TIDMSOLG

RNS Number : 6712I

SolGold PLC

20 April 2022

20 April 2022

SolGold plc

("SolGold" or the "Company")

Pre-Feasibility Study supports long-life, high-value Cascabel

project

The Board of Directors of SolGold (LSE & TSX: SOLG) is

pleased to announce the results of the Pre-Feasibility Study

("PFS") for the Cascabel project, held by Exploraciones Novomining

S.A. ("ENSA"), an 85% owned subsidiary of SolGold.

The PFS confirms the Cascabel project's world class, Tier 1

potential to be a large, low-cost, and long-life mining operation

that is based on achievable, proven, and tested mining and

processing assumptions. Once constructed, Cascabel is expected to

be a top 20[1] South American copper & gold mine benefiting

from a high-grade core, advantageous infrastructure and an

increasingly investor friendly government. The mine is expected to

produce a clean copper-gold-silver concentrate, to be sold to Asian

and European smelters as part of a project construction financing

package.

KEY HIGHLIGHTS

Ø Estimated US$5.2bn pre-tax Net Present Value ("NPV") and 25.3%

Internal Rate of Return ("IRR")

Ø Estimated US$2.9bn after-tax NPV, 19.3% IRR and 4.7 year

payback period from start of processing[2](, [3], [4], [5])

Ø After-tax NPV would be US$4.1bn (US$7.9bn pre-tax) and IRR

23.4% (30.5% pre-tax) at current spot commodity prices[6]

Ø Estimated average production[7] of 132ktpa of copper, 358kozpa

of gold and 1Mozpa of silver - 212ktpa copper equivalent

("CuEq")[8] - with peak[9] copper production of 210ktpa (391ktpa

CuEq(8) )

Ø Initial project Life-of-Mine ("LOM") All-In-Sustaining Cost

("AISC") of US$0.06/lb of copper, placing Cascabel well within the

first decile of the copper industry cost curve(1)

Ø On achieving nameplate capacity, average of approximately

190ktpa of copper, 680kozpa of gold and 1.3Mozpa of silver

(>330ktpa CuEq(8) ) over initial 5 years at an average negative

AISC of US$(1.38)/lb

Ø Estimated pre-production capital expenditure of US$2.7bn for

the initial cave development, first process plant module and

infrastructure

Ø Initial Mineral Reserve of 558Mt containing 3.3Mt Cu @ 0.58%,

9.4Moz Au @ 0.52g/t and 30Moz Ag @ 1.65g/t over an initial 26-year

mine life

Ø Potential mine life upside in excess of 50 years following

initial LOM[10]

Ø Annual after-tax free cash flow ("FCF") to average US$740m(5,

7) , peaking at over US$1.6bn(5, 9)

Ø Average annual EBITDA[11] of nearly US$1.2bn(5, 7) , peaking

at over US$2.4bn(5, 9)

Ø Additional optimisations being progressed for a PFS Addendum

planned for completion in H2 CY22

Ø Cascabel project Definitive Feasibility Study ("DFS") planned

for completion in H2 CY23

Ø SolGold will host a PFS presentation on 20 April 2022 at

9:30am London time. Please register at:

https://www.investormeetcompany.com/solgold-plc/register-investor

SolGold's MD & CEO, Darryl Cuzzubbo, commented on the

PFS:

"I am extremely pleased to announce the results of the

pre-feasibility study for the proposed Cascabel mine in Ecuador. In

essence, it supports what we have believed all along - that this

project is no ordinary mining asset. Cascabel will be a

significant, multi-decade and very low cost producer of copper that

can help enable Ecuador's emergence as the next copper frontier at

a time when the world needs copper the most as we transition to a

net zero carbon emissions future.

This project is economically attractive and based upon

assumptions that we believe can be delivered upon. There is further

upside that will be explored over the coming months and the next

phase of the project as we seek the necessary Government approvals

to move into early works and execution.

Such a project will create over 6,000 indirect and direct jobs,

not to mention will bring significant royalty and tax revenue

benefiting all Ecuadorians."

SolGold's Chair of the Cascabel Project Steering Committee,

Keith Marshall, commented on the PFS:

"I am very encouraged with the pre-feasibility study. It offers,

what I consider to be, a robust but flexible solution for the

development of the underground mine at Cascabel. The study focused

on the "right sizing" of the project, with the objective of

reducing the technical and execution risk. It also provides a

straightforward approach to mining the deposit that optimises

selectivity, without compromising any of the resource and

maintaining optionality.

I am confident that the study lays the solid groundwork for the

next steps in the Cascabel project. I am particularly looking

forward to progressing the study work and being able to expand our

operational activities in Ecuador."

