TIDMSOLG

RNS Number : 1518I

SolGold PLC

13 April 2022

13 April 2022

SolGold plc

("SolGold" or the "Company")

Drilling Update: Tandayama-Ameríca, Cascabel Project

The Board of Directors of SolGold (LSE & TSX: SOLG) is

pleased to provide a drilling update on its Tandayama-Ameríca

("TAM") porphyry copper-gold deposit at the Cascabel project in

northern Ecuador.

The TAM deposit lies approximately 3km north of the Alpala

deposit that comprises 2,663Mt at 0.53% CuEq ([1]) in the Measured

plus Indicated categories and contained metal content of 9.9Mt Cu,

21.7Moz Au and 92.2Moz Ag ([2]) at the Cascabel project, held by

Exploraciones Novomining S.A. ("ENSA"), an 85% owned subsidiary of

SolGold.

The TAM deposit currently contains a Mineral Resource Estimate

("MRE"), dated 19 October 2021, of 233Mt @ 0.33% CuEq ([3]) for

0.53Mt Cu and 1.20Moz Au each in the Indicated category, plus 197Mt

@ 0.39% CuEq for 0.52Mt Cu and 1.24Moz Au in the Inferred category.

The maiden MRE was estimated from a dataset including drill holes

1-23, plus 458m of rock-saw channel assays across hard-rock surface

outcrops. A total of 30,925m of diamond drilling, in 41 drill

holes, has now been completed at the TAM deposit, including a total

of 29,632m of final assay results.

HIGHLIGHTS

Ø Additional resources being identified at TAM continue to

provide a strategic fit towards the development of the Cascabel

property as a whole. A TAM deposit MRE update is currently

underway, assessing additional drill holes 19-40, equating to an

additional 15,065.6m of final assays results received since the

recent release of the maiden MRE in October 2021.

Ø The assay results from holes 19-40 extend mineralisation

potentially mineable by both open pit and underground bulk mining

methods and suggest capacity for resource growth. Mineralisation

remains open both along strike north and south, and at depth in the

southeast.

Ø Highlights of intersections ([4]) achieved from holes 25-40

include:

-- Hole 26: 769.9m @ 0.32% CuEq (open at depth), incl. 382m @ 0.43% CuEq and 80m @ 0.61% CuEq

-- Hole 28: 588.0m @ 0.41% CuEq, incl. 140m @ 0.80% CuEq and 74m @ 1.18% CuEq

-- Hole 32: 902.0m @ 0.28% CuEq, incl. 190m @ 0.41% CuEq and 56m @ 0.57% CuEq

-- Hole 35: 334.0m @ 0.42% CuEq, incl. 168m @ 0.68% CuEq and 80m @ 1.03 CuEq

Ø The best drilling results achieved at the TAM deposit to date

(previously announced) include:

-- Hole 13 : 1,010m @ 0.55% CuEq, incl. 392m @ 0.93% CuEq and 132m @ 1.09% CuEq

-- Hole 24: 506m @ 0.55% CuEq, incl. 220m @ 0.72% CuEq and 62m @ 1.05% CuEq

Ø Drilling continues with hole 41 at a current depth of 500m,

testing extensions to open mineralisation in the southeast quarter

of the deposit. Hole 41 has so far intersected visible copper

sulphide mineralisation from 381.7m to its current depth.

FURTHER INFORMATION

The TAM deposit lies approximately 3km north of the Alpala

deposit, at the Cascabel project, held by ENSA, an 85% owned

subsidiary of SolGold. The project area lies within the Imbabura

province of northern Ecuador approximately 100 km north of the

capital city of Quito and approximately 50 km north-northwest of

the provincial capital, Ibarra ( Figure 1 ).

To date a total of 30,925.2m of diamond drilling has been

completed at the TAM deposit, with drill hole 41 currently in

progress at a depth of 500m ( Figure 2 ). Assay results from hole

41 are pending.

Modelled geological and grade shell interpretations show an

intimate spatial relationship between intrusive phases and

subsequent copper and gold mineralisation ( Figure 3 ).

All holes were drilled for resource definition of the TAM

deposit, except drill holes 20, 27, 30-31, 33-34, 36, 39, and 40

which were drilled specifically for geotechnical purposes,

targeting the proposed west wall of a potential open pit design.

