TIDMTWD

RNS Number : 2525B

Trackwise Designs PLC

30 September 2022

TRACKWISE DESIGNS PLC

("Trackwise" or the "Company")

Interim Results for the six months ended 30 June 2022

Trackwise Designs (AIM: TWD), a leading provider of specialist

products using printed circuit technology, is pleased to announce

today its interim results for the six months ended 30 June

2022.

Financial highlights

-- Revenues of GBP3.8m (H1 2021: GBP4.1m)

-- IHT revenues of GBP0.55m (H1 2021: GBP0.58m)

-- Gross margin of 23.7% (H1 2021: 29.0%)

-- Adjusted(1) EBITDA of GBP0.83m (H1 2021: GBP0.45m)

-- Adjusted(2) operating profit of GBP0.09m (H1 2021: loss GBP0.13m)

-- Reported loss after tax of GBP1.39m (H1 2021: loss GBP0.57m),

after exceptional costs of GBP2.0m

-- Net debt(2) of GBP7.8m (cash of GBP2.4m) (31 December 2021:

GBP2.1m, cash of GBP2.9m), following continued investment at the

Stonehouse facility

-- Basic EPS - loss per share of 3.73 pence (H1 2021: loss per share of 2.00 pence)

(1) Before share based payments and exceptional costs;

(2) Cash less borrowings, excluding IFRS16 right of use lease

liabilities

Operational highlights

-- Completion of equity raise of GBP7m to support growth, as

announced in December 2021

-- Appointment of Paul Cook as Chief Financial Officer

designate

-- Continued progress made in preparing Stonehouse to become

fully operational later in FY22

-- Installed and commissioned Double Belt Press

-- Completion of GBP5.2m asset finance

-- IHT total customers and opportunities across target markets

of 97 as at 30 June 2022

-- Development of plans for Phase 2 of Stonehouse facility, in

response to significant pipeline of demand for EV Cell Connection

Systems (CCS) from UK and EU OEMs and Tier 1s.

Philip Johnston, CEO of Trackwise, commented :

"The development of our third manufacturing site at Stonehouse

continues, and we expect to see this completed in 2022 to meet

production demand from our EV OEM customer.

It is inevitable that our performance is closely linked to that

of our first IHT production customer and the EV OEM announced on 11

August 2022 that it expects lower production volumes in 2022

compared to previous estimates. As we announced earlier this month,

the announcement of the lower production volumes has had a knock-on

impact on the availability, to the Company, of the planned

asset-backed debt funding for the remaining pieces of capital

expenditure at the new Stonehouse facility and, in addition,

increases the Company's short-term cash requirements. Discussions

with the EV OEM are progressing towards agreeing a new contractual

arrangement whereby the EV OEM will provide an advance payment

against future product deliveries, and such advance payment is

expected to be backed by security.

The wider impact of the lower production volumes is that

additional funding will be required and the Company is reviewing a

number of options for additional funding with its advisers and will

provide further updates in due course.

In addition, the Company is exploring longer term strategic

investment partnerships in order to support development and

conversion of the very significant pipeline of identified IHT sales

opportunities, notably for EV battery cell connection systems

("CCS") for UK and EU OEMs, Tier 1 suppliers, and also for other

Medical and Aerospace sales opportunities."

Enquiries

Trackwise Designs plc +44 (0)1684 299 930

Philip Johnston, CEO www.trackwise.co.uk

Paul Cook, CFO

finnCap Ltd +44 (0)20 7220 0500

NOMAD and Broker

Ed Frisby/Tim Harper - Corporate

Finance

Andrew Burdis/Barney Hayward - ECM

Alma PR +44 (0)20 3405 0205

Financial PR and IR

David Ison/Caroline Forde/Josh Royston/Kieran

Breheny

Notes to editors

Trackwise is a UK-based manufacturer of specialist products

using printed circuit technology.

The full suite includes: Improved Harness Technology(TM) ("IHT")

and Advanced PCBs - Microwave and Radio Frequency ("RF"), Short

Flex, Flex Rigid and Rigid Multilayer products.

IHT uses a proprietary, patented process that Trackwise has

developed to manufacture multilayer flexible printed circuits of

unlimited length. While the technology has many applications, the

directors expect that one of its primary uses will be to replace

traditional wire harnesses in a variety of industries.

