TIDMTRY

RNS Number : 5053I

TR Property Investment Trust PLC

05 December 2022

TR Property Investment Trust plc

London Stock Exchange Announcement

Unaudited results for the six months ended 30 September 2022

Legal Entity Identifier : 549300BPGCCN3ETPQD32

Information disclosed in accordance with Disclosure Guidance and

Transparency Rule 4.2.2

5 December 2022

"This has been a dramatically poor period of performance for

property shares and the Company was no exception, delivering a six

month net asset value total return of -33.6%. Nevertheless, our

investments are focused on balance sheet strength and the security

of income, much of which is index-linked, so I am pleased to report

a 6.6% increase in the interim dividend." David Watson,

Chairman

"Index-linked income remains a valuable part of any inflation

proofing in a portfolio and we continue to focus on companies with

assets which tenants both need and can afford." Marcus

Phayre-Mudge, Fund Manager

Financial Highlights and Performance

At 30 September At 31 March

2022 2022 % Change

================================== =============== =========== ==========

Balance Sheet

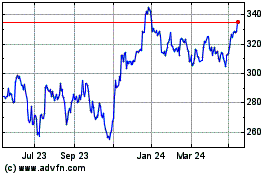

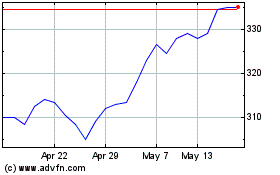

Net asset value per share 319.37p 492.43p -35.1

Shareholders' funds GBP1,014m GBP1,563m -35.1

Shares in issue at the end of the

period (m) 317.4 317.4 +0.0

Net debt 1,5 12.0% 10.2%

================================== =============== =========== ==========

Share Price

Share price 296.50p 456.50p -35.0

Market capitalisation GBP941m GBP1,449m -35.0

Half year ended Half year ended 30 September

30 September

===========================

2022 2021 % Change

=========================== ====================== =============== ====================

Revenue and Dividends

Revenue earnings per share 12.05p 10.31p +16.9

Interim dividend per share 5.65p 5.30p +6.6

Half year ended Year ended 31 March

30 September 2022

2022

===================================== ====================== ===============================

Performance: Assets and Benchmark

Net asset value total return 2,5 -33.6% +21.4%

Benchmark total return -33.8% +12.2%

Share price total return 3,5 -33.4% +19.9%

===================================== ====================== ===============================

Ongoing Charges 4,5

Including performance fee +0.59% +2.19%

Excluding performance fee +0.59% +0.60%

Excluding performance fee and direct

property costs +0.55% +0.58%

1 Net debt is the total value of loan notes and loans (including

notional exposure to contracts for differences ('CFDs')) less cash

as a proportion of Net asset value ('NAV').

2 The NAV Total Return is calculated by reinvesting the

dividends in the assets of the Company from the relevant

ex-dividend date. Dividends are deemed to be reinvested on the

ex-dividend date as this is the protocol used by the Company's

benchmark and other indices.

3 The Share Price Total Return is calculated by reinvesting the

dividends in the shares of the Company from the relevant

ex-dividend date.

4 Ongoing Charges are calculated in accordance with the AIC

methodology. The ratio for 30 September 2022 is based on forecast

expenses and charges for the year ending 31 March 2023. The

performance fee provision at 30 September 2022 is nil and therefore

the Ongoing Charges figure, including and excluding the Performance

Fee, is the same.

5 Considered to be an Alternative Performance Measure.

Chairman's Statement

Market Backdrop

This has been a dramatically poor period of performance for

property shares and the Company was no exception delivering a six

months net asset value total return of -33.6%, little better than

our benchmark of -33.8%. The share price total return was -33.4%

and whilst this is no better than the performance of the underlying

asset value, it is encouraging to see that, even after such a

severe correction in property equity prices, the discount of the

share price to the net asset value did not widen.

Macro-economic and political forces continue to dominate both

markets and investors' perceptions of the future trajectory of the

value of all risk assets. Inflation is everyone's focus as we all

grapple with the consequences of the unwinding of the era of cheap

capital engineered by the actions of central banks following the

Global Financial Crisis. Real estate as a leveraged asset class has

been hit hard. As with any market correction, property share prices

move fast and take the brunt of this sentiment change, well ahead

of the underlying physical transaction market.

Our Manager's report shows in more detail that whilst all our

companies have seen dramatic price falls, there has also been a

lack of divergence between the good and the bad. As in all bear

markets, forced sellers who require immediate liquidity dictate the

marginal price and careful stock selection is overwhelmed in the

rush to cash.

As outlined in the Annual Report in May, our Managers continue

to focus on those businesses which have worked hard to prepare

their balance sheets for an era of higher interest rates. Those

companies which have heavily utilised the corporate bond market for

their debt needs are potentially most at risk. This issue is

concentrated in the larger names, particularly those able to

achieve a credit rating. Smaller companies are mainly financed

through bank debt and so are less affected by the lack of bond

market activity. Our portfolio continues to have the small and

midcap bias where we find focused market specialisation, management

alignment and strong underlying real estate attributes. However, we

are acutely aware that smaller companies struggle to find

cheerleaders in difficult times as illiquidity becomes another item

on investors' list of negative indicators.

Revenue results and dividend

The earnings per share at the interim stage are 12.05p per

share, almost 17% ahead of the prior year's comparable figure of

10.31p per share. As in previous years, our earnings are skewed

towards the first half.

The Board is aware of the importance of a growing dividend to

shareholders and is pleased to announce an increase of 6.6% in the

interim dividend to 5.65p per share, up from the prior year interim

dividend of 5.30p.

Revenue outlook

Although we anticipate that income for the full year will be

considerably ahead of last year, we do not expect the growth in

earnings seen in the first half to be repeated in the second half.

This is partly due to the fact that our income is skewed to the

first half whilst most expenses accrue evenly through the year. In

addition we have, once again, seen some advantageous withholding

tax rates on dividends paid in the first half which we do not

expect to see repeated in the second.

As highlighted earlier, the portfolio is well positioned to

benefit from the effects of indexation, although there are clear

headwinds from rising debt costs alongside heightened economic

uncertainty for underlying tenants.

Net Debt and Currencies

Whilst net gearing was slightly higher at 30 September (12.0%)

than 31 March (10.2%), this was not the case across the whole

period.

In absolute terms, GBP10m was repaid on our revolving loan

facilities over the period. The weakening of sterling during

September's political turmoil led to an increase (in sterling

terms) in the valuation of Euro-denominated loan notes. This,

together with the rapidly falling share prices towards the end of

the month resulted in the reported gearing figure increasing in

percentage terms.

Currently all our revolving credit facilities are undrawn.

Discount and Share Repurchases

The discount of the share price to the net asset value hardly

moved over the period, starting at 7.4% and ending on 30 September

at 7.2%. The discount as at 29 November was 5.4% . No share

buy-backs or issues were made during the period.

Board changes

When recruiting to replace Simon Marrison we were delighted to

welcome Andrew Vaughan who brings great experience of property

investing both in the UK and in Continental Europe.

The Board is mindful that, whilst diverse as regards gender, it

is presently entirely white and British. The Board has commenced an

external search for a new Director who will broaden and strengthen

the insights and challenge that the Board can bring to the

Managers' strategic deliberations through their diversity of age

and ethnicity. Embracing all our desired skills within a Board of

just five Directors may prove challenging so the Board is actively

considering the optimum size of the Board to allow us to operate

effectively with the desirable range of experience and

perspectives.

