TIDMSOLG

RNS Number : 7650W

SolGold PLC

27 April 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, NEW

ZEALAND, HONG KONG, JAPAN, SOUTH AFRICA, HONG KONG OR ANY OTHER

JURISDICTION, WHERE SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD

BE UNLAWFUL.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO BUY, ACQUIRE

OR SUBSCRIBE FOR (OR THE SOLICITATION OF AN OFFER TO BUY, ACQUIRE

OR SUBSCRIBE FOR) ORDINARY SHARES TO ANY PERSON WITH A REGISTERED

ADDRESS IN, LOCATED IN, OR WHO IS A RESIDENT OF, THE UNITED STATES,

AUSTRALIA, NEW ZEALAND, HONG KONG, JAPAN, SOUTH AFRICA OR IN ANY

OTHER JURISDICTION, WHERE SUCH OFFER, SOLICITATION OR SALE WOULD BE

UNLAWFUL OR CONTRAVENE ANY REGISTRATION OR QUALIFICATION

REQUIREMENTS UNDER THE SECURITIES LAWS OF ANY SUCH

JURISDICTION.

THIS ANNOUNCEMENT IS FOR INFORMATIONAL PURPOSES ONLY, AND DOES

NOT CONSTITUTE OR FORM PART OF ANY OFFER OR INVITATION TO SELL OR

ISSUE, OR ANY SOLICITATION OF AN OFFER TO PURCHASE OR SUBSCRIBE

FOR, ANY SECURITIES OF SOLGOLD PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014, INCLUDING AS IT

FORMS PART OF DOMESTIC LAW IN THE UNITED KINGDOM BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018.

THIS ANNOUNCEMENT AMOUNTS TO A FINANCIAL PROMOTION FOR THE

PURPOSES OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT

2000 ("FSMA") AND HAS BEEN APPROVED BY PRIMARYBID LIMITED WHICH IS

AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY (FRN

779021)

For immediate release

27 April 2021

SolGold plc

("SolGold" or the "Company")

PrimaryBid Offer

The Board of Directors of SolGold plc ( LSE & TSX: SOLG ), a

leading exploration company focused on the discovery, definition

and development of world-class copper and gold deposits, is pleased

to announce a conditional offer for subscription via PrimaryBid

(the "Retail Offer") of new ordinary shares of 1p each in the

capital of the Company ("Retail Shares") .

The Company is also conducting a non-pre-emptive placing of new

ordinary shares ("Placing Shares" and, together with the Retail

Shares, the "New Ordinary Shares") at the Placing Price by way of

an accelerated bookbuild process (the "Placing") as announced

earlier today. The price at which the Placing Shares and Retail

Shares are to be placed (the "Placing Price") will be determined

following the close of the bookbuild. The issue price for the

Retail Shares will be the Placing Price.

The Retail Offer is conditional on, among other things, the

Retail Shares and the Placing Shares being admitted to the standard

listing segment of the Official List of the Financial Conduct

Authority (the "FCA") and to be admitted to trading on the main

market for listed securities of the London Stock Exchange plc

(together, "Admission"). Admission is expected to take place at

8.00 a.m. on or around 30 April 2021. The New Ordinary Shares are

also expected to be admitted to trading on the Toronto Stock

Exchange ("TSX"), conditional upon receiving TSX approval. The

Retail Offer will not be completed without the Placing also being

completed.

The net proceeds of the Placing will enable the Company to make

a significant investment into Ecuador and its exploration assets in

the context of an improved outlook in the country.

The goal of the Company is to drive value for stakeholders via

the exploration and ultimately development of its exciting

prospective targets already identified within the Regional

Portfolio and to seek to discover another highly prospective

mineral system such as that at the Company's flagship Alpala

project.

The Company has a proven track record of applying its

exploration blueprint of systematically evaluating its exploration

assets, which are held in four wholly owned subsidiaries across the

country. With 76 concessions covering over 3,000km(2) in Ecuador,

SolGold is the largest and most active concession holder in the

country. The net proceeds of the Placing are intended to fund (i) a

minimum of 40,000 meters of diamond core drilling, (ii) related

technical services and staff expenses and (iii) Corporate Social

Responsibility ("CSR") initiatives related to the Company's

Regional Portfolio. Excess cash will be used for the Defined

Feasibility Study ("DFS") and related workstreams related to the

Alpala Project and be available for general corporate purposes and

working capital. Further details are available in the Company

announcement relating to the Placing made earlier today.