The Company operates from three sites, located in Tewkesbury,

Stonehouse and Stevenage. It serves customers in Europe and North

America.

Trackwise Designs plc was admitted to trading on AIM in 2018

with the ticker TWD. For additional information please visit

www.trackwise.co.uk

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Financial Review

Revenue for the period fell slightly to GBP3.8m (H1

2021:GBP4.1m), which reflects the delay of an order at Stevenage

Circuits Limited (SCL) and the delayed start of production for the

EV OEM. Profitability was held back by lower sales, higher utility

costs and the under-recovery of costs as a result of lower than

expected volumes.

The lower gross profit was offset by other income of GBP0.7m,

which was the partial recognition of the estimated compensation due

as a result of the EV OEM's order shortfall against the guaranteed

minimum volumes set out in the contract. The Company incurred

further exceptional costs of GBP2.0m relating to the set-up of the

Stonehouse facility and the commencement of low volume production

for the EV OEM contract at Trackwise's Ashvale site. The loss

before taxation was GBP2.1m (H1 2021: loss GBP0.6m).

The outcome of the period is that losses per share were (3.73)p

(H1 2021 losses per share: (2.00p)) .

Capital expenditure in the first half was GBP6.4m. While this

reflected continued investment ahead of the EV OEM's start of

production, it also included the installation of the double-belt

press. This is the Company's largest ever single investment and

allows us to fully exploit our Improved Harness Technology patent

and know-how.

The first half also saw an increase in working capital.

Inventory increased by GBP0.7m as a result of a build-up ahead of

the expected start of production for the EV OEM contract and a

stock build of some materials with long lead time at SCL. Debtors

increased by GBP1.7m, primarily as a result of the other income

accrued on the EV OEM contract and up-front payments for the

purchase of nickel foil ahead of the expected ramp-up of the EV OEM

contract.

These cash outflows were financed by from the GBP5.5m of

proceeds from the Placing and Open Offer launched in December 2021

and asset-backed funding of GBP5.2m. In addition, in January 2022 a

new invoice discount facility of GBP1.0m was established for SCL

and has subsequently been partially drawn down.

At 30 June 2021 the Company had net debt of GBP7.8m, reflecting

the cash movements above. Gross cash was GBP2.4m and there were

unused invoice discounting facilities, subject to the lender's draw

down criteria, of GBP1.7m.

Going Concern Review

In our annual report for the year ended 31 December 2021, which

was published on 29 July 2022, we reported that there was a funding

shortfall in our downside scenario forecasts which, together with

the risks surrounding some assumptions within our forecast models,

indicated that there were circumstances that gave rise to a

material uncertainty related to going concern.

At the time the Company was in discussions for the provision of

asset-backed funding of GBP4.4m and a trade finance facility of

GBP1.9m. As mentioned above, on 11 August 2022 the EV OEM customer

announced that it expects lower production volumes in 2022 compared

to previous estimates. This has had a knock-on impact on the

availability of the planned asset-backed debt funding and the trade

finance facility, which has impacted the Company's short-term cash

position.

In order to determine that the going concern assumption for the

preparation of these accounts continues to be correct the Directors

have prepared a Base Case forecast using the following major

assumptions:

Ø The Company shortly agrees a new contractual arrangement

whereby the EV OEM will provide an advance payment against future

product deliveries;

Ø the Group delivers its EV customer's revised orders in 2023.

These volumes are below the level of the current orders on hand and

are significantly below the guaranteed minimum volumes (GMV) set

out in the contract with the EV OEM customer;

Ø there are no further orders from the EV OEM customer for

delivery after June 2023;

Ø there is an improvement in the operating performance of

Stevenage Circuits Limited, the group's other trading subsidiary,

compared to the year ended 31 December 2021;

Ø that our machinery suppliers have no further delivery delays

and consequently the capital expenditure programme for the

Stonehouse facility is completed in 2022;

Ø that the Group's bankers maintain the invoice discounting

facilities that are currently in place; and

Ø discussions for the provision of further funding are

successfully completed.

The Company is discussing a new contractual arrangement whereby

the EV OEM will provide an advance payment against future product

deliveries and the Company is reviewing a number of options for

additional funding with its advisers.

