RNS Number : 7037C

SQS Software Quality Systems AG

04 September 2008

Embargoed until 7am

04 September 2008

SQS Software Quality Systems AG

("SQS" or "the Company")

Interim results for the six months ended 30 June 2008

SQS Software Quality Systems AG (AIM:SQS.L) the global leader in independent software testing and quality management services, today

announces its interim results for the six months ended 30 June 2008.

Financial Highlights:

* Turnover up by 23% to EUR68.9m (H1 2007: EUR56.2m), five times the European IT Services growth rate for 2008*

* Gross profit up 23% to EUR23.9m (H1 2007 EUR19.4m) with gross margin increasing to 34.7% (H1 2007: 34.5%) owing to improved

utilisation of staff, success of off-shoring strategy and improved pricing conditions driven by strong market demand

* Adjusted profit before tax up by 45% to EUR6.7m (H1 2007 EUR4.6m) with profit margin improving to 9.7% (H1 2007: 8.1%) as a

consequence of synergies and improved operational efficiencies resulting from the successful integration of acquisitions

* Adjusted earnings per share grew by 21% to EUR0.23 (H1 2007 EUR0.19)

* Cash inflow from operating activities improved by 12% to EUR4.2m (H1 2007: EUR3.8m)

Operational Highlights:

* Gartner recognition of Independent Software Testing as a distinct sector in its own right, validating the SQS offering: "It seems

that independent testing is shaping as a separate market segment." (Gartner, August 2008)

* Investment in 139 new staff - mostly consultants - to support current strong demand for SQS's services and future organic growth

of the business

* 78 new client wins against 64 in the same period last year

* Long-term contracts increased to 23 (up from 14 six months ago), driven by blended off-shore solutions

* Mitigated risk by expanding activity into traditionally smaller verticals with particularly strong performance in the automotive

and insurance sectors

* Two substantial acquisitions made post the period end expanding the European presence into the Nordic countries and the offshore

operations into India

Commenting on the results, Rudolf van Megen, CEO, said:

"In the first six months of 2008 we further reinforced our position as the global leader in independent software testing and quality

management services, maintaining our growth rate at five times that of the European IT services market.*

"We also recorded further increases in our gross margins as the result of improved pricing conditions driven by strong market demand for

our services. Given that economic conditions are widely regarded as being difficult at present, this would suggest that our offerings

constitute a non-discretionary requirement among organisations.

"Adjusted profit margins showed still greater increases, largely as a consequence of lower overheads resulting from synergies and

economies of scale provided by prior acquisitions, while cash conversion remained high as the result of strong control over debtors and

creditors.

"Adding to our organic growth are two successful acquisitions made post the period end. Validate, headquartered in Sweden, expands our

European presence into Scandinavia and Finland while Verisoft of India is a considerable addition to our off-shore operations. We expect

these acquisitions to make a positive contribution to the full year results.

"As a consequence of the above, and having made a strong start to trading in the second half, we expect to again) exceed current market

forecasts for the full year and look forward to the future with confidence."

*According to IDC market study, European IT Services will grow 4.6% in 2008.

Enquiries:

SQS Software Quality Systems AG Tel. +49 (0) 2203 91 54 50

Rudolf van Megen, Chief Executive Officer

Rene Gawron, Chief Financial Officer

Altium Capital Limited Tel. +44 (0)20 7484 4040

Nick Tulloch

ICIS Limited Tel. +44 (0)20 7651 8688

Tom Moriarty

Bob Huxford

About SQS

SQS is the global leader in independent software testing and quality management services. SQS consultants design and oversee quality

management processes during software and IT systems development and test the resulting products for errors and omissions.

Headquartered in Cologne, Germany, SQS now has more than 1,400 employees across Europe, Asia, North America and Africa. The Group has a

strong presence in Germany (Cologne, Munich, Frankfurt, Stuttgart, Goerlitz and Hamburg) and in the UK (London, Woking, Birmingham,

Manchester, Belfast), Ireland, the Netherlands, Switzerland, Austria, Sweden, Norway, Finland, India, Egypt, the United States and South

Africa. SQS also has a minor stake in an operation in Portugal and a partnership operation in Spain.

With more than 4,800 completed projects under its belt, SQS has a strong customer base including 36 FTSE-100 companies, half of the DAX

30 and nearly a third of the STOXX-50. It supports clients in a wide range of industries, including major corporations such as Deutsche

Bank, Deutsche Telekom, Barclays, BP, Boots, Credit Suisse, Volkswagen, and Daimler.

www.sqs-group.com

Chief Executive's Statement

Introduction

I am pleased to present impressive interim results for the first half of 2008, in which SQS once again recorded a, chiefly organic,

revenue improvement some five times that of the wider European IT services sector. According to a Market Study by IDC, the European IT

Services sector is expected to grow by 4.6% in 2008. SQS recorded revenue growth of 23% to EUR68.9m (H1 2007: EUR56.2m) as we continued to

experience strong market demand for our specialist independent testing services, resulting in 78 new client wins during the period.

This strong demand saw still further increases in pricing for SQS's services which was only partially reflected in wage inflation. As a

result, the gross margin improved by 0.6% to 34.7% (H1 2007 34.5%) demonstrating that the markets in which we operate remain healthy and

implying that software testing constitutes an essential, non-discretionary item within an organisation's IT budget.

Profit margins for the period increased materially with adjusted profit before tax up by 45% to EUR6.7m (H1 2007 EUR4.6m), translating

to a PBT margin of 9.7% (H1 2007: 8.1%). Much of this improvement was achieved through synergies, efficiencies and economies of scale

resulting from the successful integration of prior acquisitions.

We have continued to strengthen our client base, particularly in newer or traditionally smaller verticals, with a record 78 new clients

across 22 industries signed during the period. Broadening the diversity of our client base has been a long-term strategic goal which enables

us to increase potential opportunities while simultaneously reducing reliance upon a given sector and the success we have had in

implementing this strategy is proof of the strength of our offering. The Company has increased its presence in the automotive, insurance,

telecom and public sectors which have all performed solidly during the period.

During the period we have increased the number of long-term contracts - those greater than 12 months in duration - to 23, representing

13% of total revenue, up from 11% last year. This has resulted in a greater proportion (approximately 77%) of revenues being of a repeatable

nature. Our ability to offer blended on-shore/off-shore solutions has had a particularly positive effect on this aspect of the business as

clients are keen to lock-in to the economic benefits such solutions can offer.

Off-shore solutions also provide higher margin business for us and the expansion of our off-shore facilities constitutes a central part

of our strategy. We were therefore pleased to acquire Verisoft, post the period end, which added an India based operation of some 150 staff

members to our existing portfolio of offshore operations in Egypt and South Africa. This acquisition is of particular strategic importance

as many global organisations have outsourced either all or part of their development to the region.

We continued to invest in growth, increasing the number of staff during the period by 139 (of which 134 are revenue generating

consultants) to a total of 1,151. This compares to a total of 860 at the same time last year and 1,012 at the 2007 year end. Additional

administration costs incurred by the hiring and training of new staff has been more than offset by improvements in pricing and staff

utilisation, hence the improvements to the gross margin.