The current hole 41 focusses on resource extension in the southeast

quarter of the deposit footprint.

A summary of drilling results achieved from drill holes 24-40

are included in Table 1 .

The full size and tenor of the TAM system has not yet been

tested. Mineralisation remains open to the south and east and at

depth. Further surface geochemical anomalies to the east of the

current drilling area also require drill testing.

The maiden Mineral Resource at TAM dated 19 October 2021 totals

233Mt @ 0.33% CuEq for 0.53Mt Cu, and 1.20Moz Au in the Indicated

category, plus 197Mt @ 0.39% CuEq for 0.52Mt Cu, and 1.24Moz Au in

the Inferred category.

The TAM maiden MRE dataset comprised 17,535m of diamond drilling

from holes 1-23, 458m of surface rock-saw channel assays from 72

outcrops, and 14,566m of final assay results from holes 1-18.

An updated TAM MRE#2 is currently underway with a dataset that

comprises 30,925.2m of diamond drilling from holes 1-41, 458m of

surface rock-saw channel assays from 72 outcrops and a total of

29,631.6m of final assay results from holes 1-40.

References to figures relate to the version visible in PDF

format by clicking the link below:

http://www.rns-pdf.londonstockexchange.com/rns/1518I_1-2022-4-12.pdf

([1]) Alpala MRE was reported at a cut-off grade of 0.21% copper

equivalent (CuEq) using a copper equivalency factor of 0.613

(whereby CuEq = Cu + Au x 0.613). Cut-off grades and copper

equivalency used for reporting were based on third party metal

price research, forecasting of Cu and Au prices, and a cost

structure from mining studies data available at the time. Costs

include mining, processing and general and administration

(G&A). Net Smelter Return (NSR) includes metallurgical

recoveries and off-site realisation (TCRC) including royalties and

utilising metal prices of Cu at US$3.40/lb and Au at

US$1,400/oz.

([2]) See "Cascabel Property NI 43-101 Technical Report, Alpala

Porphyry Copper-Gold-Silver Deposit - Mineral Resource Estimation,

January 2021" with an Effective date: 18 March 2020 and Amended

Date: 15 January 2021 (the "Amended Technical Report"), filed at

www.Sedar.com on January 29, 2021.

([3]) Cut-off grades have been developed independently for open

pit mining methods and underground bulk mining methods. Cut-off

grades and copper equivalency used for reporting were based on

third party metal price research, forecasting of Cu and Au prices,

and a cost structure from mining studies data available at the

time. Costs include mining, processing and general and

administration (G&A). Net Smelter Return (NSR) includes

metallurgical recoveries and off-site realisation (TCRC) including

royalties and utilising metal prices of Cu at US$3.30/lb and Au at

US$1,700/oz, and a copper equivalency factor of 0.654 (whereby CuEq

= Cu + Au x 0.654). The cut-off grade for potentially open pittable

material has been calculated at 0.16% CuEq, while the cut-off grade

for material potentially mineable by a bulk underground mining

method such as block caving has been calculated at 0.28% CuEq.

([4]) Significant down-hole drill intercepts at TAM are reported

using a data aggregation method based on copper equivalent (CuEq)

cut-off grades with up to 10m internal dilution, excluding bridging

to a single sample and with minimum intersection length of 50m.

Figure 1 : Location of TAM, Alpala and Aguinaga deposits at the

Cascabel project.

Figure 2 : Comparative plan view looking down of TAM orebody at

a cut-off grade of 0.3% CuEq, showing the orebody at the time of

the TAM maiden MRE in holes 1-18 (TOP) and the current orebody from

drilling completed in holes 1-41 (BOTTOM). Potential open pittable

resource area previously identified in the TAM Maiden MRE is shown

in light brown, and the orientation line of cross-section A-A'

(overleaf) is shown in red. Grid spacing 300m.

Figure 3 : Drill Section A-A', looking northwest, with a window

thickness of 150m, showing modelled geology

(TOP) and CuEq grade shells (BOTTOM) at the TAM deposit. Grid spacing 300m.