Whilst the Base Case forecast represents, in the Board's view,

the most likely scenario there may be continuing impacts from all

of the risks identified above and so consequently there will be

risks that performance will be below our expectations. Therefore,

the Directors have also prepared a severe but plausible downside

scenario which assumes the following:

Ø that the Company fails to agree the new contractual

arrangement with the EV OEM; and

Ø no further funds can be raised.

In these circumstances the Group would face a funding shortfall

of GBP7.9m. This, together with the risk surrounding some of the

assumptions within the models, indicates that there are

circumstances that give rise to a material uncertainty related to

going concern.

On the basis of the Base Case assumptions noted above the Base

Case forecast shows that the Group will be able to continue as a

going concern.

Board Change

At the company's Annual General Meeting on 22 August 2022 Mark

Hodgkins stepped down as a director and Paul Cook was appointed as

CFO.

CEO's Statement

It remains a difficult time to be in business, with labour

supply, inflation, supply chain dislocation and Brexit-related

customs issues all posing their own challenges to the business.

However, these challenges are being, can be, and will be met by

pro-active management of the issues across the three sites.

Beyond the contract with the UK EV OEM, we are actively pursuing

the very large market opportunity - which could total many GBP100m

of business - in the developing UK and European EV supply chain for

battery CCS. Stonehouse Phase 2 will be - in our opinion - a unique

and well-positioned resource to deliver that opportunity. We are

confident of further material developments, regardless of the

macro-economic situation.

The APCB division, where we have recently appointed a new

Managing Director, remains an important part of the business, but

the principal growth will come from IHT. The investments that we

have made - the building for growth - are and will continue to

deliver, across the three principal IHT market verticals.

At the top end of our capability, Trackwise is one of, if not

the, leading supplier of long flex PCBs worldwide. I am very

grateful for all stakeholders for their part in helping the

business towards achieving its potential.

Improved Harness Technology

Improved Harness Technology (IHT), the long-term growth driver

for Trackwise, is the patented technology which enables the

manufacture of length-unlimited multi-layer flexible printed

circuit boards.

While IHT has a wide range of applications, we have set out the

three markets where we expect to see the greatest levels of growth

for this technology. These are:

1. Electric Vehicles

2. Medical

3. Aerospace

We remain confident in the applicability of our proprietary

technology to these markets and the significant revenues this has

the potential to generate.

With the delivery and commissioning of the Double Belt Press

(DBP), the length-unlimited multilayer flex PCB manufacturing

process envisaged in the original IHT patent application in January

2012 has now been realised as an in-house capability. This is a

major milestone for the business.

The DBP is a key strategic asset, providing a state-of-the-art

capability to manufacture our own metal-clad laminates, as well as

allowing us to bond together individual circuit layers to form the

patented length-unlimited multilayer circuits. A number of customer

developments had been held until such time as we have this

capability in-house, and, more generally, our rate of development

has the potential to speed up immeasurably.

Advanced PCBs

The Advanced PCBs division comprises Stevenage Circuits

Limited.

The division delivered a disappointing first half, with sales

down 10.6%, due to an expected GBP250,000 outsourced order being

deferred, now expected in the second half. Sales of manufactured

products increased by 7.6%, driven largely by price increases.

We were delighted to welcome Christoph Boueke, as Managing

Director of Stevenage Circuits Limited in July 2022.

Current trading and outlook

Following the appointment of the new Managing Director of the

APCB division, we have already started to see improved operations

within the business and performance is expected to continue to

improve in the medium term.

While delays from our EV OEM are disappointing and highly

disruptive to the business, the Company is working with the OEM and

with other funders to allow the roll-to-roll production capability

at the Stonehouse site to begin production in Q4 2022, to achieve

full (single shift) production in Q1 2023, thereby proving our

ability to deliver "Quantity, Quality, Qualified", a key milestone

for the business.

Discussions with the EV OEM are progressing towards agreeing a

new contractual arrangement whereby the EV OEM will provide an

advance payment against future product deliveries, and such advance

payment is expected to be backed by security.

The wider impact of the lower production volumes from our EV OEM

is that additional funding will be required and the Company is

reviewing a number of options for additional funding with its

advisers and will provide further updates in due course.

The Company is exploring longer term strategic investment

partnerships in order to support development and conversion of the

very significant pipeline of identified IHT sales opportunities,

notably for EV battery cell connection systems ("CCS") for UK and

EU OEMs, Tier 1 suppliers, and also for other Medical and Aerospace

sales opportunities.

