TIDMTRX

RNS Number : 7179L

Tissue Regenix Group PLC

10 September 2019

Tissue Regenix Group plc

Unaudited Interim Results for the six months ended 30 June

2019

Leeds, 10 September 2019 - Tissue Regenix Group (AIM:TRX)

("Tissue Regenix" or the "Group") the regenerative medical devices

company announces its unaudited interim results for the six months

ended 30 June 2019.

Highlights

Financial

-- Group sales increased to GBP6.1m (H1 2018: GBP5.6m)

- DermaPure increased sales by 33% to GBP2.0m (H1 2018: GBP1.5m)

- GBM-v revenue growth of 19% to GBP1.1m (H1 2018: GBP0.9m)

- Orthopaedics & Dental sales were affected by a realigning

of manufacturing to address capacity in H2 but still delivered

sales of GBP3.0m (H1 2018: GBP3.2m)

-- Group EBITDA* loss of GBP3.6m (H1 2018: GBP3.5m)

-- Cash balance of GBP10.1m (H1 2018: GBP12.2m), post-$7.5m

drawdown under a credit facility secured for up to $20m to invest

in meeting growing demand for products

*EBITDA is a non-IFRS measure that the Group uses to assess its

performance. It is defined as earnings before interest, taxation,

depreciation and amortisation

Commercial

-- Accelerating US market penetration

o Expanded Group Purchasing Organisation coverage for

DermaPure(R)

o Commissioned SurgiPure(R) XD post marketing clinical data

collection trial

-- Continue to exploit global market potential

o Entered Latin America for the first time through a

distribution agreement for BioRinse(R) products in Chile

-- Working towards strengthened portfolio

o Submitted positive two-year clinical data for OrthoPure(TM) XT

to the notified body

Operational

-- Commenced second shift for BioRinse(R) products

-- Appointed US President of Operations

-- Supply chain improvement to deliver efficiencies

Post period

-- John Samuel resumed position of Executive Chairman, Gareth

Jones appointed Interim Chief Executive Officer and Mike Barker

appointed Chief Financial Officer following the resignation of

Steve Couldwell as Chief Executive Officer due to a recurrence of

his illness.

Executive Chairman, John Samuel, commented: "We have strong

global demand for our products, which allowed us to deliver

continued revenue growth, demonstrated by DermaPure, which

increased sales by 33% in the first half. We remain focused on

short and medium term initiatives to increase capacity and

alleviate supply constraints."

"During the first half of the year, we streamlined our supply

chain activities and enhanced our operational procedures. These

initiatives have enabled us to increase production capabilities

within the San Antonio facility, the benefits of which will come to

fruition in the second half of the year. Longer term, having

secured a credit facility of up to $20m with MidCap Financial LLP,

this will support our ambitious growth plans, by adding further

processing capacity to the San Antonio facility and expanding our

commercial footprint."

"We anticipated that the year would be significantly weighted

towards the second half, as announced on the 4 June 2019, at the

time of the Company's results for the year ended 31 December

2018.

We continue to expect that this will be the case, and, against a

background where we see the ever growing demand for our products as

the business looks to increase its manufacturing capabilities, the

ability to bring this on stream during the second half of the year

will be key in determining the year end outcome."

For more Information:

Tissue Regenix Group plc Tel: 0330 430 3073 /

Caitlin Pearson Head of Communications 07920272 441

--------------------------------------------- ---------------------

Stifel Nicolaus Europe Limited (Nominated Tel: 0207 710 7600

Adviser and Broker)

Jonathan Senior / Alex Price / Ben Maddison

--------------------------------------------- ---------------------

FTI Consulting Tel: 0203 727 1000

Brett Pollard / Victoria Foster Mitchell

/ Mary Whittow

============================================= =====================

About Tissue Regenix

Tissue Regenix is a leading medical devices company in the field

of regenerative medicine. Tissue Regenix was formed in 2006 when it

was spun-out from the University of Leeds, UK. The company's

patented decellularisation ('dCELL(R) ') technology removes DNA and

other cellular material from animal and human soft tissue leaving

an acellular tissue scaffold which is not rejected by the patient's

body and can then be used to repair diseased or worn out body

parts. Current applications address many critical clinical needs

such as sports medicine, heart valve replacement and wound

care.

In November 2012 Tissue Regenix Group plc set up a subsidiary

company in the United States - 'Tissue Regenix Wound Care Inc.',

January 2016 saw the establishment of joint venture GBM-V, a multi-

tissue bank based in Rostock, Germany.

