TIDMUTG

RNS Number : 1457M

Unite Group PLC (The)

10 January 2023

PRESS RELEASE

10 January 2023

THE UNITE GROUP PLC

('Unite Students', 'Unite', the 'Group', or the 'Company')

TRADING UPDATE AND Q4 FUND VALUATIONS

Unite Students, the UK's leading owner, manager and developer of

student accommodation, today announces an update on current trading

for the Group and quarterly property valuations for the Unite UK

Student Accommodation Fund ('USAF') and the London Student

Accommodation Joint Venture ('LSAV') as at 31 December 2022.

Highlights

-- Guidance reiterated for adjusted EPS at the top end of 40-41p

range for FY2022, and a total accounting return of around 8%

-- Strong start to the 2023/24 sales cycle with 70% of beds sold (2022/23: 60%)

-- Targeting rental growth of at least 5% for 2023/24 (previously 4.5-5.0%)

-- Committed development pipeline of two schemes, totalling

1,421 beds and GBP200m in future capex, fully funded from existing

facilities

-- Q4 like-for-like valuation decreases of 1.4% and 2.8% in USAF

and LSAV respectively, and increases of 4.6% and 5.6% for

FY2022

Richard Smith, Chief Executive of Unite Students, commented

:

"We have seen a strong start to the 2023/24 sales cycle,

reflecting the appeal of our high-quality portfolio and

fixed-price, all-inclusive offer, which provides students with

significant savings and certainty on their bills. Reservations are

significantly ahead of recent sales cycles, reflecting strong

demand from new and existing students as well as new nomination

agreements with universities. We now expect to deliver rental

growth of at least 5% for the 2023/24 academic year, which will

help offset the cost pressures we are facing through higher utility

and staff costs. Growing income also offers support to our property

valuations as the market adjusts to an environment of higher

funding costs.

"Despite the challenging economic environment, the business

remains well positioned thanks to increasing student numbers and

growing demand for high-quality, purpose-built student

accommodation across our markets. Moreover, our alignment to the

strongest universities and the capabilities of our best-in-class

operating platform mean we remain confident of continuing to

deliver strong operational results."

Current trading

2022 earnings guidance

As previously guided, higher than expected rental income in term

1 of the 2022/23 academic year has more than offset the impact of

higher interest costs in the second half of the financial year. As

a result, we reiterate our guidance for adjusted EPS to be at the

top end of our 40-41p range for FY2022.

2023/24 reservations

Demand for the Group's accommodation has been strong in the

first part of the sales cycle.

Across the Group's entire property portfolio, 70% of rooms are

now sold for the 2023/24 academic year, significantly ahead of the

prior year and pre-pandemic levels (2022/23: 60%). In our strongest

markets we have seen an increasing number of students looking to

secure accommodation earlier in the sales cycle than previous

years. We have also seen increased demand from universities who see

quality accommodation as a key part of their proposition to

prospective students. Reservations under nomination agreements

account for 52% of available beds for 2023/24, up 2ppts versus the

same stage in the 2022/23 sales cycle.

As a result of this strong demand and the need to offset cost

pressures in our business, we now expect to deliver income growth

of at least 5% for 2023/24 (previously 4.5-5.0%).

We recognise the cost-of-living pressures being faced by

students and parents and are confident that our fixed price,

all-inclusive offer will continue to provide value for money

compared to alternative options in the purpose-built student

accommodation (PBSA) and houses in multiple occupation (HMO)

sectors. Our offer provides important price certainty on utilities

and additional product and service features, such as on-hand

maintenance teams and 24/7 security, in locations close to

campus.

Development pipeline

The Group is committed to two development schemes, Derby Road in

Nottingham, completing in 2023, and Jubilee House in Stratford,

totalling GBP200 million in future capital commitments and

delivering a blended yield on cost of 6.5% for the PBSA

elements.

In December 2022, the Group acquired the land for our Jubilee

House scheme for GBP73 million. The PBSA element of the

fully-consented scheme is expected to be delivered in time for the

2026/27 academic year, with construction due to start in the second

quarter of 2023. The development will be delivered as a university

partnership, with at least half of the available beds let under a

nomination agreement. The mixed-use scheme will deliver 65,000 sq

ft of academic space, let for an initial 35-year term to the

Secretary of State for Levelling Up, Housing and Communities.

Following completion and subject to market conditions, we expect to

sell the academic space to a third party.

We are reviewing future development starts in our secured

pipeline to ensure projects deliver earnings accretion in an

environment of higher funding costs. Given the strength of demand

from students and universities, we expect to commit to additional

development projects during 2023.