Interim Condensed Consolidated Statement of Comprehensive

Income

Notes Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

GBP'000 GBP'000 GBP'000

Revenue 3 3,781 4,090 8,011

Cost of sales (2,884) (2,904) (5,699)

Gross profit 897 1,186 2,312

Other operating income 4 729 - 57

Administrative expenses

excluding exceptional

costs and share based

payment (1,540) (1,315) (2,953)

Exceptional and non-recurring

costs 5 (2,013) (195) (941)

Share based payment charges (27) (149) (153)

Total administrative expenses (3,580) (1,659) (4,047)

Operating loss (1,954) (473) (1,678)

Finance income - - 3

Finance costs (175) (138) (301)

Loss before taxation (2,128) (611) (1,976)

Taxation 6 737 42 324

Loss and total comprehensive

expense for the period (1,392) (569) (1,652)

------------ ------------- -------------

Loss per share (pence)

Basic and diluted 8 (3.73) (2.00) (5.78)

------------ ------------- -------------

Interim Condensed Consolidated Statement of Financial Position

Notes Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 9 10,774 7,940 9,932

Property, plant and

equipment 10 22,731 11,425 13,131

33,505 19,365 23,063

---------- ---------- -------------

Current assets

Inventories 2,679 2,296 2,022

Trade and other receivables 5,538 5,498 7,795

Current tax receivable 1,147 1,146 858

Cash and cash equivalents 2,360 4,806 2,897

---------- ---------- -------------

11,724 13,746 13,572

---------- ---------- -------------

Total assets 45,229 33,111 36,635

---------- ---------- -------------

LIABILITIES

Current liabilities

Trade and other payables (2,844) (2,501) (3,015)

Borrowings 11 (3,036) (887) (1,850)

(5,880) (3,388) (4,865)

---------- ---------- -------------

Non-current liabilities

Deferred income -

grants (1,090) (975) (1,067)

Borrowings 11 (9,397) (3,714) (5,514)

Deferred tax liabilities (153) (506) (623)

Provisions (115) (79) (115)

---------- ---------- -------------

(10,755) (5,274) (7,319)

---------- ---------- -------------

Total liabilities (16,635) (8,662) (12,184)

---------- ---------- -------------

Net assets 28,594 24,449 24,451

---------- ---------- -------------

EQUITY

Share capital 1,500 1,137 1,207

Share premium account 27,215 20,989 22,000

Retained earnings (191) 2,214 1,155

Revaluation reserve 70 109 89

Total equity 28,594 24,449 24,451

---------- ---------- -------------

Interim Condensed Consolidated Statement of Changes in Equity

Share Share Retained Revaluation Total

capital premium earnings reserve equity

account

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2021 1,137 20,989 2,615 128 24,869

Loss and total comprehensive

expense for the

period - - (569) - (569)

Share based payment - - 149 - 149

Revaluation realised

in period - - 19 (19) -

--------- --------- ---------- ------------ --------

At 30 June 2021 1,137 20,989 2,214 109 24,449

--------- --------- ---------- ------------ --------

Loss and total comprehensive

expense for the

period - - (1,083) - (1,083)

Issue of shares 70 1,011 - - 1,081

Share based payment - - 4 - 4

Revaluation realised

in period 20 (20)

At 31 December

2021 1,207 22,000 1,155 89 24,451

--------- --------- ---------- ------------ --------

Loss and total comprehensive

expense for the

period - - (1,392) - (1,392)

Issue of shares 293 5,215 - - 5,508

Share based payment - - 27 - 27

Revaluation realised

in period - - 19 (19) -

--------- ------------

At 30 June 2022 1,500 27,215 (191) 70 28,594

--------- --------- ---------- ------------ --------

Interim Condensed Consolidated Statement of Cash Flows

Unaudited Unaudited Audited

Six months Six months Year

ended 30 ended ended

June 2022 30 June 31 December

2021 2021

GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Loss for the period before

taxation (2,129) (611) (1,976)

Adjustment for:

Employee share-based payment

charges 27 149 153

Depreciation of property,

plant and equipment 585 524 965

Amortisation of intangible

assets 273 181 426

Finance costs 175 138 298

Changes in working capital:

Increase in inventories (657) (286) (12)