Retail Offer

The Company values its retail investor base and is therefore

pleased to provide private and other investors the opportunity to

participate in the Retail Offer by applying exclusively through the

PrimaryBid mobile app (available on the Apple App Store and Google

Play). PrimaryBid does not charge investors any commission for this

service.

The Retail Offer, via the PrimaryBid mobile app, is now open to

individual and institutional investors and will close at 9 .00 p.m.

on 27 April 2021 . The Retail Offer may close early if it is

oversubscribed.

The Company in consultation with PrimaryBid reserves the right

to scale back any order at its discretion. The Company and

PrimaryBid reserve the right to reject any application for

subscription under the Offer without giving any reason for such

rejection.

No commission is charged to investors on applications to

participate in the Retail Offer made through PrimaryBid. It is

vital to note that once an application for Retail Shares has been

made and accepted via PrimaryBid, an application cannot be

withdrawn.

For further information on PrimaryBid or the procedure for

applications under the Retail Offer, visit

www.primarybid.com or email PrimaryBid at enquiries@primarybid.com.

The Retail Shares will be issued free of all liens, charges and

encumbrances and will, when issued and fully paid, rank pari passu

in all respects with the Company's existing Ordinary Shares,

including, without limitation, the right to receive all dividends

and other distributions declared, made or paid after the date of

issue.

Details of the Retail Offer

Given the longstanding support of retail shareholders, the

Company believes that it is appropriate to provide retail and other

interested investors the opportunity to participate in the Offer.

The Company is therefore making the Offer available exclusively

through the PrimaryBid mobile app.

The Retail Offer is made under the exemptions against the need

for a prospectus allowed under the Prospectus Rules. As such, there

is no need for publication of a prospectus pursuant to the

Prospectus Rules, or for approval of the same by the Financial

Conduct Authority in its capacity as the UK Listing Authority. The

Retail Offer is not being made into any Restricted Jurisdiction or

any other jurisdiction where it would be unlawful to do so.

There is a minimum subscription of GBP100 per investor under the

terms of the Retail Offer which is open to existing shareholders

and other investors subscribing via the PrimaryBid mobile app.

For further details please refer to the PrimaryBid website at

www.PrimaryBid.com . The terms and conditions on which the Retail

Offer is made, including the procedure for application and payment

for Retail Shares, is available to all persons who register with

PrimaryBid.

http://www.rns-pdf.londonstockexchange.com/rns/7650W_1-2021-4-27.pdf

Investors should make their own investigations into the merits

of an investment in the Company. Nothing in this announcement

amounts to a recommendation to invest in the Company or amounts to

investment, taxation or legal advice.

It should be noted that a subscription for Retail Shares and

investment in the Company carries a number of risks. Investors

should consider the risk factors set out on PrimaryBid.com before

making a decision to subscribe for Retail Shares. Investors should

take independent advice from a person experienced in advising on

investment in securities such as the Retail Shares if they are in

any doubt.

This announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this announcement.

The person responsible for arranging this announcement on behalf

of SolGold plc is Ingo Hofmaier Executive General Manager,

Corporate Finance.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018.

For further information, please contact:

SolGold plc www.solgold.com.au

Keith Marshall (Interim CEO) +44 (0) 20 3823

Ingo Hofmaier (Executive General Manager, 2130

Corporate Finance)

PrimaryBid Limited enquiries@primarybid.com

Fahim Chowdhury / James Deal

Notes to Editors

About the Company

SolGold is a leading exploration company focused on the

discovery, definition and development of world-class copper and

gold deposits. SolGold , with 76 concessions covering over

3,000km(2), is the largest and most active concession holder in

Ecuador (based on exploration expenditure reported by SNP Global)

and is aggressively exploring this highly prospective,

underexplored and copper-gold-rich section of the Andean Copper

Belt which is currently responsible for c40% of global mined copper

production (according to Wood Mackenzie). Ecuador is one of the

most important new mining jurisdictions and is endorsed by major

mining companies. The Company further believes that the newly

elected president will offer continued support for responsible

mining activities and a focus on foreign direct investments.

