TIDMSSTY

RNS Number : 5854N

Safestay PLC

26 September 2023

26 September 2023

Safestay plc

("Safestay", the "Company" or the "Group")

Interim Results

Safestay (AIM: SSTY), the owner and operator of an international

brand of contemporary hostels, is pleased to announce its Interim

Results for the 6 months to 30 June 2023.

'Strong demand from not only young travellers but also families

and business travellers'

H1 Highlights

-- Recorded strong revenues of GBP10.5 million (2022: GBP7.3

million) outperforming pre-pandemic levels (2019: GBP8.1

million)

-- Delivered with an occupancy rate of 68.5% (2022: 51%), still

lower than historic levels pre-COVID, but REVPAB is GBP16.06 (2022:

GBP11.77) compared to GBP15.47 in 2019.

-- Significant increase in average bed rate (ABR) to GBP23.44 (2022: GBP21.5)

-- Generated EBITDA of GBP2.6 million (2022: GBP2.5 million)

held back by a one-off payroll increase and abnormally high energy

costs.

-- Cash at bank of GBP7.3 million as at 30 June 2023 (2022: GBP5.2 million)

-- As at 30 June 2023, accounting net asset value per share was

41.6p (30 June 2022: 44.6p per share). This was casued by the loss

after tax and unrealised foreign exchange losses but is not

reflective of market valuations for property assets which remain

firm.

H2 Trading & Outlook

-- Strong summer with sales in July and August up 11% and 16%

respectively on 2022 and forward bookings for the remainder of 2023

significantly ahead of last year

-- Diversifying mix of customers as families and business

travellers choose hostels for greater value accommodation

-- Focus on driving organic growth across the business,

established a new office in Warsaw to focus solely on attracting

group bookings from colleges, schools and universities

-- Launch of new website in July 2023 set to drive direct sales

-- Continuing to seek earnings enhancing acquisitions

Larry Lipman, Chairman of the Group, commenting on the results

said:

"It was difficult to know if our strong performance in 2022 was

due to a one-off bounce back from the pandemic or the return to

normal trading. Based on our performance so far in 2023, it is

clear we have returned to a healthy market with some key points of

difference. Having been through the pandemic, we have re-emerged as

a leaner, financially stronger business with an excellent portfolio

of premium hostels in prime locations. Added to this, demand has

been strong and pricing has improved by c.20% since 2019 which has

enabled us to generate new sales records. With occupancy still

below 2019 and school and college groups still to come back to

historic levels, there remains plenty of scope for further

growth."

Enquries

+44 (0) 20 8815

Safestay plc 1600

Larry Lipman

Liberum Capital Limited

+44 (0) 20 3100

(Nominated Adviser and Broker) 2000

Andrew Godber/Edward Thomas

+44 (0) 20 3151

Novella 7008

Tim Robertson

Safia Colebrook

For more information visit our:

Website www.safestay.com

Vox Markets page

https://www.voxmarkets.co.uk/company/SSTY/news/

Instagram page www.instagram.com/safestayhostels/

Chairman's Statement

Introduction

The business has come back strongly since the pandemic and these

results for the six months to 30(th) June 2023 show the business

delivering, with a particularly good sales performance, up by 44%

against 2022 and by 30% against 2019. This reflects our customers'

desire to continue to travel and visit the famous cities of Europe,

where our premium hostels in city centre locations are proving

attractive, especially in these economically challenging times.

Good demand continued into the key summer months of July and August

during which the Group achieved occupancy levels of 85%. Overall,

the Group is comfortably placed to achieve market expectations for

the current year.

Financial review

The Group generated revenues of GBP10.5 million (2022: GBP7.3

million), leading to EBITDA of GBP2.6 million (2022: GBP2.5

million). EBITDA margin was 25% (2022: 34%) reduced by an increase

in payroll costs and higher energy costs. Payroll costs in 2022

were abnormally low due to the difficult recruitment market, so

this is a one-off post pandemic inflationary impact on payroll

costs that has now stabilised. Also, new two year UK electricity

contracts have now reduced annual energy bills by GBP0.2 million.