In August 2017 Tissue Regenix acquired CellRight Technologies(R)

, a biotech company that specializes in regenerative medicine and

is dedicated to the development of innovative osteoinductive and

wound care scaffolds that enhance healing opportunities of defects

created by trauma and disease. CellRight's human osteobiologics may

be used in spine, trauma, general orthopedic, foot & ankle,

dental, and sports medicine surgical procedures.

Business Review

BioSurgery

The BioSurgery division (DermaPure(R),) grew revenue 33%

year-on-year to GBP2.0m, as the repositioning in the hospital space

continues to gain traction.

We received a further Group Purchasing Organisation (GPO)

approval in April, and now have access to circa 95% of all

hospitals covered under GPOs in the US. With the increasing use of

the product in uro-gyneacology procedures, where we have a

specialist distribution partner, ARMS Medical, and the commencement

of use in maxilliofacial and dental applications, we expect

continued strong demand for the BioSurgery products in the second

half of the year. To satisfy growing demand we have reinstated the

processing agreement with Community Tissue Services for the

production of DermaPure(R) in order to increase capacity and have

received the first products under this agreement.

The business continues to make good inroads into premium medical

institutions within the US market and this, coupled with additional

product line extensions, is anticipated to create opportunities in

the near future.

Orthopaedics and Dental

As we realigned manufacturing capacity for further growth in the

second half of the year there was a slight dip in revenue

performance during the first half of the year for the Orthopaedics

and Dental division, primarily comprising of the BioRinse(R)

portfolio.

We introduced a second shift during the first quarter, which has

increased processing capacity, and, in conjunction with supply

chain improvements, we expect to see these changes drive revenue

performance in the second half of the year. The relationship with

our BioRinse(R) strategic distribution partner, Arthrex, Inc.

continues to develop as we look to explore additional market

opportunities.

Positive two-year clinical data for OrthoPure(TM) XT (porcine

tendon) has been submitted to the notified body and we remain

optimistic that we will be awarded the CE mark during 2019

GBM-V

Our controlled joint venture GBM-V is now largely

self-sustainable and during the period increased revenue by 19%

though the sale of corneal implants, whilst it also manages the

regulatory process for the CardioPure products in Germany, which

remains on track for a launch during 2020.

Operations and Management

Daniel Lee, appointed as President of US Operations in January

2019, has initially focused on developing the manufacturing

capabilities and re-alignment of our supply chain processes at the

San Antonio facility, with the introduction of a second shift, and

in March 2019 the hiring of a Head of Donor Services.

On the orthopaedic / dental side of the business (BioRinse(R)),

the lead-time for final products to become available is 3 months.

This means that manufacturing in Q3 will be increased, following

these initiatives, and this will be key in determining our final

revenues for 2019.

Post balance sheet events

As announced on 15 August 2019, we have entered into an

agreement for a 10-year lease, with an option to purchase, on a

21,000sq ft manufacturing facility, adjacent to our current

building in San Antonio which allows for the first phase of the

expansion project to begin. Initially, the office space and

warehousing will be transferred into the new facility allowing for

further clean rooms to be installed in the original building. Over

time, this will allow for further clean rooms to be brought on

stream as required.

Steve Couldwell, Chief Executive Officer (CEO), informed the

Board of a recurrence of his illness, and resigned his position

with immediate effect in order to concentrate on his recovery. John

Samuel resumed the position of Executive Chairman, Gareth Jones,

Chief Operating Officer, has taken up the position of interim-CEO.

Mike Barker, who has supported the Group since January was

appointed as Chief Finance Officer and Director on the Board.

Financial Overview

During the first half of 2019, we have achieved a number of

milestones in order to help secure our future success. Pivotal to

this was the credit agreement with MidCap Financial LLP, which has

allowed us access of up to $20m of debt financing, meaning we can

begin to implement our ambitious growth plans.

Revenue

Revenue has increased to GBP6.1m (H1 2018: GBP5.6m). BioSurgery

has increased by 33% and our joint venture, GBM-V, has increased by

19% on a reported basis. As a result of manufacturing capacity

constraints in the first half, Orthopaedics and Dental revenues

decreased by 5%.

Margin

Margin decreased in H1 from 56% to 47% reflecting short term

higher cost absorption as the second shift was brought up to full

efficiency and an adverse sales mix as lower BioRinse(R) product

volumes (generally our higher margin products) contributed less to

the overall total.