We are also pleased to report that in an independently commissioned study Gartner declared "independent testing is shaping as a separate

market segment". Educating the market as to the importance of employing independent software testing specialists, distinct from any

development function, in order to provide a thorough, objective and ultimately higher quality service, has been a key goal of our marketing

efforts. This recognition, therefore, is testament to our success in marketing our offering, particularly through our increasingly popular

conferences and events. It is also representative of the growing realisation within industry of the importance of the SQS offering.

Finally, we continue to further enforce our position as market leaders with our revenues now more than three times those of our nearest

independent software testing competitor. This position is predicted to strengthen still further in the second half with an expected positive

contribution from the post period acquisition of Validate, which gives SQS additional operations in the mature markets of Sweden, Finland

and Norway.

Dividend

SQS proposes to continue to operate a dividend policy in line with earnings. However, in accordance with German law, the Company may

only pay one dividend in each financial year and therefore SQS expects to declare a dividend following the announcement of our final results

for the year ending 31 December 2008.

Business strategy

Our strategy is to build upon our market position as the global leader in independent software testing and quality management services.

While retaining our focus on the European market, we will continue to look at opportunities to further extend into the Asiatic and Oceanic

regions, as we did with our acquisition in India, to exploit offshore as well as local business opportunities.

One aspect of this strategy involves increasing long-term outsourcing contracts to provide greater visibility of revenues. Our ability

to provide blended onshore-offshore solutions has helped us to increase the number of long term contracts during the period, leading to

greater levels of repeat revenues of approximately 77%. We have continued to build upon this strategy since the period end by expanding our

offshore operations with the acquisition of Verisoft in India.

We plan to continue our investments into new and expanding markets and, with 32 services, we offer the largest portfolio of solutions

among our competitors (as confirmed by the PAC market study on software testing 2008) in an ever greater diversity of verticals. New

offerings such as management consulting are proving especially successful for SQS, helping to connect our quality services to the business

departments ("Quality meets Business"). In addition, SQS is not reliant on business partners or third parties for securing contracts,

instead utilising our own sales and marketing resources and existing relationships with clients. This also provides us with an excellent

platform from which to cross-sell additional services into our clients.

A further aspect of our strategy is to strengthen our position in key European markets. This has been achieved through considerable

organic revenue growth across all European geographies during the period and with the acquisition of Validate in Sweden, giving us access to

the Nordic markets which have a mature understanding of the benefits of independence within testing services.

We will continue to look actively for acquisitions to support and accelerate our strategic goals going forward.

The Company's strategy is centred on five strategic business areas, all of which contribute to market leadership as a service company

and the resulting improvements in shareholder value. These are:

* Market Leadership: Extend leadership in independent quality management and testing by delivering added value to our customers in

order to help them achieve their goals

* Growth: Increase Group revenues significantly above the market growth rate for IT services

* Financial Strength: Remain the strongest independent software testing and quality-management services company in Europe

* Employment: Extend and retain a strong base of skilled and highly motivated employees

* Technology Leadership: Spot and anticipate trends in business and IT with respect to software quality management and utilise what

we learn for the benefit of our clients and shareholders.

Services and product lines

As the largest independent provider of software quality management services we are continuously developing our range of offerings. They

are:

* Professional services for business and IT: SQS offers over 32 software testing and quality management services, considerably more

than any of our competitors. Newer offerings such as management consulting or licence compliancy management help the Company to forge

relationships at the highest level with clients and give us greater influence over the projects on which we work creating plentiful

opportunities to cross sell additional services. Many of these newer services are attaining rapid growth rates at present, though from a

smaller base than our traditional testing services.

* Tools, licences, and maintenance: Our tools are unique in the market and have been developed around our 26 years experience of

testing software projects, resulting in a product set that provides consistent and measurable results, and where several components are

integrated into other market leading tools. Software and maintenance accounts for some 1.4% of our turnover.

* IT training: Revenue from training expanded in line with the Company's growth rate during the period. New offerings introduced by

SQS during the first half of the year, such as Requirements Management, saw a high demand for personal certification in this field, as

necessitated by the IREB (International Requirements Engineering Board). New qualifications such as QAMP (Quality Assurance Management

Professional) were also introduced during the period. As well as offering training for this qualification, SQS has also chosen to be one of

the first Professional Service Organisations to demand QAMP certification for its own employees.

* Conferences and events: We held successful SQC conferences (Software and Systems Quality Conferences), the largest quality

management and software testing events in Europe, in 5 cities during the period. Our next conference will be in London on September 29 - 30

2008 and our first conference outside Europe, in Canberra, Australia, will be held in late October 2008. These events have proved an

excellent marketing tool for SQS and are helping to raise awareness among organisations of the benefits an independent body can bring in

providing an impartial, and therefore more effective, level of testing to software projects.

Acquisitions

Validate, headquartered in Sweden

We announced our agreement to purchase 100% of the issued share capital of Validate Group, a software testing and quality management

business headquartered in Sweden, on 11 June 2008, and completed the acquisition on 2 July 2008.

Maximum consideration for the Acquisition will be Swedish Krona (SEK) 153.3m (EUR16.4m) of which, 25% will be satisfied in cash and up

to 75% can be satisfied by the issue of new SQS ordinary shares to the vendors. An initial consideration of SEK68.1m (EUR7.3m) was paid on

Closing.

In addition to its headquarters in Sweden, Validate has operations in Norway and Finland, providing SQS with access to the Nordic

markets with their mature understanding of the benefits of independence within testing services and in line with SQS's strategy of further

expansion into European markets. The acquisition is also of high strategic importance to Validate's management who recognised the benefits

of scale and off-shoring facilities in attracting larger, longer term contracts. As a result, the acquisition is expected to be immediately

earnings enhancing and whilst there has been no financial effect on these interim results.

Validate is one of the leading providers of software testing in Scandinavia and Finland with approximately 70 staff and 20 customers

including many of the region's blue chip corporations. In the year ended 31 December 2007 Validate generated profit before tax of EUR0.3m on

revenues of EUR4.6m and is expected to generate profit before tax of EUR0.8m on revenues of EUR8.0m in the current year. As at 31 December

2007, Validate had net assets of EUR0.4m.

Verisoft, India

We announced the agreement to acquire 75% of the issued share capital of VeriSoft, a leading provider of software testing and quality

assurance services within India, on 16 June 2008. The maximum consideration for the acquisition is EUR1.8m of which 44% will be satisfied in

cash and 56% in shares, which includes an initial cash payment of EUR0.61m. We retain the option to purchase the remaining shares in the

Company between April 2011 and April 2016 for a consideration determined by Verisoft's Profit after Tax performance.

The acquisition is of strategic significance to SQS as it leaves us better positioned to benefit from the increasing customer

requirement for blended on and off-shore testing solutions. The acquisition considerably increases our off-shoring capacity while further

improving our coverage of multiple languages and time zones. Also, it will allow SQS to provide an improved level of support to its, mainly

UK, customers who have located their test management operations in India.