Outlook

Indexation continues to support revenue growth while rising debt

costs pull in the opposite direction. Many of our companies have

the vast majority of their debt costs fixed or hedged for several

years and therefore can confidently look forward to indexation

feeding through to the bottom line. Of course, the key issue then

is how far vacancy rates and tenant retention will be impacted by

the impending recession. Our Manager continues to focus on that

risk but we do need to remember that for all our tenants rent is a

principal business cost. Historically, mild recessions with low

levels of corporate failure have resulted in minimal tenant

delinquencies.

After such a bruising period of weak performance, our Managers

have challenged their investment hypothesis and reasserted their

focus on those businesses which will weather this storm and be able

to take advantage of the opportunities which will no doubt arise

from it. The quoted sector is in a strong place, relative to many

private property enterprises with strong balance sheets,

established credit facilities and high-quality portfolios.

Generalist investors are shunning the sector and that is

reflected in all property share prices. Share prices still stand at

large discounts to our adjusted, real time net asset value

calculations. This Autumn's political events in the UK have been

damaging to the UK's reputation for financial and fiscal prudence.

We can only hope that the new Prime Minister is able to restore

confidence and deliver the stability which markets crave. It is a

tall order but the reduction in the cost of UK Government debt

since the last week of October is not only encouraging but crucial

for all asset values.

David Watson

Chairman

2 December 2022

Interim management report and Directors' responsibility

statement

Interim management report

The Chairman's Statement on pages 3 to 5 and the Manager's

Report on pages 7 to 12 of the half year report give details of the

important events which have occurred during the period and their

impact on the financial statements.

Principal and emerging risks and uncertainties

The principal risks and uncertainties facing the Company have

not changed since the date of the Annual Report 2022 and continue

to be as set out in that report.

The principal risks and uncertainties facing the Company

include, but are not limited to, poor share price performance in

comparison to the underlying NAV; poor investment performance of

the portfolio relative to the benchmark; market risk; the Company

is unable to maintain dividend growth; accounting and operational

risks; financial risks; loss of Investment Trust Status; legal,

regulatory and reporting risks; inappropriate use of gearing and

personnel changes at Investment Manager. An explanation of these

risks and how they are managed are set out on pages 26 to 29 of the

Annual Report and Financial Statements for the year ended 31 March

2022 (which can be found on the Company's website

www.trproperty.com).

Going concern

As stated in note 5 to the financial statements, the directors

are satisfied that the Group has sufficient resources to continue

in operation for a period of at least 12 months from the date of

this report. Accordingly, the going concern basis is adopted in

preparing the condensed financial statements.

Directors' responsibility statement

In accordance with Chapter 4 of the Disclosure Guidance and

Transparency Rules, the Directors confirm that to the best of their

knowledge:

(1) the condensed set of financial statements has been prepared

in accordance with applicable UK Accounting Standards on a going

concern basis and gives a true and fair view of the assets,

liabilities, financial position and net return of the Company;

(2) the half year report includes a fair review of the important

events that have occurred during the first six months of the

financial year and their impact on the financial statements;

(3) the statement of Principal and Emerging Risks and

Uncertainties shown opposite is a fair review of the principal and

emerging risks and uncertainties for the remainder of the financial

year; and

(4) the half year report includes a fair review of the related

party transactions that have taken place in the first six months of

the financial year.

On behalf of the Board

David Watson

Chairman

2 December 2022

Manager's report

as at 30 September 2022

Performance

The net asset value ('NAV') total return for the six months was

-33.6%, the benchmark, FTSE EPRA Nareit Developed Europe TR (in

GBP) fell -33.8%. These figures are clearly disappointing.

Investors will no doubt be concerned that given the scale of the

correction, the direction of travel was obvious and more protective

action should have been taken. It all looks clear in hindsight but

events on the ground were not so straightforward.

Whilst the financial year started poorly with April recording a

-6.2% return, there followed a period of stability in May as

investors hoped that the initial hawkish response from the central

banks would have the required impact. This quickly turned out to be

wishful thinking and June was a dramatic month, with the NAV

falling 15%. July saw a strong reversal (+9.5%) as bond markets

responded to the theme that rising rates were having the required

deflationary impact. Writing this review in November, such market

behaviour feels naively optimistic. Readers will have noticed the

constant references to rates; essentially the entire market

direction for real estate equities was driven by expectations of

central banks and bond market behaviour. Real estate fundamentals

have taken the proverbial back seat.

If the period under review (from 31st March) had ended in

mid-August, the NAV total return would have been just -13% and the

share price total return -8%. The real damage occurred as investors

returned from their summer holidays and absorbed the US Federal

Reserve's hawkish statements at Jackson Hole. Real estate equities

were the worst performing GIC sector in September as inflation

numbers and base rate expectations continued to rise. The perfect

storm of supply driven cost increases meeting economies running at

full employment has resulted in bond markets pricing in ever

greater increases in the cost of money.

Our investment thesis through the Summer and up until September

had been that whilst rates would rise, our portfolio was heavily

focused on businesses with little near term refinancing, manageable

LTVs and all importantly, the ability to grow their top line

earnings through indexation, market rental reversions and even

development. At the sector level markets such as logistics, student

accommodation and private sector residential continue to experience

supply/demand imbalances.

However, September was a glimpse of a new paradigm, investors

are not interested in asset class fundamentals. It is all about

leverage and yield expansion and this is best illustrated by the

performance of German residential property companies. These

businesses have incredibly resilient earnings, their tenants are,

for the most part, paying rents c.20% below open market values and

as a result their share prices reflect asset valuations well below

replacement value. They have very low vacancy rates due to strong

tenant demand. Even in recessions people need accommodation. Over

the last decade they have grown through acquisition, improving

operating efficiencies and crucially accessing bond markets for

lower and lower debt costs. As their shares began to trade at a

discount to asset value they could no longer make accretive

acquisitions whilst simultaneously debt costs rose and bond market

liquidity became an issue. The German element of our benchmark fell

-44.6% in the period. The Company's largest overweight in this area

is Phoenix Spree Deutschland (4% of NAV), an owner of high-quality

Berlin units. This business has no refinancing requirements until

2025, it does not use listed bonds and crucially it has permission

to sell 75% of its apartments as condominiums (i.e. vacant

possession) as and when they become vacant. In the topsy turvy

world of regulated rents, a flat which can be sold empty and not

forced into being let at a restricted rent is 20% more valuable.

However, these facts have not stopped the share price falling 24%

in the first half. Far less than the larger German companies but

still dramatic. We continue to believe that the gulf between demand

and supply remains a valuable underpin of value in cities such as

Berlin.

Performance attribution is straightforward. Any sub-sectors we

were overweight in, regardless of company quality, balance sheet

resilience or opportunities for growth delivered a negative alpha

contribution. Industrials were hard hit as yields had been driven

very low on the expectation of rental growth and now stand well

below the cost of debt - an unsustainable position. Our underweight

to Sweden proved to be an important positive contributor as

investors shied away from the most leveraged businesses in our

coverage. However, their share prices have been incredibly volatile

with the Swedish sub-sector down 24% in June, only to rally +23% in

July. Maintaining conviction in such turbulent times is challenging

given our bottom-up focus on company quality.

Our physical property portfolio fared better with a

like-for-like fall of 7.5% concentrated at our two industrial

assets in Wandsworth and Gloucester. At the Colonnades in

Bayswater, we sold the remaining residential interest for GBP5.05m.

