TIDMSAFE

RNS Number : 4984B

Safestore Holdings plc

11 February 2022

Safestore Holding plc Annual Report and Accounts and AGM

documents

11 February 2022

Safestore Holdings plc ("the Company" or "the Group")

Publication of Annual Report and Accounts 2021, Notice of 2022

Annual General Meeting and Proxy Voting Arrangements

Safestore Holdings plc ("the Company") announces, in accordance

with Listing Rules 9.6.1 and 9.6.3, that copies of the Annual

Report and Accounts 2021, Notice of 2022 Annual General Meeting

have been submitted to the Financial Conduct Authority and will

shortly be available for inspection on the national storage

mechanism at https://data.fca.org.uk/#/nsm/nationalstoragemechanism

.

These documents have been posted to those shareholders who have

elected to receive hard copy communications or have otherwise been

made available to shareholders today.

The Company's 2022 Annual General Meeting will be held at

Brittanic House, Stirling Way, Borehamwood, Hertfordshire WD6 2BT

at 12 noon on Wednesday, 16 March 2022. Full details of the

proposed resolutions are set out in the Notice of Meeting.

The Annual Report and Accounts for the year ended 31 October

2021 is now available for download from the Company's website

at:

https://www.safestore.co.uk/corporate/investors/report - and -

presentations/

The Notice of 2022 Annual General Meeting is also available for

download from the Group's website at:

https://www.safestore.co.uk/corporate/investors/report - and -

presentations/

All shareholders are encouraged to complete and submit a proxy

appointment online by using our electronic proxy appointment

service offered by our Registrar, Link Group, at

www.signalshares.com . All votes must be received by 12 noon on 14

March 2022.

Shareholders unable to locate any of the documents on the web

page, need help with voting online or require a paper proxy form,

please contact our Registrar, Link Group by email to

enquiries@linkgroup.co.uk or you may call Link on +44 (0)371 664

0391. Calls are charged at the standard geographic rate and will

vary by provider. Calls outside the United Kingdom will be charged

at the applicable international rate. Lines are open between 9.00am

and 5.30pm Monday to Friday, excluding public holidays in England

and Wales.

The information included in the appendix to this announcement

has been extracted from the Annual Report and is reproduced here

solely for the purpose of complying with Disclosure Guidance and

Transparency Rule ("DTR") 6.3.5 on respect of how to make annual

financial reports available to the public.

The content of this announcement, including the appendix, should

be read in conjunction with the preliminary announcement of annual

results, (the "Preliminary Results Announcement")* released on 13

January 2022, which is available on the Company's website at:

https://www.safestore.co.uk/corporate/investors/report-and-presentations/

Together these announcements constitute the material required by

DTR 6.3.5 to be communicated in full unedited text through a

Regulatory Information Service. This material is not a substitute

for reading the full Annual Report. Defined terms used in the

appendix refer to terms as defined in the Annual Report. Page

numbers in the appendix refer to pages in the Annual Report.

For further information, please contact:

Safestore Holdings plc

Helen Bramall, Company Secretary Tel: 020 8732 1500

LEI Code : 213800WGA3YSJC1YOH73

Additional Disclosures Not Included in Preliminary Results

Announcement

Statement of Directors' responsibilities

Page 109 of the Annual Report contains the following statement

regarding responsibility for the financial statements and the

management report included in the Annual Report.

The Directors, who are named on pages 66 and 67, are responsible

for preparing the Annual Report and Financial Statements in

accordance with applicable law and regulation.

Company law requires the Directors to prepare such financial

statements for each financial year. Under that law the Directors

are required to prepare the Group financial statements in

accordance with International Financial Reporting Standards

("IFRS") as adopted by the European Union and Article 4 of the IAS

Regulation and have also chosen to prepare the parent company

financial statements in accordance with Financial Reporting

Standard 101 'Reduced Disclosure Framework'. Under company law the

Directors must not approve the financial statements unless they are

satisfied that they give a true and fair view of the state of

affairs of the Group and the parent company and of the profit or

loss of the Group for that period.

