TIDMSURE

RNS Number : 6293Z

Sure Ventures PLC

15 September 2022

Sure Ventures plc ('Sure Ventures' or 'the Company')

Portfolio Update Q2 2022, NAV Calculation and Director

commentary

Sure Ventures is a London listed venture capital fund which

invests in early stage software companies in the rapidly growing

technology areas of Augmented Reality ('AR'), Virtual Reality

('VR'), Internet of Things ('IoT') and Artificial Intelligence

(AI). We are pleased to provide an update on the Company's

investment portfolio.

SURE VALLEY VENTURES FUND

Sure Ventures made a EUR7million commitment to Sure Valley

Ventures Fund ('Sure Valley') representing an interest in Sure

Valley of approximately 25.9%. This commitment was made at a price

of EUR1.00 per share. The current NAV of the Sure Valley Ventures

ICAV is EUR1.47 which is a 2.836%% decrease from its NAV as at Q1

2022.

Sure Valley has several investments across the AI, AR, VR and

IoT sectors and the major contributing factors and commentary on

underlying companies that has driven this NAV calculation are as

follows:

Admix/Landvault

Admix merged with Landvault, a builder in metaverse worlds like

The Sandbox and Decentraland as it pivots to Web 3. The combined

company will be known as Landvault. By merging with Laundvault,

Admix aims to become a go-to service provider for major

intellectual property holders and brands enabling big companies

across all industries to enter the metaverse and be monetised with

Admix's in-game advertising technology.

Admix completed a re-organisation of the team and also have

integrated the LandVault

Management Team. This strategic move has led to a significantly

improved margins and they have been successful in winning clients

with major world wide brands.

GetVisibility

In March 2022 Getvisibility closed a Series A round of

EUR10,000,000 led by AIC which included

Fortino Capital and as well as follow-on investment from Sure

Valley Ventures, Pires Investments

and Manifold Investments Limited among others.

Getvisibility has also expanded its pipeline by $6M and has

onboarded 31 new channel partners across 7 countries. Getvisibility

recently expanded its product offering by adding Google's platform

capabilities and a new Data Breach Risk report which will help

businesses measure and benchmark their security and data governance

capabilities.

Volograms

The mobile AR market is forecast to grow from the one billion

compatible devices and over $8 billion in revenue in 2019 to 2.5

billion compatible devices and $60 billion in revenue by 2024. The

Volograms mobile product will enable mobile phone users to take AR

pictures and videos, then view, edit and share them with others.

This can be done directly or through social media platforms. Thus,

the product is an end user or consumer product but the planned

route to market will be through mobile OEMs.

We believe that Volograms is opening a new market category for

AR photos and video. This

category should have much greater appeal for content creators

and social media users than the

existing static 3D content solutions on offer

Listed holdings

Equity markets have been volatile, and both Engage XR (EXR.L)

and Immotion PLC (IMMO.L) traded lower on a quarter-on-quarter

basis. The AIFM are happy with both positions and are long term

investors. Both listed entities are producing strong revenue growth

and market adoption.

Immotion PLC: the company's LBE business is currently enjoying

very strong trading in the key summer period, with unaudited July

2022 revenue of GBP1.3m being the division's best ever month. This

takes unaudited LBE revenue for the seven months to 31 July 2022 to

GBP5.7m, a 78% increase from GBP3.2m in the equivalent period in

2021.

completed two small-scale installations at Chester Zoo and

Legoland Discovery Center Philadelphia and so the Group now has 488

seats across 54 locations. The Group has visibility on a pipeline

of new sites and additional seats at certain existing sites. Should

all these developments materialise, the Directors expect that the

Group will comfortably pass the 500 seat mark by the end of H2

2022.

ENGAGE XR reported their Interim results for the period to June

2022 and were inline with market expectations. Total revenue for

the Group up c.41% to EUR1.76m (H1 2021: EUR1.25m) with Engage

revenue up 62%. The gross margin sits at a very healthy 81% and the

company had 4.9m Euros of cash.

The number of commercial customers has increased to over 180

since ENGAGE's launch in May 2019 with over 50 customers added in

2022. US Partner VictoryXR has launched 10 'Metaversities' funded

by Meta and built on the ENGAGE platform and now has 24/5 customer

support with teams in the US, Australia, and Europe available to

support customers.

SURE VALLEY VENTURES ENTERPRISE CAPITAL FUND

During the first quarter of 2022 Sure Ventures PLC also made a

commitment of GBP5m to the Sure Valley Ventures Capital Fund. The

fund has launched, and the first investment was made in a company

called RETìníZE on the 16(th) of March 2022.

Retinize are developing an innovative software product called

Animotive that is harnessing the latest VR technologies to

transform the 3D animation production process. The proceeds of the

seed round will drive the next two-year step in its growth and the

global rollout of Animotive.

The seed round, led by the SVV Software Fund's GBP1 million

investment, marks the first investment from this fund which

recently announced its first close of GBP85 million, which included

a cornerstone GBP50 million investment from the British Business

Bank, an investment arm of the UK Government.

Sure Ventures PLC NAV

The Sure ventures PLC NAV at the end of June 2022 sits at

125.75p. This represents a 2.443% decrease across the period, down

from 128.9p per share at the end of Q1. This decrease represents

costs and changes to the value of its listed holdings in Engage XR

and Immotion PLC.

Forward looking statement & Director comment

When calculating the NAV for both Sure Valley Ventures and Sure

Ventures PLC we do not re-rate an unlisted investee company

valuation unless there is a funding round priced by another

investor. The nature and stage of the software companies that we

invest requires patience and we are now starting to see these

businesses mature at a strong pace. The pipeline of deals for Sure

Valley ventures Enterprise Capital fund remains robust.

Gareth Burchell comment

"Sure Valley Ventures and its portfolio of deep technology

companies continue to perform well in what are difficult economic

circumstances. There are a number of our companies that are looking

to their next stage growth, scaling up the commercialisation of

their product offering and we are confident of continued growth in

Q3 2022 "

For further information, please visit www.sureventuresplc.com or

contact:

Gareth Burchell

Sure Ventures plc

+44 (0) 20 7186 9918

Notes to Editors

Sure Ventures plc listed on the London Stock Exchange in January

2018 giving retail investors access to an asset class that is

usually dominated by private venture capital funds. Sure Ventures

is focusing on companies in the UK, Republic of Ireland and other

European countries, making seed and series A investments in

companies with first rate management teams, products which benefit

from market validation with target revenue run rates of at least

GBP400,000 over the next 12 months. Website:

https://www.sureventuresplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUUVVRRUKUKAAR

(END) Dow Jones Newswires

September 15, 2022 07:01 ET (11:01 GMT)

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Nov 2024 to Dec 2024

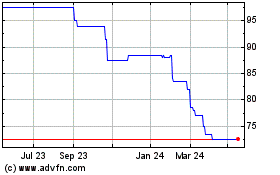

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Dec 2023 to Dec 2024