The asset is now a pure commercial play underpinned by a long lease

to Waitrose with fixed rental increases.

Offices

Both occupiers and investors appear clear on one aspect of

office property: they want buildings which are fit for purpose and

will stand up to scrutiny on their environmental credentials. The

jury remains out on the impact of remote working although certain

tenets of corporate behaviour are becoming the new norm. The

majority of Continental European cities (bar Paris) have seen a

return to pre-pandemic occupancy levels, however the UK, and London

in particular, remain well below those levels. Poor infrastructure

and length of commute are the clear drivers. A pattern of tenant

demand is appearing: the most central and best quality buildings

continue to attract demand. Financial tenant focused markets such

as the City of London, Canary Wharf and La Defense are suffering

elevated void rates and falling rents. CBDs with multiple types of

occupier such as London's West End and Central Paris are seeing

rental tension and broad stability. Knight Frank reports that in

Q2, Paris CBD saw vacancy fall to 3.3% (close to a record low) with

prime rents close to EUR950 per m (2) , again closing in on a

previous peak. Take up is lower than Q4 2021 but so is the

available space. We believe this trend is set to continue in these

best placed assets.

Investors still appear attracted to trophy, new builds. The

recent deals such as the sale of Deutsche Bank's new HQ at 21

Moorfields at an initial yield of 4.4% already looks a good deal

for the vendor, Landsec, but the index-linked income and very long

lease is understandably attractive to its new pension fund owner.

Foreign capital is also visible with the German buyer at GPE's 50

Finsbury Square and the Chinese buyer of TikTok's HQ built by

Helical Bar.

Elsewhere we see rents retrenching. Tenants are back in the

'wait and see' mode. Having spent the last 18 months working out

what space they need in a hybrid world, they now need to assess the

impact of the forthcoming recession (mild or otherwise) on their

requirements. Shorter leases and flexibility (which may ultimately

be more expensive) are becoming the norm. Landlords have to adapt

and investors then need to price in the risk of rental volatility.

Improving energy efficiency is now a central part of any office

refurbishment and we believe landlords of suburban and regional

properties with lower rents (and capital values) are

underestimating the costs of these expanding regulatory

requirements.

Retail

The structural shift to omni-channel continues. The helicopter

view remains the same. Retailers will happily pay if the location

delivers sales, but the number of such locations continues to fall.

Collectively we have too much retail space and the UK remains the

worst culprit (compared to Continental Europe). However, retail

rents have effectively halved over the last decade and valuations

have collapsed. We will therefore see smaller capital value falls

in the MSCI/IPD data for shopping centres versus logistics as

moving yields from 8% to 9% results in half the capital fall

compared to moving from 3% to 4%. Simply put, retail has already

been repriced. This statement applies to the UK. Europe is a

different playing field where valuers react much more slowly and

will remain comforted by rental stability. This stability will be

delivered, in the short run, by substantial indexation compensating

for rising tenant failures.

Two parts of the retail landscape which continue to outperform

are outlet centres and retail warehousing. The former because it

offers a more 'internet-proof' sales channel and the latter because

rents are much lower and they have become an increasingly critical

part of the omni-channel sale process. Click and collect from an

edge of town, easy access location rather than a regional shopping

centre with your car a 10-minute walk from the store. Consumers'

discretionary spend is reducing as energy costs, mortgage rates and

rental levels rise. We like the domination of value-focused

retailers on the retail warehouse parks we partially own through

Ediston Property. The company trades at a 30% discount to its asset

value and has no major refinancing until late 2027. The dividend

yield is 8.3%.

Supermarkets have been our other major retail exposure through

both Supermarket REIT in the UK and Cibus in Finland. The

fundamentals for food shopping margins remain very resilient when

compared to more discretionary spending. Food sales in both

countries are dominated by a small group of competitors across the

complete value/price landscape. This quality of counterparties

together with index-linked leases will prove to be a valuable

provider of top line earnings growth. The problem for both these

companies was the managerial failure to fix their cost of debt;

both businesses had too much floating rate debt and both had their

share prices pummelled as a result. Cibus saw its price fall 25%

from the middle of August to the end of September even though its

top line is growing with healthy indexation. Post the interim,

Supermarket Income REIT entered into interest rate swaps that

hedged all of its floating rate debt at an effective 2.6%. This

cost 2.5% of net asset value. Expensive insurance against rising

rates.

Industrial

The strong momentum in the logistics market has continued

despite the news that Amazon was slowing its take up of space

across the globe. Essentially, we see other operators taking

advantage of the behemoth's space indigestion. Whilst European

economic growth is going to slow or even enter a recession, the

structural tailwinds for this sector persist, particularly the need

to re-engineer complex supply chains which invariably result in the

need to store more materials, ingredients and parts closer to their

end market. Savills reported pan-European take up in H1 2022 of

20million m (2) , up 12% on the same prior-year period, mainly

driven by the UK and Germany. Vacancy rates across Europe have

dropped to a record low of 2.9% and led to headline rents

increasing by an average of 8% over the past 12 months.

It is no surprise that investors had continued to drive yields

lower (and capital values higher) given the expectation of ongoing

rental growth and development gains. However, the increases in the

cost of borrowing have dramatically reversed this yield tightening

cycle. As highlighted earlier, when yields are as low as 3.5%, a

100bps increase to 4.5% reduces the capital value by 22%. Whilst

not all logistics property is valued at these historically low

levels, the sector's pricing continues to reflect good rental

growth prospects. We remain confident that the structural

undersupply of logistics and industrial space in urban markets will

continue to drive rents. Our experience at Ferrier Street,

Wandsworth where we are offering short leases ahead of potential

redevelopment bears this out.

Residential

The shortage of private sector rental accommodation remains

acute. In Germany the regulation of rents (resulting in approx. 20%

below market rents) results in tenant turnover being lower than in

open market jurisdictions leading to very high occupancy levels

with commensurately low payment delinquency. However, the impact of

energy costs and the difficulty in forecasting the increased

service charge recovery rates has led to a reduction in the

expectation of the rate of rental growth.

In markets where the private rented sector is a smaller sector,

such as the UK, regulation had already reduced the number of small

landlords and this has now been compounded by rising mortgage

rates. Large amounts of the private rental sector owned by

'amateur' landlords (owning less than 5 units) have been sold to

the owner-occupier market. The consequence is inflation busting

rental growth in any undersupplied city. London remains top of the

list. As house prices begin to fall, we may well see more people

choosing to temporarily rent, again adding to demand.

Finally, with historically high levels of employment leading to

wage inflation, we see nominal increases in residential rents in

open market jurisdictions such as the UK and Finland as

sustainable.

Alternatives

Purpose built student accommodation continues to fare relatively

well, with rising numbers of students competing for a limited (but

growing) number of beds. Rents in the private rented sector also

continue to rise, particularly as regulation of HMOs (Houses in

Multiple Occupation) continues to squeeze margins for private

landlords. According to Bonsard, rents have increased on average by

9.7% in the 2022 academic year. The survey looked at 140 operations

across all European countries and the highest rates of growth were

in the severely undersupplied Eastern European markets. We continue

to own Unite (UK) and Xior (Belgium and Spain) who have recently

completed a significant corporate acquisition raising EUR61m in a

placing which we participated in.

Self-storage also continues to confound the sceptics with the

Self-Storage Association UK reporting further occupancy growth

across its members. We are fully aware that reduced housing

transaction volumes should impact turnover but the growth of

commercial customers and the growing awareness of the sector remain

long-term, systemic trends.