VeriSoft has approximately 150 staff headquartered in Pune, a major software development region in India. The Company also has a small

operation in the US and brings with it our first US clients. Furthermore, as opposed to purely testing software projects, the acquisition

enters SQS into the growing market for the testing of packaged software products and computer games.

The acquisition, completed on 4 July 2008, had no effect on the results for the first half of 2008. However, we expect the acquisition

to have a material impact upon the sales of our blended onshoreoffshore solutions during the second half of the year.

The Company also announced the completion of the two year earn out period on 30 June 2008 associated with the acquisition of Cresta

Limited. The targets set for the period were exceeded by a significant margin, demonstrating the resounding success of the acquisition. The

final figures for the earn out payment are still to be confirmed.

Market drivers

Software quality management and testing is a specialised segment of the IT services market and therefore growth in the IT services

market correlates closely with growth in software quality management and testing. Research conducted by IDC in 2008 showed the European

growth rate for IT services to be 6.4% in 2007, with 4.6% expected for 2008. SQS reported growth of 23% for 2008 owing to our ability to

successfully exploit many of the factors that drive the market for software testing.

It is currently the case that a significantly high proportion of IT projects (19% according to the latest Standish report) result in

failure, either as a consequence of inadequate investment resulting in budget or time constraints or from a lack of impartiality during the

testing process.

The reality of this situation has been demonstrated by a number of high-profile project failures in the media over recent months. Such

events are helping to raise awareness within industry of the importance of independence in providing effective software testing solutions

and this increased awareness was evident in a recent study by Gartner in which Independent Software Testing was described as a potential

sector in its own right: "More and more companies look into independent testing as the offerings of an increasing number of service

providers mature. It seems that independent testing is shaping as a separate market segment".

The ubiquity of software project failures has also prompted the imposition of many new regulations on IT systems by directives such as

Basel II, SOX or MiFID Markets in Financial Instruments Directive. This provides further impetus to organisations to seek out testing

providers that can supply effective, measurable and consistent solutions that are independent from the development of the project and are

therefore not compromised by their vested interest in the project's success.

The Board

During the period we were pleased to announce the appointment of David Cotterell, CEO of SQS UK, Ireland and South Africa, to the

Management Board of SQS. Prior to working for SQS David was Managing Director of Cresta Ltd, SQS's successful acquisition made in 2006. The

appointment became effective on 1 July 2008. There were no further appointments to either the Management Board or the Board during the

period. Heinz Bons left the Management Board effective as of 31 December, 2007.

Employees

On behalf of the board, I would like to take this opportunity to thank all our employees for their excellent commitment, contribution

and hard work during the first half of the year. I would also like to welcome aboard the new employees who have joined SQS during the

period, bringing with them skills and initiatives that I am confident will contribute positively to the Company going forward.

Outlook

We experienced robust demand for our services during the first half of 2008 and the healthy market conditions are showing no sign of

abating at present. The second half has already started strongly with a number of significant contracts signed.

Furthermore, the two acquisitions made post the period end are expected to have a positive impact upon the performance in the second

half. Following our previous success in integrating acquisitions, the enlarged group is well positioned to leverage growth and as a result

we expect to again exceed current market forecasts for the full year and look forward to the future with confidence.

Rudolf van Megen

Chief Executive Officer

4th September 2008

Financial Review

Summary

Turnover for the Group was up by 23% to EUR68.9m (H1 2007: EUR56.2m) during the period. Geographically, we saw revenue growth across all

of the countries in which we operate. In Germany, our largest market, we achieved significant top line growth of 29.9%. We also performed

strongly in Switzerland with revenue growth of 15.6% and continued our penetration of the UK, Ireland and South African markets, recording

an increase in sales of 6.4%. Most of the above growth rates were organic.

Other European Countries recorded a 148% increase in turnover, the bulk of which came from the successful acquisition last August of

Triton in Austria, which has now been fully integrated into the Group.

Germany

Revenue in Germany, our largest market, amounted to EUR33.9m (H1 2007: EUR26.1m), a rise of 29.9%. Growth was mostly organic and the

performance is a reflection of our market leading presence in the region coupled with strong market demand which was enhanced by our

Homeshore centre in Goerlitz.

United Kingdom/Ireland/South Africa

We continue to make good progress within the UK based businesses market, with revenues rising 6.4% to EUR23.9m (H1 2007: EUR22.5m).

Following the successful integration of the Cresta acquisition, we are now focused on continuing to drive organic growth in the region,

which represented 34.7% of total revenues during the period. The solid performance included contributions from some key contract wins

including that with Anglo Irish Bank, Ireland's third largest bank announced in May.

Switzerland

Operations in Switzerland generated a 15.6% rise in revenue, all of which was organic, to EUR6.9m (H1 2007: EUR6.0m), such that the

region now represents 10% of total revenues.

Other Countries

We have seen the most significant revenue growth in Other European Countries, which consists primarily of Austria and the Netherlands.

Revenues in these markets increased 148.0% to EUR4.1m (H1 2007: EUR1.7m), however the bulk of this growth was due to the acquisition of

Triton in Austria which was made in August 2007 and therefore did not contribute to revenues in the comparable period last year.

Triton has proved a particularly successful acquisition to date. It has enhanced our management consulting business enormously,

providing many cross-selling opportunities as well as enabling us to foster relationships with clients at the top level and improve our

influence upon the projects on which we work.

New Geographies

Post the period end we acquired Verisoft of India which adds to our existing portfolio of offshore operations in Egypt and South Africa.

Validate of Sweden was also acquired after the period end, giving us a presence in the Nordic countries where previously we had none. We

expect these acquisitions to make a positive contribution to revenues for the full year.

Margins and Profitability

Gross profit continued to improve rising 23.1% to EUR23.9m (H1 2007: EUR19.4m), with gross margin now standing at 34.7% (H1 2007:

34.5%). This rise is primarily due to pricing improvements and continued high utilisation of staff.

Adjusted profit before tax for the period was EUR6.7m (H1 2007: EUR4.6m), an increase of 45.4%. We saw a significant improvement in the

profit margin which grew to 9.7% (H1 2007: 8.1%) largely as the consequence of cost savings resulting from synergies and economies of scale

provided by prior acquisitions.

Adjusted earnings per share grew by 21% to EUR0.23* (H1 2007: EUR0.19).

*(calculated by adjusting the profit after tax for the corporate income tax assets, deferred taxes, the pro forma interest cost of the

Cresta and Triton purchase obligations and amortisation cost of the acquired customer relationship as part of a business combination

Triton.)

Costs

General & Administrative expenses totalled EUR10.9m (H1 2007: EUR8.9m) falling slightly as a proportion of sales to 15.8% (H1: 2007

15.9%). Cost savings resulted chiefly from improved operational efficiencies and economies of scale brought about by the successful

integration of former acquisitions.

Sales & Marketing costs for the period were EUR4.8m (H1 2007: EUR3.9m) falling to 6.9% as a proportion of sales (H1 2007: 7.0%). This

proportionately lower expense resulted from economies of scale, as the growing business does not require a relative growth in marketing

costs to effect the same results, while sales costs are almost the same.