Former CEO and now Non-Executive Director and a direct and

indirect shareholder with 12.9% of SolGold Nick Mather said:

"The various upsides at Cascabel offered by additional

mineralised porphyry systems still being outlined and assessed,

potential for additional production and treatment plant capacity,

refinements to the mine plan, continued low cost of capital and

what I see as the opportunity for long run higher copper prices as

the world electrifies, suggest that this project indeed has

considerable further upside to be evaluated.

More importantly, SolGold's comprehensive exploration footprint

and ongoing exploration success will, in my view, establish not

just one project of significance but a string of them throughout

Ecuador, defining a globally important copper province and the

potential to have a significant impact on Ecuador's economy. In a

world of visionary enterprise looking to address escalating metal

demand to facilitate global electrification and limit global

warming to 2(o) C in an economically, socially and environmentally

just manner, SolGold's position is unique."

References to figures relate to the version visible in PDF

format by clicking the link below:

http://www.rns-pdf.londonstockexchange.com/rns/6712I_1-2022-4-19.pdf

SUMMARY OF CASCABEL PFS RESULTS

Economic Evaluation

The PFS investigated multiple scenarios in order to identify an

initial base case to take forwards, with additional resources and

upside to be investigated, supporting the next phase optimisations,

and confirming the application of block cave mining to the Alpala

underground resource.

Attractive initial cave project, potentially delivering:

Ø Initial 26-year operating life and 25Mtpa process plant

throughput

Ø Total ore production of 558Mt, containing 3.3Mt Cu, 9.4Moz Au

and 30Moz Ag

Ø Process plant producing 2.8Mt Cu, 7.6Moz Au and 21.7Moz Ag

over the initial 26 year life of the project

Ø Average annual production in five years following initial cave

ramp up of 190ktpa Cu, 680kozpa Au and 1.3Mozpa Ag

Ø Average annual production (7) for initial cave of 132ktpa Cu,

358kozpa Au and 1.0Mozpa Ag

Ø All in sustaining cost of US$0.06 /lb Cu over the initial 26

year mine project

Ø Estimated initial capital expenditure of US$2.7bn for the

initial cave development, first process plant module and

infrastructure

Ø Payback of 4.7 years from start of operations

Ø After-tax NPV and IRR of US$2.9bn and 19.3%, respectively

An initial Mineral Reserve estimate for the Cascabel project of

558Mt, with 0.58% Cu, 0.52 g/t Au and 1.65 g/t Ag for 3.3Mt Cu,

9.4Moz Au and 30Moz Ag.

Exploration success and future potential with unexplored areas

identified for future drilling and extension of additional reported

resources.

The PFS underpins the Mineral Reserve estimate and further

optimisations of the mine and process plant are expected to deliver

additional value.

The availability of low-cost hydropower, on site water

resources, the use of targeted underground mining, process plant

configuration, the potential use of an electric mining fleet,

concentrate transport via a pipeline are expected to deliver a

lower carbon footprint compared to projects which do not have these

benefits.

The Cascabel project DFS is planned for completion in H2 CY23,

with additional optimisations including:

Ø Further investigations into process plant feed rates,

including additional resources such as the Tandayama-Ameríca

resource

Ø Capital cost reduction opportunities

Ø Alpala underground mine design optimisation, mine sequence and

scheduling, application of macro blocks

Ø Process plant design optimisation, following additional test

work

Ø Hydropower project development

Key PFS outcomes Base Case AET - 2 Spot Prices

(100% project basis) [12] (6)

Economic

assumptions Copper (US$/lb) 3.60 4.20 4.74

Gold (US$/oz) 1,700 1,933 1,933

Silver (US$/oz) 19.9 24.5 24.5

Government royalty rate 3% (base & precious metals)

Ecuador tax rates[13] 15% profit share / 25% corporate

Production Throughput 25 Mtpa

Initial project LOM 26 years

Total ore mined 558 Mt

Average copper grade / recovery 0.58% / 87.1%

Average gold grade / recovery 0.52 g/t / 72.1%

Average silver grade / recovery 1.65 g/t / 65.7%

Total CuEq produced(8) 4.5 Mt

Total copper produced 2.8 Mt

Total gold produced 7.6 Moz

Total silver produced 21.7 Moz

Annual CuEq production (peak/average)(7, 391 kt / 212 kt

8, 9, [14])

Annual copper production (peak/average)(7, 210 kt / 132 kt

9, 14)

Annual gold production (peak/average)(7, 829 koz / 358 koz

9, 14)

Annual silver production (peak/average)(7, 1.4 Moz / 1.0 Moz

9, 14)

Capital Pre-production US$2,746m

Post-production US$2,136m

Average net cash cost (US$/lb

Operating Cu) (0.40) (0.66) (0.63)

Average AISC (US$/lb Cu) 0.06 (0.20) (0.17)