Table 1 : Selected drilling results from holes 24-40 at the TAM

deposit

Notes to Table

1:

1. Significant down-hole drill intercepts are reported using a data

aggregation method based on copper equivalent (CuEq) cut-off grades

with up to 10m internal dilution, excluding bridging to a single

sample and with minimum intersection length of 50m.

2. True width of down-hole intersections reported are expected to

be approximately 35-90% of the down-hole lengths, depending on the

attitude of the drill hole. Drill hole inclinations range from -15

to -80 degrees.

3. Copper equivalency factor of 0.654 (whereby CuEq = Cu + Au x 0.654)

is based on third party metal price research, forecasting of Cu and

Au prices, and a cost structure from mining studies data available

from a similar deposit. Costs include mining, processing and general

and administration (G&A). Net Smelter Return (NSR) includes metallurgical

recoveries and off-site realisation (TCRC) including royalties and

utilising metal prices of Cu at US$3.30/lb and Au at US$1,700/oz.

4. Metre percent Copper Equivalent (m% CuEq) = interval length (m)

x grade of the entire interval (CuEq%). This calculation provides

a standardised measure of comparing drilling intercepts by calculating

an analogous interval length that would hold a CuEq% grade of 1%

for each metre within the selected interval.

5. "nsi"- no significant intersection.

6. " * "- intersection remains open at depth.

Qualified Person:

Information in this report relating to the exploration results

is based on data reviewed by Mr Jason Ward ((CP) B.Sc. Geol.), the

Chief Geologist of the Company. Mr Ward is a Fellow of the

Australasian Institute of Mining and Metallurgy, holds the

designation FAusIMM (CP), and has in excess of 20 years' experience

in mineral exploration and is a Qualified Person for the purposes

of the relevant LSE and TSX Rules. Mr Ward consents to the

inclusion of the information in the form and context in which it

appears.

Information in this report relating to the Mineral Resource

Estimate was reviewed by Dr Andrew Fowler. Dr Fowler is a Chartered

Professional Member of the Australasian Institute of Mining and

Metallurgy and has in excess of 20 years' experience in Mineral

Resource Estimation, open pit mining, underground mining and

mineral exploration. He is an independent Qualified Person for the

purposes of the relevant LSE and TSX Rules. Dr Fowler consents to

the inclusion of the information in the form and context in which

it appears.

By order of the Board

Dennis Wilkins

Company Secretary

Certain information contained in this announcement would have

been deemed inside information.

CONTACTS

Dennis Wilkins

SolGold Plc (Company Secretary) Tel: +61 (0) 417 945 049

dwilkins@solgold.com.au

Ingo Hofmaier

SolGold Plc (Acting CFO) Tel: +44 (0) 20 3823 2130

ihofmaier@solgold.com.au

Fawzi Hanano / Lia Abady

SolGold Plc (Investors / Communication) Tel: +44 (0) 20 3823 2130

fhanano@solgold.com.au / labady@solgold.com.au

Tavistock (Media)

Jos Simson/Gareth Tredway Tel: +44 (0) 20 7920 3150

Follow us on twitter @SolGold_plc

ABOUT SOLGOLD

SolGold is a leading resources company focussed on the

discovery, definition and development of world-class copper and

gold deposits. In 2018, SolGold's management team was recognised by

the "Mines and Money" Forum as an example of excellence in the

industry and continues to strive to deliver objectives efficiently

and in the interests of shareholders. SolGold is aggressively

exploring the length and breadth of this highly prospective and

gold-rich section of the Andean Copper Belt which is currently

responsible for c40% of global mined copper production.

The Company operates with transparency and in accordance with

international best practices. SolGold is committed to delivering

value to its shareholders, while simultaneously providing economic

and social benefits to impacted communities, fostering a healthy

and safe workplace and minimizing the environmental impact.

Dedicated stakeholders

SolGold employs a staff of approximately 800 employees of whom

98% are Ecuadorean. This is expected to grow as the operations

expand at Cascabel, and in Ecuador generally. SolGold focusses its

operations to be safe, reliable and environmentally responsible and

maintains close relationships with its local communities. SolGold

has engaged an increasingly skilled, refined and experienced team

of geoscientists using state of the art geophysical and geochemical

modelling applied to an extensive database to enable the delivery

of ore grade intersections from nearly every drill hole at Alpala.