Finally our Research & Development expense was reduced to EUR1.4m (H1 2007: EUR1.8m) representing 2.1% (H1 2007: 3.2%) of revenues. The

reduction in spending on R&D was due to a more efficient use of research resources. Further to this, some additional work was carried out by

innovation groups composed of SQS consultants, whose efforts were not expensed as R&D.

Cash Flow and Financing

Cash flow from operating activities continued to improve to EUR4.2m (H1 2007: EUR3.8m), primarily as a consequence of continuing

improvements to the management of debtors and creditors. Debtor days reduced to 65 (H1 2007: 70) as a result from continued improved

invoicing processes and collection.

The share capital was reduced by EUR4.3m during the period as the result of the dividend payment in May 2008, while the termination of

leasing contracts reduced cash by a further EUR0.2m. The increase of finance loans returned EUR2.6m in cash, resulting in a net cash outflow

for the first 6 months of 2008 of EUR1.8m.

Balance Sheet

We closed the period with EUR1.8m (H1 2007: EUR3.6m) of cash on the balance sheet with borrowings standing at EUR2.9m (H1 2007:

EUR1.1m). These movements resulted chiefly from the dividend payment of EUR4.3m and acquisition related payments of EUR2.7m for Validate and

EUR0.6m for Verisoft during the period.

Taxation

A tax charge of EUR1.7m includes current tax expenses of EUR1.8m (H1 2007: EUR0.9m) and deferred tax income of EUR0.1m (H1 2007:

(EUR0.4m)).

For the full year, we expect an actual tax rate of 28% and a rate of 28% in 2009.

Foreign Exchange

Approximately 55% of the Company's turnover is generated in Euros. For the conversion of the local currency into Euros, the official

fixed exchange rate was chosen. For the conversion of the balance sheet items from foreign currency into Euros, the official mean rate as at

30 June 2008 was used.

Foreign exchange had a negative impact on earnings for the period. Had the Pound/Euro exchange rate remained the same as in H1 2007 our

UK revenues for the period would have been EUR2.8m higher, translating to an additional EUR0.54m PBT. Despite this, SQS still reported EPS

of EUR0.23 representing growth of 21% (H1 2007: EUR0.19m). Were there to have been no effect from the exchange of currencies on our results

the earnings number would have been EUR7.2m and the profit growth rate 57%, demonstrating the strong underlying health of our business.

Amortisation

Amortisation of goodwill is no longer carried out due to changes in IFRS accounting rules. On account of the high amortisation of

goodwill values in previous years, their book values today lie considerably below the original acquisition costs. As a result, no reduction

in value was necessary as a result of the impairment tests carried out in accordance with IAS 36.

International Financial Reporting Standards (IFRS)

The Interim Consolidated Financial Statements of SQS and its subsidiary companies ("SQS Group") are prepared in conformity with all IFRS

Standards (International Financial Reporting Standards, formerly International Accounting Standards) and Interpretations of the IASB

(International Accounting Standards Board) which are mandatory at 30 June 2008, whereas the interim reports are published in an abbreviated

form according to IAS 34. The same accounting and valuation method used for the 2007 annual Consolidated Financial Statements was applied.

The Interim Consolidated Financial Statements have neither been audited nor reviewed.

The SQS Group Consolidated Financial Statements for the six month period ended 30 June 2008 were prepared in accordance with uniform

accounting and valuation principles in Euros.

Rene Gawron

Chief Financial Officer

4 September 2008

Consolidated Profit and Loss Account

Six months ended 30 June 2008

Six months ended Six months ended Year ended

30 June 2008 30June 2007 31 December 2007

EURm (Notes) (unaudited) (unaudited) (audited)

Revenue 68,867 56,214 121,059

Cost of sales (3) 44,966 36,801 79,307

Gross profit 23,901 19,413 41,752

General and administrative (3) 11,271 8,943 19,244

expenses

Sales and marketing expenses (3) 4,765 3,931 8,621

Research and development (3) 1,450 1,811 3,614

expenses

Profit before tax and 6,415 4,728 10,273

financing result (EBIT)

Finance income 205 201 556

Finance costs 684 636 1,163

Net interest (4) (479) (435) (607)

Profit before taxes (PBT) 5,936 4,293 9,666

Income tax (5) 1,672 1,369 2,932

Profit for the year 4,264 2,924 6,734

Attributable to:

Equity shareholders 4,264 2,924 6,734

Minority interests (14) 0 0 0

Consolidated profit for the 4,264 2,924 6,734

year

Earnings per share, undiluted (6) 0.20 0.16 0.35

(EUR)

Earnings per share, diluted (6) 0.19 0.16 0.34

(EUR)

Adjusted earnings per share (6) 0.23 0.19 0.41

(EUR), for comparison only

Consolidated Balance Sheet

Six months ended 30 June 2008

30 June 2008 30 June 2007 31 December 2007

EURm (Notes) (unaudited) (unaudited) (audited)

Current assets

Cash and cash equivalents (9) 1,774 3,578 7,220

Marketable securities (9) 0 1,020 0

Trade receivables 27,958 25,785 27,173

Other receivables 5,691 1,290 1,000

Work in progress 2,745 36 139

Income tax receivables 131 94 157

38,299 31,803 35,689

Non-current assets

Intangible assets (7) 6,391 3,153 5,999

Goodwill (7) 45,980 28,313 45,977

Property, plant and equipment (8) 2,664 1,202 2,243

Income tax receivable 1,547 1,464 1,512

Deferred taxes 651 1,435 867

57,233 35,567 56,598

Total Assets 95,532 67,370 92,287

Current liabilities

Bank loans and overdrafts (10) 2,827 989 191

Finance lease 406 0 515

Trade creditors 5,010 3,250 3,547

Other provisions (12) 78 109 102

Tax accruals 2,161 1,385 1,668

Tax liabilities 2,967 3,110 3,745

Other current liabilities (11) 23,216 16,270 24,162

36,665 25,113 33,930

Non-Current liabilities

Bank loans (10) 102 109 105

Finance lease 183 0 279

Other provisions (12) 241 112 92

Pension provisions 172 316 147

Deferred taxes 1,523 989 1,652

Other non-current liabilities (11) 7,263 6,575 7,064

9,484 8,101 9,339

Total Liabilities 46,149 33,214 43,269

Shareholders' equity (13)

Share capital 21,599 18,691 21,546

Share premium 25,204 16,692 25,029

Statutory reserves 53 53 53

Other reserves (1,189) (1,243) (1,381)

Retained earnings 3,716 (37) 3,771

Equity attributable to equity 49,383 34,156 49,018

shareholders

Minority interests (14) 0 0 0

Total Equity 49,383 34,156 49,018

Equity and Liabilities 95,532 67,370 92,287

Consolidated Cash Flow Statement

Six months ended 30 June 2008

notes Six months ended 30 Six months ended 30 Year ended 31

June 2008 June 2007 December 2007

EURm (unaudited) (unaudited) (audited)