In preparing the parent company financial statements, the

Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether Financial Reporting Standard 101 'Reduced

Disclosure Framework' has been followed, subject to any material

departures disclosed and explained in the financial statements;

and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

In preparing the Group financial statements, International

Accounting Standard 1 requires that Directors:

-- properly select and apply accounting policies;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in IFRS is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance; and

-- make an assessment of the Group's ability to continue as a going concern.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's

transactions and disclose with reasonable accuracy at any time the

financial position of the parent company and the Group and enable

them to ensure that the financial statements comply with the

Companies Act 2006. They are also responsible for safeguarding the

assets of the parent company and the Group and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the Group's

website at www.safestore.co.uk. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

Directors' responsibility statement

We confirm that, to the best of our knowledge:

-- the financial statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Group and the undertakings included in the consolidation

taken as a whole;

-- the strategic report includes a fair review of the

development and performance of the business and the position of the

Group and the undertakings included in the consolidation taken as a

whole, together with a description of the principal risks and

uncertainties that they face; and

-- the Annual Report and Financial Statements, taken as a whole,

is fair, balanced and understandable and provides the information

necessary for shareholders to assess the Group's position and

performance, business model and strategy.

Principal risks and risk management

Pages 33 to 38 of the Annual Report contain the following

statement on principal risks and uncertainties faced by the

Group.

Risks are considered at every business level and are assessed,

discussed and taken into account when deciding upon future

strategy, approving transactions and monitoring performance

Risks and risk management

The Board recognises that effective risk management requires

awareness and engagement at all levels of our organisation.

Risk management process

The Board is responsible for determining the nature of the risks

the Group faces, and for ensuring that appropriate mitigating

actions are in place to manage them in a manner that enables the

Group to achieve its strategic objectives.

Effective risk management requires awareness and engagement at

all levels of our organisation. It is for this reason that the risk

management process is incorporated into the day-to-day management

of our business, as well as being reflected in the Group's core

processes and controls. The Board has defined the Group's risk

appetite and oversees the risk management strategy and the

effectiveness of the Group's internal control framework. Risks are

considered at every business level and are assessed, discussed and

taken into account when deciding upon future strategy, approving

transactions and monitoring performance.

Strategic risks are identified, assessed and managed by the

Board, with support from the Audit Committee, which in turn is

supported by the Risk Committee. Strategic risks are reviewed by

the Audit Committee to ensure they are valid and that they

represent the key risks associated with the current strategic

direction of the Group. Operational risks are identified, assessed

and managed by the Risk Committee and Executive Team members, and

reported to the Board and the Audit Committee. These risks cover

all areas of the business, such as finance, operations, investment,

development and corporate risks.

The risk management process commences with rigorous risk

identification sessions incorporating contributions from functional

managers and Executive Team members. The output is reviewed and

discussed by the Risk Committee, supported by members of senior

management from across the business. The Board, supported by the

Risk Committee, identifies and prioritises the top business risks,

with a focus on the identification of key strategic, financial and

operational risks. The potential impact and likelihood of the risks

occurring are determined, key risk mitigations are identified and

the current level of risk is assessed against the Board's risk

appetite. These top business risks form the basis for the principal

risks and uncertainties detailed in the section below.

Principal risks and uncertainties

The principal risks and uncertainties described are considered

to have the most significant effect on Safestore's strategic

objectives.

