.

In the coming weeks, I will be familiarising my successor, Chris

Betts, with the Wynnstay portfolio and our tenants in order to

ensure a smooth transition as well as discussing with him some of

the opportunities that may arise depending on the direction that he

and the Board may wish to take the portfolio. I am confident that

Wynnstay can continue to grow successfully for the benefit of all

shareholders, of which I plan to continue to be one, and I will

follow the Company's future development with great interest.

Finally, I would like to thank the Board, our professional

advisers, our service providers and suppliers for their support

over many years and to thank all the Wynnstay shareholders over the

past seventeen years for their loyalty and commitment.

Paul Williams

Managing Director

13 June 2023

WYNNSTAY PROPERTIES PLC

STATEMENT OF COMPREHENSIVE INCOME FOR YEARED 25 MARCH 2023

Notes 2023 2022

GBP'000 GBP'000

Property Income 2 2,312 2,308

Property Costs 3 (96) (125)

Administrative Costs 4 (719) (614)

Net Property Income 1,497 1,569

Movement in Fair Value of

Investment Properties 10 345 5,887

Profit on Sale of Investment

Property - 125

Operating Income 1,842 7,581

Investment Income 6 27 --

Finance Costs 6 (439) (379)

Income before Taxation 1,430 7,202

Taxation 7 (288) (1,784)

Income after Taxation and

Total Comprehensive Income 1,142 5,418

Basic and diluted earnings

per share 9 42.2p 199.8p

The Company has no items of other comprehensive income.

WYNNSTAY PROPERTIES PLC

STATEMENT OF FINANCIAL POSITION 25 MARCH 2023

2023 2022

Notes GBP'000 GBP'000

Non-Current Assets

Investment Properties 10 39,320 38,975

Investments 12 3 3

39,323 38,978

Current Assets

Trade and other receivables 14 482 301

Cash and Cash Equivalents 3,268 3,491

3,750 3,792

Current Liabilities

Trade and other payables 15 (844) (1,048)

Income Taxes Payable (308) (284)

(1,152) (1,332)

Net Current Assets 2,598 2,460

Total Assets Less Current

Liabilities 41,921 41,438

Non-Current Liabilities

Bank Loans Payable 16 (9,951) (9,938)

Deferred Tax Payable 17 (2,034) (1,953)

(11,985) (11,891)

Net Assets 29,936 29,547

Capital and Reserves

Share Capital 18 789 789

Capital Redemption Reserve 205 205

Share Premium Account 1,135 1,135

Treasury Shares (1,734) (1,570)

Retained Earnings 29,541 28,988

29,936 29,547

Net Asset Value pence per

share 1,110p 1,090p

Approved by the Board and authorised for issue on 13 June

2023

P.G.H. Collins C.P. Williams

Director Director

Registered number: 00022473

WYNNSTAY PROPERTIES PLC

STATEMENT OF CASH FLOWS FOR THE YEARED 25 MARCH 2023

2023 2022

GBP'000 GBP'000

Cash flows from operating activities

Income before taxation 1,430 7,202

Adjusted for:

Increase in fair value of investment

properties (345) (5,887)

Interest receivable (27) -

Interest and finance costs payable 439 379

Profit on sale of investment property - (125)

Amortised loan fees 13 -

Revaluation movement 33 -

Changes in:

(Increase)/decrease in trade and

other receivables (181) 41

(Decrease)/increase in trade and

other payables (181) 153

Cash generated from operations 1,181 1,763

Income taxes paid (206) (284)

Net cash generated from operating

activities 975 1,479

Cash flows from investing activities

Interest and other income received 27 -

Purchase of investment properties - (1,583)

Sale of investment properties - 2,618

Net cash generated from investing

activities 27 1,035

Cash flows from financing activities

Interest paid (439) (379)

Dividends paid (622) (583)

Drawdown of bank loans net of fees - 9,938

Repurchase of shares into treasury (164) -

Repayment of bank loans - (10,000)