Financials Pre-tax NPV (8%) US$5,241m US$6,915m US$7,862m

Pre-tax IRR 25.3% 28.8% 30.5%

After-tax NPV (8%) US$2,907m US$3,781m US$4,083m

After-tax IRR 19.3% 22.2% 23.4%

Capital payback period 4.7 years 4.3 years 4.2 years

Total FCF generation US$14,413m US$16,080m US$16,278m

Average annual FCF US$740m US$856m US$863m

Average annual FCF (first US$1,345m US$1,575m US$1,699m

5yrs post ramp-up)

Total EBITDA US$24,003m US$29,178m US$32,249m

Average annual EBITDA US$1,156m US$1,396m US$1,540m

Average annual EBITDA (first US$2,040m US$2,419m US$2,622m

5yrs post ramp-up)

Table 1 : Economic and operating summary

An accelerated energy transition ("AET") would increase copper

demand growth with a faster uptake of electric vehicles and

renewable energy generation, both industries having high copper

intensities. The Cascabel project concentrate is expected to be a

clean high value concentrate, with low levels of deleterious

elements, sought after by smelters globally. Wood Mackenzie's AET-2

long-term copper price forecast is US$4.20/lb and is based on

projections that conform to a 2-degree or lower global warming

scenario. At this price, and assuming current spot prices for gold

and silver, SolGold estimates an after-tax project NPV of US$3.8bn

and 22% IRR.

Project Description

Cascabel is located in northern Ecuador approximately three

hours' drive north of Quito, the capital city of Ecuador. Access is

via sealed highways through the closest major centre of Ibarra,

located approximately 80 km south of the property. Infrastructure

in the region and throughout Ecuador is generally of a high

standard, with excellent road access, power, and water sources

readily available in the local area.

The PFS process commenced in 2020 with a revision to scope in

2021 to investigate the 'right' capacity block cave for the Alpala

underground, and corresponding right sizing and expansion of the

process plant to suit. Extension opportunities, alternate mine

access methods and tailings storage facility options were also

considered during the PFS.

The block cave will be mined with Load Haul and Dump equipment

to one of two primary crushing stations on the trucking level. Both

diesel and battery electric vehicles ("BEV") were assessed during

the PFS, including the potential benefits for mine ventilation

requirements. For the PFS the block cave design was based on diesel

vehicles in all applications except BEV for the production trucking

loop. Further investigations for electrification are proposed in

the DFS.

Mineral Resource Estimate ("MRE") [15]

The Alpala porphyry copper-gold-silver deposit, at a cut-off

grade of 0.21% CuEq, comprises 2,663 Mt at 0.53% CuEq[16] in the

Measured plus Indicated categories, which includes 1,192 Mt at

0.72% CuEq in the Measured category and 1,470 Mt at 0.37% CuEq in

the Indicated category. The Inferred category contains an

additional 544 Mt at 0.31% CuEq.

The MRE comprises a contained metal content of 9.9 Mt Cu and

21.7 Moz Au in the Measured plus Indicated categories, which

includes 5.7 Mt Cu and 15.0 Moz Au in the Measured category, and

4.2 Mt Cu and 6.6 Moz Au in the Indicated category. The Inferred

category contains an additional 1.3 Mt Cu and 1.9 Moz Au.

Cut-off Mineral Mt Grade Contained metal

grade Resource

category

CuEq Cu Au Ag CuEq Cu Au Ag

(%) (%) (g/t) (g/t) (Mt) (Mt) (Moz) (Moz)

0.21% Measured 1,192 0.72 0.48 0.39 1.37 8.6 5.7 15.0 52.4

Indicated 1,470 0.37 0.28 0.14 0.84 5.5 4.2 6.6 39.8

Measured

+ Indicated 2,663 0.53 0.37 0.25 1.08 14.0 9.9 21.7 92.2

Inferred 544 0.31 0.24 0.11 0.61 1.7 1.3 1.9 10.6

Planned

dilution 5 0.00 0.00 0.00 0.00 0.0 0.0 0.0 0.0

Table 2 : Cascabel project Alpala underground mineral resource

estimate

Notes:

1. Mrs. Cecilia Artica, SME Registered Member, Principal Geology

Consultant of Mining Plus, is responsible for this Mineral Resource

statement and is an "independent Qualified Person" as such term is

defined in NI 43-101.

2. The Mineral Resource is reported using a cut-off grade of

0.21% CuEq calculated using [copper grade (%)] + [gold grade (g/t)

x 0.613].

3. The Mineral Resource is considered to have reasonable

prospects for eventual economic extraction by underground mass

mining such as block caving.

4. Mineral Resources are not Mineral Reserves and do not have

demonstrated economic viability.

5. The statement uses the terminology, definitions and

guidelines given in the CIM Standards on Mineral Resources and

Mineral Reserves (May 2014) as required by NI 43-101.