SolGold has close to 60 geologists on the ground in Ecuador

exploring for economic copper and gold deposits.

About Cascabel and Alpala

The Alpala deposit is the main target in the Cascabel

concession, located on the northern section of the heavily endowed

Andean Copper Belt, the entirety of which is renowned as the base

for nearly half of the world's copper production. The project area

hosts mineralisation of Eocene age, the same age as numerous Tier 1

deposits along the Andean Copper Belt in Chile and Peru to the

south. The project base is located at Rocafuerte within the

Cascabel concession in northern Ecuador, an approximately

three-hour drive on sealed highway north of the capital Quito,

close to water, power supply and Pacific ports.

Having fulfilled its earn-in requirements, SolGold is a

registered shareholder with an unencumbered legal and beneficial

85% interest in ENSA (Exploraciones Novomining S.A.) which holds

100% of the Cascabel concession covering approximately 50km(2) .

The junior equity owner in ENSA is required to repay 15% of costs

since SolGold's earn in was completed, from 90% of its share of

distribution of earnings or dividends from ENSA or the Cascabel

concession. It is also required to contribute to development or be

diluted, and if its interest falls below 10%, it shall reduce to a

0.5% NSR royalty which SolGold may acquire for US$3.5million.

SolGold's Regional Exploration Drive

SolGold is using its successful and cost-efficient blueprint

established at Alpala, and Cascabel generally, to explore for

additional world class copper and gold projects across Ecuador.

SolGold is a large and active concessionaire in Ecuador.

The Company wholly owns four other subsidiaries active

throughout the country that are now focussed on a number of high

priority copper and gold resource targets, several of which the

Company believes have the potential, subject to resource definition

and feasibility, to be developed in close succession or even on a

more accelerated basis compared to Alpala.

SolGold is listed on the London Stock Exchange and Toronto Stock

Exchange (LSE/TSX: SOLG). The Company has on issue a total of

2,293,816,433 fully paid ordinary shares and 32,250,000 share

options.

Quality Assurance / Quality Control on Sample Collection,

Security and Assaying

SolGold operates according to its rigorous Quality Assurance and

Quality Control (QA/QC) protocol, which is consistent with industry

best practices.

Primary sample collection involves secure transport from

SolGold's concessions in Ecuador, to the ALS certified sample

preparation facility in Quito, Ecuador. Samples are then air

freighted from Quito to the ALS certified laboratory in Lima, Peru

where the assaying of drill core, channel samples, rock chips and

soil samples is undertaken. SolGold utilises ALS certified

laboratories in Canada and Australia for the analysis of

metallurgical samples.

Samples are prepared and analysed using 100g 4-Acid digest ICP

with MS finish for 48 elements on a 0.25g aliquot (ME-MS61).

Laboratory performance is routinely monitored using umpire assays,

check batches and inter-laboratory comparisons between ALS

certified laboratory in Lima and the ACME certified laboratory in

Cuenca, Ecuador.

In order to monitor the ongoing quality of its analytical

database, SolGold's QA/QC protocol encompasses standard sampling

methodologies, including the insertion of certified powder blanks,

coarse chip blanks, standards, pulp duplicates and field

duplicates. The blanks and standards are Certified Reference

Materials supplied by Ore Research and Exploration, Australia.

SolGold's QA/QC protocol also monitors the ongoing quality of

its analytical database. The Company's protocol involves

independent data validation of the digital analytical database

including search for sample overlaps, duplicate or absent samples

as well as anomalous assay and survey results. These are routinely

performed ahead of Mineral Resource Estimates and Feasibility

Studies. No material QA/QC issues have been identified with respect

to sample collection, security and assaying.

Reviews of the sample preparation, chain of custody, data

security procedures and assaying methods used by SolGold confirm

that they are consistent with industry best practices and all

results stated in this announcement have passed SolGold's QA/QC

protocol.

The data aggregation method for calculating Copper Equivalent

(CuEq) for down-hole drilling intercepts and rock-saw channel

sampling intervals are reported using copper equivalent (CuEq)

cut-off grades with up to 10m internal dilution, excluding bridging

to a single sample and with minimum intersection length of 50m.

