TIDMUTG

RNS Number : 4167K

Unite Group PLC (The)

22 April 2020

Press release

22 April 2020

THE UNITE GROUP PLC

('Unite Students', 'Unite', the 'Group', or the ' Company ')

CORONAVIRUS UPDATE

Unite Students, the UK's leading owner, manager and developer of

student accommodation, today provides an update on the potential

impact of Coronavirus on the business and the measures it is taking

to mitigate the resulting risks and enable a rapid recovery.

2019/20 academic year

In line with our previous announcement, we have contacted

students to see if they wish to leave their accommodation for the

summer semester of 2019/20. Based on cancellation requests received

to date, we expect to forgo rent on around 43,000-46,000 beds

representing around 62-65% of all owned and managed beds.

Our remaining beds are accounted for by students who have chosen

to continue their stay with us and beds let under nomination or

lease agreements, where Universities collect rent directly from

students (21% of beds). Reflecting the strength of our University

partnerships, we have received 94% of the rent due to date in April

under these nomination and lease agreements. Remaining payments by

Universities for the summer semester are staggered between April

and September 2020.

Overall, we expect a reduction in income from the 2019/20

academic year of 16-20% on a Group share basis, an improvement on

our previous expectations.

2020/21 academic year

Reservations across the Group for the 2020/21 academic year are

currently at 80%, compared with 81% at the same time last year.

Positively, we have seen healthy levels of demand from UK students,

reflecting our decision to switch the focus of our sales and

marketing efforts to the domestic market. We are still seeing

enquiries from international students but, as expected, demand has

slowed.

Nomination agreements account for 70% of reservations secured

for 2020/21 with over two thirds now contracted, including

multi-year agreements and single-year extensions which have already

been signed. A number of Universities have already begun to

allocate students to us for the new academic year, reflecting

confidence around their accommodation requirements.

The majority of the non-contracted income is accounted for by

High and Mid-ranked Universities where we have long-standing

relationships. We will maintain a close dialogue with our

University partners as their accommodation requirements for 2020/21

become clearer. In the event beds are not taken up by Universities,

we are ready to shift our sales focus to a direct-let basis where

we are already targeting students living in houses of multiple

occupancy (HMOs).

2020 cashflow impact

We retain our previous guidance for a GBP90-125 million

reduction in Group cashflow in 2020. At the upper end of this range

we have modelled a 4 week delay to the start of the 2020/21

academic year, while awaiting greater clarity around admissions and

timetable. This results in reductions of up to 30% to Group

cashflow for the autumn semester of the 2020/21 academic year.

Cost and cash saving measures

Following a detailed review of our operating expenses and

overheads, we expect to realise GBP12-15 million in P&L cost

savings in 2020 (Unite share). This is additional to the GBP5-6

million of cost synergies expected to be realised from the Liberty

Living acquisition in 2020. These additional cost savings reflect

the flexibility of our operating platform and our ability to

in-source work for summer turnaround and cleaning as well as

savings to utility and broadband costs, and a halt to discretionary

overhead spending and non-essential recruitment. Reflecting the

decision to in-source activity, we have not utilised the

Government's furlough scheme.

As part of these savings, the Board has agreed to a 30%

reduction to salaries and pension contributions for Executive

Directors, 10-20% for senior management and a 30% reduction in fees

payable to Non-Executive Directors. These reductions will be

effective for a four-month period from 1 April.

Bonus payments for Executive Directors will also be suspended

for 2020. The Company still plans to make awards under its Long

Term Incentive Plan with a three year performance period through to

31 December 2022 (and further two year holding period for the

Executive Directors), based on the performance conditions announced

in the Company's 2019 Annual Report and set prior to the impact of

Coronavirus.

These savings, together with our decision to defer development

and non-essential operational capex, will retain an additional

GBP95-105 million of cash in the business in 2020.

HE sector outlook

The Government's central planning scenario is for the 2020/21

academic year to start in September, broadly in line with the usual

admissions cycle. This follows confirmation that students will

receive their A-level results on 13 August as originally planned.

However, there is still some uncertainty over start dates for the

academic year, which could result in both a later start and finish

to the autumn semester.

Universities UK recently proposed a package of support measures

for Universities to counter the risk of a reduced intake of

first-year students from non-EU countries. The proposal includes

increased research funding and one-year student number controls to

ensure the financial viability of all Universities. The Government

is expected to publish its response in the coming weeks. We will

continue to work closely with our University partners to adapt to

any changes in admissions for the coming academic year.

There are 1.5 million full-time students in the UK seeking

accommodation, of which 1.2 million are domestic students living

away from home and international students studying multi-year

courses. We expect Universities to offset a potential reduction in

first-year international student intake by recruiting additional UK

students from surplus applications, which totalled 101,000 in the

2019/20 academic year.

We also expect demand for purpose-built accommodation to be

supported by market share gains from the 865,000 students currently

living in HMOs. We have already shifted the focus of our marketing

activity to target students living in HMOs, where we believe that

our offer of purpose-built, affordable accommodation with a range

of value-added features such as 24-hour security, all-inclusive

bills and on-site support will be considered an attractive

alternative. Even a small shift of students from HMOs to

purpose-built student accommodation would help to substantially

offset potential reductions in international student numbers.

Development pipeline

Given the priority of conserving cash while income uncertainties

remain, we have deferred the delivery of Middlesex Street in London

and Old BRI in Bristol into 2022. A decision on resumption of capex

on Middlesex Street and Old BRI will be made once we have greater

visibility over the impact of Coronavirus on the 2020/21 academic

year. We are reviewing the possibility of delivering 2022

completions ahead of the start of the 2022/23 academic year to

generate income from short-term lets.