Increase in trade and other

receivables (1,660) (732) (375)

(Decrease)/increase in trade

and other payables (204) (221) 1,003

------------ ------------ -------------

Cash (used in)/from operations (3,590) (858) 482

Income tax (paid)/received (22) - 687

------------ ------------ -------------

Net cash (used in)/from operating

activities (3,612) (858) 1,169

------------ ------------ -------------

Cash flow from investing

activities

Purchase of property, plant

and equipment (6,358) (6,266) (10,649)

Purchase of intangible assets (1,030) (1,478) (3,553)

Grant funding 56 92 214

Interest received - - 3

Net cash used in investing

activities (7,566) (7,652) (13,985)

------------ ------------ -------------

Cash flow from financing

activities

Share capital issued 5,855 - 1,230

Expenses relating to share

capital issue (347) - (149)

Interest paid (171) (138) (301)

Lease payments (141) (106) (187)

Bank loan advanced - - 1,960

Bank loan repayments (35) - (23)

Advance of hire purchase finance

against assets already purchased 5,166 135 -

Cash inflow from invoice discounting

and other short-term financing 490 - 184

Repayment of short-term financing - (128) (128)

Repayment of capital element

of lease contracts (410) (377) (801)

-------- --------- ---------

Net cash from/(used in) financing

activities 10,771 (614) 1,785

-------- --------- ---------

Decrease in cash and cash

equivalents (537) (9,124) (11,033)

-------- --------- ---------

Net cash and cash equivalents

at beginning of the period 2,897 13,930 13,930

Net cash and cash equivalents

at end of period (all cash

balances) 2,360 4,806 2,897

-------- --------- ---------

Notes to the condensed interim financial statements

1. Corporate information

Trackwise Designs plc is a public company incorporated in the

United Kingdom. The registered address of the Company is 1 Ashvale,

Alexandra Way, Ashchurch, Tewkesbury, Gloucestershire, GL20

8NB.

The principal activity of the Company and the Group is the

development, manufacture and sale of printed circuit boards.

2. Accounting policies

Basis of preparation

This unaudited consolidated interim financial information has

been prepared in accordance with IFRS as adopted by the United

Kingdom including IAS 34 'Interim Financial Reporting'. The

principal accounting policies used in preparing the interim results

are those it expects to apply in its financial statements for the

year ending 31 December 2022. These are unchanged from those

applied in the 31 December 2021 Company financial statements

The financial information does not contain all of the

information that is required to be disclosed in a full set of IFRS

financial statements. The financial information for the six months

ended 30 June 2022 and 30 June 2021 is unreviewed and unaudited and

does not constitute the Group or Company's statutory financial

statements for those periods.

The comparative financial information for the full year ended 31

December 2021 has, however, been derived from the audited statutory

financial statements for that period. A copy of those statutory

financial statements has been delivered to the Registrar of

Companies.

Going Concern

The auditor's report on those accounts was unqualified, but

includes reference to a material uncertainty in respect of the

going concern basis without qualifying its report and did not

contain a statement under section 498(2)-(3) of the Companies Act

2006.

The Directors have considered the principal risks and

uncertainties facing the business. In making this assessment the

Directors have prepared cash flows for the foreseeable future.

These forecasts show that the Company should be able to manage its

working capital and existing resources to enable it to meet its

liabilities as they fall due. These forecasts have considered the

risks that the Company faces, notably:

Ø The Company shortly agrees a new contractual arrangement

whereby the EV OEM will provide an advance payment against future

product deliveries;

Ø that the EV OEM places a replacement order at higher prices

than those currently being charged;

Ø the Group delivers its EV customer's replacement order in full

in H1 2023. These volumes are below the level of the current orders

on hand and are significantly below the guaranteed minimum volumes

(GMV) set out in the contract with the EV OEM customer;

Ø there are no further orders from the EV OEM customer for

delivery after June 2023;

Ø there is an improvement in the operating performance of

Stevenage Circuits Limited, the group's other trading subsidiary,

compared to the year ended 31 December 2021;

Ø that our machinery suppliers have no further delivery delays

and consequently the capital expenditure programme for the

Stonehouse facility is completed in 2022;

Ø that the Group's bankers maintain the invoice discounting

facilities that are currently in place; and

Ø discussions for the provision of further funding are

successfully completed.