Healthcare continues to be the poor performer in the

'alternatives' space whether it is primary or nursing care. Whilst

the former has the benefit of direct or indirect NHS rental

support, the latter has far greater exposure to private operators.

These operators do receive large amounts of their revenue from the

government but their operating margins continue to be squeezed

through wage inflation and higher energy bills.

Debt and Equity Markets

Listed bond markets have been effectively closed, particularly

during the second half of the period under review. Just EUR1.4bn

was raised in the period, with only EUR450m after April. This

compares to EUR12.3bn in the same period last year and EUR7.7bn in

Q1 2022.

The central banks' hawkish rhetoric followed by action has

driven spreads on existing bonds to historically wide levels.

Equity owners are looking carefully at any likely moves by the

credit rating agencies, particularly those companies with bonds

trading just a notch or two above sub-investment grade. The vicious

cycle of an earnings downgrade, leading to a credit downgrade,

leading to a higher cost of debt and consequently further falls in

earnings is clearly to be avoided at all costs.

It will come as no surprise that equity capital markets were

virtually closed. However, we did see the first deeply discounted

rights issue with TAG Immobilien, a German residential owner who

had over stretched themselves with the purchase of a Polish

developer. After an incredibly busy period of M&A activity in

the previous 18 months (as detailed in the annual report) fuelled

by cheap debt, the focus of activity in this latest six-month

period was more merger than acquisition with Shaftesbury and CapCo

finally agreeing terms. The transaction had been widely anticipated

since CapCo acquired a 26% stake from Samuel Tak Lee in May 2020.

Given that this was a friendly merger, we remain astonished at the

estimated deal fees of over GBP15m. Also in May, LXI and Secure

Income REIT agreed to merge on a NAV for NAV basis, creating a

liquid, cost-efficient REIT with a GBP3.9bn of index-linked income.

As a large holder in Secure Income, we were pleased with the

transaction as the stock had been trading at a 12% discount to NAV

prior to the deal.

In Germany, ECE, the external manager of Deutsche Euroshop, a

shopping centre owner effectively completed a management buyout

backed by Oaktree (US private equity). Alexander Otto already owned

20% of Deutsche Euroshop as well as controlling ECE.

Investment Activity - property shares

Turnover (purchases and sales divided by two) totalled GBP203m

in the period, considerably ahead of the GBP150m for the same

period last year, as a series of sharp bear market rallies resulted

in more stock rotation. With average net assets over the period of

GBP1.3bn, turnover was 15.5%.

With such a dramatic market correction and with each rally then

trending down to a new low, virtually all buys look poor and all

sells look clever. Throughout the period I have maintained the

discipline of buying (or adding) to companies where I am confident

that they have two crucial underpins to their respective

businesses. Firstly, the balance sheet capability (in terms of

quantum of leverage, cost and duration of debt) to withstand the

near-term adjustment in their cost of capital. Secondly, the

resilience of their top line earnings, measuring counterparty

(tenant) strength and where they will benefit from indexation.

These criteria resulted in a marked reduction in our exposure to

Swedish property companies and this has continued post the half

year. The weakness in the share prices of German residential names

has been highlighted earlier alongside the performance of our

largest relative position, Phoenix Spree. In hindsight, the

strength of the top line earnings (low vacancy and minimal tenant

delinquency) was not enough of an attraction for investors. These

are low yielding assets and even small outward yield shift has a

large impact on valuation. With most of the German residential

names now trading at +50% discounts to asset value and even greater

discounts to replacement cost, we are no longer sellers.

Our industrial names, for several years the darlings of the

market given the prospects for rental growth, suddenly looked

expensive as structural tailwinds reshaped the demand for

logistics. Trading on large premiums, implied yields had been

driven too low. Recessionary fears reduced rental growth

expectations and capitalisation rates rose. Segro's share price has

almost halved from 1400p to below 750p (late October). I closed

much of the underweight position as the stock price dropped below

GBP10. This has clearly proved premature. Urban logistics and their

pan-European development programme (mostly pre-let) remain drivers

of returns. I did trim exposure to those industrial names heavily

focused on development (VGP, Montea and Warehouses de Pauw) whilst

holding our positions in Argan, Industrials REIT and LondonMetric

Property.

Our retail exposure in the UK remains minimal. However, I have

steadily added to the specialist retail warehouse owner, Ediston,

where we now own [16%] of the company. It has successfully

deleveraged with the sale of its remaining office buildings and is

now a pure retail warehouse play. As a very small company in listed

terms (market cap. GBP130m) it has failed to attract a broader

range of investors even though its portfolio and balance sheet are

sound. Its dividend yield is over 7% and its implied yield on

current share price of over 10%. It has no refinancing requirements

until late 2025 with 100% fixed priced debt.

European shopping centre names such as Eurocommercial Properties

and Klepierre, our two preferred stocks, have performed relatively

well with their higher earnings yield and secure balance sheets.

They compare well to Unibail Rodamco which needs to secure asset

sales in both Europe and the US and is a good example of where

investors have punished stretched balance sheets.

Office stocks remain a difficult call. London developers such as

Derwent London and GPE have very secure balance sheets with low

leverage but also few short-term value drivers. Best in class,

energy efficient (green) buildings are the future and rents will be

driven higher by the lack of supply. These businesses have the

experience and expertise to deliver this new product, however the

near-term value correction in their standing portfolios remains a

focal point for shareholders.

Many office occupiers are still deferring large property

decisions as they wrestle with their post Covid-19 space

requirements and new working practices alongside the growing risks

of an economic slowdown. The result has been an increase in

short-term letting and the use of serviced offices. All the listed

players now have a 'serviced' offer as they respond to this demand

but they are of course in competition with a multitude of branded

offerings such as WeWork, Regus and The Office Group. My response

has been to reduce our suburban exposure through the sale of CLS

and McKay Securities. In the case of the latter, whilst I took the

maximum cash in the takeover by Workspace, I have subsequently

added to our initial holding (which came with the stock element of

the deal). Across Europe, I have followed the same strategy,

holding prime CBD exposure in the largest cities such as Gecina

(Paris), Fabege (Stockholm) and Arima Real Estate (Madrid) but also

city centre assets in smaller cities which have seen a high return

to office such as Wihlborgs (Malmo).

Revenue and Revenue Outlook

Revenue at 12.05p per share was some 17% ahead of the prior year

interim earnings. Once again, we are expecting the earnings to be

skewed to the first half. We have always earned more income in the

first half than the second. Ten years ago, this was in excess of

80% of full year earnings but in subsequent years it reduced as

companies changed to smaller and more frequent dividends. In the

year to March 2021 the interim earnings represented 62% of the full

year earnings. Post Covid-19 we observed the pattern changing

again. Some dividends were cancelled through the pandemic but when

they resumed, companies seemed to be paying less frequently again.

We commented at the last year end that this had changed quite

dramatically for the year to 31 March 2022, with three-quarters of

earnings being attributed to the first half, although there were

also some one-off items which contributed to that. We expected a

resumption of more frequent payments in due course, but this has

generally not been the case to date and the pattern of earnings in

the current year looks set to replicate the last.

Underlying income is still strong with indexation in part of the

portfolio driving growth. Debt costs are rising but many of our

companies have fixed debt for several years so this will take a

while to impact.

We are focusing on tenant retention and the potential

performance of companies through an impending recession to protect

our income. We expect the current year dividend to be fully

covered.

Gearing and Debt

All our revolving credit facilities are undrawn at the time of

writing and gearing is 11.5%.