Delivery of 2020 completions will also be delayed by temporary

site closures and amended working practices. However, work has now

re-started across all sites with reduced numbers of operatives to

maintain social distancing, in accordance with recent Government

advice. A number of scenarios are being considered for completion

of the projects, including phased delivery where possible. We are

proactively engaging with our University partners to highlight

these risks and will continue to monitor the situation over the

coming weeks.

The deferred delivery of 2021 completions and savings to 2020

completions will lead to a cash saving of GBP67 million during

2020. For the remainder of 2020, there is GBP57 million of cash to

spend on developments, including costs to halt developments at

Middlesex Street and Old BRI.

Cash headroom and debt facilities

As of 17 April, the Company had GBP269 million of unrestricted

cash reserves. All of the Group's revolving credit facilities are

now fully drawn.

Unite has been confirmed as an eligible issuer for the HM

Treasury and Bank of England Covid Corporate Financing Facility

(CCFF). We expect an initial GBP50 million to be made available

under the facility, which we expect to access shortly.

USAF has completed a GBP50 million increase to an existing

GBP100 million RCF with Wells Fargo Bank, N.A. to provide

additional liquidity and funding capacity. The new GBP150 million

facility has been extended by two and a half years and now matures

in March 2024.

In addition, we are in discussions with our banks and potential

new lenders around our future funding requirements. Our earliest

Group debt maturity is April 2022.

Richard Smith, Unite Students Chief Executive Officer, commented

:

"We are committed to doing the right thing for our customers,

colleagues and other stakeholders, despite the unprecedented times

we face. This underpinned our decision to forgo rent for students

wishing to return home for the remainder of the current academic

year and the reduction in Board remuneration announced today.

We now have greater income visibility for the summer semester

and our operating platform provides us with the flexibility to

rapidly implement new marketing strategies for 2020/21 and reduce

costs. This provides increased confidence over the liquidity of our

balance sheet through the 2020/21 academic year. We will emerge

stronger from this challenging time, building on our enhanced

reputation with students and Universities."

-S -

For further information, please contact:

Unite Students

Richard Smith / Joe Lister / Michael Tel: +44 (0)117 302 7005

Burt

Powerscourt Tel: +44 (0)20 7250 1446

Justin Griffiths / Victoria Heslop

Notes to editors:

About Unite Students

Unite Students is the UK's largest owner, manager and developer

of purpose-built student accommodation serving the country's

world-leading Higher Education sector.

Following our successful GBP1.4bn acquisition of Liberty

Living's UK assets in November 2019, we now provide homes to 74,000

students across 177 properties in 27 leading university towns and

cities.

Our people are driven by a common purpose: to provide a 'Home

for Success' for the students who live with us and to be the most

trusted brand in the sector. We do this through quality service,

quality people and quality properties, all designed on the basis of

an excellent insight into students' needs and preferences.

Unite's accommodation is high quality, affordable, safe and

secure, and located where students want to live. Students live

predominantly in en-suite study bedrooms with rents covering all

bills, insurance, 24-hour security and high-speed Wi-Fi. MyUnite,

our mobile app, provides practical support such as instant

messaging and maintenance requests.

We hold a five-star British Safety Council audit rating (out of

five) following an Occupational Health and Safety audit. The audit

measured our performance against a number of key safety management

indicators, providing an international benchmark for safety

management systems and indicating best practice for continual

improvement.

Our commitment to customer service is powered by an innovative,

in-house operating platform. It provides a wide range of benefits

to our students, such as an optimised online booking process, as

well as providing us with a unique ability to drive value from our

portfolio through scale efficiencies and revenue management.

Our other strategic priority is delivering growing and

sustainable earnings, underpinned by a strong capital structure. A

key part of this strategy is growing the number of beds let through

partnerships with the strongest UK universities, which are

experiencing record levels of student demand. We currently partner

with 45 universities across the UK, guaranteeing that 56% of our

rooms are let under 'nomination agreements' providing high

visibility of forward occupancy and rental growth.

Unite Students has spent years helping young people thrive in

new situations and help them manage the big 'Leap' to university

life. Our insight has identified a significant gap between student

expectations and reality. To support this leap, we have developed

the Leapskills programme, helping to prepare prospective students

for independent living. The programme introduces students to a

number of student life scenarios to provoke group discussion on

conflict resolution, problem solving and gives a general insight

into shared living to help closer match expectations to

reality.

Unite is the founder of and major donor to the Unite Foundation,

a charitable trust established to support talented students facing

challenging financial circumstances through the provision of free

accommodation scholarships. The Foundation has so far provided

scholarships for 434 young people working in close collaboration

with 27 partner universities.

Unite is invested in and operates two specialist funds and joint

ventures with institutional investment partners: the GBP3 billion

Unite UK Student Accommodation Fund (USAF), and the GBP1 billion

London Student Accommodation Vehicle (LSAV).

Founded in 1991 in Bristol, Unite Group is an award-winning Real

Estate Investment Trust (REIT), listed on the London Stock Exchange

and a member of the FTSE 250 Index.

For more information, please visit Unite's corporate website

www.unite-group.co.uk, the student site www.unite-students.com or

the Unite Foundation www.unitefoundation.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDFLFVASRILFII

(END) Dow Jones Newswires

April 22, 2020 02:00 ET (06:00 GMT)

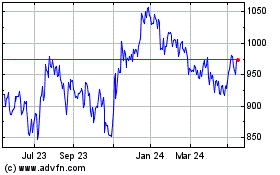

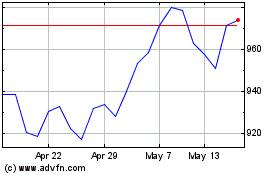

Unite (LSE:UTG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Unite (LSE:UTG)

Historical Stock Chart

From Nov 2023 to Nov 2024