The Company's current activities are focussed on progressing a

PFS study at its Alpala project and regional exploration as the

Company continues to pursue its strategy as an integrated explorer

and developer, based on preservation of value for all shareholders.

The Company maintains its plan of applying its blueprint of

systematic evaluation and exploration across its regional

exploration portfolio of 75 concessions, having created the

successful blueprint at the company's Tier 1 Alpala project.

The Alpala deposit comprises 2,663 Mt at 0.53% CuEq in the

Measured plus Indicated categories and contained metal content of

9.9 Mt copper, 21.7 Moz gold and 92.2 Moz silver. The Company is of

the view that the Alpala resource is one of the most significant

copper-gold porphyry discoveries of the last decade. The Company

further believes that it has the potential to become a key source

of future copper supply amid an expected growing medium-term market

deficit, reflecting limited new project development, a declining

base production and growing demand supported by the shift towards

electrification and decarbonisation.

A significant part of SolGold 's success to date in driving

shareholder value growth has been through its successful

exploration programmes across Ecuador's highly prospective and

under-explored section of the Andean Copper Belt. Whilst this has

resulted in the discovery and development of the world class Alpala

project, the board of directors believes that the best way to

continue to drive shareholder value at present is through further

exploration success at priority projects. The goal of the Company

is to drive value for stakeholders through this exploration

programme by the assessment and study of exciting prospective

targets already identified within the Regional Portfolio and to

seek to discover another highly prospective mineral system such as

that at the Company's flagship Alpala project.

Important Notices

This announcement has been issued by and is the sole

responsibility of the Company.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, NEW

ZEALAND, HONG KONG, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION,

WHERE SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS

NOT AN OFFER OF SECURITIES IN ANY JURISDICTION. THIS ANNOUNCEMENT

HAS NOT BEEN APPROVED BY THE LONDON STOCK EXCHANGE OR THE FCA, NOR

IS IT INTED THAT IT WILL BE SO APPROVED.THIS ANNOUNCEMENT DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN SOLGOLD PLC.

The distribution of this announcement and the offering and/or

issue of the Retail Shares in certain jurisdictions may be

restricted by law. No action has been taken by the Company or any

of its affiliates, agents, directors, officers or employees that

that would permit an offer of the Retail Shares or possession or

distribution of this announcement or any other offering or

publicity material relating to such Retail Shares in any

jurisdiction where action for that purpose is required. Persons

into whose possession this announcement comes are required by the

Company to inform themselves about and to observe any such

restrictions. Any failure to comply with this restriction may

constitute a violation of the securities laws of such

jurisdictions.

No prospectus will be made available in connection with the

matters contained in this announcement and no such prospectus is

required to be published. Persons needing advice should consult an

independent financial adviser.

This announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States, Canada, Australia, New Zealand, the Republic of South

Africa, Japan, Hong Kong or any other jurisdiction in which the

same would be unlawful. No public offering of the securities

referred to herein is being made in any such jurisdiction.

This communication is not a public offer of securities for sale

in the United States. The securities referred to herein have not

been and will not be registered under the US Securities Act 1933,

as amended (the "Securities Act") or under the securities laws of

any state or other jurisdiction of the United States, and may not

be offered or sold directly or indirectly in or into the United

States or to any U.S. persons (as defined in Regulation S under the

Securities Act), except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and in compliance with the securities laws of any

state or any other jurisdiction of the United States. The

securities referred to herein may not be offered and sold within

the United States except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. No portion of the Retail Offer will be made in the

United States, no New Ordinary Shares will be offered or sold as

part of the Retail Offer to persons located in the United States or

to U.S. persons (wherever located).

Persons (including, without limitation, nominees and trustees)

who have a contractual right or other legal obligations to forward

a copy of this Announcement should seek appropriate advice before

taking any action.

This announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results. Without

limitation, forward-looking statements sometimes use words such as

"aim", "anticipate", "target", "expect", "estimate", "intend",

"plan", "goal", "believe", "seek", "may", "could", "outlook" or

other words or terms of similar meaning (or the negative thereof).