We have just renewed our loan facility with ICBC. Margins have

increased but the revolving credit facilities (where we can repay

and redraw debt as we wish) offer us maximum flexibility in terms

of being able to vary our gearing level, so are attractive. We have

a total of GBP130m of these revolving facilities available across

three different banks.

We have a EUR50m loan note bearing an interest rate of 1.92%

which is due to mature in 2026 and GBP15m at 3.59% due to mature in

2031. Holding positions through contracts for difference ('CFDs')

can also create gearing. We pay a floating interest rate on these

positions with a small margin. We can reduce the gearing impact by

increasing the cash collateral held against them. For some

shorter-term holdings there are additional benefits in holding the

positions in this way, so CFDs will continue to be part of our

portfolio even when we are aiming for modest gearing levels.

We believe this mixture of debt gives us a balance between

flexibility and interest rate certainty.

At our current gearing level, approximately half the interest

cost is at a fixed rate and half at a floating rate.

In assessing the appropriate gearing level, we also consider the

profile of our investment portfolio. The direct property portfolio

and some of our smaller equities do not react to market conditions

in the same way, or at least in the same time horizons, as the

medium size and larger holdings, therefore the impact of gearing is

diluted to some extent across the entire portfolio. Our physical

portfolio, which has no see-through leverage at the asset level

also attracts far less volatility than the equity portfolio.

Physical Portfolio

The last six months have been a busy period for the physical

property portfolio. However, the completion of a variety of

successful asset management initiatives only partly protected the

portfolio from the inevitable valuation declines driven by the

universal rise in the cost of capital. The property portfolio

produced a total return of -6.2%, made up of a capital return of

-7.8% and an income return of 1.6%. During the period the Company

sold its residential holdings at the Colonnades for GBP5.05m. This

was done through the granting of a new 999-year lease over the

residential element with the Company retaining the freehold and

ownership of all the commercial elements. Over the last 20 years of

ownership, the Company has completed lease extensions on over 70%

of the flats, receiving in excess of GBP11m in lease premiums.

At our industrial estate in Wandsworth, we continue to build in

flexibility to the lease expiry profile to allow the full-scale

redevelopment in the medium term. To that end we have continued to

renew leases based on an earliest redevelopment date of June 2024.

Over the past 6 months we have renewed 5 leases increasing the

total rent roll by 26% and completed one new lease. There are a

further 4 lease renewals in solicitors' hands. Similarly, at our

industrial estate in Gloucester we have completed the rent review

on two units increasing the rent by 10%. We are working with the

tenant to install photovoltaic (PV) cells on the roof with the aim

of generating in excess of c.75% of their annual electricity

onsite.

Outlook

Pan-European real estate equity prices are now reflecting very

significant corrections in the value of the underlying real estate,

across all sectors. These shifts in valuation have been primarily

driven by the cost of borrowing and it has been the lowest yielding

(and therefore the most highly rated) sectors of our universe which

have been impacted the most. The worst performers were

industrial/logistics and residential. These are also the two

sub-markets with the strongest outlooks based on the ongoing

mismatch between demand and supply. These market fundamentals will,

at some point, reassert themselves in investors' decision making.

However, in the near-term, markets will continue to be driven by

central bank behaviour and equity markets will respond strongly to

any indication that the tempo of rate rises is slowing. The

question is therefore will the central banks need to see evidence

of disinflation or even recession before adjusting their

strategies. Clearly this is an unanswerable question and the

behaviour of the Bank of England and the ECB may well differ.

Either way, we will continue to focus on owning companies which can

withstand both higher interest rates and a recessionary

backdrop.

It is important to recognise that the downward leg of any

property cycle has been driven by an increase in the cost of debt

and/or a rental collapse caused by over development in a buoyant

upswing. Outside of retail property's well-rehearsed structural

changes we see very few signs of over supply. Our portfolio

positioning does reflect our nervousness towards older, lower value

(suburban) offices, many of which will fall foul of new energy

efficiency requirements. In many markets we see demand for property

as an affordable and necessary factor of production offering

index-linked income. Above and beyond the ability to maintain

income in their respective standing portfolios, many of our

companies have the track record and required skills to drive

development and asset re-positioning which will generate positive

returns post this near-term correction in market pricing.

Marcus Phayre-Mudge

Fund Manager

2 December 2022

Distribution of Investments

30 Sep 30 Sep 31 Mar 31 Mar

=============================

2022 2022 2022 2022

=============================

GBP'000 % GBP'000 %

============================= ========================== ============================

UK Securities 1

- quoted 335,729 34.6 518,417 33.2

UK Investment Properties 83,653 8.6 96,255 6.1

================================== ============= ============ ============ ==========

UK Total 419,382 43.2 614,672 39.3

Continental Europe Securities

- quoted 566,358 58.2 940,744 60.2

================================== ============= ============ ============ ==========

Investments held at fair

value 985,740 101.4 1,555,416 99.5

- CFD creditor 2 (13,658) (1.4) 7,657 0.5

================================== ============= ============ ============ ==========

Total Investment Positions 972,082 100.0 1,563,073 100.0

================================== ============= ============ ============ ==========

Investment Exposure

30 Sep 30 Sep 31 Mar 31 Mar

============================

2022 2022 2022 2022

============================

GBP'000 % GBP'000 %

============================ ========================== =========================

UK Securities

- quoted 335,729 29.5 518,417 30.5

- CFD exposure 3 81,948 7.2 57,324 3.4

UK Investment Properties 83,653 7.3 96,255 5.7

=================================== ============= ========== ============= ========

UK Total 501,330 44.0 671,996 39.6

Continental Europe Securities

- quoted 566,358 49.7 940,744 55.3

- CFD exposure 3 72,317 6.3 87,318 5.1

=================================== ============= ========== ============= ========

Total Investment Exposure4 1,140,005 100.0 1,700,058 100.0

=================================== ============= ========== ============= ========

Portfolio Summary

30 Sep 31 Mar 31 Mar 31 Mar 31 Mar

2022 2022 2021 2020 2019

============================ ========= ========= ========= ========= =========

Total investments GBP986m GBP1,555m GBP1,401m GBP1,155m GBP1,291m

Net assets GBP1,014m GBP1,563m GBP1,326m GBP1,136m GBP1,328m

UK quoted property

shares 34% 33% 28% 31% 33%

Overseas quoted property

shares 58% 60% 66% 61% 59%

Direct property (externally

valued) 8% 6% 6% 8% 8%

============================ ========= ========= ========= ========= =========

Net Currency Exposures

30 Sep 30 Sep 31 Mar 31 Mar

====

2022 2022 2022 2022

====

Fund Benchmark Fund Benchmark

% % % %

==== ====== ========= ====== =========

GBP 33.3 34.1 33.9 33.6

EUR 43.0 43.1 41.9 42.3

CHF 9.7 9.6 7.4 7.1

SEK 13.6 12.9 16.3 16.3

NOK 0.4 0.3 0.5 0.4

==== ====== ========= ====== =========

1 UK Securities includes one unlisted holding (0.01%) (31 March 2022: 0.01%)

2 Unrealised profit on CFD contract positions are held as a

current asset and unrealised losses on CFD contracts held as

balance sheet creditor.

3 Gross value of CFD positions.

4 Total investments illustrating market exposure including the

gross value of CFD positions.

