TIDMTBLD

RNS Number : 5927N

tinyBuild, Inc.

26 September 2023

26 September 2023

tinyBuild, Inc

("tinyBuild" or the "Company")

2023 Half Year Results

tinyBuild (AIM:TBLD), a premium video games publisher and

developer with global operations, is pleased to announce its

unaudited results for the 6 months ended 30 June 2023.

Financial highlights:

-- Revenue of $23.3m (H1 2022: $28.8m), 19% lower primarily due

to a sharp drop in development service revenues and

underperformance of Versus Evil

-- Adj EBITDA(1) loss of $1.2m (H1 2022: $9.9m), due to lower

proportion of revenues from first party titles and higher

development cost amortisation

-- Adj. Operating Loss2 of $4.7m (H1 2022: $6.8m), reflecting higher G&A costs

-- Cash Flow from operating activities dropped to $6.6m (H1

2022: $8.8m), reflecting lower cash profit partly offset by

positive net working capital contribution

-- One-off impairment of development costs ($18.3m) and of

intangible assets ($8.9m) reflecting the cancellation of some

titles and lower revenue prospects for other titles

-- Net cash position of $14.3m (Dec 2022: $26.5m), after $16.9m

investment in game development costs (H1 2022: $14.2m). Cash

position at the end of December 2023 expected to be between

$10-20m, as previously announced

(1) Includes amortisation of Development costs. Excludes one-off

impairment of Development costs ($18.3m), goodwill ($6.1m) and

other intangibles ($2.8m), and share-based compensation expenses

(see note 6).

(2) Includes amortisation of Development costs. Excludes one-off

impairment of Development costs ($18.3m), goodwill ($6.1m) and

other intangibles ($2.8m).

Operational highlights:

-- Release of new titles such as Rhythm Sprout, Farworld

Pioneers and The Bookwalker, plus expansion of catalogue with the

launch of VR titles for Kill It With Fire, Not For Broadcast and

Hello Neighbor: Search and Rescue, alongside platform launches.

-- Contribution from own-IP decreased to 65% of group revenue

(H1 2022: 83%), due to stronger performance of third-party titles,

both from back catalogue and new releases.

-- Strong back catalogue sales representing 93% of total

revenues (H1 2022: 99%), demonstrating the Company's ability to

extend games' life cycles and support investments in new

titles.

-- Acquisition of NotGames, a UK-based studio, for an upfront

cash consideration of $1.5m plus max contingent consideration of

$4.2m, subject to stretched financial targets. NotGames is the

developer studio of Not For Broadcast, a critically acclaimed full

motion propaganda simulator.

Directorate change:

-- On 29 March Luke Burtis, Chief Operating Officer (COO) and

Board Member, resigned from his board position and management role

to spend more time with his family. As the Company continues to

move towards the more decentralised structure set out at the

Capital Markets Day in June 2022, the responsibilities of the COO

role have been distributed among a wider group of decision-makers,

giving individuals and teams more autonomy and accountability for

their areas of responsibility.

-- On 29 June Tony Assenza, Chief Financial Officer (CFO) and

Board Member, resigned from the Company and the Board. On the same

date, tinyBuild announced that Giasone (Jaz) Salati was appointed

CFO and Michael Schauble Chief Commercial Officer. Jaz joined the

Board of Directors on 3 August 2023.

Employee Benefit Trust:

-- The Employee Benefit Trust continued to purchase ordinary

shares on the market and now holds a total of 1,520,864 ordinary

shares as at 25 September 2023. The EBT was set up in 2022 for the

benefit of current and future employees and will continue to act

independently of the Company to satisfy potential future option

exercises of vested options granted. The maximum amount of the loan

made available to the EBT at any time will be capped at $10m.

Post-Period End highlights:

-- Released new titles Punch Club 2: Fast Forward and I Am

Future, plus platform launches for Hello Engineer, Black Skylands

and Potion Craft.

-- New episodes of the Hello Neighbor animated series are

planned to release in the second half of the year, in conjunction

with important console updates to Hello Neighbor 2, which continues

to enjoy an improvement in the review score on PC.

Outlook

-- The combination of a weak macroeconomic environment,

geopolitical instability and shifts in the industry dynamics,

dampens the Company's growth potential in the near-term.

-- The pipeline for coming months includes a number of new

titles (e.g. Critter Cove, Kill It With Fire 2) and further

expansion of the catalogue (e.g. Cartel Tycoon launch on consoles),

but headwinds observed in the first half of the year will likely

continue to weigh on profitability.

-- Management is hard at work on two main fronts: 1) to

accelerate the operational transition to the 1000-hour game model,

and 2) to provide greater visibility on financial progress of each

project on a continuous basis

-- In this context, the Board remains confident the Company has

adopted the right strategy and is on track to deliver results in

line with recently-reset expectations.

Alex Nichiporchik, Chief Executive Officer of tinyBuild,

commented:

"The first half of 2023 was a story of two halves, with strong

underlying direct sales to consumers, offset by a sudden drop in

development service revenues. The speed of change in the video

games industry is insane and we know we have to adapt quickly if we

want to grow above peers. For this reason, we have been gradually

shifting towards what we call the 1000-hour game."

"In a difficult environment we continue to invest cautiously in

higher-budget games that have the potential to become very large

franchises. We are setting new Company records in terms of

wishlists on our new IP and leveraging our decentralised structure

to fit the different reality of each development team, wherever

they are in the world."