Loss for the year

Operating loss in the six months ended 30 June 2019 improved to

GBP4,220K (H1 2018: GBP4,736K).

R&D tax credits of GBP352K (H1 2018: GBP353K) represent the

estimated tax credit receivable, together with a premium of 40%, on

development costs.

Exceptional costs of GBP40k represent the costs of the MidCap

Financial Trust (MidCap) loan facility.

Cash position

Cash position for the Group at 30 June 2019 is GBP10.1m (H1

2018: GBP12.2m). The Group received the first tranche of the MidCap

loan at $7.5m in June 2019, and has available the initial revolving

credit facility of up to $3.0m.

Current trading and Outlook

During the first half of the year, we made significant

operational progress, both in terms of our production and supply

chain capabilities, investment in key appointments, and secured

further funding to underpin the development of the business and to

allow for our continued expansion. With this now in place, the

long-term outlook for our product portfolio remains positive and

our focus will be on executing against our strategic focus areas to

drive forward commercial momentum.

We continue to look at ways to develop relationships with our

strategic partners and have entered investigational discussions for

geographic expansion through licensing or distribution agreements

with a number of additional potential partners.

Demand for our products is strong, evidenced by our healthy

order book from key customers, which we expect to fulfil as the

operational improvements come to fruition. As capacity is

increased, it will allow us greater flexibility to pursue the

varied commercial opportunities we see for the products in the

market.

We anticipated that the year would be significantly weighted

towards the second half, as announced on the 4 June 2019, at the

time of the Company's results for the year ended 31 December

2018.

We continue to expect that this will be the case, and, against a

background where we see the ever growing demand for our products as

the business looks to increase its manufacturing capabilities, the

ability to bring this on stream during the second half of the year

will be key in determining the year end outcome.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(UNAUDITED)

FOR THE SIX MONTHS TO 30 JUNE 2019

6 months 6 months Year

30 Jun 2019 30 Jun 2018 31 Dec

2018

Notes (Unaudited) (Unaudited) Audited

GBP'000 GBP'000 GBP'000

---------------------------------------- ------- ------------- ------------- ----------

Revenue 6,069 5,574 11,619

Cost of sales (3,225) (2,451) (5,702)

---------------------------------------- ------- ------------- ------------- ----------

Gross Profit 2,844 3,123 5,917

Administrative expenses before

exceptional items (7,024) (7,359) (14,183)

Exceptional items (40) (500) (423)

Total administrative expenses (7,064) (7,859) (14,606)

Operating loss (4,220) (4,736) (8,689)

Finance income 11 42 72

Finance charges (183) (146) (262)

---------------------------------------- ------- ------------- ------------- ----------

Loss before tax (4,392) (4,840) (8,879)

Taxation 4 311 305 620

---------------------------------------- ------- ------------- ------------- ----------

Loss after tax (4,081) (4,535) (8,259)

---------------------------------------- ------- ------------- ------------- ----------

Attributable to:

Equity holders of the parent (4,055) (4,446) (8,186)

Non-controlling (26) (89) (73)

---------------------------------------- ------- ------------- ------------- ----------

(4,081) (4,535) (8,259)

---------------------------------------- ------- ------------- ------------- ----------

Other comprehensive income/(expense):

Foreign currency translation

differences - foreign operations 122 531 1,360

---------------------------------------- ------- ------------- ------------- ----------

TOTAL COMPREHENSIVE EXPENSE

FOR THE YEAR (3,959) (4,004) (6,899)

---------------------------------------- ------- ------------- ------------- ----------

Attributable to:

Equity holders of the parent (3,933) (3,915) (6,826)

Non-controlling interests (26) (89) (73)

(3,959) (4,004) (6,899)

Loss per share

Basic and diluted on loss attributable

to equity holders of the parent 5 (0.35p) (0.38)p (0.70)p

---------------------------------------- ------- ------------- ------------- ----------

The loss for the period arises from the Group's continuing

operations.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(UNAUDITED)

FOR THE SIX MONTHS TO 30 JUNE 2019

Attributable to equity holders

of parent

---------------------------------------------------------

Reserve Share

Reverse For Own Based Retained Non-controlling Total

Share Share Merger Acquisition Shares Payment Earnings Interests Equity

Capital Premium Reserve Reserve GBP000 Reserve Deficit Total GBP000 GBP000

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

At 31 December

2017 5,855 86,398 10,884 (7,148) (831) 1,186 (56,413) 39,931 (409) 39,522

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss for

the period - - - - - - (4,446) (4,446) (89) (4,535)

