TIDMWINK

RNS Number : 1548J

M Winkworth Plc

28 March 2018

M Winkworth Plc

Audited final results for the year to 31 December 2017

M Winkworth plc ("Winkworth" or the "Company") is pleased to

announce its

results for the year ended 31 December 2017

Highlights for the year

-- Revenues of GBP5.42 million broadly flat against prior year

despite challenging market conditions (2016: GBP5.57 million)

-- Profit before taxation GBP1.38 million (2016: GBP1.42 million)

-- Cash generated from operations GBP1.70 million (2016: GBP1.12 million)

-- Year end cash balance increased to GBP3.58 million (2016: GBP2.97 million)

-- Rental income increased to 46% of total revenues

-- Seven new offices opened and three resold to new management

-- Dividends of 7.25p declared and paid (2016: 7.2p)

Dominic Agace, CEO of the Company, commented:

"These good results were achieved against a testing background

and we believe that a broadly flat market will continue to suit our

franchise model. Our combination of local expertise, history and

knowledge, combined with an evolving platform which drives leads to

our office network under the umbrella of an established national

brand, is a formula for success. We remain debt free, with a strong

cash position and an increasing number of opportunities to grow in

2018."

For further information please contact:

M Winkworth Plc Tel: 020 7355 0206

Dominic Agace (Chief Executive Officer)

Andrew Nicol (Chief Financial Officer)

Milbourne (Public Relations) Tel: 020 3540 6458

Tim Draper

Stockdale Securities Ltd (NOMAD and Tel: 020 7601 6100

Broker)

Robert Finlay

Ed Thomas

About Winkworth

Established in Mayfair in 1835, Winkworth is a leading

franchisor of residential real estate agencies with a pre-eminent

position in the mid to upper segments of the sales and lettings

markets. The franchise model allows entrepreneurial real estate

professionals to provide the highest standards of service under the

banner of a well-respected brand name and to benefit from the

support and promotion that Winkworth offers.

Winkworth is admitted to trading on the AIM Market of the London

Stock Exchange.

For further information please visit: www.winkworthplc.com

Chairman's Statement

2017 was a challenging year for estate agents given evolving

market conditions and a reduction in sales volumes. The strength of

the Winkworth franchise model, however, has demonstrated the

benefit of having individually-owned businesses, which are more

resilient to market change, and this is reflected in our results.

Our franchisees have been able to achieve average turnover of

almost GBP500,000 per office, well above the average turnover of

our franchise competitors.

While always seeking ways to enhance our offering, we have

adhered to our proven formula of concentrating on excellent levels

of service and long-term relationships through our network of some

100 medium-sized offices. This business model makes us attractive

to incoming franchisees as they are able to achieve more than they

could were they employed at a top level elsewhere, especially at a

time when many are scaling back their operations. Winkworth's

efficient and economic logistics systems allow our franchisees to

focus their efforts on servicing their clients and carrying out

viewings.

On flotation, Winkworth targeted expansion out of London in

order to grow. This process has gathered pace and we welcome the

new businesses that joined us in 2017 and the pipeline of offices

for 2018. These have generally flowed from experienced estate

agents making new starts, but we have also seen growth from the

regeneration of some of the older Winkworth franchises where

previous owners have retired and sold. We expect this trend to

continue as many of the Winkworth franchisees commenced trading in

the 1980s. Both routes provide us with a suitable base for

growth.

It has been the Winkworth principle to make sure that our

offices have sufficient economic turnover. This is a natural

business plan for a proprietor franchisee and it has proved to be a

successful policy. We continue to develop systems and services

which enable our franchisees to deliver the best local and national

service. In particular, we have continued to work on projects to

enhance our relationships with both landlords and tenants, and I am

pleased to note the ongoing growth of our rental business.

We do not believe in developing competing brands, nor do we see

any value in acquisitions at present. We expect to see some market

consolidation as like-minded, non-competing companies consider

merging as a way of achieving cost savings and growth. We will

ourselves be alert to such opportunities but without burdening our

shareholders with debt, which we consider as inappropriate at this

point of the cycle.

I congratulate the management and our franchisees on their

performance in 2017 and a strong start to 2018.

Simon Agace

Non-Executive Chairman

27 March 2018

CEO's Statement

2017 was a year that was once again affected by political

developments, with an unexpected snap election and the ensuing

uncertainty surrounding the government's mandate to drive a Brexit

deal through, weighing on buyer sentiment in the latter half. This

led to a depressed level of transactions despite the positive

underlying factors of high employment and low interest rates.