Investment portfolio by country

Market

GBP'000 value

%

============================== =============== ===============

Belgium

Aedifica Warehouses 16,227 1.7

De Pau Cofinimmo

Xior Student Housing 10,080 1.0

VGP

Care Property Invest 9,113 1.0

Intervest Offices & 6,045 0.6

Warehouses

Montea 4,600 0.5

2,346 0.2

2,304 0.2

2,129 0.2

============================== =============== ===============

52,844 5.4

============================== =============== ===============

France Argan Gecina

Klepierre Covivio Carmila

Altarea

57,439 5.9

20,723 2.1

18,933 2.0

9,405 1.0

7,082 0.7

1,314 0.1

============================== =============== ===============

114,896 11.8

============================== =============== ===============

Germany Vonovia LEG

Aroundtown TAG 90,796 9.3

Adler Group 35,835 3.7

13,169 1.4

9,726 1.0

879 0.1

============================== =============== ===============

150,405 15.5

============================== =============== ===============

Ireland

Irish Residential Properties 1,358 0.1

============================== =============== ===============

1,358 0.1

============================== =============== ===============

Netherlands Eurocommercial

Properties Unibail

Rodamco Westfield NSI

33,980 3.5

6,510 0.7

3,036 0.3

============================== =============== ===============

43,526 4.5

============================== =============== ===============

Norway

Entra 3,750 0.4

============================== =============== ===============

3,750 0.4

============================== =============== ===============

Spain

Merlin Properties Arima 29,624 3.0

Real Estate

20,169 2.1

============================== =============== ===============

49,793 5.1

============================== =============== ===============

Companies shown by country of listing.

Financial statements

Group statement of comprehensive income

Half year ended Half year ended Year ended

30 September 2022 30 September 2021 31 March 2022

(Unaudited) (Unaudited) (Audited)

Revenue Capital Revenue Capital Revenue Capital

Return Return Total Return Return Total Return Return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- -------- ---------- ---------- -------- --------- --------- -------- --------- ---------

Income

Investment income 36,589 - 36,589 32,692 - 32,692 44,170 - 44,170

Other operating

income 69 - 69 - - - 5 - 5

Gross rental income 1,576 - 1,576 1,501 - 1,501 2,773 - 2,773

Service charge

income 463 - 463 533 - 533 1,103 - 1,103

(Losses)/gains

on investments

held at fair value - (616,054) (616,054) - 195,779 195,779 - 249,038 249,038

Net movement on

foreign exchange;

investments and

loan notes - (191) (191) - 1,854 1,854 - 1,136 1,136

Net movement on

foreign exchange;

cash and cash

equivalents - 2,508 2,508 - (147) (147) - 637 637

Net returns on

contracts for

difference 5,825 58,420 64,245 4,138 (11,040) (6,902) 5,701 16,361 22,062

-------------------- -------- ---------- ---------- -------- --------- --------- -------- --------- ---------

Total income 44,522 (555,317) (510,795) 38,864 186,446 225,310 53,752 267,172 320,924

-------------------- -------- ---------- ---------- -------- --------- --------- -------- --------- ---------

Expenses

Management and

performance fees

(note 2) (824) (2,473) (3,297) (813) (12,721) (13,534) (1,663) (29,477) (31,140)

Direct property

expenses, rent

payable and

service

charge costs (808) - (808) (726) - (726) (1,435) - (1,435)

Other

administrative

expenses (598) (253) (851) (471) (310) (781) (1,621) (608) (2,229)

-------------------- -------- ---------- ---------- -------- --------- --------- -------- --------- ---------

Total operating

expenses (2,230) (2,726) (4,956) (2,010) (13,031) (15,041) (4,719) (30,085) (34,804)

-------------------- -------- ---------- ---------- -------- --------- --------- -------- --------- ---------

Operating

profit/(loss) 42,292 (558,043) (515,751) 36,854 173,415 210,269 49,033 237,087 286,120

Finance costs (463) (1,389) (1,852) (315) (945) (1,260) (629) (1,886) (2,515)

-------------------- -------- ---------- ---------- -------- --------- --------- -------- --------- ---------

Profit/(loss)

from operations

before tax 41,829 (559,432) (517,603) 36,539 172,470 209,009 48,404 235,201 283,605

Taxation (3,603) 1,190 (2,413) (3,809) 2,247 (1,562) (4,967) 3,049 (1,918)

-------------------- -------- ---------- ---------- -------- --------- --------- -------- --------- ---------

Total comprehensive

income 38,226 (558,242) (520,016) 32,730 174,717 207,447 43,437 238,250 281,687

-------------------- -------- ---------- ---------- -------- --------- --------- -------- --------- ---------

Earnings per

Ordinary share

(note 3) 12.05p (175.91)p (163.86)p 10.31p 55.06p 65.37p 13.69p 75.07p 88.76p

The total column of this statement represents the Group's

Statement of Comprehensive Income, prepared in accordance with

UK-adopted international accounting standards. The Revenue Return

and Capital Return columns are supplementary to this and are

prepared under guidance published by the Association of Investment

Companies. All items in the above statement derive from continuing

operations.

The Group does not have any other income or expense that is not

included in the above statement therefore "Total comprehensive

income" is also the profit or loss for the period.

All income is attributable to the shareholders of the parent

Company.

The final dividend of 9.20p (2021: 9.00p) in respect of the year

ended 31 March 2022 was declared on 31 May 2022 and was paid on 2

August 2022. This can be found in the Group Statement of Changes in

Equity for the half year ended 30 September 2022.

The interim dividend of 5.65p (2021: 5.30p) in respect of the

year ending 31 March 2023 was declared on 2 December 2022 and will

be paid on 12 January 2023 to shareholders on the register on 16

December 2022. The shares will be quoted ex-dividend on 15 December

2022.

Group statement of changes in equity

Share Capital

Share Premium Redemption Retained

For the half year ended Capital Account Reserve Earnings Total

30 September 2022 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- ------------ ---------- ----------

At 31 March 2022 79,338 43,162 43,971 1,396,268 1,562,739

Net loss for the half year - - - (520,016) (520,016)

Dividends paid - - - (29,196) (29,196)

-------------------------------- --------- --------- ------------ ---------- ----------

At 30 September 2022 79,338 43,162 43,971 847,056 1,013,527

-------------------------------- --------- --------- ------------ ---------- ----------

Share Capital

Share Premium Redemption Retained

For the half year ended Capital Account Reserve Earnings Total

30 September 2021 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- ------------ ---------- ----------

At 31 March 2021 79,338 43,162 43,971 1,159,962 1,326,433

Net profit for the half

year - - - 207,447 207,447

Dividends paid - - - (28,562) (28,562)

-------------------------------- --------- --------- ------------ ---------- ----------

At 30 September 2021 79,338 43,162 43,971 1,338,847 1,505,318

-------------------------------- --------- --------- ------------ ---------- ----------

Share Capital

Share Premium Redemption Retained

For the year ended Capital Account Reserve Earnings Total

31 March 2022 (Audited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------- --------- ------------ ---------- ----------

At 31 March 2021 79,338 43,162 43,971 1,159,962 1,326,433

Net profit for the year - - - 281,687 281,687

Dividends paid - - - (45,381) (45,381)

-------------------------- --------- --------- ------------ ---------- ----------

At 31 March 2022 79,338 43,162 43,971 1,396,268 1,562,739

-------------------------- --------- --------- ------------ ---------- ----------