6. MRE is reported on a 100 percent basis within an optimised shape.

7. Figures may not compute due to rounding.

Mineral Reserve Estimate

The Mineral Reserves have been estimated for a block caving

method and take into account the effect of mixing of indicated

material with dilution from low grade or barren material

originating from within the caved zone and the overlying cave

backs. The initial Mineral Reserve represents only 21% of Measured

and Indicated Resources tonnes and approximately 38% of contained

metal.[17]

Mineral Mt Grade Contained metal

Reserve

category

Cu Au Ag Cu Au Ag

(%) (g/t) (g/t) (Mt) (Moz) (Moz)

Probable 558 0.58 0.52 1.65 3.26 9.37 30

Total 558 0.58 0.52 1.65 3.26 9.37 30

Table 3 : Cascabel project Alpala underground mineral reserve

estimate

Notes:

1. Effective date of the Mineral Reserves is 31 March 2022.

2. Only Measured and Indicated Mineral Resources were used to

report Probable Mineral Reserves.

3. Mineral Reserve reported above were not additive to the

Mineral Resource and are quoted on a 100% project basis.

4. The Mineral Reserve is based on the 18 March 2020 Mineral Resource.

5. Totals may not match due to rounding.

6. The statement uses the terminology, definitions and

guidelines given in the CIM Standards on Mineral Resources and

Mineral Reserves (May 2014) as required by NI 43-101.

7. The Mineral Reserve Estimate as of 31 March 2022 for Alpala

was independently verified by Aaron Spong FAusIMM CP (Min) who is a

full-time employee of Mining Plus. Mr Spong fulfils the

requirements to be a "Qualified Person" for the purposes of NI

43-101 and is the Qualified Person under NI 43-101 for the Mineral

Reserve.

Mining

Access to the Alpala underground mine is expected to be via twin

declines commencing from a boxcut located near the surface and the

first lift near the 300mRL. Mining is planned to be a Block Caving

mining method, whilst all horizontal development will be undertaken

utilising conventional drill and blast practices. The vertical

development for the main ventilation rises will be excavated using

blind sinking methods.

Mine production design for the block cave incorporated findings

from detailed geotechnical and hydrogeological assessments, to

determine the height of draw based on recommended draw bell

spacing. Lower grade draw points on the west of the footprint were

included in preference to those in the east to generate a smaller

span option. Current geotechnical guidelines inform to commencing

the cave on the eastern side, expanding to the west, causing a

small delay in higher grade draw points in the centre.

Initial access to the footprint will be via an early access

blind sunk shaft to the southwest of the deposit. This will link to

a twin decline mined from the north of the deposit with a portal

adjacent to the process plant. In the longer term the decline will

be the main access path.

The shaft is used to gain early access to the footprint, where

it is used to mine long lead time excavations on the footprint,

primarily the crusher chamber and access to the collection chamber

under the crusher chamber.

The declines are accessed from two separate portals. The second

portal location is for the conveyor only, located in proximity to

the process plant location. The first portal is located further to

the south to reduce the critical path distance to the footprint. An

overview concept of the lateral and vertical accesses is shown in

the figure below.

Figure 1 : Isometric view of the lateral and vertical accesses

in the Cascabel project Alpala underground mine

The portals are located in a boxcut approximately 3,000m from

the orebody. They have been positioned in close proximity to major

surface infrastructure including the processing plant due to the

nature of the surrounding terrain. It allows a direct route for the

ore to the processing plant without the requirement to build

surface haulage routes in mountainous terrain. This eliminates

material handling issues that would be apparent if the portals were

located elsewhere.

The mine design has been developed to enable all infrastructure

including the primary crushers to be off set from the cave abutment

zone in accordance with geotechnical recommendations. The

infrastructure design in this PFS has assumed loader tramming from

drawpoint to ore pass, to loadout stations for a truck haulage

loop, terminating at the tip points for the crusher feed bin/s,

located outside the caving zone.

Figure 2 : In footprint proposed truck haulage level

In addition to the initial access shaft and the access and

conveyor declines, the PFS design includes shafts for ventilation.

Each of these shafts is designed to suit the ventilation

requirements for the steady-state operating mine. The early access

shaft will also become a source of fresh air intake once all early

access requirements are completed, and the decline development

reaches the footprint.

Sufficient refuge chambers will be located in disused stockpiles

and cuddies to accommodate the number of personnel working

underground (expected to be highest during the construction phase

when mechanical/civil works are being undertaken to install the

materials handling system in addition to underground miners).

The twin decline provides a second means of egress, with the

early access shaft another potential egress method. During the

development of the footprint, small boxholed escapeway rises may be

required between the undercut and extraction levels depending on

the schedule.

Process Plant

The crushed ore from the underground primary crushers will be

conveyed to the surface and fed to the secondary crushing circuit.