Other

comprehensive

expense - - - - - - 531 531 - 531

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss and

total

comprehensive

expense for

the period - - - - - - (3,915) (3,915) (89) (4,004)

Exercise

of share

options 4 - - - - - - 4 - 4

Share based

payment

expense - - - - - 212 - 212 - 212

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

At 30 June

2018 5,859 86,398 10,884 (7,148) (831) 1,398 (60,328) 36,232 (498) 35,734

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss for

the period - - - - - - (3,740) (3,740) 16 (3,724)

Other

comprehensive

expense - - - - - - 829 829 - 829

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss and

total

comprehensive

expense for

the period - - - - - - (2,911) (2,911) 16 (2,895)

Share based

payment

expense - - - - - (269) - (269) - (269)

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

At 31 December

2018 5,859 86,398 10,884 (7,148) (831) 1,129 (63,239) 33,052 (482) 32,570

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss for

the period - - - - - - (4,055) (4,055) (26) (4,081)

Other

comprehensive

expense - - - - - - 122 122 - 122

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss and

total

comprehensive

expense for

the period - - - - - - (3,933) (3,933) (26) (3,959)

Share based

payment

expense - - - - - 18 - 18 - 18

At 30 June

2019 5,859 86,398 10,884 (7,148) (831) 1,147 (67,172) 29,137 (508) 28,629

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

AS AT 30 JUNE 2019

30 June 30 June 31 Dec

Notes 2019 2018 2018

GBP'000 GBP'000 GBP'000

------------------------------- -------- --------- --------- ---------

Non-current assets

Property, plant and equipment 2,917 2,879 2,828

Intangible assets 19,614 19,486 19,938

------------------------------- -------- --------- --------- ---------

Total non-current assets 22,531 22,365 22,766

------------------------------- -------- --------- --------- ---------

Current assets

Inventory 2,738 2,540 2,330

Trade and other receivables 3,041 3,554 3,551

Corporation tax receivable 900 925 1,200

Cash and cash equivalent 10,076 12,215 7,816

------------------------------- -------- --------- --------- ---------

Total current assets 16,755 19,234 14,897

------------------------------- -------- --------- --------- ---------

Total assets 39,286 41,599 37,663

------------------------------- -------- --------- --------- ---------

Non-current liabilities

Long term debt (5,790) (3,713) -

Deferred tax (755) (797) (791)

------------------------------- -------- --------- --------- ---------

Total non-current liabilities (6,545) (4,510) (791)

------------------------------- -------- --------- --------- ---------

Current liabilities

Trade and other payables (4,112) (1,355) (4,302)

------------------------------- -------- --------- --------- ---------

Total current liabilities (4,112) (1,355) (4,302)

------------------------------- -------- --------- --------- ---------

Total liabilities (10,657) (5,865) (5,093)

------------------------------- -------- --------- --------- ---------

Net assets 28,629 35,734 32,570

------------------------------- -------- --------- --------- ---------

Equity

Share capital 6 5,859 5,859 5,859

Share premium 6 86,398 86,398 86,398

Merger Reserve 6 10,884 10,884 10,884

Reverse acquisition reserve 6 (7,148) (7,148) (7,148)

Reserve for own shares (831) (831) (831)

Share based payment reserve 1,147 1,398 1,129

Retained earnings deficit 7 (67,172) (60,328) (63,239)

------------------------------- -------- --------- --------- ---------

Equity attributable to equity

holders of parent 29,137 36,232 33,052

Non-controlling interests (508) (498) (482)

------------------------------- -------- --------- --------- ---------

Total equity 28,629 35,734 32,570

------------------------------- -------- --------- --------- ---------

Approved by the Board and authorised for issue on 10 September

2019

CONDENSED CONSOLIDATED CASH FLOW STATEMENT (UNAUDITED)

FOR THE SIX MONTHSED 30 JUNE 2019

6 months 6 months 12 months

to to to

Notes 30 June 30 June 31 Dec

2019 2018 2018

GBP'000 GBP'000 GBP'000

------------------------------------- --------- ---------- ---------- ----------

Operating Activities

Operating loss (4,220) (4,736) (8,689)

Adjustment for non-cash items:

Depreciation of property,

plant & equipment 273 283 598

Amortisation of intangible

assets 282 267 575

Share based payment 18 212 (57)

Research tax credit received 653 1,047 1,225

Finance Charges (183) (28) -

------------------------------------------------ ---------- ---------- ----------

