TUI AG (TUI) TUI AG: INTERIM REPORT Q1 2022 1 OCTOBER 2021 - 31

DECEMBER 2021 08-Feb-2022 / 07:00 CET/CEST Dissemination of a

Regulatory Announcement, transmitted by EQS Group. The issuer is

solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

TUI GROUP

Interim report Q1 2022

1 October 2021 - 31 DECEMBER 2021

Content

Interim Management Report

Q1 2022 Summary

Report on changes in expected development

Structure and strategy of TUI Group

Consolidated earnings

Segmental performance

Financial position and net assets

Comments on the consolidated income statement

Alternative performance measures

Other segment indicators

Corporate Governance

Risk and Opportunity Report

Unaudited condensed Consolidated Interim Financial

Statements

Notes

General

Accounting principles

Group of consolidated companies

Acquisitions - Divestments

Notes to the unaudited condensed consolidated Income

Statement

Notes to the unaudited condensed consolidated Statement of

Financial Position

Responsibility statement

Review Report

Cautionary statement regarding forward-looking statements

Financial calendar

Contacts

Interim Management Report

Q1 2022 Summary

-- Group revenue of EUR2.4bn, up EUR1.9bn on the prior year (Q1

2021: EUR0.5bn), reflecting the more open travelenvironment enabled

by the successful roll-out of vaccinations during calendar year

2021. Around 40% of thisincrease in revenue was driven by Markets

& Airlines Central Region, with our Continental European

marketsbenefitting from the earlier easing of travel restrictions

by the EU, resulting in a higher level of confidence inshort-term

departures.

-- 67% of Q1 2019 capacity were operated in Q1 2022, in line

with expectations.

-- 2.3m customers departed in the quarter, an increase of 1.7m

customers versus the prior year, resulting inan average load factor

for the quarter of 79% (Q1 2021: Load factor 70%).

-- Q1 Group underlying EBITDA almost break-even at EUR65.4m

loss, improving EUR392.2m versus prior year (Q1 2021: EUR457.6m

loss).

-- Q1 Group underlying EBIT loss of EUR273.6m, an improvement of

EUR402.2m versus prior year (Q1 2021: EUR675.8mloss), with Hotels

& Resorts delivering a second sequential positive quarter since

the start of the pandemic.

-- Global Realignment Programme on track, with 25% of EUR400m

p.a. target cost savings to be delivered infinancial year 2022

(EUR240m already delivered in financial year 2021, with remainder

to be delivered by financialyear 2023).

-- Credit rating upgrades from Moody's to B3 and S&P to B-

in October 2021.

-- Strong liquidity position of EUR3.3bn1 as of 3 February 2022,

reflecting our strict cost discipline, lowerworking capital swing

as anticipated (compared to Q1 2019 normalised quarter, unaffected

by COVID-19), and EUR1.1bnproceeds from recent capital

increase.

-- First step in handing back government funding - EUR0.7bn

planned on 1 April 2022

1 Available liquidity defined as unrestricted cash plus

committed lines including financing packages

TUI Group - financial highlights

EUR million Q1 2022 Q1 2021 Var. % Var. % at constant currency

Revenue 2,369.2 468.1 + 406.1 + 398.0

Underlying EBIT1

Hotels & Resorts 61.1 - 95.6 n. a. n. a.

Cruises - 31.7 - 98.4 + 67.7 + 69.5

TUI Musement - 12.7 - 32.6 + 61.0 + 61.0

Holiday Experiences 16.7 - 226.6 n. a. n. a.

Northern Region - 171.7 - 197.3 + 13.0 + 17.8

Central Region - 55.0 - 149.4 + 63.2 + 63.0

Western Region - 32.4 - 76.5 + 57.7 + 57.1

Markets & Airlines - 259.0 - 423.1 + 38.8 + 40.9

All other segments - 31.3 - 26.0 - 20.2 - 17.7

TUI Group - 273.6 - 675.8 + 59.5 + 61.0

EBIT1 - 271.4 - 698.1 + 61.1

Underlying EBITDA - 65.4 - 457.6 + 85.7

EBITDA2 - 55.5 - 474.8 + 88.3

Group loss - 386.5 - 790.3 + 51.1

Earnings per share EUR - 0.27 - 1.32 + 79.5

Net capex and investment 53.4 - 47.1 n. a.

Equity ratio (31 Dec)3 % 2.5 -5 + 7.5

Net financial position (31 Dec) - 5,069.6 - 7,177.0 + 29.4

Employees (31 Dec) 43,162 37,081 + 16.4

Differences may occur due to rounding.

This Quarterly Report of the TUI Group was prepared for the

reporting period Q1 2022 from 1 October 2021 to 31 December

2021.

1 We define the EBIT in underlying EBIT as earnings before

interest, income taxes and result of the measurement of the Group's

interest hedges. For further details please see page 15.