Alpala Copper Equivalency (CuEq) was calculated (assuming 100%

recovery of copper and gold) using a Gold Conversion Factor of

0.613 (CuEq = Cu + Au x 0.613), calculated from a nominal copper

price of US$3.40/lb and a gold price of US$1,400/oz.

TAM open pittable and underground resources were estimated using

a Copper Equivalency (CuEq) calculated from estimated costs,

including mining, processing and general and administration

(G&A), whereby Net Smelter Return (NSR) includes metallurgical

recoveries and off-site realisation (TCRC) including royalties, and

utilising the updated nominal copper price of US$3.30/lb and a gold

price of US$1,700/oz to produce a Gold Conversion Factor of 0.654

(CuEq = Cu + Au x 0.654).

See www.solgold.com.au for more information. Follow us on

twitter @SolGold plc

CAUTIONARY NOTICE

News releases, presentations and public commentary made by

SolGold plc (the "Company") and its Officers may contain certain

statements and expressions of belief, expectation or opinion which

are forward looking statements, and which relate, inter alia, to

interpretations of exploration results to date and the Company's

proposed strategy, plans and objectives or to the expectations or

intentions of the Company's Directors, including the plan for

developing the Project currently being studied as well as the

expectations of the Company as to the forward price of copper. Such

forward-looking and interpretative statements involve known and

unknown risks, uncertainties and other important factors beyond the

control of the Company that could cause the actual performance or

achievements of the Company to be materially different from such

interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations

or forward-looking statements; and save as required by the exchange

rules of the TSX and LSE or by applicable laws, the Company does

not accept any obligation to disseminate any updates or revisions

to such interpretations or forward-looking statements. The Company

may reinterpret results to date as the status of its assets and

projects changes with time expenditure, metals prices and other

affecting circumstances.

This release may contain "forward--looking information" within

the meaning of applicable Canadian securities legislation.

Forward--looking information includes, but is not limited to,

statements regarding the Company's plans for developing its

properties. Generally, forward--looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved".

Forward--looking information is subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward--looking information, including but not limited to:

transaction risks; general business, economic, competitive,

political and social uncertainties; future prices of mineral

prices; accidents, labour disputes and shortages and other risks of

the mining industry. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Factors that could cause actual results to differ

materially from such forward-looking information include, but are

not limited to, risks relating to the ability of exploration

activities (including assay results) to accurately predict

mineralization; errors in management's geological modelling and/or

mine development plan; capital and operating costs varying

significantly from estimates; the preliminary nature of visual

assessments; delays in obtaining or failures to obtain required

governmental, environmental or other required approvals;

uncertainties relating to the availability and costs of financing

needed in the future; changes in equity markets; inflation; the

global economic climate; fluctuations in commodity prices; the

ability of the Company to complete further exploration activities,

including drilling; delays in the development of projects;

environmental risks; community and non-governmental actions; other

risks involved in the mineral exploration and development industry;

the ability of the Company to retain its key management employees

and skilled and experienced personnel; and those risks set out in

the Company's public documents filed on SEDAR at www.sedar.com .

Accordingly, readers should not place undue reliance on

forward--looking information. The Company does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

The Company and its officers do not endorse, or reject or

otherwise comment on the conclusions, interpretations or views

expressed in press articles or third-party analysis, and where

possible aims to circulate all available material on its

website.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLEAALAFEKAEFA

(END) Dow Jones Newswires

April 13, 2022 02:00 ET (06:00 GMT)

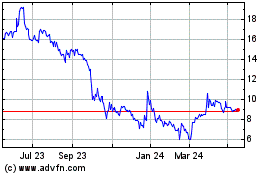

Solgold (LSE:SOLG)

Historical Stock Chart

From Oct 2024 to Nov 2024

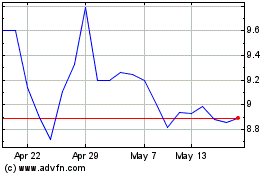

Solgold (LSE:SOLG)

Historical Stock Chart

From Nov 2023 to Nov 2024