Net cash used in financing activities (1,225) (1,024)

(Decrease)/increase in cash and

cash equivalents (223) 1,490

Cash and cash equivalents at beginning

of period 3,491 2,001

Cash and cash equivalents at end

of period 3,268 3,491

WYNNSTAY PROPERTIES PLC

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 25 MARCH 2023

YEARED 25 MARCH 2023

Capital Share

Share Redemption Premium Treasury Retained

Capital Reserve Account Shares Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 26 March

2022 789 205 1,135 (1,570) 28,988 29,547

Total comprehensive

income for the

year - - - - 1,142 1,142

Treasury Share

repurchases - - - (164) - (164)

Revaluation movement - - - - 33 33

Dividends - note

8 - - - - (622) (622)

--------- ----------- -------- ---------- ---------- -------

Balance at 25 March

2023 789 205 1,135 (1,734) 29,541 29,936

--------- ----------- -------- ---------- ---------- -------

YEARED 25 MARCH 2022

Capital Share

Share Redemption Premium Treasury Retained Total

Capital Reserve Account Shares Earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 26 March

2021 789 205 1,135 (1,570) 24,153 24,712

Total comprehensive

income for the

year - - - - 5,418 5,418

Dividends - note

8 - - - - (583) (583)

--------- ----------- -------- ---------- ---------- -------

Balance at 25 March

2022 789 205 1,135 (1,570) 28,988 29,547

--------- ----------- -------- ---------- ---------- -------

FUNDS AVAILABLE FOR DISTRIBUTION

2023 2022

GBP'000 GBP'000

Retained Earnings 29,541 28,988

Less: Cumulative Unrealised Fair Value

Adjustment of Property Investments net of tax (13,376) (12,996)

Treasury Shares (1,734) (1,570)

Distributable Reserves 14,431 14,422

WYNNSTAY PROPERTIES PLC

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 25 MARCH 2023

Explanation of Capital and Reserves:

-- Share Capital: This represents the subscription, at par

value, of the Ordinary Shares of the Company.

-- Capital Redemption Reserve: This represents money that the

Company must retain when it has bought back shares, and which it

cannot pay to shareholders as dividends: It is a non-distributable

reserve and represents paid up share capital.

-- Share Premium Account: This represents the subscription

monies paid for Ordinary Shares of the Company in excess of their

par value.

-- Treasury Shares: This represents the total consideration and

costs paid by the Company when purchasing the 458,650 shares as

referred to in Note 18.

-- Retained Earnings: This represents the profits after tax that

can be used to pay dividends. However, dividends can only be paid

from distributable deserves as detailed in the preceding table.

WYNNSTAY PROPERTIES PLC

NOTES TO THE FINANCIAL STATEMENTS FOR THE

YEARED 25 MARCH 2023

1. BASIS OF PREPARATION, ACCOUNTING POLICIES AND ESTIMATES

Wynnstay Properties PLC is a public limited company incorporated

and domiciled in England and Wales. The principal activity of the

Company is property investment, development and management. The

Company's ordinary shares are traded on the AIM, part of The London

Stock Exchange. The Company's registered number is 00022473.

1.1 Basis of Preparation

The financial statements have been prepared in accordance with

UK adopted International Accounting Standards ("IAS"). The

financial statements have been presented in Pounds Sterling being

the functional currency of the Company and rounded to the nearest

thousand. The financial statements have been prepared under the

historical cost basis modified for the revaluation of investment

properties and financial assets measured at fair value through

Operating Income.

The financial information set out in this announcement does not

constitute statutory accounts as defined in section 435 of the

Companies Act 2006. Accordingly pursuant to section 435(2), this

announcement does not include the auditor's report on the statutory

accounts.

(a) New Interpretations and Revised Standards Effective for the

year ended 25 March 2023

The Directors have adopted all new and revised standards and

interpretations issued by the International Accounting Standards

Board ("IASB") and the International Financial Reporting

Interpretations Committee ("IFRIC") of the IASB and adopted by

applicable law that are relevant to the operations and effective

for accounting periods beginning on or after 26 March 2022:

-- Amendment to IFRS 16: Leases Covid 19-Related Rent Concessions .