The key strategic and operational risks are monitored by the

Board and are defined as those which could prevent us from

achieving our business goals. Our current strategic and operational

risks and key mitigating actions are as follows:

Risk Current mitigation activities Developments since

2020

---------------------- ----------------------------------------------------------------------- ---------------------

Strategic risks

----------------------------------------------------------------------------------------------------------------------

The Group develops The Group's strategy

business plans * The strategy development process draws on internal is regularly reviewed

based on a wide and external analysis of the self-storage market, through the annual

range of variables. emerging customer trends and a range of other planning

Incorrect assumptions factors. and budgeting

about the economic process,

environment, and regular

the self-storage * Continuing focus on yield-management with regular reforecasts

market, or changes review of demand levels and pricing at each are prepared during

in the needs individual store. the year.

of customers

or the activities The Group expanded

of customers * Continuing focus on building the Safestore brand, the

may adversely acquisitions and development projects. joint venture with

affect the returns Carlyle,

achieved by the which acquired Opslag

Group, potentially * The portfolio is geographically diversified with and Leiwas stores in

resulting in performance monitoring covering the personal and the Netherlands. The

loss of shareholder business customers by segments. Group continues to

value or loss earn

of the Group's management fees and

status as the * Detailed and comprehensive sensitivity and scenario a 20% share of the

UK's largest modelling taking into consideration variable profits

self storage assumptions. of the joint venture.

provider.

The acquisition of

* Robust cost management. new

stores together with

new store openings

have

been fully integrated

in the Group's store

portfolio.

The level of risk is

considered similar to

the 31 October 2020

assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

Pandemic risk

----------------------------------------------------------------------------------------------------------------------

The Covid-19 outbreak The Covid-19 pandemic

is an unprecedented * The resilient nature of the Group's businesses, our has resulted in a

global event whose robust balance sheet, and the market fundamentals significant

impacts and duration that underpin our businesses inherently provide reduction in the

are now more widely mitigation to the Group from pandemic risk. economic

understood. While growth of the UK and

the Group now Europe in 2020 and

more clearly * Our Group strategic plans and forecasts have provided 2021.

understands an additional layer of mitigation through the The implications of

the impacts of Covid-19 crisis. Covid-19 have been

the pandemic on thoroughly

the business, considered with

we need to be * The Group continues to monitor and assess the respect

adaptable in ensuring potential and realised impacts of Covid-19. to the Group's

our business strategy

resilience through the annual

and maintaining planning

our strong and budgeting

performance. process.

Covid-19 will

continue

to be monitored

through

regular and periodic

reforecasts and

scenario

analysis during 2022.

The level of risk is

considered similar to

the 31 October 2020

assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

Finance risk

----------------------------------------------------------------------------------------------------------------------

Lack of funding In October 2019, the

resulting in * Funding requirements for business plans and the Group issued a

inability to timing for commitments are reviewed regularly as part further

meet business of the monthly management accounts. GBP125 million

plans or satisfy Sterling

liabilities or and Euro loan notes,

a breach of covenants. * The Group manages liquidity in accordance with maturing in seven and

Board-approved policies designed to ensure that the ten years.

Group has adequate funds for its ongoing needs. The Group's

loan-to-value

ratio ("LTV") has

* The Board regularly monitors financial covenant broadly

ratios and headroom. remained constant

during

the year, decreasing

* All of the Group's banking facilities now run to 30 4ppts from 29% to

June 2023. The US Private Placement Notes mature in 25%,

five, seven, eight and ten years. with increased debt

due to development

and

* New US Private Placement Notes secured during the acquisition activity

year with maturity ranging from seven years (2028) to being partially

twelve years (2033). offset

by the valuation

increase

in the store

portfolio.

Since the end of

2020,

there have been

significant

opportunities to

invest

in new stores, in

both

the UK and throughout

Europe, and as a

result

the Group has secured

additional US Private

Placement Note

funding

for GBP150 million

with

a further uncommitted

shelf debt facility

of c. GBP80 million.

Therefore, this risk

continues to remain

low and broadly

unchanged

from the 31 October

2020 assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

Treasury risk

----------------------------------------------------------------------------------------------------------------------

Adverse currency Euro denominated

or interest rate * Guidelines are set for our exposure to fixed and borrowings

movements could floating interest rates and use of interest rate continue to provide

see the cost swaps to manage this risk. an effective, natural

of debt rise, hedge against the

or impact the Euro-denominated

Sterling value * Foreign currency denominated assets are financed by net assets of our

of income flows borrowings in the same currency where appropriate. French

or investments. and Spanish

businesses.