"Our core strategy hasn't changed: we are building a diversified

portfolio of own-IP, which gives us the best upside with the

minimum risk. Once again, I want to thank our exceptional people

for their enthusiasm and dedication - we have achieved a lot so far

and we can look to the future with cautious optimism."

Enquiries :

tinyBuild, Inc investorrelations@tinybuild.com

Alex Nichiporchik - Chief Executive Officer

Giasone (Jaz) Salati - Chief Financial

Officer

Michael Schauble - Chief Commercial Officer

Berenberg (Nominated Advisor and Joint

Broker)

Mark Whitmore, Ciaran Walsh, Milo Bonser +44 (0)20 3207 7800

Numis (Joint Broker)

Hugo Rubinstein, Tejas Padalkar +44 (0)20 7260 1000

SEC Newgate (Financial PR) tinybuild@secnewgate.co.uk

Robin Tozer, Bob Huxford, George Esmond +44 (0)7540 106366

About tinyBuild:

Founded in 2013, tinyBuild (AIM: TBLD) is a leading premium

AA-rated and indie video games publisher and developer. tinyBuild

has a strong portfolio of over 80 titles and it strategically

secures access to IP and partners with developers to establish a

stable platform on which to build multi-game and multimedia

franchises.

Headquartered in Bellevue, Washington, USA, the Company has key

operations worldwide, with employees, contractors or partners in

multiple locations across five continents. tinyBuild's geographic

diversity enables it to source high-potential IP, cost-effective

development resources and a loyal customer base through innovative

grassroots marketing.

tinyBuild was admitted to AIM, a market operated by the London

Stock Exchange, in March 2021.

For further information, visit: www.tinybuildinvestors.com .

OPERATIONAL REVIEW

The first half of 2023 was dominated by macroeconomic issues

with the trade-off between high inflation and slowing growth

aggravating seemingly increased geopolitical tension between US and

Europe on one side, and Russia and China on the other side. Central

banks had no choice but to increase interest rates, which in turn

increased pressure on consumers, via higher mortgage costs among

others.

Against this difficult backdrop, global video games sales and

the number of players are expected to grow in 2023, after a mild

slowdown in 2022. More than offsetting this positive trend

tinyBuild, alongside some industry peers, saw a sharp decline in

development service revenues as many distribution partners reduced

or paused their investments in content. It is too early to say if

some of the lost revenues will return in the form of lower

cannibalisation and increased sales direct to consumers, so the

Company has quickly adopted a conservative cash management and

capital allocation policy.

The Company already identified in 2022 the need to focus on

relatively larger, more recognisable franchises that can command

player's attention in a crowded environment, games with which

players can spend over a thousand hours. There is a direct

correlation between long-term sales and system-driven games where

customers immerse themselves for several hours every day for

months. We see this very clearly in our catalogue data. Alongside

larger-budget titles we continue to scout work for indie developers

and studios that can grow over time.

The pipeline of new titles has been realigned to maximise the

long-term revenue potential, while maintaining a well-diversified

portfolio. The progress of every project has also been reviewed and

the investments resized where necessary.

tinyBuild operational model also continued to evolve reflecting

industry trends such as multiplatform development and virtual

reality (VR). AI may offer some productivity gains and in the long

it may even improve videogames engagement, for example through more

meaningful interactions with non-player characters (NPCs).

In the first half, back catalogue and own-IP titles contributed

93% and 65% of total revenue respectively, broadly in line with the

average of the past five years. New records in terms of playlist

count following the announcement of a new title have been set with

a handful of promising higher-budget games under development,

including the already announced Ferocious and SAND.

In an uncertain environment, the Board is pleased with the

recent changes to the executive team and it is confident the

company is progressing in line with expectations for the financial

year 2023.

Current portfolio and pipeline

In 2023, tinyBuild release schedule is slightly skewed towards

the second half of the year. New game launches in the first six

months performed in line with expectations and some back-catalogue

titles performed strongly as we continue to invest to strengthen

existing franchises.

In the first six months of the year, tinyBuild published three

new games and expanded the back catalogue with version 1.0,

downloadable content ("DLC") and new platforms launches:

-- Rhythm Sprout (PC and consoles) - Step to the rhythm and

fight to the beat. A handcrafted rhythm action game with original

music and a wacky story mode

-- Farworld Pioneers (PC and consoles) - A vast colony-builder.

An open world, sci-fi sandbox in PVP, PVE, and co-op

-- The Bookwalker (PC and consoles) - A narrative adventure. You

play as Etienne Quist, a writer-turned-thief with the ability to

dive into books to steal Thor's Hammer, Excalibur and more.

-- Kill It With Fire, Not For Broadcast and Hello Neighbor (VR version)

And after the end of the period, tinyBuild published:

-- Punch Club 2 - A fighter management sim

-- I Am Future - a base-building game set on the ruins of a former civilisation

-- Hello Engineer , Black Skylands and Potion Craft (platform launches)

Looking at the rest of 2023 and beyond, we announced a number of

new titles, including:

-- Critter Cove - a cozy life sim adventure that takes places

across a string of islands in a colorful and mysterious open

world

-- Tamarak Trail - A deck-building roguelike, with customisable

dice as you battle through randomly generated trails

-- Lil' Gardsman - A deduction adventure. Lil - an unlikely

12-year-old hero - is tasked with deciding the fate of over 100

unique characters

-- Kill It With Fire 2 - An interdimensional action comedy game

about murdering spiders. As The Exterminator, you'll travel across

the multiverse

-- Slime 3K - a rogue-lite shooter starring a big blob of jelly

-- RAWMEN - a light hearted, third person, food fighter. Battle

alongside or against your taste buds (2-8 players), pitting average

cooks with a talent for hurling fiery feasts against one

another

-- Streets of Rogue 2 - an immersive RPG sandbox set in a vast

randomly generated open world that gives you maximum freedom to

fight, sneak, hack, farm, build, steal, or talk your way to

power

-- Stray Souls - an immersive action-horror game about

terrifying creatures, mind-bending puzzles, and family secrets

-- Pigeon Simulator - a 'physics sandbox roguelite about the

world's most notorious birds. and their quest for world

domination

-- Broken Roads - a narrative-driven RPG set in Australia with a very distinct look

-- Ferocious - a survival shooter in which you will discover a

lost prehistoric world full of deadly creatures under the control

of hostile forces

-- S AND - A multiplayer sandbox shooter from the developers of Secret Neighbor

Investing and innovating for growth

In a period of uncertainty in the industry, the Company

continuously reviews the quantum and allocation of investments into

new higher-budget and higher-potential titles, with lower-risk

investment in catalogue expansion. Since before the IPO,

tinyBuild's mantra has been to build a well-diversified portfolio

of own-IP that can be scaled into cross-media franchises, and we

remain loyal to that.

Our increasingly nimble and decentralised structure is capable

of handling larger projects, delivering them across platforms, on

time, quality and budget. Recent launches like Punch Club 2 and I

am Future are good examples of how our sophisticated marketing

strategy can attract a large audience for a well-known franchise

and for a new IP alike.

In the first half of 2023, the executive team has become even

more selective about signing up new titles, while we continue to

take advantage of opportunities created by an uncertain

macroeconomic environment. We adopted the same cautious approach to

develop our first animated series, which will see new episodes

launching in October.

In 2023, M&A multiples still appear anchored to unrealistic

expectations, so we stepped away from some potential acquisitions

and preferred to invest more directly in studios we already have a

good working relationship with (e.g. Not Games), and in titles

spawned from our internal studios.

People

After enjoying an extended paternity leave during the first part

of the year, on 29 March, Luke Burtis (COO) announced his

resignation from the post of COO and the Board of tinyBuild to

spend more time with his family and work on exciting new projects.

Luke has been with the Company since the beginning and his

contribution to strategy and operations has been invaluable.

On 29 June, after a short period of leave for personal reasons,

Tony Assenza, CFO, resigned from the Company and the Board.

Following a Board process, tinyBuild appointed Giasone (Jaz) Salati

as CFO. On the same day, completing tinyBuild's transition to a

more focused management team, Michael Schauble, previously senior

VP of Business Development, was appointed Chief Commercial Officer.

On 3 August, Jaz joined the Board of Directors.

Company-wise, tinyBuild continues to support all its staff

(employees and independent contractors) and their families affected

by the war in Ukraine and it continues to carefully monitor the

situation. Having helped staff move out of the riskiest areas, the

Company is now focusing on mental health and administrative support

so everybody can settle in their preferred location across

Europe.

Position and strategy

tinyBuild is well-positioned with a strong pipeline of new

titles and a proven ability to attract, screen and market

high-quality game franchises. Our balanced investment strategy aims

at building a diversified portfolio of high-potential own-IP, and

our multimedia franchise model allows us to extend the life of our

IP, maximising our return on investment.

Our medium-term strategy is to expand our position as a leading

global video games developer and publisher, focussing on IP

ownership while creating long-term scalable franchises across

multiple media formats. 2023 has seen significant progress towards

that ambition, and I would like to thank all of our shareholders

for their support.

Alex Nichiporchik

Chief Executive Officer

26 September 2023

FINANCIAL REVIEW

Results for the six months ended June 2023 were in line with

recently-reset expectations, and the Company closed one acquisition

in the period.

Revenue

In the six months to June 2023, tinyBuild revenues were $23.3m,

a 19% decrease compared to the previous year (H1 2022: $28.8m),

primarily attributable to the $5.9m drop in development services

revenues and to continued underperformance of Versus Evil, only

partly offset by the resilient performance of direct-to-consumer

sales. Excluding development services and events, revenues were

flat at $17.5m, highlighting a stronger underlying performance.

Back catalogue performed strongly in the first half, supported by

over 80 titles and by well-established franchises such as Graveyard

Keeper. Revenue from events, primarily DevGAMM, increased to $0.6m

from $0.2m as a result of events reboot in Central and Western

Europe.

Adjusted EBITDA and Operating Profit

Adjusted EBITDA is presented net of amortisation of development

costs, excluding impairment of development costs, share-based

compensation expenses and exceptional costs (e.g. legal costs

related to M&A), giving a clear, yet conservative, picture of

the business progression. Adjusted EBITDA was negative $1.2m ($9.9m

in H1 of 2022), reflecting a significantly lower revenue base, a

less favourable revenue mix (higher share of third and second party

titles) and an increase in amortisation of development costs ($5.0m

in H1 2023 vs $3.8m in H1 2022).

Operating profit for H1 2023 was negative $31.9m (H1 2022:

positive $6.8m), after accounting for the $18.8m impairment of

development costs, $2.8m impairment of intangibles, and $6.1m

impairment of goodwill. Excluding the $27.7m one-off impairment

charges, Adjusted Operating Profit was negative $4.7m, reflecting a

lower EBITDA and higher general and administrative expenses ($13.6m

in H1 2023 vs $12.0m in H1 2022), only partly offset by lower

share-based compensation ($0.4m in H1 2023 vs $0.9m in H1

2022).