By their nature, all forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances

which are beyond the control of the Company, including (without

limitation and amongst other things), domestic and global economic

business conditions, the macroeconomic and other impacts of

COVID-19, market-related risks such as fluctuations in interest

rates and exchange rates, the policies and actions of governmental

and regulatory authorities, the effect of competition, inflation,

deflation, the timing effect and other uncertainties of future

acquisitions or combinations within relevant industries, the effect

of tax and other legislation and other regulations in the

jurisdictions in which the Company and its respective affiliates

operate, the effect of volatility in the equity, capital and credit

markets on the Company's profitability and ability to access

capital and credit, a decline in the Company's credit ratings; the

effect of operational risks; and the loss of key personnel. As a

result, the actual future financial condition, performance and

results of the Company may differ materially from the plans, goals

and expectations set forth in any forward-looking statements. Due

to such uncertainties and risks, readers are cautioned not to place

undue reliance on such forward-looking statements, which speak only

as of the date hereof. In light of these risks, uncertainties and

assumptions, the events described in the forward-looking statements

in this announcement may not occur. Any forward-looking statements

made in this announcement by or on behalf of the Company speak only

as of the date they are made. Except as required by applicable law

or regulation, the Company and its directors each expressly

disclaim any obligation or undertaking to publish any updates or

revisions to any forward-looking statements contained in this

announcement to reflect any changes in the Company's expectations

with regard thereto or any changes in events, conditions or

circumstances on which any such statement is based.

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK MiFIR Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the UK MiFIR Product Governance Requirements)

may otherwise have with respect thereto, the New Ordinary Shares

have been subject to a product approval process, which has

determined that the New Ordinary Shares are: (i) compatible with an

end target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, as

respectively defined in paragraphs 3.5 and 3.6 of the FCA Handbook

Conduct of Business Sourcebook; and (ii) eligible for distribution

through all permitted distribution channels (the "Target Market

Assessment"). Notwithstanding the Target Market Assessment,

distributors should note that: the price of the New Ordinary Shares

may decline and investors could lose all or part of their

investment; the New Ordinary Shares offer no guaranteed income and

no capital protection; and an investment in the New Ordinary Shares

is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction

with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have

sufficient resources to be able to bear any losses that may result

therefrom. The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the New Ordinary Shares the subject of

the capital raising.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Chapters 9A or 10A respectively of the FCA

Handbook Conduct of Business Sourcebook; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the New Ordinary

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

This announcement does not constitute a recommendation

concerning any investor's options with respect to the Retail Offer.

Recipients of this announcement should conduct their own

investigation, evaluation and analysis of the business, data and

other information described in this announcement. The price of

shares and any income expected from them may go down as well as up

and investors may not get back the full amount invested upon

disposal of the shares. Past performance is no guide to future

performance. The contents of this announcement are not to be

construed as legal, business, financial or tax advice. Each

investor or prospective investor should consult his, her or its own

legal adviser, business adviser, financial adviser or tax adviser

for legal, financial, business or tax advice.

No statement in this announcement is intended to be a profit

forecast or estimate for any period, and no statement in this

announcement should be interpreted to mean that earnings, earnings

per share or income, cash flow from operations or free cash flow

for the Company (as appropriate), for the current or future

financial years would necessarily match or exceed the historical

published earnings, earnings per share or income, cash flow from

operations or free cash flow for the Company.

The Retail Shares to be issued pursuant to the Retail Offer will

not be admitted to trading on any stock exchange other than the

London Stock Exchange and the Toronto Stock Exchange.

Neither the content of the Company's website (or any other

website) nor any website accessible by hyperlinks on the Company's

website (or any other website) is incorporated in, or forms part

of, this announcement.

The GBP/US$ exchange used in respect of the Retail Offer is

GBP1.00:US$ 1.3899 .

Qualified Persons Statement

The scientific or technical information contained in this press

release has been approved by Jason Ward (the Company's Head of

Exploration), a qualified person under National Instrument 43-101 -

Standards of Disclosure for Mineral Projects.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFZGZDDNMGMZM

(END) Dow Jones Newswires

April 27, 2021 11:47 ET (15:47 GMT)

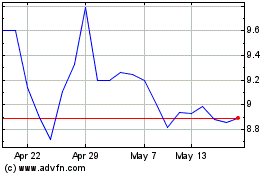

Solgold (LSE:SOLG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solgold (LSE:SOLG)

Historical Stock Chart

From Nov 2023 to Nov 2024