The product from the secondary crushing area will be conveyed to

the fine ore stockpile, and subsequently reclaimed to the

high-pressure grinding rolls ("HPGR") circuit. The product from the

HPGR circuit will report to a grinding circuit consisting of ball

mills, each operating in closed circuit with a hydrocyclone

cluster.

Figure 3 : Process plant proposed secondary and HPGR crushing

system

The ground product will report to conventional rougher

flotation. The rougher concentrate will be reground using stirred

mills and will be subsequently upgraded within the cleaner

flotation circuit to produce a saleable flotation concentrate.

Cleaner flotation tailings are further processed through

conventional flotation cells to recover gold and silver contained

within pyrite. Pyrite concentrate is thickened and subjected to a

conventional cyanide leach/carbon in pulp ("CIP") extraction

followed by an Anglo American Research Laboratory ("AARL") gold

recovery circuit. Sludge electrowinning cells recover gold and

silver from eluate for smelting to doré bars in the gold room.

The flotation concentrate will be thickened using a high-rate

thickener and then pumped via a pipeline to the Esmeraldas port

facility. Two tailings streams will be produced from the flotation

circuit, namely the rougher tailings and the cleaner scavenger (or

pyrite) tailings, requiring disposal within the tailings storage

facility ("TSF"). These tailings streams will be thickened

separately using high-rate thickeners prior to independent pumping

to, and disposal to at the TSF. The TSF design is based on

regulatory and best practice standards and guidelines, including

ANCOLD 2019 and the Global Industry Standard on Tailings Management

established by The International Council on Mining and Metals

("ICMM"), the United Nations Environment Programme ("UNEP") and the

Principles for Responsible Investment ("PRI").

Figure 4 : Simplified processing flowsheet for Cascabel

project

The concentrate slurry will be received by an additional

thickening stage at the Port facility. The concentrate will then be

dewatered using Larox continuous cloth vertical tower filters. The

resulting filter cake will be stockpiled within a covered facility

until reclaimed for seaborne transportation.

Process water will be recycled from the thickener overflows and

supplemented with treated water from the underground mine.

Additional make-up water to the process water system will be

provided from the raw water supply drawn from the on-site catchment

dam. Raw water will be also used for potable water production,

gland seal service for the slurry pumps, cooling water make-up,

reagent preparation, and fire water supply.

Indicative Production Profile

Following mining optimisation studies, the production profile

for the Cascabel project is based on a process plant nameplate

capacity of 25Mtpa from the underground block cave at the Alpala

deposit. The project is expected to reach nameplate capacity in the

fourth year from the start of process plant operations with first

ore expected in mid-2029.

Initial process plant production totalling 2.8Mt of copper,

7.6Moz of gold and 21.7Moz of silver.

Figure 5 : Production profile

The PFS mine plan targets the Alpala high grade core with copper

grades expected to average over 0.75% (1.35% copper equivalent)

over the first 10 years of production.

Figure 6 : Feed grade profile

Metal recoveries to the copper gold flotation concentrate are

based on equations fitted to the locked cycle test work ("LCT")

results and in general indicate good to very good fits of the

data.

Copper concentrate grade is based on mass recovery to

concentrate and copper recovery to concentrate.

Metal recoveries to doré are estimated based on limited test

work results. Whilst the pyrite concentrate is amenable to

cyanidation, but further test work is required to further define

the metal recovery to the pyrite concentrate and the metal

recoveries to doré.

Capital Cost Estimate

The capital cost estimate meets the requirements for a

pre-feasibility study consistent with the Association for the

Advancement of Cost Engineering ("AACE International") cost

estimating guidelines for a Class 4 estimate. The estimate accuracy

range of +/-25% is defined by the level of project definition, the

time available to prepare the estimate and the amount of project

cost data available.

The total capital cost estimate for the Cascabel project is

summarised in Table 4 .

Area Pre-Production Post-Production

US$M US$M

Mine 900 748

Process plant 465 219

Tailings storage facility 309 695

Port facility 39 15

Surface infrastructure 175 42

Indirect costs 467 113

Contingency 391 304

Total 2,746 2,136

Table 4 : Cascabel project capital cost estimate

Pre-production capital totals US$2.7bn and includes all costs up

to first ore to the process plant. Post-production costs required

to achieve production ramp-up to design capacity and sustaining

capital are estimated to total US$2.1bn.

Operating Cost Estimate

The Cascabel block cave operation is estimated to have a low

unit mining cost (operating and sustaining) of US$6.51/t. Total

average gross unit cash costs inclusive of treatment charges and

government royalties are US$1.72/lb of payable copper. AISC costs

inclusive of gold and silver by-product credits are estimated at

US$0.06/lb Cu over the 26-year mine life and averaging US$(1.38)/lb

in the first five years from achieving nameplate capacity,

positioning Cascabel well within the first decile of the global

copper industry cost curve. Net cash costs are estimated at

US$(0.40)/lb Cu. Negative cash costs reflect significant precious

metals by-product contributions, primarily gold, providing downside

protection to lenders.

