Tufton Oceanic Assets Ltd. Opportunistic Sale of a Bulker (5930P)

October 20 2021 - 2:00AM

UK Regulatory

TIDMSHIP

RNS Number : 5930P

Tufton Oceanic Assets Ltd.

20 October 2021

20 October 2021

Tufton Oceanic Assets Limited (The "Company")

Opportunistic Sale of a Bulker

The Board of Tufton Oceanic Assets Limited (ticker: SHIP.L) is

pleased to announce that the Company has agreed to divest the

Handysize Bulker Dragon for $16.2m. The vessel is, taking its

charter into account, being sold for 119% of depreciated

replacement cost ("DRC"). It was acquired for 74% of DRC in

2018.

This sale, together with the Handy Bulker investments announced

last month, demonstrate the Company's commitment to ESG and capital

re-allocation. The latter is increasingly relevant given absolute

and relative movements across and within the main shipping markets

since 3Q20.

The Company's remaining six Bulkers are all built in Japan with

an average age of 9.5 years, are fuel efficient versus their peers

and have all been acquired in the past 12 months below DRC. These

vessels earn a net unlevered yield approximately 3 percentage

points higher than Dragon.

The Investment Manager continues to identify an attractive

pipeline of opportunities across a range of the Company's target

sectors.

For further information, please contact:

Tufton Investment Management Ltd (Investment

Manager)

Andrew Hampson

Paulo Almeida +44 (0) 20 7518 6700

Singer Capital Markets

James Maxwell, Alex Bond (Corporate Finance)

Alan Geeves, James Waterlow, Sam Greatrex

(Sales) +44 (0) 20 7496 3000

Hudnall Capital LLP

Andrew Cade +44 (0) 20 7520 9085

About the Company

Tufton Oceanic Assets Limited invests in a diversified portfolio

of secondhand commercial sea-going vessels with the objective of

delivering strong cash flow and capital gains to investors. The

Company's investment manager is Tufton Investment Management Ltd.

The Company has raised a total of approximately $277.5m (gross)

through its Initial Public Offering on the Specialist Fund Segment

of the London Stock Exchange, on 20 December 2017, a subsequent

placing and offer in October 2018, a placing in March 2019, a

placing in September 2019 and tap issues in March and August 2021

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISMLBMTMTTBTAB

(END) Dow Jones Newswires

October 20, 2021 02:00 ET (06:00 GMT)

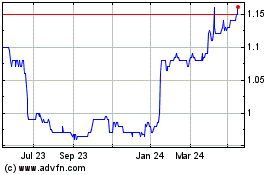

Tufton Oceanic Assets (LSE:SHIP)

Historical Stock Chart

From Sep 2024 to Oct 2024

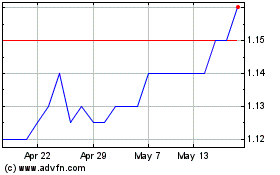

Tufton Oceanic Assets (LSE:SHIP)

Historical Stock Chart

From Oct 2023 to Oct 2024