TIDMSQS

RNS Number : 7726L

SQS Software Quality Systems AG

30 April 2015

30 April 2015

SQS Software Quality Systems AG

("SQS" or the "Company")

Acquisition of Trissential LLC ("Trissential")

SQS Software Quality Systems AG (AIM:SQS.L), the world's largest

supplier of software quality services, announces that it has

conditionally agreed to acquire the entire issued share capital of

Trissential LLC. for a maximum consideration of $30.7 million (the

"Acquisition"). The Acquisition consideration will be satisfied

through a combination of existing cash, a new credit facility and

new SQS shares.

Trissential is a leading IT project, programme and portfolio

management consultancy in the Mid-West region of the United States

("US"), with a presence in Minneapolis, Milwaukee and Chicago.

Trissential operates across four principal sectors, with a strong

alignment to SQS's existing strength in manufacturing, while adding

significant expertise in retail, energy and healthcare. In the year

ended 31 December 2014, Trissential recorded revenues of $32.3

million and profit before tax of $1.6 million.

Acquisition Rationale

The Acquisition provides SQS with a substantial and stable

revenue platform, supporting SQS's stated strategy of diversifying

its geographic revenue split by materially enhancing its operations

in the US. For the 12 months to 31 December 2014, SQS generated

EUR12.3m revenue in the US, accounting for 5% of total group

revenue.

The Acquisition will approximately quadruple SQS's existing

onsite delivery capability in the United States and adds

significant exposure to the active IT services market in the

Mid-West region. Importantly, Trissential brings with it

established and valuable relationships with a range of customers.

From this base, SQS will seek to develop further business for its

testing activities, including SQS's offshore capability.

Trissential is expected to add materially to SQS's US revenue

contribution in the current financial year.

Trissential brings with it a strong management team headed by

Keith Korsi, Managing Director. Keith will continue to lead the

Trissential business under SQS's ownership.

Acquisition Consideration

The consideration for the Acquisition will be satisfied by a

combination of cash and SQS shares. Under the terms of the

Acquisition, SQS will pay the vendors of Trissential an initial

consideration of $17.7 million, comprising a cash payment of $11

million, to be funded from existing cash and a new credit facility,

and $6.7 million payable in shares, equating to the issue of

737,804 Ordinary Shares, based on the average middle market closing

price of SQS shares during the 20 business days preceding 29 April

2015 (and converted into US dollars at the exchange rate prevailing

on each day) (the "Reference Share Price").

A further $3 million of consideration will be payable, subject

to any indemnity claims, in SQS shares, based on the Reference

Share Price, between 18 and 24 months from the completion date of

the Acquisition.

Finally, earn-out consideration of up to $10 million (the

"Earn-out Consideration") will be payable subject to the

achievement of certain performance-related targets over next three

years. The Earn-out Consideration will be payable within 90 days

from the end of the earn-out period which ends 36 months following

completion, and satisfied as to 55 per cent in cash and 45 per cent

in new SQS shares, the number of which will be calculated using the

Reference Share Price.

Application will be made for the Initial Consideration Shares to

be admitted to trading on AIM following completion of the

Acquisition. All consideration shares to be issued to the vendors

of Trissential in connection with the Acquisition will be subject

to orderly market trading provisions that 25% of the consideration

shares can be sold in each 6 month period after the date of

receipt, except in the relation to any sale by the vendors of SQS

shares to meet such tax liabilities that may arise in relation to

the Acquisition.

SQS intends on retaining Trissential's separate legal status for

the foreseeable future. From an accounting perspective, Trissential

will be consolidated into the SQS group in full.

It is expected that the Acquisition will complete in June

2015.

Commenting on the Acquisition, Diederik Vos, Chief Executive

Officer of SQS said: "We are delighted to welcome Trissential to

the SQS group; it strengthens our existing foothold and capability

in the United States and immediately significantly enhances our

scale in North America, a key stated strategic objective for this

year.

"Trissential's strong management team has built a highly

successful IT project, programme and portfolio management business

in the Mid-West, with a suite of long standing, high quality

customers bringing with them a strong recurring revenue stream.

"We are very pleased that Keith Korsi will continue to lead the

Trissential business. We believe that this Acquisition will support

the strategic build out of specialist consulting both in the US and

globally in line with our strategic goals as well as providing a

strong platform to further develop our testing business in the key

US market."

Commenting on the Acquisition, Keith Korsi, Founder and Chief

Executive Officer of Trissential said:

"The Acquisition by SQS marks a significant milestone in the

evolution of Trissential. We are delighted to be joining the SQS

team, given not only the obvious synergies between our

organisations but also the clear opportunities for expanding our

capabilities and offerings to our and SQS's customers, which we

believe will fuel our growth in the US market."

Enquiries:

SQS Software Quality Systems AG Tel. +49 (0) 2203 91

54 0

Diederik Vos, Chief Executive Officer

Rene Gawron, Chief Financial Officer

Canaccord Genuity - Nomad and Joint Broker Tel +44 (0) 20 7523

8000

Simon Bridges / Peter Stewart / Emma Gabriel

Westhouse Securities - Joint Broker Tel. +44 (0) 20 7601

6100

Robert Finlay / Antonio Bossi

Walbrook PR - Financial Media and Investor Tel. +44 (0)20 7933

Relations 8780

Paul Cornelius / Sam Allen / Nick Rome sqs@walbrookpr.com

About SQS

SQS is the world's leading specialist in software quality. This

position stems from over 30 years of successful consultancy

operations. SQS consultants provide solutions for all aspects of

quality throughout the whole software product lifecycle driven by a

standardised methodology, offshore automation processes and deep

domain knowledge in various industries. Headquartered in Cologne,

Germany, the company now employs approximately 4,200 staff. SQS has

offices in Germany, UK, US, Australia, Austria, Egypt, Finland,

France, India, Ireland, Italy, Malaysia, the Netherlands, Norway,

Singapore, South Africa, Sweden, Switzerland and UAE. In addition,

SQS maintains a minority stake in a company in Portugal. In 2014,

SQS has generated revenues of EUR268.5 million.

SQS is the first German company to have a primary listing on

AIM, a market operated by the London Stock Exchange. In addition,

SQS shares are also traded on the German Stock Exchange in

Frankfurt am Main.

With over 7,000 completed projects under its belt, SQS has a

strong client base, including half of the DAX 30, nearly a third of

the STOXX 50 and 20 per cent of the FTSE 100 companies. These

include, among others, Allianz, Beazley, BP, Centrica, Commerzbank,

Daimler, Deutsche Post, Generali, JP Morgan, Meteor, Reuters, UBS

and Volkswagen as well as other companies from the six key

industries on which SQS is focussed.

For more information, see www.sqs.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQILMPTMBMTBIA

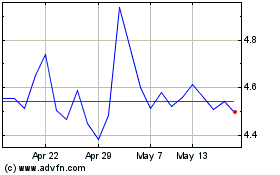

-1x Square (LSE:SQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

-1x Square (LSE:SQS)

Historical Stock Chart

From Jul 2023 to Jul 2024