Despite this, and as predicted, Winkworth reverted to a more

normalised year. The mini boom caused by buyers looking to beat the

additional stamp duty tax of 3% on second properties in the first

half of 2016 was not repeated and, once again, we achieved more of

our income in the second half.

Against this background we saw a sustained rise in sales

activity in central London, where demand has increased following

price falls of some 15% since the stamp duty changes of Autumn

2014. Sales revenue in central London rose by 16% on 2016, with an

increase in transactions of 8%. This supported the overall London

performance, which came in at broadly flat at -1%. We are also

particularly pleased to note that the average price of a property

sold by Winkworth's London offices rose from GBP692,000 to

GBP718,000, an increase of 4% despite property prices declining

across the city over the course of the year. In addition, we

recorded a rise in average percentage commissions, reflecting the

value that customers put on trusted advisers in an uncertain

market. We see this as endorsement of the strengthening Winkworth

proposition.

Gross rentals revenue grew by 6% in 2017, reflecting the

initiatives we have put in place to drive this sector of the

business. Our corporate rentals department (CRD) continued to

support above-trend performance, with 139 deals across the network

with 61 different companies adding GBP283,000 in gross revenue to

those franchisees with markets which are the most attractive for

corporate relocation. This department has started well in 2018,

with a significant increase in deals closed compared to the same

period in 2017.

Property management revenue grew by 15%, a similar level to the

16% achieved in 2016, while country rental income was 9% higher. As

a result of the increase in rental revenue we have moved closer to

our goal of a 50/50 split between lettings and sales - at the end

of 2017 our revenue split was 46% lettings and management and 54%

sales, up from a 44/56 split in 2016.

Total gross revenues of the franchised office network in 2017

were flat at GBP46.2m (2016: GBP46.1m) with sales 5% lower at

GBP24.8m (2016: GBP25.9m) and rentals up 6% to GBP21.3m (2016:

GBP20.1m). London offices accounted for 80% of gross revenues

(79%). Winkworth's revenues fell by 2.7% to GBP5.42m (2016:

GBP5.57m) and profit before taxation was 2.8% lower at GBP1.38m

(2016: GBP1.42m). Cashflow rose by 51.8% to GBP1.70m

(2016:GBP1.12m), as a result of which the year end cash balance

increased to GBP3.58m (2016: GBP2.97m). Dividends of 7.25p were

declared for the year (2016: 7.2p).

We see the current market as an opportunity to attract

experienced and talented operators to the Winkworth network, as

successful agents look to move into business ownership to gain

greater control over their earnings potential. This has always been

a key motivation and is providing us with the opportunity to

re-invigorate the network in areas where some older franchisees are

looking to exit. Three franchises were resold last year and four in

2016. The offices which were resold in 2016 increased their

combined turnover on average by 15% in 2017, despite a more

difficult market, and we would expect the offices resold in 2017 to

add to this growth as the new operators drive their businesses to

outperform the market.

We have put significant effort into developing our centralised

departments to help us to gain market share. The client services

department (CSD), which refers leads between offices, continued to

grow, delivering GBP780,000 of revenue to the network in 2017. CSD

is currently on track to exceed this figure in 2018 with 73

instructions to the end of February versus 53 in the same period of

2017. As this department grows, it also improves in efficiency,

with the cost of a lead to franchisees falling from GBP170 in 2016

to GBP140 in 2017 and GBP80 so far in 2018, as the size of the

network lowers the marketing costs to franchisees.

Following its launch in June 2017, centralised recruitment is

progressing ahead of target, placing five candidates a month so far

in 2018 and helping new offices to accelerate their launches with

high quality employees. This activity also supports our new

franchising efforts by increasing our connections with talented

estate agents looking for new opportunities within the

industry.

Finally, we are pleased that our updated website, launched in

March 2017, has delivered more leads to our franchisees despite a

weak second half of the year in terms of overall applicants. It has

provided a robust platform for our digital evolution, enabling the

launch of our vendor portal in November to which 40 offices have

already signed up. We are pleased that it was recognised as website

of the year at the Negotiator awards in November 2017.

We aim to continue to build on this success in 2018 with

continued investment in the vendor portal for clients and the

development of the landlord portal, ensuring we have a best in

class website to offer existing and new franchisees. We will also

be conducting nationwide digital campaigns to continue to drive

leads. We are currently two months into our digital campaign and

this is on track to deliver an additional 200,000 visits per month

to our website and, in turn, to our franchisees.

Outlook

The underlying fundamentals of the market remain positive.