Finance costs and taxation

Finance costs were immaterial in H1 2023, and taxation credit

was $6.4m (H1 2022: $2.3m charge) reflecting the lower taxable

income.

Impairment

In H1 2023, tinyBuild incurred substantial charges relating to

the impairment of development costs ($18.8m in H1 2023 vs $0m in H1

2022), M&A-related intangibles ($2.8m in H1 2023 vs $0m in H1

2022) and goodwill ($6.1m in H1 2023 vs $0m in H1 2022). These

non-cash charges reflect the adjustment of expectations for future

revenues of some titles due to the industry-wide changes and

therefore are not expected to recur.

Cash Flow

Cash flows from operating activities was $6.6m ($8.8m in H1

2022), a relatively modest drop despite the sharper decline in

revenues and increase in costs thanks to more careful cash

management and also due to a normalisation of timing differences

that impacted results in the second half of 2022. Software

development costs, mainly consisting of developer salaries,

advances, localisation and porting, was at $16.9m ($14.2m in H1

2022), reflecting a stabilisation in investment for upcoming

pipeline releases.

Financial Position

The net cash position at the end of June 2023 was $14.3m ($26.5m

at the end of December 2022), with the majority of the variation

driven by lower revenues and higher organic investments. tinyBuild

has zero debt and a completely undrawn revolving credit facility of

up to $35m.

Events after the reporting date

Giasone (Jaz) Salati was appointed to the Board of Directors on

3 August 2023.

Giasone (Jaz) Salati

Chief Financial Officer

26 September 2023

TINYBUILD INC.

CONSOLIDATED CONDENSED INCOME STATEMENT

6 months 6 months Year ended

Note ended 30 ended 30 31 December

June 2023 June 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Revenue 4 23,295 28,750 63,295

Cost of sales:

- Cost of sales (13,832) (9,058) (20,592)

- Impairment of development

costs 7 (18,288) - (95)

Total cost of sales (32,120) (9,058) (20,687)

Gross (loss)/profit (8,825) 19,692 42,608

Administrative expenses:

- General administrative

expenses (13,561) (12,000) (23,328)

- Impairment of intangible

assets 7 (8,908) - (11,075)

- Share-based payment expenses (367) (887) (1,726)

- Ukraine/Russia conflict

related costs (281) - (1,678)

Total administrative expenses (23,117) (12,887) (37,807)

Other operating income - - 11,122

Operating (loss)/profit (31,942) 6,805 15,923

Finance costs (16) (24) (73)

Finance income 261 8 80

Profit before tax (31,697) 6,789 15,930

Income tax credit/(expense) 6,414 (2,306) (4,417)

(Loss)/profit for the year (25,283) 4,483 11,513

Attributable to:

Owners of the parent company (25,523) 4,457 11,545

Non-controlling interests 240 26 (32)

(25,283) 4,483 11,513

Basic earnings/(loss) per

share ($) 5 (0.126) 0.022 0.057

Diluted earnings/(loss) per

share ($) 5 (0.126) 0.022 0.056

Adjusted EBITDA 6 (1,249) 9,882 24,355

Adjusted total comprehensive

income attributable to the

owners per share ($) 6 0.010 0.023 0.066

TINYBUILD INC.

CONSOLIDATED CONDENSED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

(Loss)/Profit for the year (25,283) 4,483 11,513

Other comprehensive income net of

taxation

Exchange differences on translation

of foreign operations - may be reclassified

to profit and loss 94 - 7

Total comprehensive (loss)/income

for the year (25,189) 4,483 11,520

Attributable to:

Owners of the parent company (25,429) 4,457 11,552

Non-controlling interests 240 26 (32)

(25,189) 4,483 11,520

TINYBUILD INC.

CONSOLIDATED CONDENSED STATEMENT OF FINANCIAL POSITION

30 June 31 December

2023 2022

Unaudited Audited

ASSETS Note $'000 $'000

Non-current assets

Goodwill 7 29 3,746

Other intangible assets 7 65,180 76,638

Property, plant and equipment:

- owned assets 846 794

- right-of-use assets 282 342

Deferred tax assets 4,934 -

Trade and other receivables 405 406

Total non-current assets 71,676 81,926

Current assets

Trade and other receivables 16,173 25,382

Cash and cash equivalents 14,338 26,496

Total current assets 30,511 51,878

TOTAL ASSETS 102,187 133,804

EQUITY AND LIABILITIES

Equity

Share capital 10 204 204

Share premium 65,593 65,593

Warrant reserve 1,920 1,920

Translation reserve 101 7

Retained earnings 18,754 43,910

Equity attributable to owners of

the parent company 86,572 111,634

Non-controlling interest 197 (43)

Total equity 86,769 111,591

LIABILITIES

Non-current liabilities

Lease liabilities 47 97

Contingent consideration 705 -

Deferred tax liabilities - 1,800

Total non-current liabilities 752 1,897

Current liabilities

Trade and other payables 13,862 20,046

Contingent consideration 531 -

Lease liabilities 273 270

Total current liabilities 14,666 20,316

Total liabilities 15,418 22,213

TOTAL EQUITY AND LIABILITIES 102,187 133,804

TINYBUILD INC.