Operating cash outflow (3,177) (2,955) (6,348)

------------------------------------------------ ---------- ---------- ----------

Increase/ decrease in inventory (408) 399 542

Increase/ decrease in trade

& other receivables 468 (603) (1,188)

Increase/ decrease in trade

& other payables (482) (1,007) 156

------------------------------------------------ ---------- ---------- ----------

Net cash outflow from operations (3,599) (4,166) (6,838)

------------------------------------------------ ---------- ---------- ----------

Investing activities

Interest received 11 42 72

Purchase of property, plant

& equipment (366) (113) (290)

Capitalised development expenditure - (24) (116)

Acquisition of subsidiary - - (1,564)

------------------------------------------------ ---------- ---------- ----------

Net cash outflow from investing

activities (355) (95) (1,898)

------------------------------------------------ ---------- ---------- ----------

Financing activities

Proceeds from issue of share - - -

capital

Proceeds from exercised share

options - 4 4

Proceeds from loan 6,114 - -

Net cash inflow from financing

activities 6,114 4 4

------------------------------------------------ ---------- ---------- ----------

Increase/ (decrease) in cash

and cash equivalents 2,160 (4,257) (8,732)

Foreign exchange translation

movement 100 49 125

Cash and cash equivalents

at start of period 7,816 16,423 16,423

------------------------------------------------ ---------- ---------- ----------

Cash and cash equivalents

at end of period 10,076 12,215 7,816

------------------------------------------------ ---------- ---------- ----------

NOTES TO THE CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE SIX MONTHSED 30 JUNE 2019

1. Basis of preparation

The condensed financial statements are not statutory accounts,

have not been audited and, as permitted under the AIM Rules, do not

comply with IAS 34 "Interim Financial Reporting".

The accounting policies adopted are in accordance with

International Financial Reporting Standards and are consistent with

those expected to be applied in the preparation of the audited

financial statements for the year ending 31 December 2019,

including the adoption of the following new standard with effect

from 1(st) January 2019:

-- IFRS 16 Leases

The comparative figures for the year ended 31 December 2018 are

from the statutory accounts. Those accounts have been reported on

by the Company's Auditor and delivered to the Registrar of

Companies. The report of the Auditor was unqualified, did not

include reference to any matters by way of emphasis and did not

contain a statement under section 498 of the Companies Act

2006.

This is the first set of results since the adoption of IFRS 16

which has caused no material impact to the Group's financial

statements as the Group has been able to benefit from the exemption

for leases with less than 12 months left to run.

2. Segmental reporting

The following table provides disclosure of the Group's revenue

by geographical market based on location of the customer:

6 months 6 months 12 months

to to to

Notes 30 June 30 June 31 Dec

2019 2018 2018

GBP'000 GBP'000 GBP'000

--------------- --------- --------- --------- ----------

USA 4,961 4,559 9,434

Rest of world 1,108 1,015 2,185

-------------------------- --------- --------- ----------

6,069 5,574 11,619

------------------------- --------- --------- ----------

6 months to BioSurgery Orthopaedics Cardiac Other Central Total

30 June 2019 & Dental

-----------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ----------- ------------- -------- -------- -------- --------

Revenue 1,963 3,049 - 1,057 - 6,069

Cost of sales (1,095) (1,430) - (700) - (3,225)

----------------- ----------- ------------- -------- -------- -------- --------

Gross Profit 868 1,619 - 357 - 2,844

Administrative

costs (2,018) (2,319) (193) (289) (2,205) (7,024)

Exceptional

costs - - - (40) (40)

----------------- ----------- ------------- -------- -------- -------- --------

Operating

loss (1,150) (700) (193) 68 (2,245) (4,219)

Finance income - - - - 11 11

Finance charges - - - - (183) (183)

----------------- ----------- ------------- -------- -------- -------- --------

Loss before

taxation (1,150) (700) (193) 68 (2,417) (4,392)

Taxation - - - - 311 311

----------------- ----------- ------------- -------- -------- -------- --------

Loss for the

year (1,150) (700) (193) 68 (2,106) (4,081)

----------------- ----------- ------------- -------- -------- -------- --------

6 months to BioSurgery Orthopaedics Cardiac Other Central Total

30 June 2018 & Dental

-----------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ----------- ------------- -------- -------- -------- --------

Revenue 1,478 3,205 - 891 - 5,574

Cost of sales (732) (1,115) - (604) - (2,451)