Net cash flow from operating

activities

Profit before taxes 5,936 4,292 9,666

Add back for

Depreciation and amortisation 2,059 1,474 3,854

Profit (Loss) on the sale of 10 0 52

fixed assets

Other non-cash income not 295 (100) (554)

affecting payments

Net interest income 405 449 855

Operating profit before 8,705 6,115 13,873

changes in the net current

assets

Increase in trade receivables

and

receivables from partly (786) (3,555) (3,991)

completed contracts not yet

billed

Increase (Decrease) in work in

progress, other assets

and pre-paid expenses and (4,030) 47 518

deferred charges

Increase in trade creditors 1,463 91 1

Increase in remaining accruals 113 1,116 3,780

Increase (Decrease) in pension 25 22 (147)

accruals

Decrease (Increase) in other

liabilities and

deferred income (1,280) (77) (494)

Cash flow from operating 4,210 3,759 13,540

activities

Cash effect of foreign (29) (14) (249)

exchange rate movements

Interest payments (4) (184) (216) (497)

Tax payments (5) (1,585) (138) (1,440)

Net cash flow from current 2,412 3,391 11,354

business activities

Cash flow from investment

activities

Purchase of intangible assets (1,926) (1,009) (2,090)

Purchase of tangible assets (1,078) (409) (840)

Cashflows arising from 0 0 (3,088)

business combinations

Transfer into an notary trust (3,270) 0 0

account to purchase of shares

Sale/(Purchase) of marketable (9) 0 (1,020) 0

securities available for sale

Foreign currency result 41 (1) 249

Interest received (4) 127 28 241

Net cash flow from investment (6,106) (2,411) (5,528)

activities

Cash flow from financing activities

Proceeds from the issue of share capital 140 4,817 4,817

Costs for IPO 0 (98) (100)

Dividends paid (4,320) 0

Repayment of finance loans (10) (182) (4,686) (5,497)

Increase of finance loans (10) 2,815 0 0

Redemption / termination of leasing contracts (205) 0 (391)

Net cash flow from financing activities (1,752) 33 (1,171)

Change in the level of funds affecting (5,446) 1,013 4,655

payments

Cash and cash equivalents

at the beginning of the period 7,220 2,565 2,565

Cash and cash equivalents

at the end of the period 1,774 3,578 7,220

Consolidated Development of Shareholders' Equity

Six months ended 30 June 2008 (IFRS)

TEUR Minority Share Share Statutory Other Currency Retained Total

interests capital premium reserves reserves translation earnings Equity

differences

1st January 2007 0 17,191 13,323 53 (1,074) (31) (2,963) 26,499

Capital increase by cash 1,500 3,317 4,817

contribution

Currency translation (79) (79)

differences

Stock option program 53 53

Costs for Capital increase by (60) (60)

cash contribution (net of tax)

Effects directly recognised in 1,500 3,370 (60) (79) 4,731

equity

Profit for the period 2,924 2,924

30th June 2007 (unaudited) 0 18,691 16,693 53 (1,134) (110) (39) 34,154

Capital increase as 2,855 8,281 11,136

consideration for business

combinations

Currency translation (137)

differences

Stock option program 55 55

Costs for Capital increase by 0

cash contribution (net of tax)

Effects directly recognised in 2,855 8,336 (137) 11,191

equity

Profit for the period 3,810 3,810

31st December 2007 (audited) 0 21,546 25,029 53 (1,134) (247) 3,771 49,018

Capital increase as 53 87 140

consideration for business

combinations

Dividends paid (4,319) (4,319)

Currency translation 192 192

differences

Stock option program 88

Costs for IPO 0

Effects directly recognised in 53 175 0 192 (3,987)

equity

Profit for the period 4,264 4,264

30th June 2008 (unaudited) 0 21,599 25,204 53 (1,134) (55) 3,716 49,383

1. Summary of Significant Accounting Policies

Basis of preparation

The Interim Consolidated Financial Statements of SQS and its subsidiary companies ("SQS Group") are prepared in conformity with all IFRS

Standards (International Financial Reporting Standards, formerly IAS = International Accounting Standards) and Interpretations of the IASB

(International Accounting Standards Board) which are mandatory at 30 June 2008, whereas the interim reports are published in an abbreviated

form according to IAS 34. The Interim Consolidated Financial Statements have neither been audited nor reviewed.

The Financial Information has been prepared on the historical cost basis. The same accounting and valuation method used for the 2007

annual Consolidated Financial Statements was applied. Further information about the Group's accounting principles and policies is contained

in the SQS Consolidated Financial Statement at 31st December 2007.

The Financial Information is presented in Euros and amounts are rounded to the nearest thousand (EURk) except when otherwise indicated.

The interim condensed consolidated financial statements do not include all the information and disclosures required in the annual

financial statements, and should be read in conjunction with the SQS Consolidated Financial Statement at 31st December 2007.

Statement of compliance

The Financial Information of SQS and its subsidiaries (together the 'SQS Group') has been prepared in accordance with IFRS as adopted

for use in the EU.

Basis of consolidation

As at 30 June, the Company held interests in the share capital of more than 20 % of the following undertakings:

Consolidated companies Country of Six month ended 30 Six month ended 30 Year ended 31

incorporation June 2008 June 2007 December 2007

Share of capital Share of capital Share of capital

% % %

SQS Group (UK) Limited, Woking UK 100.0 100.0 100.0

SQS Group Limited, London UK 100.0 100.0 100.0

SQS Software Quality Systems Ireland 100.0 100.0 100.0

(Ireland) Ltd.

SQS Nederland BV, Zaltbommel The Netherlands 90.5 90.5 90.5

SQS GesmbH, Vienna Austria 100.0 100.0 100.0

SQS Software Quality Systems Switzerland 97.0 97.0 97.0

(Schweiz) AG, Zh

SQS Group Management Austria 100.0 - 100.0

Consulting GmbH (formely

Triton Unternehmensberatung

GmbH Deutschland), Vienna

PPT Unternehmensberatung GmbH, Austria 100.0 - 100.0

Vienna

SQS Group Management Germany 100.0 - 100.0

Consulting GmbH (formely

Triton Unternehmensberatung

GmbH Deutschland), Munich

SQS Egypt Egypt 100.0 - -

3 % of the shares in SQS Software Quality Systems (Schweiz) AG are held for legal reasons by members of the board of this entity in

accordance with the interests of SQS.

Use of estimates

The preparation of the Interim Financial Statements in compliance with the International Financial Reporting Standards requires the

disclosure of assumptions and estimates made by the management, which have an effect on the amount and the presentation of the assets and

liabilities shown in the balance sheet, the income and expenditure as well as any contingent items. The actual results may deviate from

these estimates.

The main estimates and judgements of the management of SQS refer to:

* the useful life of intangible assets and property, plant and equipment,

* the valuation of the liability from the Cresta and Triton purchases

* deferred taxes on losses carried forward,

* the valuation of pension assets and liabilities,

* the planning premises relating to the value in use of cash generating units.