Rental agreements with landlords have normalised and overall, the

cost base is steady.

The Group recorded a loss before tax of GBP1.0 million (2022:

loss of GBP0.3 million) and a loss per share of 1.4p (2021: loss of

0.5p), primarily reflecting the recent interest rate increases. As

always, the majority of income is generated in the second half of

the year.

Group bank borrowings as at 30 June 2023 were GBP16.6 million

with cash at bank of GBP7.3 million. The primary loan is due for

renewal in January 2025 and the refinancing process for this is now

in progress. The directors expect to obtain at least similar terms

to the current facility. The value of the Group's portfolio of

properties further underpins the Group's finances. The Directors

believe that the valuations of both the Elephant & Castle site

of GBP26.8m and the combined Glasgow, Pisa and York freehold sites

of GBP11.9 million have not changed since the December 2022

accounts.

As at 30 June 2023, accounting net asset value per share was

41.6p per share (30 June 2022: 44.6p per share), which is not

reflective of freehold valuations which remain firm as can be seen

from the examples above.

Operational review

Safestay operates 16 sites, offering 3,251 beds across 11

European and 3 UK cities. The first six months have clearly shown

that the business is again moving forward with good prospects to

grow both organically and via acquisition.

Growth depends on increasing demand and this continues to be

driven largely by young people looking to explore Europe's

principal cities, and wishing to stay in clean, centrally located

and attractive surroundings for a reasonable price. These young

people are made up of Millennials, Generation Z and organised

groups coming from schools and universities. They are typically

technologically savvy, working to short decision time frames,

socially active and price conscious. Safestay looks to match these

characteristics, with significantly improved online marketing

across social media platforms and the group website, showcasing the

unique portfolio and making booking easy for stays in single or

multiple hostels. These features are decreasing the Group's

reliance on online travel agents.

One area of difference post pandemic has been the volume of

group bookings. Pre-pandemic, group bookings made up 38% of room

revenue in 2019 whereas group bookings in the period under review

were 13%. There is therefore an opportunity to re-build group

bookings and in August, a new office was opened in Warsaw dedicated

to targeting group sales.

Occupancy was 68.5% in H1, against 51% last year, a very good

performance especially when combined with an average room rate of

GBP23.44 and as shown by a REVPAB of GBP16.06 Occupancy naturally

increases over the summer and so the average for the year will be

higher, but still below the average achieved in 2019 of 71%, which

provides a good indication of the headroom for further growth.

Average bed rate has increased by c. 20% since 2019 and is a key

driver of growth, in part due to the successful application of

dynamic pricing under the PricePoint system which re-calculates

pricing based on demand every two minutes. Business on the books is

significantly higher at this point than 2022 and it is expected

that it will be approximately GBP1m higher at the year end than

2022.

Under the guidance of our Chief Operating Officer, Peter Zielke,

who joined the Group in February 2023, a primary aim has been to

lift all operational standards across the portfolio and create

unique experiences for our guests. Amongst areas of focus are

customer engagement, area management reviews, health & safety

and HR. Each of these has received specific attention with the

Group importing proven systems, which in general have been used

previously by the Management, to track performance and digitalise

tasks where appropriate.

Since 1 January 2023, the Group has returned to an annual capex

budget equivalent to 3% of annual turnover. This is essential to

maintaining the Group's reputation as a leading premium hostel

operator and to protecting the quality of the portfolio by ensuring

that the buildings themselves and the contents within remain in

excellent condition.

Safestay is an experienced acquirer of hostels and well-

positioned to take advantage of current market conditions as the

supply of hostels and other buildings capable of being converted to

hostels come to the market, but only if all internal criteria are

met.

Overall, the core offer of a comfortable and safe stay in

beautiful, often iconic buildings that are centrally located, in

well-known and popular cities but still with a bed rate of around

just GBP23, is unchanged. This combination remains the main driver

of our business and the focus of our marketing efforts.