Figure 7 : 2032 Copper industry cash cost curve[18]

Cash flow generation

Cascabel's indicative production profile and low operating costs

are expected to support strong after-tax free cash flow generation

totalling nearly US$14.5bn over the 26-year initial mine life and

averaging US$740m annually.

Figure 8 : After-tax free cash flow profile

Environmental, Social and Governance ("ESG")

SolGold is committed to the social and environmental

sustainability of its projects and being a leader in this space

within Ecuador. As SolGold advances the Cascabel project, clearly

defined criteria will be reported as studies advance into

development and operations.

As a minimum, SolGold considers the following criteria

immediately applicable not only from a corporate perspective but

also to its activities within countries where SolGold has

interests:

-- Environment: managing carbon footprint and use of renewable resources

-- Social: encourages diversity and pays fair wages

-- Governance: Committed to complying with UK Corporate Governance Code from mid-2022

SolGold has built strong community partnerships over the last

decade in the country and has an extensive engagement process that

will be continued through the Environmental Impact Assessment

("EIA") stage.

Ecuadorian law requires that an EIA be conducted prior to

authorisation of construction and operations. In addition to

Ecuadorian requirements, SolGold will ensure that the EIA is

compliant with appropriate international standards. At minimum,

these would include consideration to the applicable Equator

Principles, the International Finance Corporation ("IFC")

Performance Standards and Environmental, Health, and Safety

Guidelines, as well as Sustainable Development Goals ("SDG") which

align with the development of the Cascabel project and the effected

regions.

In anticipation of advancing the permitting processes within

Ecuador, environmental baseline studies within the Cascabel

tenement are well advanced.

SolGold will be evaluating several options as part of the DFS to

manage and minimise the project's overall carbon footprint. These

include maximising power from hydro generation sources, further

investigations on electrification, assessing process integration to

optimise operational efficiency, among other initiatives.

SolGold is continuing on its journey toward compliance with the

UK Corporate Governance Code and intends to be compliant with all

aspects of the code from mid-2022.

Sensitivity Analysis

A sensitivity analysis was performed on the base case after-tax

NPV to examine the sensitivity to commodity prices, capital costs

and operating costs.

The Cascabel project is most sensitive to changes in the copper

and gold prices as well as capital costs; less sensitive to changes

in operating costs, and least sensitive to changes to silver

prices. Figure 9 and Table 5 show the results of the after-tax

analysis.

Figure 9 : After-tax sensitivity analysis (NPV(8%) )

After-tax NPV Copper Price (base US$3.60/lb)

of project

(US$M)

-30% -20% -10% 0% +10% +20% +30%

Discount

Rate 5% 3,177 3,795 4,398 5,007 5,615 6,119 6,263

6% 2,597 3,134 3,659 4,189 4,718 5,168 5,336

7% 2,105 2,574 3,033 3,496 3,958 4,360 4,541

8% 1,687 2,098 2,501 2,907 3,312 3,672 3,857

9% 1,331 1,693 2,047 2,405 2,762 3,084 3,268

10% 1,028 1,347 1,660 1,976 2,291 2,581 2,760

Gold Price (base US$1,700/oz)

-30% -20% -10% 0% +10% +20% +30%

Discount

Rate 5% 3,829 4,223 4,615 5,007 5,399 5,800 6,030

6% 3,148 3,497 3,843 4,189 4,534 4,888 5,111

7% 2,574 2,882 3,189 3,496 3,801 4,114 4,327

8% 2,088 2,362 2,634 2,907 3,178 3,456 3,657

9% 1,675 1,919 2,162 2,405 2,647 2,894 3,082

10% 1,324 1,543 1,760 1,976 2,193 2,413 2,587

Table 5 : Metal price and discount rate sensitivity analysis

Outstanding Opportunities and Upside Options

The Cascabel project optimisations which will be progressed

include:

Ø Further investigations into process plant feed rates,

including additional resources such as the Tandayama-Ameríca

resource

Ø Capital cost reduction opportunities

Ø Alpala underground mine design optimisation, mine sequence and

scheduling, application of macro blocks

Ø Process plant design optimisation, following additional test

work

Ø Hydropower project development

Next Steps

The Cascabel project DFS is planned for completion in H2 CY23.

SolGold plc is currently progressing additional optimisations in

preparation for the DFS that will be included in a PFS Addendum

planned for completion in H2 CY22.

SolGold plans to engage with the relevant government departments

from Q2 CY22 to commence fiscal discussions and the permitting

process.

SolGold intends to release a National Instrument 43-101 ("NI

43-101") technical report on Cascabel within 45 days of this

release (the "Technical Report").

