TIDMTGR

RNS Number : 6700Y

Tirupati Graphite PLC

09 May 2023

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018. Upon the

publication of this announcement, this information is considered to

be in the public domain.

9 May 2023

Tirupati Graphite plc

('Tirupati', 'TG' or the 'Company')

Unaudited Trading Results for The Financial Year 1 April 2022 to

31 March 2023

Tirupati Graphite plc (TGR.L, TGRHF.OTCQX), the specialist

graphite and graphene company developing sustainable new age

materials, is pleased to announce its Unaudited Trading Results for

the financial year ended 31 March 2023 ("FY23").

Highlights

-- Gross profit for FY23 increased 170% Year on Year ("YoY") to GBP1,372,048 (FY22: GBP508,112)

-- Total production increased by 59% YoY to 4,770 tons (FY22: 2,996 tons)

-- Total Sales increased by 76% YoY to GBP2,890,010 (FY22: GBP1,645,308)

-- Basket price realised per ton of graphite sold increased by 17% to GBP726 (FY22: GBP618)

-- A summary of the operating results for the year are as detailed in table below

% Change

Particulars Unit FY 2023 FY 2022 YoY

Revenue and Sales

-------- ----------- ---------- ---------

Quantity Sold & Shipped MT 3,982 2,662 +50%

-------- ----------- ---------- ---------

Revenue from Sales GBP 2,890,010 1,645,308 +76%

-------- ----------- ---------- ---------

Price realised GBP/MT 726 618 +17%

-------- ----------- ---------- ---------

Production and Cost of

Production

-------- ----------- ---------- ---------

Quantity Produced MT 4,770 2,996 +59%

-------- ----------- ---------- ---------

Mining & Processing Costs GBP 1,512,563 935,604 +62%

-------- ----------- ---------- ---------

Human Resources GBP 326,783 378,671 -14%

-------- ----------- ---------- ---------

Logistics Utilities & Plant

Admin Costs GBP 368,061 308,278 +19%

-------- ----------- ---------- ---------

(Increase) / Decrease in

Inventory GBP -689,445 -485,357 +42%

-------- ----------- ---------- ---------

Total Cost of Production GBP 1,517,962 1,137,196 +33%

-------- ----------- ---------- ---------

Cost of Production per

ton GBP/MT 318 380 -16%

-------- ----------- ---------- ---------

Operating Profits & Margins

-------- ----------- ---------- ---------

Gross Profits GBP 1,372,048 508,112 +170%

-------- ----------- ---------- ---------

Gross Margin % of sales % 47 31 +52%

-------- ----------- ---------- ---------

Cost of Production % of

Price realised % 44 61 -28%

-------- ----------- ---------- ---------

Further Overview for FY23

-- Development of new capacities and overcoming bottlenecks

faced remained the larger part of the Company's activities during

the year

-- As a result, the Company continued development across its two

projects and reached a plant capacity of 30,000 tons per annum

("tpa").

-- Various measures taken by the Company during the year have

been implemented successfully in development and operations with

initial impacts becoming visible in the financial results for FY23,

these include:

o reducing operating costs;

o attaining better ability to overcome adverse weather

conditions; and

o initiating renewable energy generation and the usage

thereof.

-- First commercial shipment from the Company's 18,000 tpa

capacity Sahamamy mining and processing facilities was made in

March 2023, tailor made to its customer's requirements.

-- The cumulative investments made in CAPEX by the Company at

its projects in Madagascar since inception up to 31 March 2023 now

stands at GBP13.5million, including exploration and evaluation

Demand matrix

-- The global push for climate action and energy transition are

resulting in increased consumption of flake graphite in energy

storage lithium-ion batteries used in electric vehicles

-- Increasing consumption of flake graphite is also reported in

other sustainable development applications like fire safety,

thermal management and advanced materials

-- Consumption in conventional applications collectively remains

the larger part of global flake graphite usage, though energy

transition applications are forecast to overtake these in the near

future and are expected to create an inflection point

-- Substantial global dependence for flake graphite on China has

created greater interest in the consumer industry for alternative

sources

-- The Company is not aware of any other new material production

having been established during the year outside China and only a

handful of developments other than by the Company are underway in

the current year

-- The Company's products have been exported from origin in

Madagascar across three continents during FY23 and the Company

remains engaged with the markets accumulating annual orders for its

current capacities, and future prospects for its growth plans

Shishir Poddar, Executive Chairman, said:

"We have now completed the first phase of our development into a

global leader in this niche speciality material space. In the

process, we have successfully managed episodes of extreme

difficulty, but have remained firmly focused on our objectives and

targets. From the new financial year, we have begun the journey on

the next phase, consolidating on what we have achieved and moving

forward towards our next targets.

"The stage is now set for us to build a sustainable flake

graphite company. Our key differentiator is and remains that we are

the only Company that has been founded and managed by a team that

specialises in this speciality material, thus helping us to be cost

effective as evidenced by our lower capital intensity and operating

cost.

"I take this opportunity to express our gratitude to all our

investors and on behalf of the TG team, we reiterate our commitment

to remain firm on our vision and continue to develop our path to

success."

S

For further information, please visit

https://www.tirupatigraphite.co.uk/ or contact:

Tirupati Graphite Plc

Puruvi Poddar - Chief of Corporate & Business admin@tirupatigraphite.co.uk

Development +44 (0) 20 39849894

Optiva Securities Limited (Broker)

Ben Maitland - Corporate Finance +44 (0) 20 3034 2707

Robert Emmet - Corporate Broking +44 (0) 20 3981 4173

FTI Consulting (Financial PR) +44 (0) 20 3727 1000

Ben Brewerton / Nick Hennis / Kelly Smith tirupati@fticonsulting.com

About Tirupati Graphite

Tirupati Graphite Plc is a specialist flake graphite company and

places a special emphasis on "green" applications of flake

graphite, including renewable energy, energy efficiency, energy

storage and thermal management and is committed to ensuring its

operations are sustainable as well.

The Company's operations include primary mining and processing

in Madagascar, where the Company operates two key projects,

Sahamamy and Vatomina. With the start of commercial production of

its latest 18,000 tpa plant at Sahamamy in March 2023, it now has

an installed capacity of 30,000 tpa high-quality flake graphite

concentrate with up to 97% purity in Madagascar, planned to

increase to 84,000 tpa as per the Company's modular medium-term

development plan.

On 1 April 2023 the Company completed the acquisition of Suni

Resources SA, Mozambique, whose two main assets are (i) the

Montepuez Project which holds the mining licence over an area of

3,667 hectares with JORC 2012 defined reserves & resources of

almost 120 million tonnes; plus (ii) the Balama Central Project,

which has a mining license over 1,543 hectares with JORC 2012

defined mineral reserves and resources of 33 million tonnes. Both

projects have licenses permitting build out to an annual production

of 100,000 and 58,000 tons of flake graphite respectively.

TG believes that the addition of these projects provides the

Company with sufficient resources to achieve its ambition of

satisfying 8% of the estimated global flake graphite demand - of

around 5 million tons per annum - by 2030.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

TSTSSAFWAEDSEFI

(END) Dow Jones Newswires

May 09, 2023 02:00 ET (06:00 GMT)

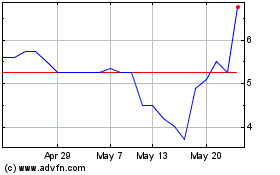

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jul 2023 to Jul 2024