* The Group has entered into FX forwards to reduce the

volatility associated with the translation risk of We have managed the

the Euro. transition from LIBOR

to SONIA effectively.

This risk remains

low.

Mitigation of future

rate increases is

provided

by our interest rate

swaps and fixed

interest

borrowings, so the

risk

of adverse interest

rate fluctuations

remains

broadly unchanged

since

the prior year.

---------------------- ----------------------------------------------------------------------- ---------------------

Property investment and development risk

----------------------------------------------------------------------------------------------------------------------

Acquisition and Projects are not

development of * Thorough due diligence is conducted and detailed pursued

properties that analysis is undertaken prior to Board approval for when they fail to

fail to meet property investment and development. meet

performance our rigorous

expectations, investment

overexposure * Execution of targeted acquisitions and disposals. criteria, and

to developments post-investment

within a short reviews indicate that

timeframe or * The Group's overall exposure to developments is sound and appropriate

the inability monitored and controlled, with projects phased to investment decisions

to find and open avoid over-commitment. have been made.

new stores may

have an adverse The capital

impact on the * The performance of individual properties is requirements

portfolio valuation, benchmarked against target returns and of development

resulting in post-investment reviews are undertaken. projects

loss of shareholder undertaken during the

value. year have been

Corporate transactions carefully

may be at risk forecasted and

of competition monitored,

referral or post and we continue to

transaction legal maintain

or banking significant capacity

formalities. within our financing

arrangements.

We continue to pursue

investment and

development

opportunities, and

consider

our recent track

record

to have been

successful.

Therefore, the Board

considers that there

has been no

significant

change to this risk

since the 31 October

2020 assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

Valuation risk

----------------------------------------------------------------------------------------------------------------------

Value of our The valuation of the

properties declining * Independent valuations are conducted regularly by Group's portfolio has

as a result of experienced, independent, professionally qualified continued to grow

external market valuers. during

or internal management the year, reflecting

factors could both valuation gains

result in a breach * A diversified portfolio which is let to a large arising from the

of borrowing number of customers helps to mitigate any negative increasing

covenants. impact arising from changing conditions in the profitability of our

In the absence financial and property markets. portfolio and

of relevant additions

transactional to our portfolio

evidence, valuations * Headroom of LTV banking covenants is maintained and through

can be inherently reviewed. corporate

subjective leading acquisitions

to a degree of and the opening of

uncertainty. * Current gearing levels provide sizeable headroom on new

our portfolio valuation and mitigate the likelihood development stores.

of covenants being endangered. The level of this

risk

is viewed as broadly

similar to the 31

October

2020 assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

Occupancy risk

----------------------------------------------------------------------------------------------------------------------

A potential loss Covid-19 has resulted

of income and * Personal and business customers cover a wide range of in a contraction in

increased vacancy segments, sectors and geographic territories with economic growth.

due to falling limited exposure to any single customer. However,

demand, oversupply recent like-for-like

or customer default, occupancy trends have

which could also * Dedicated support for enquiry capture. been strong and the

adversely impact newly opened stores

the portfolio are performing well.

valuation. * Weekly monitoring of occupancy levels and close

management of stores. Growth in our store

portfolio diversifies

the potential impact

* Management of pricing to stimulate demand, when of underperformance

appropriate. of an individual

store.

* Monitoring of reasons for customers vacating and exit The risk continues to

interviews conducted. remain low and

consistent

with the assessment

* Independent feedback facility for customer for the year ended 31

experience. October 2020.

* The like-for-like occupancy rate across the portfolio

has continued to grow partly due to flexibility

offered on deals by in-house marketing and the

Customer Support Centre.