Outlook

We are very pleased with the progression of the business since

we were allowed to re-open post pandemic. Arguably, the Group is

better positioned than before, having had to rebuild the business

and done so with the benefit of doing something for the second

time. Our trading results for the first half of the year and the

first two months of the summer show we are comfortably on track for

the year and that we are well placed to continue to increase

occupancy and average bed rate into 2024.

Larry Lipman

Chairman

26 September 2023

Condensed consolidated statement of comprehensive income

Unaudited Unaudited Audited Year

6 months to 6 months to to 31 December

30 June 2023 30 June 2022 2022

Note GBP000s GBP000s GBP000s

------------- ------------- ---------------

Revenue 2 10,472 7,286 19,146

Cost of sales (1,882) (906) (3,142)

Gross profit 8,589 6,380 16,004

Administrative expenses (7,948) (5,759) (13,801)

Exceptional Costs - - (369)

Total administrative expenses (7,948) (5,759) (14,170)

------------- ------------- ---------------

Operating profit / (loss) after exceptional expenses 3 642 620 1,834

Interest received 11 1 2

Finance costs (1,655) (960) (2,559)

Loss before tax (1,002) (339) (723)

Tax 119 (5) 441

------------- ------------- ---------------

Loss after tax (883) (344) (282)

============= ============= ===============

Exchange differences on translating foreign operations (1,901) (969) 134

============= ============= ===============

Total comprehensive profit / (loss) for the period attributable

to owners of the parent company (2,784) (1,313) (148)

============= ============= ===============

Basic / diluted loss per share (1.36p) (0.53p) (0.44p)

============= ============= ===============

Condensed consolidated statement of Unaudited Unaudited Audited

financial position

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

--------- --------- -----------

Non-current assets

Property, plant and equipment 68,309 73,974 72,059

Intangible assets 9 11 9

Goodwill 11,663 12,145 12,014

Lease assets 440 500 453

Deferred tax asset 1,814 1,126 1,379

Total non-current assets 82,235 87,755 85,914

--------- --------- -----------

Current assets

Stock 26 44 25

Trade and other receivables 707 605 1,121

Lease assets 135 105 139

Current tax asset 49 199 65

Cash and cash equivalents 7,261 5,215 5,226

Total current assets 8,176 6,168 6,576

--------- --------- -----------

Total assets 90,411 93,923 92,490

Current liabilities

Borrowings 1,108 574 925

Lease liabilities 1,810 2,033 1,764

Trade and other payables 5,535 2,236 3,128

Total current liabilities 8,453 4,843 5,817

--------- --------- -----------

Non-current liabilities

Borrowings 22,554 24,140 23,101

Lease liabilities 29,030 32,783 30,450

Deferred tax 3,347 3,287 3,364

Total non-current liabilities 54,931 60,210 56,915

--------- --------- -----------

Total liabilities 63,384 65,052 62,732

--------- --------- -----------

-

Net assets 27,027 28,871 29,758

--------- --------- -----------

Equity

Share capital 649 647 647

Share premium account 23,959 23,904 23,904

Other components of equity 16,513 17,590 18,417

Retained earnings (14,093) (13,271) (13,210)

--------- --------- -----------

Total equity attributable to owners

of the parent company 27,027 28,871 29,758

========= ========= ===========

Condensed consolidated statement of changes in equity

For the six months to 30 June 2023

Share Share premium Other Components Retained Total

Capital account of Equity earnings Equity

GBP000 GBP000 GBP000 GBP000 GBP000

-------- ------------- ---------------- --------- -------

Balance at 1 January 2023 647 23,904 18,417 (13,210) 29,758

Comprehensive income

(Loss) for the period - - - (883) (883)

Movement in translation reserve - - (1,901) - (1,901)

Total comprehensive income - - (1,901) (883) (2,784)