----------------- ----------- ------------- -------- -------- -------- --------

Gross Profit 746 2,090 - 287 - 3,123

Administrative

costs (2,042) (2,835) (224) (272) (1,986) (7,359)

Exceptional

costs - - - - (500) (500)

----------------- ----------- ------------- -------- -------- -------- --------

Operating

loss (1,296) (745) (224) 15 (2,486) (4,736)

Finance income - - - - 42 42

Finance charges - - - - (146) (146)

----------------- ----------- ------------- -------- -------- -------- --------

Loss before

taxation (1,296) (745) (224) 15 (2,590) (4,840)

Taxation (6) 259 52 - - 305

----------------- ----------- ------------- -------- -------- -------- --------

Loss for the

year (1,302) (486) (172) 15 (2,590) (4,535)

----------------- ----------- ------------- -------- -------- -------- --------

12 months BioSurgery Orthopaedics Cardiac Other Central Total

to 31 December & Dental

2018

-----------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ----------- ------------- -------- -------- -------- ---------

Revenue 3,381 6,396 - 1,842 - 11,619

Cost of sales (1,769) (2,676) - (1,257) - (5,702)

----------------- ----------- ------------- -------- -------- -------- ---------

Gross Profit 1,612 3,720 - 585 - 5,917

Administrative

costs (4,169) (4,992) (428) (551) (4,043) (14,183)

Exceptional

costs - - - - (423) (423)

----------------- ----------- ------------- -------- -------- -------- ---------

Operating

loss (2,557) (1,272) (428) 34 (4,466) (8,689)

Finance income - - - - (190) (190)

Finance charges - - - - - -

----------------- ----------- ------------- -------- -------- -------- ---------

Loss before

taxation (2,557) (1,272) (428) 34 (4,656) (8,879)

Taxation 73 543 102 - (98) 620

----------------- ----------- ------------- -------- -------- -------- ---------

Loss for the

year (2,484) (729) (326) 34 (4,754) (8,259)

----------------- ----------- ------------- -------- -------- -------- ---------

3. Taxation

6 months 6 months 12 months

to to to

30 June 30 June 31 Dec 2018

2019 2018 GBP'000

GBP'000 GBP'000

---------------------------------- --------- --------- -------------

Current Tax:

UK corporation tax credit

on research and development

costs in the period (353) (352) (790)

US corporation tax 42 47 72

(311) (305) (718)

Deferred tax:

Origination and reversal

of temporary timing differences - - 98

----------------------------------- --------- --------- -------------

Tax credit on loss on ordinary

activities (311) (305) (620)

----------------------------------- --------- --------- -------------

The Group has accumulated losses available to carry forward

against future trading profits.

4. Loss per share (basic and diluted)

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the parent by the weighted

average number of ordinary shares in issue during the period

excluding own shares held jointly by the Tissue Regenix Employee

Share Trust and certain employees. Diluted loss per share is

calculated by adjusting the weighted average number of ordinary

shares in issue during the period to assume conversion of all

dilutive potential ordinary shares.

6 months 6 months 12 months

to to to

30 June 30 June 31 Dec

2019 2018 2018

GBP'000 GBP'000 GBP'000

---------------------------------- ---------------- ---------------- ----------------

Total loss attributable to

the equity holders of the

parent (4,055) (4,446) (8,186)

----------------------------------- ---------------- ---------------- ----------------

No. No. No.

---------------------------------- ---------------- ---------------- ----------------

Weighted average number of

ordinary shares in issue during

the period 1,171,534,448 1,171,534,448 1,171,633,442

----------------------------------- ---------------- ---------------- ----------------

Loss per share

Basic and diluted on loss

for the period (0.35)p (0.38)p (0.70)p

----------------------------------- ---------------- ---------------- ----------------

The Company has issued employees options over 23,786,780

ordinary shares and there are 16,940,386 jointly owned shares which

are potentially dilutive. There is, however, no dilutive effect of

these issued options as there is a loss for each of the periods

concerned.

5. Interim financial report

A copy of this interim report is available on the Company's

website at www.tissueregenix.com in accordance with AIM Rule

20.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

IR BUGDCSSGBGCC

(END) Dow Jones Newswires

September 10, 2019 02:00 ET (06:00 GMT)

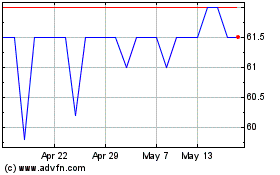

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Apr 2024 to May 2024

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From May 2023 to May 2024