---------------------- ----------------------------------------------------------------------- ---------------------

Real estate investment trust ("REIT") risk

----------------------------------------------------------------------------------------------------------------------

Failure to comply The Group has

with the REIT * Internal monitoring procedures are in place to ensure remained

legislation could that the appropriate rules and legislation are compliant with all

expose the Group complied with and this is formally reported to the REIT

to potential Board. legislation

tax penalties throughout

or loss of its the year.

REIT status. There has been no

significant

change to this risk

since the 31 October

2020 assessment.

In addition, we have

also reviewed the

recent

amendments to the UK

REIT rules, taking

effect

from 1 April 2022,

which

do not affect this

assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

Catastrophic event

----------------------------------------------------------------------------------------------------------------------

A major catastrophic Continuing focus from

event could mean * Business continuity plans are in place and tested. the Risk Committee,

that the Group with particular

is unable to attention

carry out its * Back-up systems at offsite locations and remote to specific issues.

business for working capabilities.

a sustained period The level of risk is

or health and considered similar to

safety issues * Reviews and assessments are undertaken periodically the 31 October 2020

put customers, for enhancements to supplement the existing compliant assessment.

staff or property aspects of buildings and processes.

at risk.

These may result * Monitoring and review by the Health and Safety

in reputational Committee.

damage, injury

or property damage,

or customer * Robust operational procedures, including health and

compensation, safety policies, and a specific focus on fire

causing a loss prevention and safety procedures.

of market share

and/or income.

* Fire risk assessments in stores.

* Periodic security review of all systems supported by

external monitoring and penetration testing.

* Limited retention of customer data.

* Online colleague training modules.

---------------------- ----------------------------------------------------------------------- ---------------------

Regulatory compliance risk

----------------------------------------------------------------------------------------------------------------------

The regulatory The framework of tax

landscape for * Monitoring and review by the Risk Committee. controls has been

UK listed companies reviewed

is constantly during the year,

developing and * Project-specific steering committees to address the ensuring

becoming more implementation of new regulatory requirements. key tax risks are in

demanding, with line with the Group's

new reporting obligations. All

and compliance * Liaison with relevant authorities and trade regulatory

requirements associations. compliance risks have

arising frequently. been monitored during

Non- compliance the year.

with these regulations * Where a store is at risk of compulsory purchase,

can lead to penalties, contingency plans are developed. The level of risk is

fines or reputational considered similar to

damage. the 31 October 2020

Changes in tax * Legal and professional advice. assessment.

regimes could

affect tax

expenditure. * Online training modules.

The Group is

also subject

to the risk of

compulsory purchases

of property,

which could result

in a loss of

income and impact

the portfolio

valuation.

---------------------- ----------------------------------------------------------------------- ---------------------

Marketing risk

----------------------------------------------------------------------------------------------------------------------

Our marketing We continue to build

strategy is critical * Constant measuring and monitoring of our web presence functional expertise

to the success and ensuring compliance with rules and regulations. at Group level in

of the business. performance

This includes marketing, organic

maintaining web * Market leading website. and

leadership and local searches and

our relationship analytics.

with Google. * Use of online techniques to drive brand visibility.

The Group marketing

A lack of effective forum continues to

strategy would * Our pricing strategy monitors and adapts to evolving review

result in loss customer behaviour. performance, market

of income and developments and our

market share ongoing improvement

and adversely plan.

impact the portfolio

valuation. We have implemented

a new value and

quality

focused performance

marketing strategy.

The level of risk is

considered similar to

the 31 October 2020

assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

IT security/GDPR

----------------------------------------------------------------------------------------------------------------------

Cyber-attacks During the year the

and data security * Constant monitoring by the IT department and Group continued to

breaches are consultation with specialist advice firms ensure we invest

becoming more have the most up-to-date security available. in digital security.

prominent with Some of the changes

greater sophistication include more frequent

of attacks. This * Twice yearly formal IT security review at Group Audit penetration testing

has the potential Committee. of internet facing

to result in systems,

reputational adding components

damage, fines * We minimise the retention of customer and colleague such

or customer data in accordance with GDPR best practice. as anti-ransomware as

compensation, well as the

causing a loss replacement

of market share * The policies and procedures are under constant review of components such as

and income and benchmarked against industry best practice. These firewalls to the

policies also include defend, detect and response latest

policies. technology and

specification.