-------- ------------- ---------------- --------- -------

Transactions with owners

Share Issue 2 54 (24) - 32

Share-based payment charge

for the period - - 21 - 21

-------- ------------- ---------------- --------- -------

Balance at 30 June 2023 649 23,959 16,513 (14,093) 27,027

======== ============= ================ ========= =======

Share Share premium Other Components Retained Total

Capital account of Equity earnings Equity

GBP000 GBP000 GBP000 GBP000 GBP000

-------- ------------- ---------------- --------- -------

Balance at 1 January 2022 647 23,904 18,510 (12,928) 30,133

Comprehensive income

(Loss) for the period - - - (343) (343)

Movement in translation reserve - - (969) - (969)

Total comprehensive income - - (969) (343) (1,312)

Transactions with owners

Share-based payment charge

for the period - - 49 - 49

-------- ------------- ---------------- --------- -------

Balance at 30 June 2022 647 23,904 17,590 (13,271) 28,871

======== ============= ================ ========= =======

Share Share premium Other Components Retained Total

Capital account of Equity earnings Equity

GBP000 GBP000 GBP000 GBP000 GBP000

-------- ------------- ---------------- --------- -------

Balance at 1 January 2022 647 23,904 18,510 (12,928) 30,133

Loss for the year - - - (282) (282)

Other comprehensive income

Movement in translation reserve - - (134) - (134)

-------- ------------- ---------------- --------- -------

Total comprehensive loss - - (134) (282) (416)

Transactions with owners

Share based payment charge

for the period - - 42 - 42

Balance at 31 December 2022 647 23,904 18,417 (13,210) 29,758

======== ============= ================ ========= =======

Condensed consolidated statement Unaudited Unaudited Audited

of cash flows

Note 6 months 6 months Year

to 30 June to 30 to 31

2023 June 2022 December

2022

GBP000 GBP000 GBP000

----------- ---------- ---------

Operating activities

Cash generated from operations 3 4,969 2,939 6,130

Income tax paid 28 4 133

----------- ---------- ---------

Net cash generated from operating

activities 4,997 2,943 6,263

----------- ---------- ---------

Investing activities

Purchase of property, plant and equipment (183) (176) (365)

Purchase of intangible assets - - (5)

Net cash outflow from investing

activities (183) (176) (370)

----------- ---------- ---------

Cash flows from financing activities

Repayment of bank loans (500) (250) (997)

Principal elements of lease payments (1,505) (1,678) (3,495)

Interest paid (775) (106) (656)

(2,780) (2,034) (5,148)

----------- ---------- ---------

Cash and cash equivalents at beginning

of period 5,226 4,482 4,482

Net increase in cash and cash equivalents 2,035 733 744

----------- ---------- ---------

Cash and cash equivalents at end

of period 7,261 5,215 5,226

=========== ========== =========

1 ACCOUNTING POLICIES FOR THE GROUP AND COMPANY FINANCIAL STATEMENTS

Safestay plc is listed on the AIM market of the London Stock

Exchange and was incorporated and is domiciled in the UK.

The Group and Company interim financial statements have been

prepared in accordance with UK-adopted International Accounting

Standards

Financial information contained in this document does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 ("the Act"). The statutory accounts for the

year ended 31 December 2022 have been filed with the Registrar of

Companies. The report of the auditors on those statutory accounts

was unqualified, and did not contain a statement under section

498(2) or (3) of the Act.

The financial information for the six months ended 30 June 2023

and 30 June 2022 is unaudited.

These condensed interim financial statements do not include all

the information required for full annual financial statements and

should be read in conjunction with the Group's consolidated annual

financial statements for the year ended 31 December 2022.

The financial statements have been presented in sterling,

prepared under the historical cost convention, except for the

revaluation of freehold properties and right of use assets.

The accounting policies have been applied consistently

throughout all periods presented in these financial statements.

These accounting policies comply with each IFRS that is mandatory

for accounting periods ending on 31 December 2022.

New standards and interpretations effective in the year

No new standards have been implemented this year that have a

material impact on the business.