-- IAS 37: Provisions, Contingent Liabilities and Contingent Assets .

The adoption of these interpretations and revised standards had

no material impact on the disclosures and presentation of the

financial statements.

(b) Standards and Interpretations in Issue but not yet

Effective

The International Accounting Standards Board ("IASB") and

International Financial Reporting Interpretations Committee

("IFRIC") have issued the below revisions to existing standards or

new interpretations or new standards with an effective date of

implementation after the period of these financial statements.

The following new amendment applicable in future periods has not

been early adopted as it is not expected to have a significant

impact on the financial statements of the Company:

-- Amendments to IAS 1: Classification of Liabilities as Current

or Non-current (effective for accounting

periods beginning on or after 1 January 2023).

-- Amendments to IAS 1 and IFRS Practice Statement 2 Disclosure of Accounting Policies.

-- Amendments to IAS 8 Definition of Accounting Estimates.

-- Amendments to IAS 12 Deferred Tax related to Assets and

Liabilities arising from a Single Transaction.

(c) Going concern

The financial statements have been prepared on a going concern

basis. This requires the Directors to consider, as at the date of

approving the financial statements, that there is reasonable

expectation that the Company has adequate financial resources to

continue to operate, and to meet its liabilities as they fall due

for payment, for at least twelve months following the approval of

the financial statements.

The Directors have reviewed cash balances and borrowing

facilities to cover at least twelve months of operations, including

financing costs and continuation of employment and advisory costs

as currently contracted without any reduction for cost saving

initiatives. The results of the review show that the Company has

cash and borrowing facilities to cover at least twelve months of

operations, and that the Company will satisfy the financial

covenant ratios in the borrowing facilities as described in Note

16. In addition, the Statement of Financial Position as at 25 March

2023 shows that the Company held a cash balance of GBP3.3m and net

assets of GBP29.9m and had a low gearing ratio of 22.3%. In the

light of the foregoing considerations, the Directors consider that

the adoption of the going concern basis is reasonable and

appropriate.

1.2 Accounting Policies

Investment Properties

All the Company's investment properties are independently

revalued annually and stated at fair value as at 25 March. The

aggregate of any resulting increases or decreases are taken to

operating income within the Statement of Comprehensive Income. The

basis of independent valuation is described in Note 10.

Investment properties are recognised as acquisitions or

disposals based on the date of contract completion.

Depreciation

In accordance with IAS 40, freehold investment properties are

included in the Statement of Financial Position at fair value and

are not depreciated.

The Company has no other property, plant and equipment.

Disposal of Investments

The gains and losses on the disposal of investment properties

and other investments are included in Operating Income in the year

of disposal. Gains and losses are calculated on the net difference

between the carrying value of the properties and the net proceeds

from their disposal.

Property Income

Property income is recognised on a straight-line basis over the

period of the lease and is measured at the fair value of the

consideration receivable. Lease deposits are held in separate

designated deposit accounts and are thus not treated as assets of

the Company in the financial statements. All income is derived in

the United Kingdom. When there are changes to a tenancy agreement

it is considered whether any lease incentives were given. Lease

incentives are amortised over the period of the earliest of the

lease termination date or the tenant lease break option date.

Deferred Income

Deferred Income arises from rents received in advance of the

period to which they relate and are treated as Trade and Other

Payables in the Statement of Financial Position. See note 15.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax. Current tax is the expected tax payable on the

taxable income for the year based on the tax rate enacted or

substantively enacted at the reporting date, and any adjustment to

tax payable in respect of prior years. Taxable profit differs from

income before taxation because it excludes items of income or

expense that are deductible in other years, and it further excludes

items that are never taxable or deductible.