The risk is not

considered

to have increased for

the Group nor is the

Group considered to

be at greater risk

than

the wider industry;

however, we consider

that digital threats

on the whole are

increasing.

The level of risk is

considered similar to

the 31 October 2020

assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

Brand and Reputational risk

----------------------------------------------------------------------------------------------------------------------

Our reputation, The Retail Service

with Safestore's * Constant involvement by the Retail Service team to function

growth and the engage with customers and address their concerns. always engages with

increased awareness customers to resolve

of self storage, any issues or

including increased * Constant training of the store teams to provide a complaints.

demand driving clear and concise communication strategy to

higher prices, customers. Pages 50 to 54 of our

may potentially sustainability report

attract greater provide insight into

social media attention * Our understanding of and engagement with all our how we engage with

and scrutiny. stakeholders enables early visibility of our

dissatisfaction. customers and the

community.

The level of risk is

considered similar to

the 31 October 2020

assessment.

---------------------- ----------------------------------------------------------------------- ---------------------

Geographical expansion

----------------------------------------------------------------------------------------------------------------------

The Group has The level of risk is

invested in expanding * Large portfolio of potential new sites, prioritised considered similar to

the overseas based on detailed research into areas most likely to the 31 October 2020

operations be successful. assessment.

of the business

through both

subsidiaries * Strong operational knowledge and experience in

and the Joint integrating new business.

Venture with Carlyle

over the last

two years. * We have well documented procedures for the

integration of new acquisitions and a good track

Suitable new sites record of recent success.

may become more

difficult to find,

with new sites

failing to achieve

the required occupancy

and therefore

deliver the required

sales and

profitability

within an acceptable

timeframe.

Integration of

smaller acquisitions

may be challenging

where the

infrastructure

of the acquired

business is not

of a level required

by Group.

---------------------- ----------------------------------------------------------------------- ---------------------

Human Resource Risk

----------------------------------------------------------------------------------------------------------------------

Fundamental to The level of risk is

the Group's success * The Group embarked upon its five-year strategic plan considered to have

are our people. in 2017 and during this period has had an efficient, increased

As such, due to high performing and stable management team in place. slightly from the 31

market Our retention strategy aims to ensure we achieve long October 2020

competitiveness, term engagement, through a combination of motivating assessment.

we are exposed factors.

to a risk of colleague

turnover, and

subsequent loss * We continue to consult regularly with our management

of key personnel team and monitor involuntary turnover. We maintain

and knowledge. adequate succession for our key talent.

* The Board and Remuneration Committee regularly review

colleague feedback provided through surveys, our

workforce advisory panel and CEO town hall events.

These mechanisms enable colleagues to raise questions

,

discuss wider business issues and provide feedback on

subjects including wider workforce remuneration.

* In early 2021, Safestore received the Investors in

People Platinum Accreditation. This demonstrates that

our colleagues are happy, healthy, safe and engaged

in supporting Safestore to deliver sustainable

business performance.

---------------------- ----------------------------------------------------------------------- ---------------------

Climate change related risk

----------------------------------------------------------------------------------------------------------------------