Following the stamp duty changes introduced in 2014, asking prices

have adjusted significantly downwards in central London and this is

now increasingly the case in London zones 2 and 3. Sellers are

accepting these reductions and this, in turn, is in some areas

leading to improved levels of transactions despite applicant

numbers remaining at low levels. We expect this trend to continue

throughout the year and for the reduction in stamp duty for first

time buyers to stimulate the lower end of the property market,

feeding through to the upper levels in due course.

On the lettings side of the business, our applicants are

tracking at some 12% ahead of the same period of last year, which

should support further growth in 2018. Landlords are consolidating

their portfolios following the tax changes on mortgage interest and

increasing their equity in buy-to-let properties, and this

tightening of supply is expected to lead to further increases in

rental prices.

New franchising applicant numbers are more than 25% above this

point in 2017, and with two offices already opened in Banstead and

Poringland we look forward to maintaining the momentum gained in

2017 by targeting to open eight new offices in 2018 in areas

affiliated to our extensive London network.

We believe that a broadly flat market will continue to suit our

franchise model. Our combination of local expertise, history and

knowledge, combined with an evolving platform which drives leads to

our office network under the umbrella of an established national

brand, is a formula for success. We remain debt free, with a strong

cash position and an increasing number of opportunities to grow in

2018.

Dominic Agace

Chief Executive Officer

27 March 2018

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE YEARED 31 DECEMBER 2017

2017 2016

Notes GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue 5,423 5,568

Cost of sales (1,292) (1,477)

-------- --------

GROSS PROFIT 4,131 4,091

Administrative expenses (2,829) (2,746)

OPERATING PROFIT 1,302 1,345

Finance income 74 71

-------- --------

PROFIT BEFORE TAXATION 1,376 1,416

Tax 1 (273) (290)

-------- --------

PROFIT AND TOTAL COMPREHENSIVE INCOME

FOR THE YEAR 1,103 1,126

======== ========

Earnings per share expressed

in pence per share: 3

Basic 8.66 8.84

Diluted 8.66 8.84

======== ========

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31 DECEMBER 2017

2017 2016

Notes GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Intangible assets 796 777

Property, plant and equipment 98 116

Investments 7 7

Trade and other receivables 516 716

1,417 1,616

-------- --------

CURRENT ASSETS

Trade and other receivables 1,102 1,348

Corporation tax receivable 208 69

Cash and cash equivalents 3,579 2,971

-------- --------

4,889 4,388

-------- --------

TOTAL ASSETS 6,306 6,004

======== ========

EQUITY

SHAREHOLDERS' EQUITY

Share capital 5 64 64

Share premium 1,793 1,793

Other reserves 51 51

Retained earnings 3,742 3,556

-------- --------

TOTAL EQUITY 5,650 5,464

-------- --------

LIABILITIES

NON-CURRENT LIABILITIES

Deferred tax 11 16

-------- --------

CURRENT LIABILITIES

Trade and other payables 645 524

TOTAL LIABILITIES 656 540

-------- --------

TOTAL EQUITY AND LIABILITIES 6,306 6,004

======== ========

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2017

Called

up

share Retained Share Other Total

Notes capital earnings premium reserves equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January 2016 64 3,334 1,793 51 5,242

Changes in equity

Transactions with owners

Dividends 2 - (904) - - (904)

Total comprehensive income - 1,126 - - 1,126

-------- --------- -------- --------- --------

Balance at 31 December 2016 64 3,556 1,793 51 5,464

-------- --------- -------- --------- --------

Changes in equity

Transactions with owners

Dividends 2 - (917) - - (917)

Total comprehensive income - 1,103 - - 1,103

-------- --------- -------- --------- --------

Balance at 31 December 2017 64 3,742 1,793 51 5,650

======== ========= ======== ========= ========

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2017

2017 2016

Notes GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 4 2,115 1,568

Tax paid (417) (452)

-------- --------

Net cash from operating activities 1,698 1,116

-------- --------

Cash flows from investing activities

Purchase of intangible fixed assets (224) (122)

Purchase of tangible fixed assets (23) (128)

Interest received 74 71

-------- --------

Net cash from investing activities (173) (179)

-------- --------

Cash flows from financing activities

Equity dividends paid (917) (1,132)

-------- --------

Net cash from financing activities (917) (1,132)

-------- --------

Increase/(decrease) in cash and cash

equivalents 608 (195)

Cash and cash equivalents at beginning

of year 2,971 3,166

-------- --------

Cash and cash equivalents at end of

year 3,579 2,971

======== ========

M WINKWORTH PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2017

1. TAXATION

Analysis of tax expense

2017 2016

GBP'000 GBP'000

Current tax:

Taxation 274 274

Adjustment re previous years 4 (2)

-------- --------

Total current tax 278 272

Deferred tax (5) 18

-------- --------

Total tax expense in consolidated

statement of profit or loss and

other comprehensive income 273 290

======== ========

Factors affecting the tax expense

The tax assessed for the year is higher than the standard rate

of corporation tax in the UK. The difference is explained

below:

2017 2016

GBP'000 GBP'000

Profit before tax 1,376 1,416

======== ========

Profit multiplied by the standard

rate of corporation

tax in the UK of 19.250% (2016 -

20%) 265 283

Effects of:

Expenses not deductible for tax

purposes 7 8

Adjustment in respect of prior periods

taxable 4 (2)

Depreciation in excess of capital

allowances (3) 1

-------- --------

Tax expense 273 290

======== ========

2. DIVIDENDS

2017 2016

GBP'000 GBP'000

Ordinary shares of 0.5p each

Interim 917 904

======== ========

There are no proposed dividends at the reporting date.

3. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

2017

Weighted

average

number Per-share

Earnings of shares amount

GBP'000 '000 pence

Basic EPS

Earnings attributable to ordinary

shareholders 1,103 12,733 8.66

Effect of dilutive securities

Options - - -

--------- ---------- ----------

Diluted EPS

Adjusted earnings 1,103 12,733 8.66

========= ========== ==========

Given that the market price of the shares has fallen lower than

the strike price, this has made the shares anti-dilutive.

2016

Weighted

average

number Per-share

Earnings of shares amount

GBP'000 '000 pence

Basic EPS

Earnings attributable to ordinary

shareholders 1,126 12,733 8.84

Effect of dilutive securities - - -

Diluted EPS

Adjusted earnings 1,126 12,733 8.84

========= ========== ==========

4. RECONCILIATION OF PROFIT BEFORE TAX TO CASH GENERATED FROM OPERATIONS

Group

2017 2016

GBP'000 GBP'000

Profit before tax 1,376 1,416

Depreciation charges 246 368

Finance income (74) (71)

-------- --------

1,548 1,713

Decrease/ (increase) in trade and

other receivables 446 (98)

Increase/ (decrease) in trade and

other payables 121 (47)

-------- --------

Cash generated from operations 2,115 1,568

======== ========

Company

2017 2016

GBP'000 GBP'000

Profit before tax 917 906

Finance income (917) (906)

-------- --------

Increase in trade and other payables - 230

-------- --------

Cash generated from operations - 230

======== ========

The movements in liabilities from financing cashflows are

nil.

5. CALLED UP SHARE CAPITAL

2017 2016

GBP'000 GBP'000

Authorised:

Ordinary shares

20,000,000 of 0.5p 100 100

======== ========

2017 2016

GBP'000 GBP'000

Issued and fully paid:

Ordinary shares

12,733,238 of 0.5p 64 64

======== ========

6. FINANCIAL INFORMATION

The financial information contained within this preliminary

announcement for the year ended 31 December 2017 is derived from

but does not comprise statutory financial statements within the

meaning of section 434 of the Companies Act 2006. Statutory

accounts for the year ended 31 December 2016 have been filed with

the Registrar of Companies and those for the year ended 31 December

2017 will be filed following the Company's annual general meeting.

The auditors' reports on the statutory accounts for the years ended

31 December 2017 and 31 December 2016 are unqualified, do not draw

attention to any matters by way of emphasis, and do not contain any

statements under section 498 of the Companies Act 2006.

7. ANNUAL REPORT AND ACCOUNTS

Copies of the annual report and accounts for the year ended 31

December 2017 together with the notice of the Annual General

Meeting to be held at the offices of M Winkworth Plc on 1 May 2018,

will be posted to shareholders shortly and will be available to

view and download from the Company's website at

www.winkworthplc.com

The annual report and accounts will be filed at Companies House

in due course.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UBVBRWBAOUAR

(END) Dow Jones Newswires

March 28, 2018 02:00 ET (06:00 GMT)

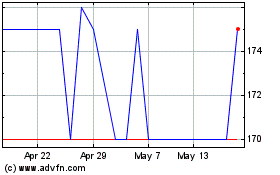

M Winkworth (LSE:WINK)

Historical Stock Chart

From Oct 2024 to Nov 2024

M Winkworth (LSE:WINK)

Historical Stock Chart

From Nov 2023 to Nov 2024