Deferred taxation is the tax expected to be payable or

recoverable on differences between the carrying amounts of assets

and liabilities in the financial statements and the corresponding

tax bases used in the computation of taxable profits and is

accounted for using the statement of financial position liability

method. Deferred tax liabilities are recognised for all taxable

temporary differences (including unrealised gains on revaluation of

investment properties) and deferred tax assets are recognised to

the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be

utilised.

The Company provides for deferred tax on investment properties

by reference to the tax that would be due on the sale of the

investment properties. Deferred tax is calculated at the rates that

are expected to apply in the period when the liability is settled,

or the asset is realised. Deferred tax is charged or credited to

Income after Taxation and Total Comprehensive Income, including

deferred tax on the revaluation of investment property.

Trade and Other Accounts Receivable

Trade and other receivables are initially measured at the

operating lease measurement value and subsequently measured at

amortised cost as reduced by appropriate allowances for expected

credit losses. All receivables do not carry any interest and are

short term in nature.

Cash and Cash Equivalents

Cash comprises cash at bank and on demand deposits. Cash

equivalents are short term (less than three months from inception),

repayable on demand and are subject to an insignificant risk of

change in value.

Trade and Other Accounts Payable

Trade and other payables are initially measured at fair value

and subsequently measured at amortised cost. All trade and other

accounts payable are non-interest bearing.

Pensions

Pension contributions towards the employee's pension plan are

charged to the statement of comprehensive income as incurred. The

pension scheme is a defined contribution scheme.

Borrowings

Interest rate borrowings are initially recognised at fair value,

being proceeds received less any directly attributable transaction

costs. Borrowings are subsequently stated at amortised cost. Any

difference between the proceeds (net of transaction costs) and the

redemption value is recognised in profit or loss over the period of

the borrowings using the effective interest method. Borrowings are

classified as current liabilities unless the Company has an

unconditional right to defer settlement of the liability for at

least 12 months after the reporting date.

Dilapidations

Dilapidations receipts are recognised in the Statement of

Comprehensive Income when the right to receive them arises. They

are recorded in revenue as other property income unless a property

has been agreed to be sold whereby the receipt is treated as part

of the proceeds of sale of the property. See Note 2.

1.3 Key Sources of Estimation Uncertainty and Judgements

The preparation of the financial statements requires management

to make judgements, estimates and assumptions that may affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expenses.

Revisions to accounting estimates are recognised in the period

in which the estimate is revised if the revision affects only that

period. The key sources of estimation uncertainty that have a

significant risk of causing material adjustment to the carrying

amounts of assets and liabilities within the next financial year

are those relating to the fair value of investment properties which

are revalued annually by the Directors having taken advice from the

Company's independent external valuers, on the basis described in

Note 10. A key judgement taken by the Directors is as to whether a

property is being held for sale.

There are no other judgemental areas identified by management

that could have a material effect on the financial statements at

the reporting date.

2. PROPERTY INCOME 2023 2022

GBP'000 GBP'000

Rental income 2,304 2,252

Other property income 8 56

2,312 2,308

Rental income comprises rents earned and apportioned over the

lease period taking into account rent free periods and rents

received during the period. Other property income comprises

unexpended dilapidations and miscellaneous income arising from

the letting of properties.

3. PROPERTY COSTS 2023 2022

GBP'000 GBP'000

Empty rates 2 3

Property management 33 65

35 68

Legal fees 40 34

Agent fees 21 23

96 125

4. ADMINISTRATIVE COSTS 2023 2022

GBP'000 GBP'000

Rents payable - short term lease 6 32

General administration, including staff costs 582 548

Auditors' remuneration - audit fees CLA Evelyn

Partners Limited 41 31

Tax services - Saffrey Champness 9 3

Non-Recurring costs - costs relating to new

Board appointments 81 -

719 614

5. STAFF COSTS 2023 2022

GBP'000 GBP'000

Staff costs, including Directors' fees, during

the year were as follows:

Wages and salaries 270 289

Social security costs 36 34

Other pension costs 49 13

355 336

Further details of Directors' emoluments, totalling GBP319,000

(2022: GBP302,000), are shown under Directors' Emoluments in

the Directors' Report and form part of these Financial Statements.