The Group is exposed As part of our

to climate change * The good working order of our stores is of critical journey

related transition importance to our business model with our standing to enhance our

and physical risks. commitment to provide long term sustainable real disclosures

Physical risks estate investment. along the

may affect the recommendations

Group's stores of the TCFD, the

and may result * Physical climate risk of new developments is Group

in higher maintenance, evaluated as part of the investment appraisal process is continuing to

repair and insurance for new developments. develop

costs. Failing its understanding of

to transition its exposure and

to a low carbon * We have a proactive maintenance programme in place vulnerability

economy may cause with a regular programme of store inspection with our to climate change

an increase in maintenance teams following sustainable principles risk

taxation, decrease and, wherever practicable, using materials that have Our Sustainability

in access to loan recycled content or are from sustainable sources. Committee,

facilities and with representation

reputational damage. from across all

* If we choose to develop a store in a high risk area, levels

we usually proactively deploy flood mitigation of the business, is

measures. considering the

impact

of climate change

* We are committed to build to a minimum standard of related

BREEAM 'Very Good' on all of our new store risks and is working

developments. with the Board and

its

suppliers to develop

* All new store developments are registered with the an ambitious plan to

Considerate Constructors Scheme, which considers the reduce carbon

public, the workforce and the environment. emissions.

Our investment

appraisal

process has been

updated

to consider climate

change related risks

of new investments.

The level of risk is

considered similar to

the 31 October 2020

---------------------- ----------------------------------------------------------------------- ---------------------

Consequences of the UK's decision to leave the EU ("Brexit")

----------------------------------------------------------------------------------------------------------------------

The uncertainty As the Group had only

associated with * Economic uncertainty is not a new risk for the Group, limited exposure to

the UK's future but Brexit increased the likelihood of previously the direct risks that

relationship with recognised risks, and is addressed under the finance arose due to Brexit,

the EU has risk, treasury risk and valuation risk categories the level of this

significantly above. risk

reduced. is considered to have

As the Group does significantly reduced

not directly rely * Self storage is a localised industry, with a broad since the 31 October

on imports or and diversified customer base, so demand has shown no 2020 assessment.

exports, the Group initial adverse impact post Brexit and is unlikely to

is largely protected be significantly impacted in the future.

from the near

term impact of

the UK's exit * The Group's workforce in the UK includes a low

from the EU. proportion of employees whose right to work in the UK

Nonetheless, may be impacted by potential Brexit-related

changes associated legislation changes.

with further

regulation

will be closely

monitored and

assessed.

---------------------- ----------------------------------------------------------------------- ---------------------

Viability statement

The UK Corporate Governance Code requires us to issue a

"viability statement" declaring whether we believe Safestore can

continue to operate and meet its liabilities, taking into account

its current position and principal risks. The overriding aim is to

encourage Directors to focus on the longer term and be more

actively involved in risk management and internal controls. In

assessing viability, the Board considered a number of key factors,

including our strategy (see page 6 ), our business model (see pages

15 and 16) , our risk appetite and our principal risks and

uncertainties (see pages 33 to 37 of the strategic report).

The Board is required to assess the Company's viability over a

period greater than twelve months, and in keeping with the way that

the Board views the development of our business over the long term

a period of three years is considered appropriate, and is

consistent with the timeframes incorporated into the Group's

strategic planning cycle, with the review considering the Group's

cash flows, dividend cover, REIT compliance, financial covenants

and other key financial performance metrics over the period. Our

assessment of viability therefore continues to align with this

three-year outlook.

In assessing viability, the Directors considered the position

presented in the budget and three-year plan recently approved by

the Board. In the context of the current environment, four

plausible sensitivities were applied to the plan, including a

stress test scenario. These were based on the potential financial

impact of the Group's principal risks and uncertainties and the

specific risks associated with the continued Covid-19 pandemic.

These scenarios are differentiated by the impact of demand and

enquiry levels , average rate growth and the level of cost savings.

A test sensitivity was also performed where we have carried out a

reverse stress test to model what would be required to breach ICR

and LTV covenants which indicated highly improbable changes would

be needed before any issues were to arise .

During the year, Safestore was successful in extending its

borrowing facilities, with the issuance of the equivalent of GBP149

million new Sterling and Euro denominated US Private Placement

("USPP") Notes. The current revolving credit facilities of GBP250

million and EUR70 million mature in June 2023. In assessing

viability sensitivities, it has been assumed that RCF refinancing

will be available on similar terms to those negotiated in 2019,

maturing in 2023. In making this viability statement, with the

current strength of underlying performance of the business and its

balance sheet, the Directors are of the view that it is reasonable

to expect the refinancing of the RCF to be available on similar

terms.