Qualified Persons

The Qualified Persons for the "Cascabel Project, Ecuador,

NI43-101 Technical Report on Pre-Feasibility Study", that has an

effective date of 31 March 2022, are detailed in the table

below.

Category Name Company

Mineral Resource Cecilia Artica, BSc MSc (formerly) Mining

Estimate RMSME Plus

Mineral Reserve Estimate Aaron Spong, BEng FAusIMM Mining Plus

CP (Min)

Environment, Social, Tim Rowles, BSc MSc FAusIMM Knight Piésold

Tailings & Water CP RPEQ Pty Ltd

Metallurgy Peter Gron, BSc FAusIMM Wood plc

Process Plant & Infrastructure Steve Klose, BEng MSc Wood plc

FAusIMM

Financial Evaluation Kirk Hanson, MBA PE Wood plc

Marketing Christopher Heath, BSc Wood Mackenzie

Hons PhD FAusIMM

By order of the Board

Dennis Wilkins

Company Secretary

Certain information contained in this announcement would have

been deemed inside information.

CONTACTS

Dennis Wilkins

SolGold Plc (Company Secretary) Tel: +61 (0) 417 945 049

dwilkins@solgold.com.au

Ingo Hofmaier

SolGold Plc (Acting CFO) ihofmaier@solgold.com.au Tel: +44 (0) 20 3823 2130

Fawzi Hanano / Lia Abady

SolGold Plc (Investors / Communication) Tel: +44 (0) 20 3823 2130

fhanano@solgold.com.au / labady@solgold.com.au

Tavistock (Media)

Jos Simson / Gareth Tredway Tel: +44 (0) 20 7920 3150

See www.solgold.com.au for more information. Follow us on

twitter @SolGold plc

CAUTIONARY NOTICE

News releases, presentations and public commentary made by

SolGold plc (the "Company") and its Officers may contain certain

statements and expressions of belief, expectation or opinion which

are forward looking statements, and which relate, inter alia, to

interpretations of exploration results to date and the Company's

proposed strategy, plans and objectives or to the expectations or

intentions of the Company's Directors, including the plan for

developing the Project currently being studied as well as the

expectations of the Company as to the forward price of copper. Such

forward-looking and interpretative statements involve known and

unknown risks, uncertainties and other important factors beyond the

control of the Company that could cause the actual performance or

achievements of the Company to be materially different from such

interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations

or forward-looking statements; and save as required by the exchange

rules of the TSX and LSE or by applicable laws, the Company does

not accept any obligation to disseminate any updates or revisions

to such interpretations or forward-looking statements. The Company

may reinterpret results to date as the status of its assets and

projects changes with time expenditure, metals prices and other

affecting circumstances.

This release may contain "forward--looking information" within

the meaning of applicable Canadian securities legislation.

Forward--looking information includes, but is not limited to,

statements regarding the Company's plans for developing its

properties. Generally, forward--looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved".

Forward--looking information is subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward--looking information, including but not limited to:

transaction risks; general business, economic, competitive,

political and social uncertainties; future prices of mineral

prices; accidents, labour disputes and shortages and other risks of

the mining industry. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Factors that could cause actual results to differ

materially from such forward-looking information include, but are

not limited to, risks relating to the ability of exploration

activities (including assay results) to accurately predict

mineralisation; errors in management's geological modelling and/or

mine development plan; capital and operating costs varying

significantly from estimates; the preliminary nature of visual

assessments; delays in obtaining or failures to obtain required

governmental, environmental or other required approvals;

uncertainties relating to the availability and costs of financing

needed in the future; changes in equity markets; inflation; the

global economic climate; fluctuations in commodity prices; the

ability of the Company to complete further exploration activities,

including drilling; delays in the development of projects;

environmental risks; community and non-governmental actions; other

risks involved in the mineral exploration and development industry;

the ability of the Company to retain its key management employees

and skilled and experienced personnel; and those risks set out in

the Company's public documents filed on SEDAR at www.sedar.com .

Accordingly, readers should not place undue reliance on

forward--looking information. The Company does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

The Company and its officers do not endorse, or reject or

otherwise comment on the conclusions, interpretations or views

expressed in press articles or third-party analysis, and where

possible aims to circulate all available material on its

website.

The Company recognises that the term World Class is subjective

and for the purpose of the Company's projects the Company considers

the drilling results at the Alpala porphyry copper-gold deposit at

its Cascabel project to represent intersections of a World Class

deposit on the basis of comparisons with other drilling

intersections from World Class deposits, some of which have become,

or are becoming, producing mines and on the basis of available

independent opinions which may be referenced to define the term

"World Class" (or "Tier 1").