Funding

We have observed a slight easing in funding market conditions

over the past quarter and lenders remain supportive of the Group

and the student accommodation sector. The Group has recently

extended its Revolving Credit Facility (RCF) by GBP150 million to

GBP600 million in total, at terms in line with the existing

facility. At year-end, the wholly-owned Group had GBP397 million of

cash and debt headroom, comprising GBP29 million of cash balances

and GBP368 million of undrawn debt.

The GBP100 million L&G loan facility in LSAV, which is due

to mature in January 2023, will be repaid at maturity from existing

reserves within LSAV. We continue to make good progress in

refinancing the GBP380 million June 2023 bond maturities in USAF

(Unite share: GBP108 million), with demand from a range of

lenders.

The Group has had its Baa2 (Positive outlook) and BBB (Stable

outlook) credit ratings affirmed by Moody's and Standard &

Poor's respectively.

Quarterly fund valuations

At 31 December 2022, USAF's property portfolio was independently

valued at GBP2,888 million, reflecting a 1.4% decrease on a

like-for-like basis during the quarter. Over the year as a whole,

valuations for USAF increased by 4.6% on a like-for-like basis. The

valuation decrease in the quarter was driven by an increase in

property yields of 13bps to a weighted average of 5.0%, which more

than offset the positive impact of rental growth. Over the past 12

months, valuation growth was driven by rental growth and a 7bps

reduction in property yields on a like-for-like basis.

LSAV's property portfolio was independently valued at GBP1,921

million, reflecting a 2.8% decrease on a like-for-like basis during

the quarter. Over the year as a whole, valuations for LSAV

increased by 5.6% on a like-for-like basis. The valuation decrease

in the quarter was driven by an increase in property yields of

18bps to a weighted average of 4.1%, which more than offset the

positive impact of rental growth. Over the past 12 months,

valuation growth was driven by rental growth with yields broadly

stable.

We expect the valuation of our wholly owned portfolio at 31

December 2022 to reflect an increase in property yields comparable

to the USAF portfolio in H2 2022. This is expected to support a

total accounting return of around 8% for FY2022.

Drivers of LfL valuation movement (Q4 2022)

-------------------------------------------------

Valuation Rental Yield Other Total

Dec 2022 growth movement

----- ---------- ----------- ------------ ---------- ----------

USAF GBP2,888m 1.3 % (2.7) % 0.0 % (1.4) %

LSAV GBP1,921m 1.7 % (4.5) % 0.0 % (2.8) %

Drivers of LfL valuation movement (FY2022)

-------------------------------------------------

Rental Yield Other Total

growth movement

----- ---------- ----------- ------------ ---------- ----------

USAF 4.2 % 1.1 % (0.7) % 4.6 %

LSAV 5.6 % (0.2) % 0.2 % 5.6 %

S

For further information, please contact:

Unite Students

Joe Lister / Mike Burt Tel: +44 117 302 7005

Unite press office Tel: +44 117 450 6300

Powerscourt

Justin Griffiths / Victoria Heslop Tel: +44 20 7250 1446

About Unite Students

Unite Students is the UK's largest owner, manager and developer

of purpose-built student accommodation (PBSA) serving the country's

world-leading higher education sector. We provide homes to 70,000

students across 156 properties in 23 leading university towns and

cities. We currently partner with over 60 universities across the

UK.

Our people are driven by a common purpose: to provide a 'Home

for Success' for the students who live with us. Unite Students'

accommodation is safe and secure, high quality, and affordable.

Students live predominantly in en-suite study bedrooms with rents

covering all bills, insurance, 24-hour security and high-speed

Wi-Fi. We also achieved a five-star British Safety Council rating

in our last audit.

We are committed to raising standards in the student

accommodation sector for our customers, investors and employees.

This is why our Sustainability Strategy includes a commitment to

become net zero carbon across our operations and developments by

2030.

Founded in 1991 in Bristol, the Unite Group is an award-winning

Real Estate Investment Trust (REIT), listed on the London Stock

Exchange. For more information, visit Unite Group's corporate

website www.unitegroup.com or the Unite Students site

www.unitestudents.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSSAFMUEDSEDF

(END) Dow Jones Newswires

January 10, 2023 02:00 ET (07:00 GMT)

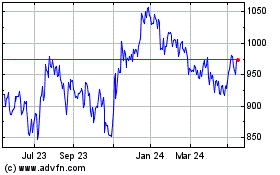

Unite (LSE:UTG)

Historical Stock Chart

From Oct 2024 to Nov 2024

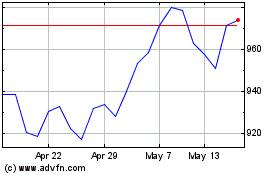

Unite (LSE:UTG)

Historical Stock Chart

From Nov 2023 to Nov 2024