The impact of these scenarios and sensitivities has been

reviewed against the Group's projected cash flow position and

financial covenants over the three-year viability period. Should

any of these scenarios occur, clear mitigating actions are

available to ensure that the Group remains liquid and financially

viable.

Such mitigating actions available includes, but not limited to,

are reducing planned capital and marketing spend, pay and

recruitment measures, making technology and operating expenditure

cuts and utilisation of available headroom on existing debt

facilities.

Further, the Covid-19 pandemic resulted in a significant

reduction in the economic growth of the UK and Europe in 2020. The

continued potential implications of Covid-19 have been thoroughly

considered with respect to the Group's strategy through the annual

planning and budgeting process. Covid-19 will continue to be

monitored through regular and periodic reforecasts and scenario

analysis over the next twelve months and align with the three-year

outlook of this review during the 2022 financial year.

The Audit Committee reviews the output of the viability

assessment in advance of final evaluation by the Board. The

Directors have also satisfied themselves that they have the

evidence necessary to support the statement in terms of the

effectiveness of the internal control environment in place to

mitigate risk.

Having reviewed the current performance, forecasts, debt

servicing requirements, total facilities and risks, the Board has a

reasonable expectation that the Group has adequate resources to

continue in operation, meets its liabilities as they fall due,

retain sufficient available cash across all three years of the

assessment period and not breach any covenant under the debt

facilities. The Board therefore has a reasonable expectation that

the Group will remain commercially viable over the three-year

period of assessment.

*Typographical Correction:

This announcement corrects a typographical error reported in the

financial review section (Underlying Finance Charge) of the

Preliminary Results Announcement released on 13 January 2022. The

total in the Facility column of the table is corrected to

GBP738.3m. The Preliminary Results Announcement published on the

Company's website and the Annual Results Presentation have been

updated.

Notes to editors:

-- Safestore is the UK's largest self-storage group with 161

stores at 31 October 2021 comprising 128 wholly owned stores in the

UK (including 71 in London and the South East with the remainder in

key metropolitan areas such as Manchester, Birmingham, Glasgow,

Edinburgh, Liverpool, Sheffield, Leeds, Newcastle and Bristol), 29

wholly owned stores in the Paris region and four stores in

Barcelona. In addition, the Group operates eight stores in the

Netherlands and six stores in Belgium under a joint venture

agreement with Carlyle.

-- Safestore operates more self-storage sites inside the M25 and

in central Paris than any competitor providing more proximity to

customers in the wealthiest and densest UK and French markets.

-- Safestore was founded in the UK in 1998. It acquired the

French business "Une Pièce en Plus" ("UPP") in 2004 which was

founded in 1998 by the current Safestore Group CEO Frederic

Vecchioli.

-- Safestore has been listed on the London Stock Exchange since

2007. It entered the FTSE 250 index in October 2015.

-- The Group provides storage to around 80,000 personal and business customers.

-- As at 31 October 2021, Safestore had a maximum lettable area

("MLA") of 6.960 million sq ft (excluding the expansion pipeline

stores, and the Carlyle Joint Venture) of which 5.883 million sq ft

was occupied.

-- Safestore employs around 700 people in the UK, Paris and Barcelona.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSFLFFDFTILLIF

(END) Dow Jones Newswires

February 11, 2022 12:32 ET (17:32 GMT)

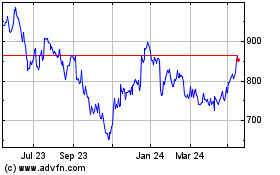

Safestore (LSE:SAFE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Safestore (LSE:SAFE)

Historical Stock Chart

From Jul 2023 to Jul 2024