2. Segmental reporting

The following tables present revenue and profit information regarding the SQS Group's business segments for the interim period ended 30

June 2008 and 30 June 2007 and for the year ended 31 December 2007.

Six month ended 30 June 2008 Germany UK Switzerland Other Total

(unaudited) based European

business Countries

EURk EURk EURk EURk EURk

Sales

External sales 33,941 23,905 6,879 4,142 68,867

Internal sales between the 617 356 294 887 2,154

segments

Result 3,720 2,213 247 235 6,415

Segment result 0

Consolidation

Financial result (479)

Taxes on income (1,672)

Result for the period 4,264

Profit share of minority 0

shareholders

Result of the Group for the 4,264

period

Six month ended 30 June 2007 Germany UK Switzerland Other Total

(unaudited) based European

business Countries

EURk EURk EURk EURk EURk

Sales

External sales 26,132 22,461 5,951 1,670 56,214

Internal sales between the 1,209 161 200 230 1,800

segments

Result

Segment result 2,064 2,235 466 (37) 4,728

Consolidation 0

Financial result (435)

Taxes on income (1,369)

Result for the period 2,924

Profit share of minority 0

shareholders

Result of the Group for the 2,924

period

Year ended 31 December 2007 Germany UK Switzerland Other Total

(audited) based European

business Countries

EURk EURk EURk EURk EURk

Sales

External sales 55,708 48,704 12,534 4,113 121,059

Internal sales between the 2,351 407 550 812 4,120

segments

Result

Segment result 3,533 5,580 822 338 10,273

Consolidation 0

Financial result (607)

Taxes on income (2,932)

Result for the period 6,734

Profit share of minority 0

shareholders

Result of the Group for the 6,734

period

3. Expenses

The Consolidated Income Statement presents expenses according to function. Additional information concerning the origin of these

expenses, by type of cost, is provided below:

Cost of material

The cost of material in the interim period ended 30 June 2008 amounted to EUR7,378k (at mid-year 2007: EUR7,334k). Cost of material

relates mainly to the procurement of external services such as contract software engineers. In addition, certain project-related or

internally used hardware and software is shown under cost of material.

Employee benefits expenses

Six month ended 30 Six month ended 30 June 2007 Year ended 31 December 2007

June 2008 (unaudited) (audited)

(unaudited)

EURk EURk EURk

Wages and salaries 35,389 28,356 60,072

Social security contributions 4,440 3,596 7,577

Expenses for retirement 415 198 618

benefits

40,244 32,150 68,267

The expenses for retirement benefits include the change in pension accruals and other retirement provisions such as direct insurance and

provident fund costs.

Amortisation and depreciation

Amortisation and depreciation charged in the interim period ended 30 June 2008 amounted to EUR 2,060k (at mid-year 2007: EUR1,474k). Of

this, EUR938k (at mid-year 2007: EUR978k) was attributable to the amortisation of development costs.

4. Financial result

The financial result is comprised as follows:

Six month ended 30 Six month ended 30 Year ended 31

June 2008 June 2007 December 2007

(unaudited) (unaudited) (audited)

EURk EURk EURk

Interest income 167 66 241

Exchange rate gains 38 12 315

Total finance income 205 78 556

Interest payable (573) (515) (1.096)

Exchange rate gains / losses (111) 2 (67)

Total finance costs (684) (513) (1,163)

Financial result (479) (435) (607)

Finance income results from fixed deposit investments and investments in securities maturing in the short term which yield interest

income, or securities negotiable at short notice.

Interest payable relates to interest on bank liabilities and liabilities from the Cresta purchase and from the purchase of Triton

Unternehmensberatung GmbH calculated using the effective interest method.

Finance income and expenses are stated after foreign exchange rate gains and losses.

The interest income represents the interest income of EUR36k caused by the increase in the present value of the corporation tax

receivable in accordance with � 37 KStG (German corporation tax law).

5. Taxes on earnings

The line item includes current tax expenses in the amount of EUR1,779k (previous interim period: EUR934k) and deferred tax income in the

amount of EUR107k (previous interim period: EUR(435)k).

Further information about the recognition and measurement of the income tax is contained in the SQS Consolidated Financial Statements at

31 December 2007.

6. Earnings per share

The earnings per share presented in accordance with IAS 33 are shown in the following table:

Six month ended 30 Six month ended 30 Year ended 31

June 2008 June 2007 December 2007

(unaudited) (unaudited) (audited)

Profit for the year 4,264 2,924 6,734

attributable to equity

shareholders, EURk

Diluted profit for the year, 4,264 2,924 6,734

EURk

Weighted average number of 21,584,894 17,920,105 19,098,779

shares in issue, undiluted

Weighted average number of 22,479,324 18,614,683 19,843,595

shares in issue, diluted

Undiluted profit per share, 0.20 0.16 0.35

EUR

Diluted profit per share, EUR 0.19 0.16 0.34

Adjusted earnings per share 0.23 0.19 0.41

(for comparison only), EUR

Undiluted earnings per share are calculated by dividing the profit for the six month period attributable to equity shareholders by the

weighted average number of shares in issue during the six month period ended 30 June 2008: 21,584,894 (at mid-year 2007: 17,920,105).

Diluted earnings per share are determined by dividing the profit for the year attributable to equity shareholders by the weighted

average number of shares in issue plus any share equivalents which would lead to a dilution.

The adjusted earnings per share were calculated by adjusting the profit after tax for the corporate income tax assets, deferred taxes,

the interest cost of the Cresta and Triton purchase obligations and amortisation cost of the acquired customer relationship as part of the

business combination "Triton". Further the difference between taxes on income payable under local GAAP and IFRS has been adjusted. This

adjusted profit after tax divided by the number of shares issued as at 30.6.2008 of 21,599,109 shares, (previous year 18,690,823 shares)

shows adjusted earnings per share of EUR0.23 (at mid-year 2007: EUR0.19).

7. Intangible assets

The item is comprised as follows:

Book values Six month ended 30 Six month ended 30 Year ended 31

June 2008 June 2007 December 2007

(unaudited) (unaudited) (audited)

EURk EURk EURk

Goodwill 45,980 28,313 45,977

Development costs 2,270 2,511 2,103

Software 1,103 640 516

Customer relationships Triton 3,018 2 3,380

(30 June 2007: Remaining

intangible assets)

Intangible assets 52,371 31,466 51,976

Development costs were capitalised in the interim period ended 30 June 2008 in the amount of EUR1,114k (half-year 2007 EUR922k) and

amortised over a period of 36 months, since the conditions under IAS 38 were fulfilled.

The amortisation of development costs is contained in the costs for research and development. The amortisation of software and remaining

intangible assets as well as the impairment losses under IAS 36 are spread over the functional costs in accordance with an allocation key.

8. Property, plant and equipment

The development of the tangible assets of the SQS Group is presented as follows:

Book values Six month ended 30 Six month ended 30 Year ended 31

June 2008 June 2007 December 2007

(unaudited) (unaudited) (audited)

EURk EURk EURk

Freehold Land and Buildings 578 228 251

Office and Business equipment 2,086 974 1,992

Property, Plant and Equipment 2,664 1,202 2,243

9. Cash and cash equivalents

Cash and cash equivalents comprise cash and credit balances at banks which can be realised in the short term and which earn commercial

rates of interest. The carrying amounts are considered to be reasonable approximation of fair value.