Further narrative in respect to the going concern evaluation

performed by management is disclosed within the Going Concern

section of the Financial Review above.

The risk surrounding some of the assumptions within the

forecasts indicates that there are circumstances that give rise to

a material uncertainty related to going concern. However, the

directors remain confident that the group remains a going concern

and as such have prepared the Financial Statements on a going

concern basis.

The financial information in the Interim Report is presented in

Sterling.

3. Segmental reporting

IFRS 8, Operating Segments, requires operating segments to be

identified on the basis of internal reports that are regularly

reviewed by the company's chief operating decision maker. The chief

operating decision maker is considered to be the Board of

Directors.

The operating segments are monitored by the chief operating

decision maker and strategic decisions are made on the basis of

adjusted segment operating results. From January 2018 the APCB and

IHT activities began to be separately reviewed and monitored,

initially in respect of revenue.

All assets, liabilities and revenues are located in, or derived

in, the United Kingdom. The material assets and liabilities relate

to overall activity with the exception of the intangible

development costs and deferred grants which are solely in respect

of IHT.

In the six months ended 30 June 2022 the group had one major IHT

customer who represented 11.2% and one APCB customer who

represented 9.6% of total revenue (30 June 2021: one major customer

who represented 11% of total revenue, and full year ended 31

December 2021:one APCB customer representing 12.7% of total revenue

and one IHT customer representing 9.5% of total revenue).

Revenue by product and geographical destination was as

follows:

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

GBP'000 GBP'000 GBP'000

IHT 546 581 1,480

APCB 3,235 3,509 6,531

--------------- ------------ -------------

3,781 4,090 8,011

--------------- ------------ -------------

UK 2,706 3,053 6,065

Europe 592 732 1,309

Other 483 305 637

3,781 4,090 8,011

--------------- ------------ -------------

4. Other operating income

There have been delays in orders from a major new customer

contract which are subject to compensatory income for the Company.

Other operating income includes GBP698,000 which is an estimate of

this income and is subject to a significant degree of judgement in

respect of the overall commercial negotiations as the production is

set up and commences.

5. Exceptional and non-recurring items

Non-recurring amounts disclosed in administrative expenses are

as follows:

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

GBP'000 GBP'000 GBP'000

New facility set up costs 1,219 141 941

Additional production and 794 - -

set-up costs

Integration and other costs - 54 -

2,013 195 941

--------------- ------------ -------------

The new facility and production contract requirements have

resulted in costs relating to the Stonehouse site during

preparation and set up ready for production. In addition there have

been ongoing additional costs of production and inefficiencies at

Ashvale in order to meet orders on a temporary basis whilst all new

plant is set up and commissioned. At the new facility, costs arise

from employing staff that have been engaged in refurbishment and

installation work rather than volume production. There are also the

property running costs including utilities, rates and professional

fees arising in this non-productive phase.

6. Income tax

Taxation is provided at the estimated rate of tax for the

period, applying the enacted rate of 25% (2021:25%) to deferred tax

balances as applicable to the expected reversal dates after March

2023, and including the benefit of enhanced allowances for research

and development costs in tax losses used to claim a credit payable

as cash to the group.

The overall credits have been impacted by both the change in

deferred tax rate following enactment of the Finance Act 2021 and

by movements in the period end share price directly affecting

deferred tax in respect of future deductions from the exercise of

share options. These non-recurring items have been analysed in the

elements of the tax credit shown below.

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

GBP'000 GBP'000 GBP'000

Development expenditure

tax credits 267 342 740

Deferred tax in respect

of share options (58) (141) (252)

Deferred tax change in rate - (121) (168)

Deferred tax from other

timing differences 528 (38) 4

--------------- ------------ -------------

737 42 324

--------------- ------------ -------------

7. Dividends paid and proposed

No dividends have been paid or proposed in the period ended 30

June 2022 or year ended 31 December 2021.

8. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

GBP'000 GBP'000 GBP'000

Loss for the purpose of basic

and diluted earnings per share

being net loss attributable

to the shareholders (1,392) (569) (1,652)

--------------- ------------ -------------

Number Number Number

Weighted average number of

ordinary shares for the purposes

of basic and diluted loss

per share 37,305,605 28,426,122 28,597,901

--------------- ------------ -------------

There are options which remain exercisable over 1,528,912

ordinary shares at 30 June 2022 and which are potentially dilutive

shares. There is no dilution of a loss for the period or

comparative periods.