2 EBITDA is defined as earnings before interest, income taxes,

goodwill impairment and amortisation and write-ups of other

intangible assets, depreciation and write-ups of property, plant

and equipment, investments and current assets.

3 Equity divided by balance sheet total in %, variance is given

in percentage points.

All change figures refer to the same period of the previous

year, unless otherwise stated.

Trading update

-- 6.0m bookings1 across Winter 2021/22 and Summer 2022, with an

acceleration in bookings since the start ofthe new year, as

confidence in international travel improves.

-- Winter 2021/22 bookings1 have slowed to 58% of Winter 2018/19

levels mainly due to Omicron-relatedamendments in late November and

December 2021, with Q2 departures currently more subdued. We expect

short-termbookings to continue and at present, we expect winter

capacity to be between low and mid-range of assumed range of60% to

80% (of Winter 2018/19 levels).

-- Summer 2022 bookings1 are 72% of Summer 2019 levels. Booking

patterns overall have been relatively stabledespite Omicron, with

recent bookings trending in the same pattern as January 2019,

albeit at reduced volume levelsat this point.

-- Following the removal of testing requirements in the UK, we

have seen a step-up in booking activity, withUK Summer 2022

bookings currently up 19% on Summer 2019.

-- Combined with the improving confidence in departure, lifting

of restrictions and later booking profile,our Summer 2022 capacity

assumption is for close to 2019 summer levels.

-- ASPs1 for both seasons holding up strongly compared to

2018/19 programmes, driven by a higher mix ofpackages and

reflective of the robust appetite for leisure travel (Winter

2021/22: +15%, Summer 2022: +22%).

-- Hotels & Resorts - As evident in Q4 as well as the

quarter under review where we have returned topositive underlying

EBITs, we have seen a clear demand for our hotels with improving

occupancies across ourdiversified portfolio. We expect this

positive trend to continue developing into the Summer 2022, with

theshort-term booking profile likely to continue also.

-- Cruises - Coming into the new calendar year, we have seen

itinerary amendments across our three brands,due to various port

closures and increasing incidence rates affecting our planned

itineraries in the Middle Eastand in the Caribbean. For all three

cruises brands, we will likely see a challenging first half as a

result withthe short-term booking profile expected to continue into

the Summer. However H2 2022 and 2023 bookings are allcurrently at

higher rates compared to booking positions as of Q1 2019.

-- TUI Musement - The number the Excursions, Activities and

Tours (EATs) sold in the first quarter arealready ahead of both Q1

2021 and (pre-COVID-19) Q1 2019, reflecting firstly the more open

travel environment andsecondly the successful integration of

Musement. The integration of Musement has increased both product

inventoryand the number of destinations offered on our digital

platform, and with the wider reopening of travel, we havebegun

resuming our growth plans for this segment which remains highly

fragmented and largely offline. We expectEATs to develop beyond the

capacity assumptions of our Markets & Airlines Winter 2021/22

and Summer 2022, asthird-party sales return, in line with a wider

reopening across our global destinations.

1 Bookings up to 30 January 2022 compared to 2019 programmes

(undistorted by COVID-19) and relate to all customers whether risk

or non-risk

Global Realignment Programme - Targeted savings EUR400m p.a. by

financial year 2023

In May 2020, we announced our Global Realignment Programme to

address group-wide costs, with a target of permanently saving more

than EUR400m per annum by financial year 2023.

In the financial year ending September 2021, 60% (EUR240m) of

our announced targeted savings were delivered. Savings have been

most significantly delivered across the Markets & Airlines

division (85% of savings to date).

The programme is on track to deliver a further 25% of our

targeted savings in financial year 2022 and remains on track to

deliver the full programme benefits by end of financial year

2023.

Net debt

Q1 2022 net debt position of EUR5.1bn is in line with 2021

year-end position. The Q1 position includes proceeds from our

capital increase of EUR1.1bn and reflects our improved operating

result combined with the expected lower seasonal Q1 working capital

outflow of EUR937m, demonstrating our continuous focus on cost and

cash discipline.

Completion of capital increase of EUR1.1bn

We successfully completed a second capital increase in November

2021. The gross issue proceeds totalled around EUR1.1bn. The

Group's share capital increased nominally by EUR523.5m to

EUR1.623bn.

Strategic priorities

(MORE TO FOLLOW) Dow Jones Newswires

February 08, 2022 01:01 ET (06:01 GMT)

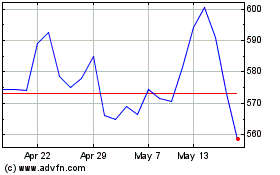

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

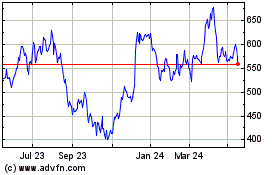

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024