CONSOLIDATED CONDENSED STATEMENT OF CHANGES IN EQUITY

Share Share Warrant Translation Retained Total Non-controlling Total

capital premium reserve reserve earnings equity interest equity

attributable

to owners

of the

parent

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Note

Balance at 1 January

2022 203 63,546 1,920 - 30,639 96,308 137 96,445

Profit and total

comprehensive

income for the year - - - - 4,457 4,457 26 4,483

Transactions

with owners in

their

capacity as

owners:

Issue of shares, net

of transaction

costs 1 1,569 - - - 1,570 - 1,570

Issue of shares on

exercise of

options - 28 - - - 28 - 28

Dividends paid - - - - - - (148) (148)

Share-based payments - - - - 887 887 - 887

Total transactions

with owners 1 1,597 - - 887 2,485 (148) 2,337

Balance at 30 June

2022 204 65,143 1,920 - 35,983 103,250 15 103,265

Share Share Warrant Translation Retained Total Non-controlling Total

capital premium reserve reserve earnings equity interest equity

attributable

to owners

of the

parent

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Balance at 1 January

2023 204 65,593 1,920 7 43,910 111,634 (43) 111,591

Loss for the period - - - - (25,523) (25,523) 240 (25,283)

Other

comprehensive

income:

Foreign exchange

differences on

translation of

foreign operations - - - 94 - 94 - 94

Total comprehensive

loss for the

period - - - 94 (25,523) (25,429) 240 (25,189)

Transactions

with owners in

their

capacity as

owners:

Issue of 10 - - - - - - - -

shares, net of

transaction

costs

Share-based payments - - - - 367 367 - 367

Total transactions

with owners - - - - 367 367 - 367

Balance at 30 June

2023 204 65,593 1,920 101 18,754 86,572 197 86,769

TINYBUILD INC.

CONSOLIDATED CONDENSED STATEMENT OF CASH FLOWS

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

Unaudited Unaudited Audited

Note $'000 $'000 $'000

Cash flows from operating activities

Cash generated from operations 11 6,289 8,811 19,188

Interest received 261 - 80

Net cash generated from operating

activities 6,550 8,811 19,268

Cash flows from investing activities

Acquisition of subsidiaries, net

of cash acquired (1,234) - -

Software development (16,925) (14,245) (35,789)

Purchase of intellectual property - - (4,150)

Purchase of property, plant and

equipment (287) (554) (1,180)

Interest received - 8 -

Net cash used in investing activities (18,446) (14,791) (41,119)

Cash flows from financing activities

Proceeds on exercise of share

options - - 28

Payment of principal portion of

lease liabilities (262) (92) (365)

Dividends paid to non-controlling

interests - (148) (148)

Net cash used in financing activities (262) (240) (485)

Cash and cash equivalents

Net (decrease)/increase in the

year (12,158) (6,220) (22,336)

At beginning of period 26,496 48,832 48,832

At end of period 14,338 42,612 26,496

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

FOR THE SIX MONTH PERIODED 30 JUNE 2023

1 GENERAL INFORMATION

tinyBuild Inc. ("the Company") is a public company limited by

shares, and is registered, domiciled and incorporated in Delaware,

USA. The address of the registered office is 1100 Bellevue Way NE,

STE 8A #317, Bellevue, WA 98004, United States.

The Group ("the Group") consists of tinyBuild Inc. and all of

its subsidiaries. The Group's principal activity is that of an

indie video game publisher and developer.

The Board of Directors approved this interim financial

information on 26 September 2023.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

These condensed, consolidated financial statements for the

interim half-year reporting period ended 30 June 2023 have been

prepared in accordance with IAS 34 'Interim Financial Reporting'.

These interim financial statements do not constitute full financial

statements and do not include all the notes of the type normally

included in annual financial statements. Accordingly, these

financial statements are to be read in conjunction with the annual

report for the year ended 31 December 2022.

The annual financial statements of the Group are prepared in

accordance with International Financial Reporting Standards

("IFRS") as issued by the International Accounting Standards Board

("IASB"). The Annual Report and Financial Statements for 2022 have

been issued and are available on the Group's investor relations'

website:

https://www.tinybuildinvestors.com/documents-and-presentations.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated

financial statements as in its 31 December 2022 annual financial

statements, except for those that relate to new standards and

interpretations effective for the first time for periods beginning

on (or after) 1 January 2023 and have been adopted in the 2023

financial statements. There are no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that will have a material impact on the

Group.

Tax charged within the 6 months ended 30 June 2023 has been

calculated by applying the effective rate of tax which is expected

to apply to the Group for the year ending 31 December 2023 as

required by IAS 34.

The financial statements have been prepared on the historical

cost basis except for, where disclosed in the accounting policies,

certain financial instruments that are measured at fair value. The

financial statements are prepared in US Dollars, which is the

functional currency and presentational currency of the Company.

Monetary amounts in these financial statements are rounded to the

nearest thousand US Dollars (US$'000).

Going concern

The Group has cash and cash equivalents of $14.3m, which is

sufficient to cover its current trade and other payables balance of

$13.9m. Furthermore, the Group has access to a currently undrawn

loan facility of up to $35m. In light of this, the Directors

confirm that they have a reasonable expectation that the Group will

have adequate resources to continue in operational existence for at

least twelve months beyond the issuance of these financial

statements and accordingly these financial statements are prepared

on a going concern basis, with no material uncertainty over going

concern.

3 SEGMENTAL REPORTING

IFRS 8 'Operating Segments' requires that operating segments be

identified on the basis of internal reporting and decision-making.