Group balance sheet

30 September 30 September 31 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------- ------------- ----------

Non-current assets

Investments held at fair value 985,740 1,581,562 1,506,436

Investments held at for sale - - 48,980

-------------------------------------- ------------- ------------- ----------

985,740 1,581,562 1,555,416

Deferred taxation asset 903 - 903

-------------------------------------- ------------- ------------- ----------

986,643 1,581,562 1,556,319

Current assets

Debtors 95,476 71,604 97,673

Cash and cash equivalents 30,442 14,415 32,109

-------------------------------------- ------------- ------------- ----------

125,918 86,019 129,782

Current liabilities (40,155) (104,287) (66,109)

-------------------------------------- ------------- ------------- ----------

Net current assets/(liabilities) 85,763 (18,268) 63,673

-------------------------------------- ------------- ------------- ----------

Total assets plus net current assets 1,072,406 1,563,294 1,619,992

Non-current liabilities (58,879) (57,976) (57,253)

-------------------------------------- ------------- ------------- ----------

Net assets 1,013,527 1,505,318 1,562,739

-------------------------------------- ------------- ------------- ----------

Capital and reserves

Called up share capital 79,338 79,338 79,338

Share premium account 43,162 43,162 43,162

Capital redemption reserve 43,971 43,971 43,971

Retained earnings (note 7) 847,056 1,338,847 1,396,268

-------------------------------------- ------------- ------------- ----------

Equity shareholders' funds 1,013,527 1,505,318 1,562,739

-------------------------------------- ------------- ------------- ----------

Net asset value per:

Ordinary share 319.37p 474.34p 492.43p

-------------------------------------- ------------- ------------- ----------

Group cash flow statement

Half year ended Half year ended Year ended

30 September 30 September 31 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

--------------------------------------------------------------------- ---------------- ---------------- -----------

Reconciliation of profit from operations before tax to net cash

outflow from operating activities

(Loss)/profit from operations before tax (517,603) 209,009 283,605

Finance costs 1,852 1,260 2,515

Losses/(gains) on investments and derivatives held at fair value

through profit or loss 557,634 (184,739) (265,399)

Net movement on foreign exchange; cash and cash equivalents and loan

notes (882) (3,239) (977)

Scrip dividends included in investment income and net returns on

contracts for difference (6,061) (10,722) (10,839)

Sales of investments 205,676 156,192 544,370

Purchases of investments (166,258) (129,670) (430,830)

Decrease in prepayments and accrued income 1,554 1,597 8

Decrease/(Increase) in sales settlement debtor 26,887 5,019 (32,871)

(Decrease)/Increase in purchase settlement creditor (5,364) (194) 5,170

(Increase)/decrease in other debtors (32,933) (12,451) 2,951

(Decrease)/increase in other creditors (24,411) 860 13,809

--------------------------------------------------------------------- ---------------- ---------------- -----------

Net cash inflow from operating activities before interest and

taxation 40,091 32,922 111,512

Interest paid (1,852) (1,260) (2,515)

Taxation paid (3,218) (2,652) (1,258)

--------------------------------------------------------------------- ---------------- ---------------- -----------

Net cash inflow from operating activities 35,021 29,010 107,739

Financing activities

Equity dividends paid (29,196) (28,562) (45,381)

Repayment of loans (note 6) (10,000) (15,000) (60,000)

--------------------------------------------------------------------- ---------------- ---------------- -----------

Net cash outflow from financing activities (39,196) (43,562) (105,381)

--------------------------------------------------------------------- ---------------- ---------------- -----------

(Decrease)/increase in cash (4,175) (14,552) 2,358

Cash and cash equivalents at start of period 32,109 29,114 29,114

Net movement on foreign exchange; cash and cash equivalents 2,508 (147) 637

--------------------------------------------------------------------- ---------------- ---------------- -----------

Cash and cash equivalents at end of period 30,442 14,415 32,109

--------------------------------------------------------------------- ---------------- ---------------- -----------

Notes to the financial statements

1 Basis of accounting

The accounting policies applied in these interim financial

statements are consistent with those applied in the Company's most

recent annual financial statements. The financial statements have

been prepared on a going concern basis and in accordance with

UK-adopted International Accounting Standards (IAS) 34 'Interim

Financial Reporting'.

The financial statements have also been prepared in accordance

with the Statement of Recommended Practice (SORP), "Financial

Statements of Investment Trust Companies and Venture Capital

Trusts", to the extent that it is consistent with UK-adopted

International Accounting Standards.

The financial statements are presented in sterling and all

values are rounded to the nearest thousand pounds (GBP'000) except

where otherwise indicated.

In accordance with UK-adopted IAS, IFRS 10, the Company has been

designated as an investment entity on the basis that:

-- It obtains funds from investors and provides those investors

with investment management services;

-- It commits to its investors that its business purpose is to

invest solely for returns from capital appreciation and investment

income; and

-- It measures and evaluates performance of substantially all of

its investments on a fair value basis.

Each of the subsidiaries of the company was established for the

sole purpose of operating or supporting the investment operations

of the company (including raising additional financing), and is not

itself an investment entity. UK--adopted IAS, IFRS 10, sets out

that in the case of controlled entities that support the investment

activity of the investment entity, those entities should be

consolidated rather than presented as investments at fair value.

Accordingly, the Company has consolidated the results and financial

positions of those subsidiaries.

Subsidiaries are consolidated from the date of their

acquisition, being the date on which the Company obtains control,

and continue to be consolidated until the date that such control

ceases. The financial statements of subsidiaries used in the

preparation of the consolidated financial statements are based on

consistent accounting policies. All intra-group balances and

transactions, including unrealised profits arising therefrom, are

eliminated. This is consistent with the presentation in previous

periods.

All the subsidiaries of the Company have been consolidated in

these financial statements.

The accounting policies adopted are consistent with those of the

previous consolidated annual financial statements.

The standards issued before the reporting date that become

effective after 30 September 2022 are not expected to have a

material effect on equity or profit for the subsequent period. The

Group has not early adopted any new UK-adopted International

Accounting Standards or Interpretation. Standards, amendments and

interpretations issued but not yet effective up to the date of

issuance of the Group's financial statements are listed below:

IAS 1 Amendments - Classification of Liabilities as Current or

Non-Current (effective date 1 January 2023). The amendments specify

the requirements for classifying liabilities as current or

non-current. The amendments are not expected to have a material

impact on the Group's financial statements.

IAS 1 Amendments - Disclosure of Accounting Policies (effective

1 January 2023). The amendments require an entity to disclose its

material accounting policy information instead of its significant

accounting policies. The amendments contain guidance and examples

on identifying material accounting policy information. The

amendments are not expected to have a material impact on the

Group's financial statements.

IAS 1 Amendments - Non-current Liabilities with Covenants

(effective date 1 January 2024). The amendments improved the

information an entity provides when its right to defer settlement

of a liability for at least twelve months is subject to compliance

with covenants. The amendments also responded to stakeholders'

concerns about the classification of such a liability as current or

non-current.

IAS 8 Amendments - Definition of Accounting Estimates (effective

1 January 2023) The amendments define accounting estimates as

"monetary amounts in financial statements that are subject to

measurement uncertainty". The amendments also clarify the

interaction between an accounting policy and an accounting

estimate. The amendments are not expected to have a material impact

on the Group's financial statements.

IAS 12 Amendments - Deferred Tax related to Assets and

Liabilities arising from a Single Transaction (effective 1 January

2023). The amendments require entities with certain assets to

recognise deferred tax on particular transactions that, on initial

recognition, give rise to equal amounts of taxable and deductible

temporary differences.