The Company considers that World Class deposits are rare, very

large, long life, low cost, and are responsible for approximately

half of total global metals production. World Class deposits are

generally accepted as deposits of a size and quality that create

multiple expansion opportunities and have or are likely to

demonstrate robust economics that ensure development irrespective

of position within the global commodity cycles, or whether or not

the deposit has been fully drilled out, or a feasibility study

completed.

Standards drawn from industry experts (1Singer and Menzie, 2010;

2Schodde, 2006; 3Schodde and Hronsky, 2006; 4Singer, 1995;

5Laznicka, 2010) have characterised World Class deposits at

prevailing commodity prices. The relevant criteria for World Class

deposits, adjusted to current long run commodity prices, are

considered to be those holding or likely to hold more than 5

million tonnes of copper and/or more than 6 million ounces of gold

with a modelled net present value of greater than US$1billion.

The Company cautions that the Cascabel project remains an

early-stage project at this time and there is inherent uncertainty

relating to any project at prior to the determination of

pre-feasibility study and/or defined feasibility study.

On this basis, reference to the Cascabel project as "World

Class" (or "Tier 1") is considered to be appropriate.

[1] Wood Mackenzie Q4 2021 Outlook, 2032 forecast

[2] The PFS is subject to an accuracy range of +/-25% in

accordance with AACE class 4 estimates. The findings in the PFS and

the implementation of the Cascabel project are subject to all the

necessary approvals, permits, internal and regulatory requirements

and further works. The estimates are indicative only and are

subject to market and operating conditions. They should not be

interpreted as guidance. The information contained herein is a

summary only and is qualified in its entirety by reference to the

Technical Report (as defined below).

[3] 100% project basis.

[4] Based on a discount rate of 8% (real).

[5] Based on long-term commodity price assumptions of US$3.60

/lb for copper, US$1,700 /oz for gold and US$19.9 /oz for

silver

[6] Spot prices on 4 April 2022 of US$4.74 /lb for copper,

US$1,933 /oz for gold and US$24.5 /oz for silver

[7] Average based on years 4 - 22 at full nameplate capacity

[8] Assumptions for copper equivalent calculations as provided

in Table 1 for commodity prices, grades and recoveries. Copper

equivalent production (by-product basis) = Recovered Cu tonnes +

(Au Price US$/oz) / (Cu Price US$/t) x (Recovered + doré gold

ounces) + (Ag Price US$/oz) / (Cu Price US$/t) x (Recovered + doré

silver ounces).

[9] Peak production, free cash flow and EBITDA in year 5 from start of production

[10] As the Mineral Reserve represents only 21% of the M&I

Resource tonnes the Company believes there is potential further

mine life upside in excess of 50 years.

[11] EBITDA is a Non IFRS Financial Measure and refers to

Earnings Before Interest, Tax, Depreciation and Amortisation.

[12] Wood Mackenzie Accelerated Energy Transition (2 degrees)

long-term copper price forecast of US$4.20/lb. Assuming spot price

for gold and silver.

[13] Profit share: 12% to state, 3% to employees. Corporate tax

applied to EBT (Earnings Before Tax) after deduction of profit

share.

[14] Peak production in year 5 from start of production.

[15] See "Cascabel Property NI 43-101 Technical Report, Alpala

Porphyry Copper-Gold-Silver Deposit - Mineral Resource Estimation,

January 2021" with an Effective date: 18 March 2020 and Amended

Date: 15 January 2021 (the "Amended Technical Report"), filed at

www.Sedar.com on January 29, 2021.

[16] Alpala MRE was reported at a cut-off grade of 0.21% copper

equivalent (CuEq) using a copper equivalency factor of 0 613

(whereby CuEq = Cu + Au x 0.613). Cut-off grades and copper

equivalency used for reporting were based on third party metal

price research, forecasting of Cu and Au prices, and a cost

structure from mining studies data available at the time. Costs

include mining, processing and general and administration

(G&A). Net Smelter Return (NSR) includes metallurgical

recoveries and off-site realisation (TCRC) including royalties and

utilising metal prices of Cu at US$3.40/lb and Au at

US$1,400/oz.

[17] As the Mineral Reserve represents only 21% of the Measured

and Indicated Resource tonnes the Company believes there is

potential further mine life upside in excess of 50 years. Mineral

Reserve contained metal estimated at base case long-term prices of

US$3.60 /lb for copper, US$1,700 /oz for gold and US$19.9 /oz for

silver.

[18] Wood Mackenzie, 2032 Total Cash Cost including by-product contribution

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUKUARUBUSAUR

(END) Dow Jones Newswires

April 20, 2022 02:10 ET (06:10 GMT)

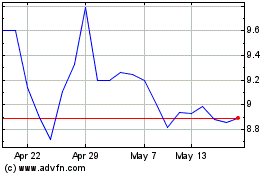

Solgold (LSE:SOLG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solgold (LSE:SOLG)

Historical Stock Chart

From Nov 2023 to Nov 2024