The Group identifies operating segments based on internal

management reporting that is regularly reported to and reviewed by

the Chief Executive Officer, which is identified as the chief

operating decision maker. Management information is reported as one

operating segment, being revenue from self-published franchises and

other revenue streams such as royalties, licensing, development and

events.

Whilst the chief operating decision maker assessed there to be

only one segment, the Company's portfolio of games is split between

those based on IP owned by the Group and IP owned by a third party

and hence to aid the readers' understanding of our results, the

split of revenue from these two categories is shown below.

Game and merchandise royalties 6 months 6 months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Owned IP 12,765 13,107 26,915

Third-party IP 4,690 4,359 13,105

17,455 17,466 40,020

Three customers were responsible for approximately 51% of the

Group's revenues (30 June 2022: three - 70%, 31 December 2022:

three - 67%).

The Group has nine right-of-use assets located overseas with a

carrying value of $272,000 (30 June 2022: six - $374,000, 31

December 2022: seven - $342,000). The Group also has tangible fixed

assets located overseas with a total carrying value of $687,000 (30

June 2022: $212,000, 31 December 2022: $623,000). All other

non-current assets are located in the US.

4 REVENUE 6 months 6 months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

Unaudited Unaudited Audited

An analysis of the Group's revenue $'000 $'000 $'000

is as follows:

Revenue analysed by class of business

Game and merchandise royalties 17,455 17,466 40,020

Development services 5,224 11,134 22,744

Events 616 150 531

23,295 28,750 63,295

5 EARNINGS PER SHARE

The Group reports basic and diluted earnings per common share. Basic

earnings per share is calculated by dividing the profit attributable

to common shareholders of the Company by the weighted average number

of common shares outstanding during the period, which excludes any treasury

shares held by the Group.

Diluted earnings per share is determined by dividing the profit attributable

to common shareholders by the weighted average number of common shares

outstanding, taking into account the effects of all potential dilutive

common shares, including options.

6 months 6 months Year ended

ended 30 ended 30 June 31 December

June 2023 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Total comprehensive (loss)/income attributable

to the owners of the company (25,523) 4,457 11,545

Weighted average number of shares 203,284,429 203,119,680 203,421,359

Basic earnings/(loss) per share ($) (0.126) 0.022 0.057

6 months 6 months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Total comprehensive (loss)/income attributable

to the owners of the company (25,523) 4,457 11,545

Weighted average number of shares 203,284,429 203,119,680 203,421,359

Dilutive effect of share options - 2,135,640 1,481,621

Dilutive effect of warrants - 149,130 -

Dilutive effect of restricted stock

awards - 954,654 954,654

Weighted average number of diluted shares 203,284,429 206,359,104 205,857,634

Diluted earnings/(loss) per share ($) (0.126) 0.022 0.056

Pursuant to IAS 33 'Earnings per Share', options whose exercise

price is higher than the value of the Company's security were not

taken into account in determining the effect of dilutive

instruments. The calculation of diluted earnings per share does not

assume conversion, exercise, or other issue of potential ordinary

shares that would have an antidilutive effect on earnings per

share.

6 ALTERNATIVE PERFORMANCE MEASURES

The Directors of the Group have presented the performance

measures 'Adjusted EBITDA' and 'Adjusted total comprehensive income

attributable to the owners per share' as they monitor these

performance measures at a consolidated level and they believe this

measure is relevant to an understanding of the Group's financial

performance. The Group does not present a 'Diluted Adjusted total

comprehensive income attributable to the owners per share'.

Adjusted EBITDA is calculated by adjusting profit from continuing

operations to exclude the impact of taxation, net finance costs,

share-based payment expenses, depreciation, impairment of

intangible assets, amortisation of purchased intellectual property,

acquisition costs, legal and professional costs associated with the

purchase of subsidiaries and intellectual property, Ukraine related

expenses and fair value gains on contingent consideration

liabilities. Adjusted total comprehensive income attributable to

the owners per share is calculated by adjusting total comprehensive

income attributable to the owners of the company to exclude the

impact of impairment of intangible assets, legal and professional

costs associated with the purchase of subsidiaries and intellectual

property, Ukraine related expenses and fair value gains on

contingent consideration liabilities. Adjusted EBITDA and Adjusted

total comprehensive income attributable to the owners per share are

not defined performance measures in IFRS. The Group's definition of

Adjusted EBITDA and Adjusted total comprehensive income

attributable to the owners per share may not be comparable with

similarly titled performance measures and disclosures by other

entities.

Amortisation of $5.0m (30 June 2022: $3.8m, 31 December 2022:

$5.8m) of software development costs has been included in arriving

at Adjusted EBITDA and Adjusted total comprehensive income

attributable to the owners per share as they are a primary cost in

the company's ordinary course of business.