2 SEGMENTAL ANALYSIS

Unaudited Unaudited Audited

6 months 6 months Year to 31

to 30 June to 30 June December 2021

2023 2022 2022

GBP000 GBP000 GBP000

----------- ----------- --------------

Hostel accommodation 9,463 6,564 17,150

Food and Beverages sales 697 495 1,109

Other income 312 227 517

Total Income 10,472 7,286 18,776

----------- ----------- --------------

UK Spain Europe Shared services Total

Unaudited 6 months to 30 June 2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 3,556 2,477 4,438 - 10,472

-------- -------- -------- --------------- --------

Profit/(loss) before tax 931 96 444 (2,473) (1,002)

Add back: Finance costs 98 - 16 1,530 1,644

Add back: Depreciation & Amortisation 298 549 615 511 1,973

-------- -------- -------- --------------- --------

EBITDA 1,327 645 1,075 (433) 2,615

Exceptional & Share based payment expense - - - 21 21

Adjusted EBITDA 1,327 645 1,075 (412) 2,636

-------- -------- -------- --------------- --------

Total assets 34,969 16,335 24,309 14,798 90,411

-------- -------- -------- --------------- --------

Total liabilities (12,227) (12,168) (12,681) (26,306) (63,384)

-------- -------- -------- --------------- --------

Unaudited 6 months to 30 June 2022 UK Spain Europe Shared services Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 2,657 1,813 2,816 - 7,286

-------- -------- -------- --------------- --------

Profit/(loss) before tax 509 403 456 (1,706) (338)

Add back: Finance costs 160 244 203 353 960

Add back: Depreciation & Amortisation 404 636 670 198 1,908

-------- -------- -------- --------------- --------

EBITDA 1,073 1,283 1,329 (1,155) 2,530

Exceptional & Share based payment expense 49 - - - 49

Rent concessions - (24) - - (24)

Adjusted EBITDA 1,122 1,259 1,329 (1,155) 2,555

-------- -------- -------- --------------- --------

Total assets 34,456 20,739 26,206 12,522 93,923

-------- -------- -------- --------------- --------

Total liabilities (11,653) (13,916) (12,687) (26,796) (65,052)

-------- -------- -------- --------------- --------

Audited 12 months to 31 December 2022 UK Spain Europe Shared services Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 6,864 4,464 7,818 - 19,146

-------- -------- -------- --------------- --------

Profit/(loss) before tax 2,574 278 1,007 (4,583) (724)

Add back: Finance costs 191 1 59 2,306 2,558

Add back: Depreciation & Amortisation 253 1,045 1,370 987 3,654

-------- -------- -------- --------------- --------

EBITDA 3,018 1,324 2,436 (1,290) 5,488

Exceptional & Share based payment expense 411 411

Adjusted EBITDA 3,018 1,324 2,436 (878) 5,900

-------- -------- -------- --------------- --------

Total assets 36,539 16,570 25,233 14,147 92,490

-------- -------- -------- --------------- --------

Total liabilities (9,164) (12,088) (12,672) (28,808) (62,732)

-------- -------- -------- --------------- --------

3. NOTES TO THE CASHFLOW STATEMENT

Unaudited Unaudited Audited

6 months 6 months Year to

to 30 June to 30 June 31 December

2023 2022 2022

GBP0 GBP0 GBP0

----------- ----------- ------------

Loss before tax (1,002) (283) (724)

Adjustments for:

Depreciation of property, plant

and equipment and 1,973 1,908 3,586

amortisation of intangible assets

Finance costs 1,644 960 2,558

Share-based payments 21 - 42

Exchange movements (506) 43 (836)

Lease Modification - - 280

Rent Concessions - (24) -

Changes in working capital

Decrease/(Increase) in inventory 1 (9) 11

(Increase)/Decrease in trade receivables 431 622 154

Increase/(Decrease) in trade and

other payables 2,408 (272) 1,059

----------- ----------- ------------

Cash generated from operating

activities 4,969 2,939 6,130

----------- ----------- ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUMWBUPWGQA

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

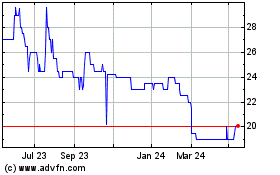

Safestay (LSE:SSTY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Safestay (LSE:SSTY)

Historical Stock Chart

From Nov 2023 to Nov 2024