The development of cash and cash equivalents is presented in the Consolidated Cash Flow Statement.

10. Bank loans, overdrafts and other loans

The finance liabilities are comprised as follows:

Six month ended 30 Six month ended 30 June 2007 Year ended 31 December 2007

June 2008 (unaudited) (audited)

(unaudited)

EURk EURk EURk

Bank loan and overdraft 2,827 989 191

Current finance liabilities 2,827 989 191

Bank loans 102 109 105

Non-current finance 102 109 105

liabilities

Total finance liabilities 2,929 1,098 296

Of these, secured 108 1,015 288

The current account liabilities exist both with SQS Software Quality Systems AG and its subsidiaries. For some subsidiaries bank

overdraft agreements are in place.

11. Other liabilities

The item is comprised as follows:

Six month ended 30 Six month ended 30 Year ended 31 December 2007

June 2008 June 2007 (audited)

(unaudited) (unaudited)

EURk EURk EURk

Liabilities in regard to 1,611 641 1,164

social security

Personnel liabilities (leave, 6,933 5,860 8,504

bonus claims)

Obligations from Cresta 6,767 10,921 7,538

purchase

Obligations from Triton 8,745 0 8,439

purchase

Remaining other liabilities 3,427 2,490 2,396

Deferred income 43 (9) 237

Bonded loans 2,953 2,942 2,948

30,479 22,845 31,226

The remaining other liabilities comprise trade accruals and other items due in the short term. The carrying amounts are considered to be

reasonable approximation of fair value.

SQS has remaining liabilities from the Cresta purchase with a fair value of EUR6,767k (at mid-year 2007: EUR10,921k). The non-current

liability has an amount of EUR0k (at mid-year 2007: EUR3,617k).

Further SQS has remaining liabilities from the Triton purchase with a fair value of EUR8,745k. The non-current liability has an amount

of EUR4,299k. For further details see SQS Consolidated Financial Statements at 31st December 2007.

The bonded loan represents a nominal amount of EUR3,000k. The loan payment is reduced by a discount. The discount is set off against the

loan in accordance with IAS 39.AG 65. The interest rate is agreed with 6.93% p.a. The redemption is due in 2012. The Deutsche Bank AG acts

as appointed paying agent. The Deutsche Bank is entitled to assign the bond to a special purpose entity, a trustee thereof, a bank or an

insurance company. The interest rate is linked to the rating of the SQS Group following a defined rating system. If the SQS Group improves

the rating the interest rate will be decreased. If the rating decreases below a certain bound the creditors have the right to terminate the

bonded loan immediately.

12. Other provisions

Other provisions in the amount of EUR319k (31 December 2007: EUR194k) include the warranty costs in the amount of EUR78k (31 December

2007: EUR74k) and the vacant property provision in the amount of EUR97k (31 December 2007 EUR120k).

13. Equity

SQS is listed on the AIM market in London and on the Open Market in Frankfurt (Main).

The development of the equity is presented in the Consolidated Development of Shareholders' Equity.

Subscribed Capital

The subscribed capital amounts to EUR21,599,109 (at 31 December 2007: EUR21,546,309). It is divided into 21,599,109 (at 31 December

2007: 21,546,309) individual registered shares with an arithmetical share in the share capital of EUR1 each. Each share entitles the holder

to one right to vote. No preference shares have been issued. The capital is fully paid up.

The movements in the issued share capital are as follows:

Individual shares Nominal value

Number EUR

As at 30 June 2007 18,690,823 18,690,823

Increase in capital against redemption of 2,855,486 2,855,486

obligations

from Cresta purchase

(Entry of 21 September 2007)

As at 31 December 2007 21,546,309 21,546,309

Increase in capital against redemption of 52,800 52,800

convertible bond

(Issue on 18 February 2008)

As at 30 June 2008 21,599,109 21,599,109

The General Meeting of 14 September 2005 resolved the authorisation of the management board with the approval of the supervisory board

to issue non-interest bearing convertible bonds in the aggregate nominal value of up to EUR52,800 and to offer such convertible bonds for

subscription to Gresham Computing plc, UK. In accordance with this authorisation 52,800 convertible bond in the nominal amount of EUR1.00

each were issued to Gresham Computing plc. by the declaration of conversation and by the issue of the share certificates of 52,800

registered SQS shares of 18 February 2008.

Accordingly, SQS had no shares in its ownership as at 30. June 2008.

Conditional capital

The General Meeting of 2 June 2006 resolved a new conditional capital by an amount of up to EUR1,500,000 by issuance of up to 1,500,000

new individual registered shares (Conditional Capital II). The conditional capital II serves to grant up to 1,500,000 share options until 31

December 2008 as incentive compensation for SQS employees and executives. This resolution became effective with the entry of 30 June 2006.

Authorised capital

The General Meeting of 28 May 2008 resolved the authorisation of the management board with the approval of the supervisory board to

increase the share capital until 30 April 2013 by issuing of up to 4,300,000 new registered non-par value shares against contributions in

cash or in kind (authorised capital IV).

Thereafter, the authorised capital developed as follows:

EURk

As at 30 June 2007 4,954

Increase of authorised capital II 4,300

Usage of authorised capital II (2,856)

As at 31 December 2007 6,398

Increase of authorised capital IV 4,300

As at 30 June 2008 10,698

Share premium

Additional paid-in capital includes any premiums received on the issuing of the share capital. Any transaction costs associated with the

issuing of shares are deducted or set off from additional paid-in capital, net of any related income tax benefits. Equity-settled

share-based employee remuneration is also credited to additional paid-in capital until related stock options are exercised.

Statutory reserves

The statutory reserves in SQS AG were formed in accordance with Section 150 of the Stock Corporation Act (Germany).

Other reserves

The foreign currency translation differences arise on conversation of the opening reserves of subsidiary undertakings where the

functional currency of the subsidiary is not the Euro.

14. Retained earnings

Retained earnings represent the accumulated retained profits less payments of dividend and losses of SQS Group.

15. Minority Interests

There is no change in this item compared to 30 June 2007.

Up to 2003 losses applicable to the minority have exceeded the minority interest in the subsidiary's equity. In accordance with IAS

27.35 the excess and any further losses applicable to the minority have been allocated against the majority interest. In the case that the

subsidiary reports profits, such profits are allocated to the majority interest until the minority's share of losses previously absorbed by

the majority bas been recovered. In the interim period ended 30 June 2008 no minority profits were allocated to the majority (half year

2007: EUR2k).

16. Notes to the Statement of Cash flows

The Cash Flow Statement shows how the funds of the Group have changed in the course of the business year through outflows and inflows of

funds. The payments are arranged according to investment, financing and business activities.

The sources of funds on which the Cash Flow Statement is based consist of cash and cash equivalents (cash on hand and bank balances).