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Profit/(loss) for the period (25,283) 4,483 11,513

Income tax expense (6,414) 2,306 4,417

Finance costs 16 24 73

Finance income (261) (8) (80)

Share-based payment expenses 367 887 1,726

Amortisation of purchased intellectual

property, brands and customer relationships 2,327 1,754 3,999

Depreciation of property, plant and equipment 496 224 747

Impairment of intangible assets 27,195 - 11,075

Ukraine/Russia conflict related costs 281 - 1,678

Acquisition costs 27 212 329

Other operating income - - (11,122)

Adjusted EBITDA (1,249) 9,882 24,355

6 months 6 months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Total comprehensive (loss)/income attributable

to the owners of the company (25,523) 4,457 11,545

Impairment of intangible assets 27,195 - 11,075

Ukraine/Russia conflict related costs 281 - 1,678

Acquisition costs 27 212 329

Other operating income - - (11,122)

Adjusted total comprehensive income

attributable to the owners of the company 1,980 4,669 13,505

Weighted average number of shares 203,284,429 203,119,680 203,421,359

Adjusted total comprehensive income

attributable to the owners per share

($) 0.010 0.023 0.066

7 INTANGIBLE ASSETS

Purchased Software

Customer intellectual development

Goodwill Brands relationships property costs Total

$'000 $'000 $'000 $'000 $'000 $'000

Cost:

As at 1 January 2022 13,202 1,815 4,261 21,320 30,160 70,758

Additions - internally

generated - - - - 35,789 35,789

Additions - separately

acquired - - - 8,395 - 8,395

Transfers - - - 251 (251) -

As at 31 December 2022 13,202 1,815 4,261 29,966 65,697 114,941

Additions - internally

generated - - - - 16,926 16,926

Additions - business

combinations 2,418 - - - - 2,418

As at 30 June 2023 15,620 1,815 4,261 29,966 82,623 134,285

Amortisation and impairment:

As at 1 January 2022 - 10 51 2,687 10,853 13,601

Amortisation charge for

the year - 121 609 3,269 5,787 9,786

Impairment charge for the

year 9,456 675 - 944 95 11,170

As at 31 December 2022 9,456 806 660 6,900 16,735 34,557

Amortisation charge for

the period - 36 304 1,987 4,996 7,323

Impairment charge for the

period 6,135 - 2,773 - 18,288 27,196

As at 30 June 2023 15,591 842 3,737 8,887 40,019 69,076

Carrying amount:

As at 30 June 2023 29 973 524 21,079 42,604 65,209

As at 31 December 2022 3,746 1,009 3,601 23,066 48,962 80,384

Impairment of goodwill relates to acquisitions made in 2021 and

2023, and impairment of customer relationships relates to a 2021

acquisition. The impairment of software development costs reflects

lower than expected sales and future projections, as well as a

number of games for which development has ceased. The recoverable

amounts of the consolidated entity's goodwill and intangible assets

have been determined by a value-in-use calculation using a

discounted cash flow model, based on an annual projection period

approved by management and extrapolated for a further 4 years,

together with a terminal value. Where the value in use recoverable

amount of the cash-generating units (CGU's) was not sufficient to

support the carrying value, the assets were impaired. The

impairment recognised during the financial period was due to lower

than expected sales and future projections. The following key

assumptions were used in the discounted cash flow model:

-- 13% pre-tax discount rate;

-- 5.4% to 5.5% per annum projected revenue growth rate;

-- 3.0% to 4.7% per annum increase in operating costs and overheads.

8 BUSINESS COMBINATIONS

On 6 April 2023, the Group acquired 100% of the issued share

capital of NotGames Ltd, a private company domiciled and

incorporated in the United Kingdom. NotGames is the development

studio of Not For Broadcast, a critically acclaimed full motion

propaganda simulator. The goodwill of $2,418,000 represents our

bolstered development capabilities in propaganda genres.

Consideration for the acquisition comprised $1,500,000 initial cash

consideration and a further $1,236,000 of contingent consideration

has been recognised in respect of cash and a variable number of

equity instruments which will be issued in the event of the

acquired company meeting certain financial targets in the future.

The fair value of the contingent consideration has been calculated

by estimating the probability of targets being met and discounting

the corresponding liability to its present value. The potential

outcome of the undiscounted contingent consideration ranges between

$Nil and $4,200,000. Acquisition related costs totalling $27,000

have been recognised in profit or loss within general

administrative expenses. The acquired business contributed revenues

of $nil and losses after tax of $207,000 to the Group. If the

business combination took place on 1 January 2023, the contribution

would have been $nil revenue and $187,000 losses after tax.

The fair values of the identifiable assets acquired, and

liabilities assumed at the date of acquisition were:

Fair value

Book value adjustments Total

$'000 $'000 $'000

Property, plant and equipment 40 - 40

Trade and other receivables 42 - 42

Cash and cash equivalents 266 - 266

Trade and other payables (30) - (30)

318 - 318

Goodwill 2,418

2,736

Consideration:

Cash 1,500

Fair value of contingent consideration

liability 1,236

Total consideration 2,736

As disclosed in note 7, intangible assets including goodwill

have been subject to impairment testing due to lower than expected

sales and future projections. Impairments recognised are disclosed

in note 7. The contingent consideration liability is categorised

within level 3 of the fair value hierarchy as one or more inputs

are not based on observable market data, including forecasts. There

has been no change in the fair value of the contingent

consideration from the date of initial recognition up to the

reporting date which requires adjustment, therefore there is no

impact on the income statement for the period. The key unobservable

input in the valuation of the contingent consideration and the

recoverable amount of the goodwill is the discount rate, which

management have estimated to be 13%.