There are no other key management personnel.

2023 2022

No. No.

The average number of employees, including

Non-Executive Directors, engaged wholly in

management and administration was: 5 5

The number of Directors for whom the Company

paid pension benefits

during the year was: 1 1

6. FINANCE COSTS (NET) 2023 2022

GBP'000 GBP'000

Interest payable and finance costs on bank

loans 439 379

Less: Bank interest receivable 27 -

412 379

7. TAXATION 2023 2022

GBP'000 GBP'000

(a) Analysis of the tax charge for the year:

UK Corporation tax at 19% (2022: 19%)

Total current tax charge 206 293

Deferred tax - temporary differences 82 1,491

Tax charge for the year 288 1,784

(b) Factors affecting the tax charge for

the year:

Net Income before taxation 1,430 7,202

Current Year:

Corporation tax thereon at 19% (2022: 19%) 272 1,368

Corporation tax adjustment for unrealised (65) -

property value gains

Capital gains net tax movement on disposals - 106

Deferred tax adjustment for change to 25%

tax rate (2022: 25%) - 467

Deferred tax net adjustments arising from

revaluation of properties properties 81 (157)

Total tax charge for the year 288 1,784

In the Spring Budget 2021 the UK Government announced that

from 1 April 2023 the corporation tax rate would rise from

19% to 25% on all profits in excess of GBP250,000. This new

law was substantively enacted on 24 May 2021.

8. DIVIDS 2023 2022

GBP'000 GBP'000

Final dividend paid in year of 14.0p per

share

(2022: Final dividend 13.0p per share) 378 352

Interim dividend paid in year of 9.0p per

share

(2022: Interim dividend 8.5p per share) 244 231

622 583

On 13 June 2023 the Board resolved to pay a final dividend

of 15p per share which will be recorded in the Financial Statements

for the year ending 25 March 2024.

9. EARNINGS PER SHARE

Basic earnings per share are calculated by dividing Income

after Taxation and Total Comprehensive Income attributable

to Ordinary Shareholders of GBP1,142,000 (2022: GBP5,418,000)

by the weighted average number of 2,703,357 (2022: 2,711,617)

ordinary shares in issue during the period excluding shares

held as treasury. There are no instruments in issue that would

have the effect of diluting earnings per share.

10. INVESTMENT PROPERTIES 2023 2022

GBP'000 GBP'000

Properties

Balance at beginning of financial year 38,975 34,005

Additions - 1,583

Disposals - (2,500)

Revaluation Surplus 345 5,887

Balance at end of financial year 39,320 38,975

The Company's freehold properties were valued as at 25 March

2023 by BNP Paribas Real Estate, Chartered Surveyors, acting in the

capacity of external valuers, and adopted by the Directors. The

valuations were undertaken in accordance with the requirements of

IFRS 13 and the RICS Valuation - Global Standards 2020.

The valuation of each property was on the basis of Fair Value.

The valuers reported that the total aggregate Fair Value of the

properties held by the Company was GBP39,320,000.

The valuer's opinions were primarily derived from comparable

recent market transactions on arms-length terms.

In the financial year ending 25 March 2023, the total fees

earned by the valuer from Wynnstay Properties PLC and connected

parties were less than 5% of the valuer's Company turnover.

The valuation complies with International Financial Reporting

Standards. The definition adopted by the International Accounting

Standards Board (IASB) in IFRS 13 is Fair Value, defined as: 'The

price that would be received to sell an asset, or paid to transfer

a liability, in an orderly transaction between market participants

at the measurement date.'

These recurring fair value measurements for non-financial assets

use inputs that are not based on observable market data, and

therefore fall within level 3 of the fair value hierarchy.