2 Management fees

Half year ended Half year ended Year ended

30 September 2022 30 September 2021 31 March 2022

(Unaudited) (Unaudited) (Audited)

Revenue Capital Revenue Capital Revenue Capital

Return Return Total Return Return Total Return Return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Management

fee 824 2,473 3,297 813 2,439 3,252 1,663 4,988 6,651

Performance

fee - - - - 10,282 10,282 - 24,489 24,489

------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

824 2,473 3,297 813 12,721 13,534 1,663 29,477 31,140

------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

No provision has been made for a performance fee based on the

net assets at 30 September 2022. Any payments are not due until the

full year performance fee is calculated at 31 March 2023.

3 Earnings per ordinary share

The earnings per Ordinary share can be analysed between revenue

and capital, as below.

Half year Half year

ended ended Year ended

30 September 30 September 31 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

------------------------------------- ------------- ------------- ------------

Net revenue profit 38,226 32,730 43,437

Net capital (loss)/profit (558,242) 174,717 238,250

------------------------------------- ------------- ------------- ------------

Net total (loss)/profit (520,016) 207,447 281,687

------------------------------------- ------------- ------------- ------------

Weighted average number of Ordinary

shares in issue during the period 317,350,980 317,350,980 317,350,980

------------------------------------- ------------- ------------- ------------

pence pence pence

------------------------------------- --------- ------ ------

Revenue earnings per Ordinary share 12.05 10.31 13.69

Capital earnings per Ordinary share (175.91) 55.06 75.07

------------------------------------- --------- ------ ------

Earnings per Ordinary share (163.86) 65.37 88.76

------------------------------------- --------- ------ ------

4 Changes in share capital

During the half year and since 30 September 2022 no Ordinary

shares have been purchased and cancelled.

As at 30 September 2022 there were 317,350,980 Ordinary shares

(30 September 2021: 317,350,980; 31 March 2022: 317,350,980

Ordinary shares) of 25p in issue.

5 Going concern

In assessing the going concern basis of accounting the Directors

have had regard to the guidance issued by the Financial Reporting

Council. They have also considered the Company's objective,

strategy and policy; current cash position; the availability of the

loan facility and compliance with all financial loan covenants; and

the operational resilience of the Company and its service

providers.

At present the global economy is suffering considerable

disruption due to the effects of the COVID-19 pandemic,

inflationary concerns and the war in Ukraine and the Directors have

given serious consideration to the consequences for this Company. A

detailed assessment of the ability of the Company and Group to meet

its liabilities as they fall due, including stress and liquidity

tests which considered the effects of substantial falls in

investment valuations, substantial reductions in revenue received

and reductions in market liquidity as a result of these

factors.

Based on this information, their knowledge and experience of the

Company's portfolio and stockmarkets, the Directors believe that

the Company has the ability to meet its financial obligations as

they fall due for a period of at least twelve months from the date

of approval of these financial statements. Accordingly, these

financial statements have been prepared on a going concern

basis.

6 Fair value of financial assets and financial liabilities

Financial assets and financial liabilities are carried in the

Balance Sheet either at their fair value (investments) or the

balance sheet amount is a reasonable approximation of fair value

(due from brokers, dividends and interest receivable, due to

brokers, accruals and cash at bank).

Fair value hierarchy disclosures

The table below sets out fair value measurements using

UK-adopted IAS (IFRS 13) fair value hierarchy.

Financial assets/(liabilities) at fair value through profit or

loss

Level 1 Level 2 Level 3 Total

------------------------------------

At 30 September 2022 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------- --------- -------- ---------

Equity investments 899,514 - 2,573 902,087

Investment properties - - 83,653 83,653

Contracts for difference - (13,658) - (13,658)

Foreign exchange forward contracts - 442 - 442

------------------------------------ -------- --------- -------- ---------

899,514 (13,216) 86,226 972,524

------------------------------------ -------- --------- -------- ---------

Level 1 Level 2 Level 3 Total

At 30 September 2021 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ---------- --------- -------- ----------

Equity investments 1,490,133 - 1,651 1,491,784

Investment properties - - 89,778 89,778

Contracts for difference - (12,185) - (12,185)

Foreign exchange forward contracts - 1,028 - 1,028

------------------------------------ ---------- --------- -------- ----------

1,490,133 (11,157) 91,429 1,570,405

------------------------------------ ---------- --------- -------- ----------

Level 1 Level 2 Level 3 Total

At 31 March 2022 (Audited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ---------- -------- -------- ----------

Equity investments 1,456,820 - 2,341 1,459,161

Investment properties - - 96,255 96,255

Contracts for difference - 7,657 - 7,657

Foreign exchange forward contracts - 2,736 - 2,736

------------------------------------ ---------- -------- -------- ----------

1,456,820 10,393 98,596 1,565,809

------------------------------------ ---------- -------- -------- ----------

Categorisation within the hierarchy has been determined on the

basis of the lowest level input that is significant to the fair

value measurement of the relevant asset as follows:

Level 1 - valued using quoted prices in an active market for

identical assets.

Level 2 - valued by reference to valuation techniques using

observable inputs other than quoted prices within level 1.

Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data.

Contracts for Difference are synthetic equities and are valued

by reference to the investments' underlying market values.

Valuations of Investment Properties - Level 3

The Group carries its investment properties at fair value in

accordance with UK-adopted IAS (IFRS 13), revalued twice a year,

with changes in fair values being recognised in the Group Statement

of Comprehensive Income. The Group engaged Knight Frank LLP as

independent valuation specialists to determine fair value as at 30

September 2022.

Determination of the fair value of investment properties has

been prepared on the basis defined by the RICS Valuation - Global

Standards (The Red Book Global Standards) as follows:

"The estimated amount for which a property should exchange on

the date of valuation between a willing buyer and a willing seller

in an arm's length transaction after proper marketing wherein the

parties had each acted knowledgeably, prudently and without

compulsion."

The valuation takes into account future cash flow from assets

(such as lettings, tenants' profiles, future revenue streams,

capital values of fixtures and fittings, plant and machinery, any

environmental matters and the overall repair and condition of the

property) and discount rates applicable to those assets. These

assumptions are based on local market conditions existing at the

balance sheet date.

In arriving at their estimates of fair values as at 30 September

2022, the valuers have used their market knowledge and professional

judgement and have not only relied solely on historical

transactional comparables.

Reconciliation of movements in Financial assets categorised as

level 3

31 March Appreciation/ 30 September

At 30 September 2022 Purchases Sales (Depreciation) 2022

2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- --------- ---------- --------- ---------------- -------------

Unlisted equity investments 2,341 - - 232 2,573

----------------------------- --------- ---------- --------- ---------------- -------------

Investment properties

- Mixed use 48,187 97 (5,050) (1,661) 41,573

- Office & Industrial 48,068 88 - (6,076) 42,080

----------------------------- --------- ---------- --------- ---------------- -------------

96,255 185 (5,050) (7,737) 83,653

----------------------------- --------- ---------- --------- ---------------- -------------

98,596 185 (5,050) (7,505) 86,226

----------------------------- --------- ---------- --------- ---------------- -------------

Transfers between hierarchy levels

There were no transfers between any levels during the

period.

Sensitivity information

The significant unobservable inputs used in the fair value

measurement categorised within Level 3 of the fair value hierarchy

of investment properties are:

-- Estimated rental value: GBP6.5 - GBP65 per sq ft

-- Capitalisation rates: 2.0% - 6.0%

Significant increases (decreases) in estimated rental value and

rent growth in isolation would result in a significantly higher

(lower) fair value measurement. A significant increase (decrease)