TIDMSIV

RNS Number : 2260A

Sivota PLC

22 September 2022

22 September 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA,

CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN, ANY MEMBER STATE OF

THE EUROPEAN ECONOMIC AREA OR ANY JURISDICTION IN WHICH IT WOULD BE

UNLAWFUL TO DO SO.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION REGARDING SIVOTA

PLC. NOTHING IN THIS ANNOUNCEMENT OR THE PROSPECTUS CONSTITUTES AN

OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITIES

IN ANY TERRITORY.

SIVOTA PLC

(" Sivota ," or "the Company")

Readmission of the entire issued Ordinary Share capital to the

Official List (by way of a Standard Listing under Chapter 14 of the

Listing Rules) and to trading on the London Stock Exchange's Main

Market for listed securities

Prospectus publication and expected date of Readmission

Sivota, the London listed investment vehicle focused on

later-stage, Israeli technology companies, announces that it has

today published a prospectus (the " Prospectus " ) approved by the

FCA in connection with the readmission of its entire issued

ordinary capital (the "Ordinary Shares") to the standard segment of

the Official List of the FCA and to trading on the London Stock

Exchange's Main Market for listed securities ("Readmission").

Readmission (including the recommencement of trading in the

Ordinary Shares) is expected to occur at 8.00 a.m. on 26 September

2022.

Background to Readmission

On 7 December 2021, the Company announced that it had entered

into non-binding term sheet (with Apester Limited ("Apester"), an

Israeli incorporated business which operates an innovative digital

experience software platform that enables brands, publishers and

e-commerce to create and distribute interactive digital

experiences, in relation to a potential transaction. The Company's

shares were suspended pending (i) completion of the transaction

which would be a reverse takeover for the purposes of the Listing

Rules and (ii) publication of a prospectus in relation to its

enlarged group.

On 13 May 2022, the Company announced the acquisition of a

majority stake in Apester Ltd (the "Acquisition"). Under the terms

of the Acquisition agreement, the Company was issued Preferred Seed

Shares in the capital of Apester for an aggregate price of US $12.0

million reflecting pre-money valuation of Apester of $16.0 million

on a fully diluted basis. The cash consideration for the

Acquisition was raised through a $14.2 million (gross) placing and

direct subscription of 11,500,000 new ordinary shares of one pence

each in the Company at GBP1.00 a share from existing and new

investors in Sivota. The Prospectus relating to the Company and its

enlarged group has therefore been published for the purposes of

Readmission.

Prospectus availability

A copy of the Prospectus will be available on the Company's

website at https://sivotacapital.com/ . Neither the content of the

Company's website, nor the content on any website accessible from

hyperlinks on its website for any other website, is incorporated

into, or forms part of, this announcement nor, unless previously

published by means of a recognised information service, should any

such content be relied upon in reaching a decision as to whether or

not to acquire, continue to hold, or dispose of, securities in the

Company.

Background to the Acquisition

Apester is a digital experience software platform that enables

brands to engage and understand customers across all digital media

channels, in turn increasing lead generation, brand uplift,

conversion and sales for its customers.

Developed over seven years and with c. $36 million invested in

its technology prior to the Acquisition, Apester employs 35 people

worldwide, generated revenues of $9.2 million in 2021 (2020: $7.3

million), and services c. 143 global customers including renowned

brands such as CNN, RollingStone, The Independent, IKEA, Australian

Football League and more.

Apester facilitates businesses to better understand their

customers across all digital channels including websites, apps and

social media. Its platform provides tools to create a range of

personalised interactive experiences and applications, including

customer surveys, mobile landing pages, onboarding forms,

interactive videos, polls, quizzes, custom applications and web

stories.

Apester's suite of software applications also includes a Data

Management Platform that allows customers to collect, store and

'own' Zero Party and First-Party engagement data generated from

experiences and applications created on Apester while adhering to

compliance and privacy regulations. The platform's analytics help

to create valuable insight into customer trends, sentiment and

preferences, enabling brands and publishers to better understand

their customers and to accelerate their business performance.

The Digital Experience Platform (DXP) market size is projected

to reach $43.43 billion by 2028, growing at a CAGR of 13.4% 1 from

2021 to 2028. This growth is underpinned by key trends including

the acceleration of the digital economy as a result of Covid-19 and

customers increasingly wanting to maximise engagement to deliver

meaningful ROI. Apester's self-serve, scalable and

customer-friendly platform is well-placed to capitalise on this

significant market growth.

Sivota will focus on the following key growth priorities:

-- Market focus and client segmentation: concentrate on publishers and small- to medium-sized brands/e-commerce businesses; and identify potential customers with business cases similar to proven case studies

-- Enhance self-serve platform: continued development of the technology

-- Business model: shift focus from usage-based model to a SaaS business

-- Financial model management: setting new financial plans and

KPIs; tight control over ROI, cash flow and models

-- Operational processes: optimise delivery processes to improve

margins with existing clients and scale capabilities

Total voting rights

Following Readmission the total issued share capital of the

Company will be 12,585,000 Ordinary Shares. There are no Ordinary

Shares held in treasury. Therefore, following Readmission, this

figure of 12,585,000 should be used by shareholders as the

denominator for the calculation by which they determine if they are

required to notify their interest in, or a change to their interest

in, the Company under the Disclosure Requirements and Transparency

Rules of the FCA.

1

https://www.prnewswire.com/news-releases/digital-experience-platform-market-size-worth--43-43-billion-globally-by-2028-at-13-4-cagr-verified-market-research-301432876.html

For further information, please visit www.sivotacapital.com or

contact:

Sivota PLC via Vigo Consulting

Tim Weller, Non-Executive Chairman

Ziv Ben-Barouch, Chief Executive Officer

Canaccord Genuity Limited + 44 (0) 20 7523

Alex Aylen - Head of Equities 8000

Vigo Consulting

Jeremy Garcia + 44 (0)20 7390 0230

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBKDBKKBKBPCB

(END) Dow Jones Newswires

September 22, 2022 02:01 ET (06:01 GMT)

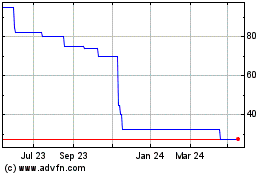

Sivota (LSE:SIV)

Historical Stock Chart

From Dec 2024 to Jan 2025

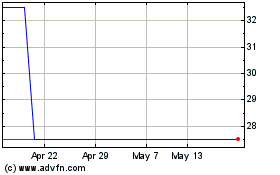

Sivota (LSE:SIV)

Historical Stock Chart

From Jan 2024 to Jan 2025