9. Intangible fixed assets

Development

costs

GBP'000

Cost

At 1 January 2021 6,815

Additions 1,548

As at 30 June 2021 8,363

Additions 2,236

As at 31 December 2021 10,599

Additions 1,107

As at 30 June 2022 11,706

------------

Amortisation

At 1 January 2021 523

Charge 175

As at 30 June 2021 698

Charge 227

As at 31 December 2021 925

Charge 259

As at 30 June 2022 1,184

------------

Carrying amount

As at 30 June 2021 7,665

------------

As at 31 December 2021 9,674

------------

As at 30 June 2022 10,522

------------

The capitalised development project costs relate to the

significant continuing investment in respect of the Company's

Improved Harness Technology ('IHT') process for unlimited length

printed circuit boards and know-how which is being developed by the

Company with amortisation on the initial development projects

commencing in 2018.

The remainder of intangible assets is represented by software

assets and an unchanged amount of goodwill in respect of the

initial technology.

10. Tangible fixed assets

Freehold Leasehold Plant Right Assets Total

property improvements and machinery of use under

asset construction

-buildings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

As at 1 January

2021 - 480 7,239 2,728 - 10,447

Additions 3,002 4 302 - 625 3,933

As at 30 June

2021 3,002 484 7,541 2,728 625 14,380

Additions - 8 656 36 1,611 2,311

Disposals - (62) (47) - - (109)

---------- -------------- --------------- ------------ -------------- --------

As at 31 December

2021 3,002 430 8,150 2,764 2,236 16,582

Additions - - 6,379 - 3,894 10,273

As at 30 June

2022 3,002 430 14,529 2,764 6,130 26,855

---------- -------------- --------------- ------------ -------------- --------

Depreciation

At 1 January 2021 - 161 1,771 340 - 2,272

Charge - 21 513 149 683

As at 30 June

2021 - 182 2,284 489 2,955

Charge - 21 434 150 - 605

Disposals - (62) (47) - - (109)

----------

As at 31 December

2021 - 141 2,671 639 - 3,451

Charge - 18 502 153 - 673

As at 30 June

2022 - 159 3,173 792 - 4,124

---------- -------------- --------------- ------------ -------------- --------

Carrying amount

As at 30 June

2021 3,002 302 5,257 2,239 625 11,425

---------- ------------

As at 31 December

2021 3,002 289 5,479 2,125 2,236 13,131

---------- -------------- --------------- ------------ -------------- --------

As at 30 June

2022 3,002 271 11,356 1,972 6,130 22,731

---------- -------------- --------------- ------------ -------------- --------

The group has continued to invest in the freehold production

facility at Stonehouse with the fit out of the property and new

plant being commissioned.

11. Borrowings

New hire purchase agreements have been drawn on in the period

ended 30 June 2022 in order to finance the new plant and equipment

at the Stonehouse facility. Other short-term financing represents

advances against equipment which is expected to be converted to a

term agreement when the equipment is fully in place.

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Amounts falling due within

one year:

Lease liabilities 290 187 274

Hire purchase contract

obligations 1,452 700 772

Bank loan 71 - 71

Invoice financing 840 - 184

Other short-term financing 383 - 549

-------- -------- ------------

3,036 887 1,850

-------- -------- ------------

Amounts falling due between

one and five years:

Lease liabilities 1,362 1,289 1,308

Hire purchase contract

obligations 4,639 1,485 1,557

Bank loan 1,831 - 1,866

-------- -------- ------------

7,832 2,774 4,731

-------- -------- ------------

Amounts falling due in

more than five years:

Lease liabilities 572 940 783

Hire purchase contract 993 - -

obligations

-------- -------- ------------

1,565 940 783

-------- -------- ------------

Total borrowings 12,433 4,601 7,364

-------- -------- ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKCBNFBKDCCB

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

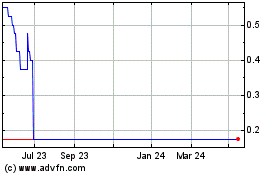

Trackwise Designs (LSE:TWD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Trackwise Designs (LSE:TWD)

Historical Stock Chart

From Feb 2024 to Feb 2025