9 SHARE-BASED PAYMENTS

The Group operates two share-based payment plans, the Equity

Incentive Plan and a Stock Restriction Agreement, which are

detailed as follows:

The Stock Restriction Agreement is a plan that provides for

grants of Restricted Stock Awards (RSA) for the founders of the

company and acquired employees. The awarded shares are made in the

Company's ordinary share capital. The fair value of the RSAs is

estimated by using the Black-Scholes valuation model on the date of

grant, based on certain assumptions, and is charged on a

straight-line basis over the required service period, normally two

to three years. The fair value of the 2021 grant is $2.095 per

share. The 2021 RSAs vest over 3 years in a 50:25:25 ratio. Each

instalment has been treated as a separate share option grant

because each instalment has a different vesting period. This plan

is equity-settled. A reconciliation of RSAs is as follows:

30 June 31 December

2023 2022

Opening RSA outstanding 477,327 954,654

RSA granted - -

RSA vested - (477,327)

Closing RSA outstanding 477,327 477,327

Weighted average remaining contractual

life in years 0.92 1.42

The company has an Equity Incentive Plan that provides for the

issuance of non-qualified stock options to officers and other

employees that have a contracted term of 10 years and generally

vest over four years. The stock options are granted on shares

issued by the company. A reconciliation of share option movements

is shown below:

Number Weighted Number Weighted Weighted

of options average of options average average

outstanding exercise exercisable exercise remaining

price ($) price ($) contractual

life (years)

At 1 January 2023 3,547,217 1.02 1,812,394 0.94 7.58

Exercised during the - -

period

Forfeited during the

period (403,685) 0.80

At 30 June 2023 3,143,531 1.06 1,728,204 1.11 7.17

During the period covered by the financial statements, no

options were granted or exercised and no options expired. A total

of 403,685 options were forfeited.

10 SHARE CAPITAL 30 June 31 December

2023 2022

Unaudited Audited

Number Number

Class of share

Ordinary shares of $0.001 each 203,878,238 203,848,987

30 June 31 December

2023 2022

Unaudited Audited

$'000 $'000

Class of share

Ordinary shares of $0.001 each 204 204

204 204

On 17 January 2023, 29,251 Ordinary shares of $0.001 each were

issued to employees for nil consideration. The shares are subject

to a 12 month lock-up period.

11 CASH GENERATED FROM OPERATIONS 6 months

ended 6 months Year ended

30 June ended 31 December

2023 30 June 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Profit/(loss) for the year (25,283) 4,483 11,513

Adjustments for:

Share-based payments 367 887 1,726

Amortisation of intangible assets 7,323 5,577 9,777

Impairment of goodwill 6,135 - 9,456

Impairment of intangible assets 21,061 - 1,714

Gain on contingent consideration - - (11,129)

Depreciation of tangible fixed assets 496 224 747

Loss on disposal of tangible fixed

assets 39 - -

Finance costs 16 24 73

Finance income (261) (8) (80)

Income tax (credit)/expense (6,414) 2,306 4,962

(Decrease)/increase in deferred tax

liability - 371 (545)

Movements in working capital:

Decrease/(increase) in receivables 9,250 (737) (13,778)

(Decrease)/increase in payables (5,075) (3,914) 5,887

Income tax paid (1,365) (402) (1,135)

Cash generated from/(used in) operations 6,289 8,811 19,188

12 RELATED PARTY TRANSACTIONS

An analysis of key management personnel remuneration is set out

below:

Key management personnel remuneration 6 months

ended 6 months Year ended

30 June ended 31 December

2023 30 June 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Aggregate emoluments 1,559 802 2,217

Equity-settled share-based payments 15 61 88

1,574 863 2,305

Transactions with other related parties

The wife of the Company's CEO is a member and manager of DevGAMM

LLC. During the period, DevGAMM LLC paid dividends totalling $Nil

(30 June 2022: $148,000, 31 December 2022: $148,000) to this

related party. There were no other related party transactions

during the period which require disclosure.

13 CONTINGENT LIABILITIES

In November 2021, tinyBuild acquired Versus Evil LLC ("Versus

Evil") and Red Cerberus LLC ("Red Cerberus") from third parties

("claimants"). The claimants allege that tinyBuild breached three

material obligations under the relevant Membership Interest

Purchase Agreement (the "MIPA"). First, the claimants allege that

tinyBuild was obligated and failed to make timely capital

contributions to Versus Evil during fiscal years 2022 and 2023.

Second, the claimants allege that tinyBuild was obligated and

failed to release to the claimants certain funds that were held

back under the terms of the MIPA. Third, the claimants allege that

tinyBuild was obligated and failed to provide material support to

Versus Evil that was promised under the MIPA.

In May 2020, a third party contracted with Red Cerberus to

provide consulting services. tinyBuild acquired Red Cerberus in

November 2021 along with the rights and obligations under the

relevant Consulting Agreement and Nondisclosure Agreement with the

third party. The third party alleges that in 2022, a Red Cerberus

employee misappropriated the claimant's confidential information

while employed by Red Cerberus and asserts potential losses in both

the United States and Brazil. The third party has submitted a

demand for indemnification against such losses to Red Cerberus.

The Group has obtained professional legal advice and considers

that it had strong and convincing arguments for disputing the

claims. At 30 June 2023, management considered probability of

payment to be remote and no provision had been recognised.

14 SUBSEQUENT EVENTS

Subsequent events have been reviewed and evaluated up to the

date that these financial statements were approved and authorised

for issue by the Directors, and there are no material events to be

disclosed or adjusted for in these financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUUPBUPWGRA

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

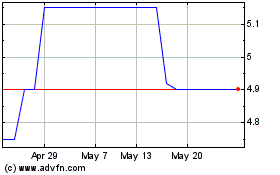

Tinybuild (LSE:TBLD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tinybuild (LSE:TBLD)

Historical Stock Chart

From Nov 2023 to Nov 2024