Safestay PLC Trading Statement (6478B)

February 03 2020 - 2:00AM

UK Regulatory

TIDMSSTY

RNS Number : 6478B

Safestay PLC

03 February 2020

3 February 2020

Safestay plc

("Safestay", the "Company" or the "Group")

FY19 Trading Statement

Safestay (AIM: SSTY), the owner and operator of an international

brand of contemporary hostels, is pleased to announce a successful

trading period for the 12 months to 31 December 2019, recording

significant increases in revenues, occupancy and EBITDA.

FY19 Highlights

-- 25% growth in total revenues to GBP18.3 million (2018:

GBP14.6 million) with like for like revenues up 7%

-- 11% increase in adjusted EBITDA* to GBP3.8 million (2018: GBP3.4 million)

-- 77.3% occupancy achieved over the period, up from 75.6%, reflecting good demand

-- 5% increase in average bed rate to GBP21.3 (2018: GBP20.3)

-- 43% growth in F&B revenues now representing 14% of total revenues

-- Completed 6 transactions, adding 8 hostels increasing the

portfolio to 21 sites and over 5,100 beds

-- Europe now represents 49% of sales (2018: 43%)

* adjusted EBITDA excludes one-off, non-recurring expenditure

which would otherwise distort the metric for comparison

purposes

Larry Lipman, Chairman of Safestay, said, "In 2019 we near

doubled the size of the Safestay network. In doing so, the Safestay

brand has become Europe's leading premium hostel network totalling

21 sites, all in sought-after central locations in the UK and

Europe's best known cities. The brand is now well established and

positioned to sell over a million bed nights in 2020 in unique

hostels ranging from Edinburgh to Athens.

Trading in 2019 was good, all key indicators were strongly

positive, in particular the organic growth performance, and

critically we have yet to really benefit from the recent

acquisitions agreed towards the end of the year. Safestay is

therefore well placed to grow substantially in 2020 and take

advantage of the increasing popularity of the modern hostel

sector."

Trading performance

The business performed well in 2019, achieving 25% growth in

sales. Demand has been consistent across the business with

occupancy now averaging 77.3%, helped by a 50% increase in direct

web bookings driven by the Company's booking engine and website

which were refreshed in early 2019.

F&B, previously identified as a growth opportunity, was up

43% in 2019 and supported by the refurbishment of 3 restaurants in

Barcelona, Elephant & Castle and Edinburgh. These enhancements

were part of the GBP1.8 million refurbishment and renovations

programme across 2019 and 2020. Re-investment is core to

maintaining the premium status of Safestay amongst the hostel

market and the ongoing high levels of guest satisfaction.

The integration of the new hostels acquired in 2019 is

proceeding well with the investment made over the last three years

in centralised IT and booking systems and the integration

experience the Group has gained, ensuring that the incoming sites

can be integrated efficiently, and immediately benefit from the

Group's economies of scale.

In January 2020, a new 5 year GBP23 million loan facility was

agreed with HSBC. The new facility is on the same terms and

replaces the GBP18 million 5 year loan facility agreed in 2017 also

with HSBC and with an interest rate of 2.45% + LIBOR, providing the

Company with additional headroom to support its commercial

objectives.

Further to the announcement made on 18 December 2019, the

acquisition of the Bratislava and Warsaw Hostels from Dreamgroup

Management E.C.P. Ltd for a total consideration of EUR2.7 million

has been completed. The completion of the acquisition of the third

hostel of the Dream portfolio, which is located in Prague, will

take place in the next weeks.

Outlook

The financial performance and the investment made in 2019 has

created real momentum going into 2020. While still very early in

the year, performance in the first month of 2020 and forward

bookings for Q1 are very encouraging, a positive signal for the

coming year, which will also benefit from the acquisitions made

last year.

Current Network

Region Location Beds Leasehold/Freehold

UK Edinburgh 618 Finance lease

Glasgow* 200 Freehold

London "Kensington 345 Finance lease

Holland Park"

London "Elephant and 491 Finance lease

Castle"

York 151 Freehold

======================== ====== ===================

Europe Athens 132 Leasehold

Barcelona "Passeig 380 Leasehold

de Gràcia"

Barcelona "Gothic 132 Leasehold

Quarter"

Barcelona "Sea" 96 Leasehold

Berlin* 168 Leasehold

Bratislava 124 Leasehold

Brussels* 196 Leasehold

Lisbon 150 Leasehold

Madrid 228 Leasehold

Pisa 171 Freehold

Prague "Charles Bridge" 150 Leasehold

Vienna* 137 Leasehold

Warsaw 158 Leasehold

======================== ====== ===================

Total Operating 18 4,027

======================== ====== ===================

Prague "Museum" (Q1 204 Leasehold

2020)

Paris (2020) 246 Leasehold

Venice (2022) 660 Freehold (JV)

======================== ====== ===================

Total under development 3 1,110

======================== ====== ===================

Total Network 21 5,137

======================== ====== ===================

*bed stock after completion of the conversion / renovation in

Vienna, Brussels, Glasgow and Berlin, all due to complete in Q1

2020

Enquiries

Safestay plc +44 (0) 20 8815 1600

Larry Lipman

Liberum Capital Limited

(Nominated Adviser and Broker) +44 (0) 20 3100 2000

Andrew Godber/Edward Thomas/Laura Hamilton

Novella +44 (0) 20 3151 7008

Tim Robertson

Fergus Young

For more information visit our:

Website www.safestay.com

Vox Markets page

https://www.voxmarkets.co.uk/company/SSTY/news/

Instagram page www.instagram.com/safestayhostels/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTEAXFFDAEEEFA

(END) Dow Jones Newswires

February 03, 2020 02:00 ET (07:00 GMT)

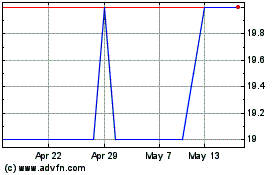

Safestay (LSE:SSTY)

Historical Stock Chart

From Aug 2024 to Sep 2024

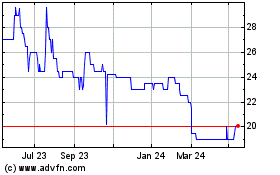

Safestay (LSE:SSTY)

Historical Stock Chart

From Sep 2023 to Sep 2024