The most pertinent market data observed reflected net initial

yields which ranged from broadly 4.15% to 6.50%, with equivalent

yields estimated to range between broadly 5.50% and 6.75%. The

portfolio exhibits a net initial yield of 5.73% (2022: 5.19%) and a

nominal equivalent yield of 6.02% (2022: 5.71%).

There have been no transfers between levels of the fair value

hierarchy. Movements in the fair value are recognised in profit or

loss.

A 0.5% decrease in the weighted equivalent yield would result in

a corresponding increase of GBP3.67 million in the fair value

movement through profit or loss. A 0.5% increase in the same yield

would result in a corresponding decrease of GBP3.09 million in the

fair value movement through profit or loss.

11. OPERATING LEASES RECEIVABLE 2023 2022

The following are the future minimum GBP'000 GBP'000

lease payments receivable under non-cancellable

operating leases which expire:

Not later than one year 324 354

Between 1 and 5 years 4,368 4,753

Over 5 years 2,752 622

7,444 5,729

Rental income under operating leases recognised through profit

or loss amounted to GBP2,304,000 (2022: GBP2,252,000).

Typically, the properties were let for a term of between 5 and

10 years at a market rent with rent reviews every 5 years. The

above maturity analysis reflects future minimum lease payments

receivable to the next break clause in the operating lease. The

properties are generally leased on terms where the tenant has

the responsibility for repairs and running costs for each individual

unit with a service charge payable to cover common services provided

by the landlord on certain properties. The Company manages the

services provided for a management fee and the service charges

are not recognised as income in the accounts of the Company as

any receipts are netted off against the associated expenditures

with any residual balance being shown as a liability.

If the tenant does not carry out its responsibility for repairs

and the Company receives a dilapidations payment, the resulting

cash is recorded in revenue as other property income unless a

property has been agreed to be sold where the receipt is treated

as part of the proceeds of sale of the property. See Note 2.

12. INVESTMENTS 2023 2022

GBP'000 GBP'000

Quoted investments 3 3

13. SUBSIDIARY COMPANY

The Company has the following dormant subsidiary which the Directors

consider immaterial to, and thus has not been consolidated into,

the financial statements. The subsidiary holds the legal title

to an access road to an investment property, the use of which

is shared between the Company, its tenants at the property and

neighbouring premises.

Scanreach Limited 80% owned Dormant Net Assets: GBP4,447 (2022:

GBP4,447)

14. ACCOUNTS RECEIVABLE 2023 2022

GBP'000 GBP'000

Trade receivables 296 215

Other receivables 186 86

482 301

Trade receivables include an adjustment for credit losses of

GBP8,000 (2022: GBPnil). Trade receivables of GBPnil (2022: nil)

are considered past due, but not impaired. A provision for impairment

of trade receivables is established using an expected loss model.

Trade receivables, which are the only financial assets at amortised

cost, are non-interest bearing and generally have a 15 day term.

Due to their short maturities, the carrying amount of trade and

other receivables is a reasonable approximation of their fair

value.

Of the trade receivables balance at the end of the year, GBP180,560

(2022: GBP188,816) is due from the Company's largest customer.

There are two other customers who represent more than 5% of the

total balance of trade receivables.

15. ACCOUNTS PAYABLE 2023 2022

GBP'000 GBP'000

Trade payables 39 7

Other creditors 80 84

Deferred income 585 535

Accruals 140 422

844 1,048

The average credit period taken for trade purchases is 17 days

(2022: 4 days). No interest is charged on the outstanding balances.

The Directors consider that the carrying amounts of trade and

other payables is a reasonable approximation of their fair value.

16. BANK LOANS PAYABLE 2023 2022

GBP'000 GBP'000

Non-current loan 9,951 9,938

In December 2021, a five-year Fixed Rate Facility of GBP10 million

and a Revolving Credit Facility of GBP5.0 million were entered

into providing a total committed credit facility of GBP15.0 million.

Interest on loan amounts drawn down under the Fixed Rate Facility

of GBP10 million (2022: GBP10 million) is charged at 3.61% per