17. Related party transactions

Under IAS 24, related persons and related companies are persons and companies who have the possibility of controlling another party or

exercising significant influence over their finance or business policy. In the SQS Group, these are the Management Board members as well as

the members of the Supervisory Board and Mr. and Mrs. van Megen, by reason of their position as shareholders, as well as the real estate

investment fund "S.T.O.L. Immobilien Verwaltung GmbH & Co. KG", Cologne, and "Am Westhover Berg GbR mbH", Cologne. Since 01 January 2008 Mr.

Bons retired from the Management Board. So he and his wife are not regarded as related parties anymore.

Details in individual shares Six month ended 30 Six month ended 30 Year ended 31 December 2007

June 2008 June 2007 (audited)

(unaudited) (unaudited)

Non-par shares Non-par shares Non-par shares

Rudolf van Megen, Member of 3,268,149 3,657,647 3,251,681

Management Board

Ilona van Megen, n Rumsch 932,544 932,544 932,544

Children of van Megen 3,170 - -

Heinz Bons, retired Member of - 3,295,945 2,899,979

Management Board

Maria Helene Bons, n Peters

- 932,544 932,544

RenGawron, Member of 47,129 2,289 44,129

Management Board

Supervisory Board 17,500 17,500 17,500

Total 4,268,492 8,838,469 8,068,377

In detail, the following transactions have taken place with these persons and companies:

As a part of the remuneration for the Management Board activities, SQS has granted a pension commitment to a Management Board member.

Mr. Gawron holds a minority stake of one share in the Swiss subsidiary on trust for SQS Software Quality Systems AG since his office as

member of the administrative board of this company makes this necessary under Swiss law.

SQS uses property owned by the closed real estate investment fund "S.T.O.L. Immobilien Verwaltung GmbH & Co. KG", Cologne, and also the

real estate investment fund "Am Westhover Berg GbR mbH", Cologne. The shares in the fund are held by employees and also a Management Board

member of SQS AG. The contractual conditions of the lease of properties are compatible with normal market conditions. The total expenses

incurred under these contracts amounted in the interim period to EUR691k (half year 2007: EUR651k).

The total emoluments of the Management Board members amounted in the interim period ended 30 June 2008 to EUR458k (half-year 2007:

EUR556k). The emoluments of the Supervisory Board members amounted in total to EUR41k (half-year 2007: EUR41k) of which EUR41k had not been

paid by the end of the interim period.

Members of the Management board held 15.3 % (half-year 2007: 37.2 %) of the shares in SQS as at 30 June 2008. The reduction is mostly

due to Mr. Bons' retirement from the Management Board as at 31 December 2007.

18. Proposed Dividend

The General Meeting of 28 May 2008 resolved to pay EUR0.20 dividends per share for the business year 2007 in the total amount of

EUR4,319,821.80.

19. Other Information

There is currently no litigation that might have significant impact on the earnings situation of SQS AG.

20. Post interim period events

Validate Group, Sweden

SQS has entered into an agreement to acquire 100 % of the issued share capital of the Validate Group ("Validate"), Sweden, a software

testing and quality management business in Sweden, and its subsidiaries including all formerly existing minority shares. The Acquisition

will be executed predominantly via the acquisition of "2020 Governance AB", the holding company. The closing is effective on the begin July

2008.

Validate is headquartered in Kista, Sweden and has subsidiaries in Finland and Norway. As one of the leading providers of software

testing in Scandinavia, the Validate Group, currently has approximately 70 staff and 20 customers including many of the region's blue chip

corporations. In the year ended 31 December 2007 Validate generated profit before tax of EUR0.3m on revenues of EUR4.6m and is expected to

generate profit before tax of EUR0.8m on revenues of EUR8.0m in the current year. As at 31 December 2007, Validate had net assets of

EUR0.4m.

Maximum consideration for the Acquisition (assuming the purchase of 100% of the Validate Group and subject to certain adjustments

depending on the development of the SQS share price) will be Swedish Krona (SEK) 153.3m (EUR16.4m) of which, overall, 25% will be satisfied

in cash and up to 75% can be satisfied by the issue of new SQS ordinary shares to the vendors (who include current Validate management). Of

this maximum consideration, SEK68.1m (EUR7.3m) (the "Initial Consideration") is due on Closing and SEK85.2m (EUR9.1m) will be deferred and

payable over the three years following Closing, dependent upon the achievement by Validate of specified growth and profit targets. Of the

Initial Consideration, 37% (SEK25.2m (EUR2.7m)) will be satisfied in cash from internal SQS resources and 63% (SEK42.9m (EUR4.6m)) through

the issuance of 1,221,144 new SQS ordinary shares (the "New Ordinary Shares").

VeriSoft, India

SQS has entered into an agreement to acquire 75% of the issued share capital of VeriSoft with an option to purchase the remaining

shares.

VeriSoft is headquartered in Pune, India, one of the country's leading technology centres, and is a leading provider of software testing

and quality assurance in the region, with subsidiaries in the US and the UK. With approximately 150 staff, VeriSoft has completed over 300

testing projects for some 100 customers of which 50% are based outside India. In the year ended 31 March 2008, VeriSoft generated profit

before tax of EUR0.1m on revenues of EUR1.2m.

The maximum consideration for the acquisition of 75% of VeriSoft will be INR121m (EUR1.8m) of which 44% will be satisfied in cash and up

to 56% can be satisfied by the issue of new SQS ordinary shares to the vendors (who include current VeriSoft management). Of this maximum

consideration, INR40m (EUR0.61m) (the "Initial Consideration") is due as a cash payment on Closing and INR68m (EUR1m) will be deferred and

payable (up to 100% in newly issued ordinary SQS shares) over the two years following Closing, dependent upon the achievement by VeriSoft of

specified growth and profit targets. A further consideration of INR13m (EUR0.2m) will be paid for a 95 year lease over land that VeriSoft

has been allotted in the Special Economic Zone ("SEZ") IT Technology Park in Pune. The SEZ provides a favourable tax status for new work and

SQS expects that it will build its new offshore testing centre there over the next 2 years. The acquisition is completed on 1 July 2008.

There is a further option for SQS to acquire the remaining 25% of the shares in VeriSoft between April 2011 and April 2016 for a

consideration which is determined by VeriSoft's achieved profit after taxes and SQS' price/earnings ratio at the time, when the option is

exercised. This option is exercisable either by SQS or the vendors and 50% of the consideration for the option can be satisfied by the issue

of new SQS ordinary shares to the vendors.

Cologne, 4 September 2008

SQS Software Quality Systems AG

(D.Cotterell) (R. Gawron) (R. van Megen)

SQS Software Quality Systems AG

Stollwerckstrasse 11

D-51149 Cologne

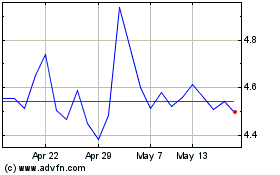

-1x Square (LSE:SQS)

Historical Stock Chart

From Oct 2024 to Nov 2024

-1x Square (LSE:SQS)

Historical Stock Chart

From Nov 2023 to Nov 2024