TIDMRTC

RNS Number : 8780A

RTC Group PLC

26 March 2013

RTC Group Plc ("RTC", "the Company" or "the Group")

Audited results for the year ended 31 December 2012

RTC Group Plc, a support services group which provides

recruitment and conferencing services, is pleased to announce its

audited results for the year ended 31 December 2012.

Highlights

-- Group revenue from continuing operations up 39% to GBP43m (2011: GBP31m)

-- Group operating profit from continuing operations before

exceptional items of GBP592,000 (2011: loss GBP87,000)

-- Profit for the year attributable to equity holders of GBP575,000 (2011: loss GBP611,000)

-- Profit per share from continued operations of 3.51p (2011: loss 4.17p)

The Board does not believe that it would be prudent to use its

financial resources to recommend a dividend at this time (2011:

nil).

Commenting on the results Bill Douie, Chairman, said:

"2012 has been a year of strong growth both in turnover and

operating profit. However, it comes as no surprise to us all that

material recovery from the recent recession remains patchy and

volatile. Nonetheless, we are confident that we have a range of

activities which all hold much promise for the Group. In addition,

ATA UK was restructured with effect from 1 January 2013 and we are

currently investing in additional headcount and recruitment

technology. We therefore expect to be approximately break-even for

the first half of the financial year and generate the vast majority

of projected profits in the second half as these staff become fully

effective and we start to see the benefits of the additional

investment in the new structure. We believe this longer term

strategy will permit sustainable and profitable growth in the years

to come."

Enquiries:

RTC Group Plc 01332 861 835

Bill Douie, Chairman

Andy Pendlebury, Chief Executive

Allenby Capital Limited - Nominated

Adviser & Broker 020 3328 5656

Jeremy Porter, Corporate Finance

Mark Connelly, Corporate Finance

Chairman's statement

For the year ended 31 December 2012

I am pleased to present the audited results for the year ended

31 December 2012.

Group

2012 has been a year of strong growth both in turnover and

operating profit. As a result we have achieved a pleasing

performance in Group operating profits before exceptional items of

GBP592,000 (2011: loss GBP87,000), contributing to a group pre-tax

profit of GBP474,000.

Trading

ATA Recruitment

UK white collar recruitment performed extremely well in markets

which continue to be volatile.

Revenue is up 30% at GBP20.601m and operating profit was

GBP0.252m (2011: loss GBP206,000).

ATA Global Supply Solutions

2012 saw the first full year effect of the largest element of

our contract in Afghanistan. Operating teething problems have been

eliminated, with travel arrangements running smoothly and currency

conversion costs reduced. Revenue is up 66% at GBP13.736m (2011:

GBP8.239m) and operating profit was GBP123,000 (2011: loss of

GBP87,000).

Ganymede Solutions

Another year of good growth across all disciplines. Revenue was

up 42% at GBP6.885m and operating profit was GBP201,000 (2011:

profit of GBP171,000 before exceptional items). During the year RTC

Group plc purchased the remaining 10% non-controlling interest in

Ganymede Solutions Limited previously held by Gary Hewett, for

GBP41,000, making it a 100% owned subsidiary.

The Derby Conference Centre

The market for conferencing remains tight and highly

competitive.

Revenue was GBP1.741m (2011: GBP1.763m) and operating profit was

GBP16,000 (2011: GBP35,000).

Capital investment

Our enhanced trading performance has enabled us to make a modest

increase in capital expenditure of GBP71k after providing for

working capital to service increased turnover.

Balance sheet

The Group balance sheet has strengthened during the year, with

net working capital increasing by GBP316,000 to GBP529,000 (2011:

GBP213,000) and a slightly increased ratio of current assets to

current liabilities of 1.07 (2011: 1.03). Our gearing ratio has

fallen to 3.0 from 4.9. Gearing is calculated as current bank

borrowing over equity. Net debt at 31 December 2012 was GBP3.5m

(2011: GBP3.1m). The Group continues to be focussed on cash

generation and ensuring a robust balance sheet to support the

growth of the business.

Dividends

Notwithstanding the reported profitability for the period, the

directors do not feel it prudent to recommend any dividend payment

for 2012.

Management

The new management structure established early in the year has

bedded in well and we are confident in its ability to deliver

future growth for the Group.

Chairman's statement

For the year ended 31 December 2012

The Group Board

As recently announced Andrew Bailey left the Group and we wish

him well. I would like to express our thanks for the diligence and

unswerving loyalty he has displayed during his many years with the

Group.

I would also like to welcome Sarah Dye to the Group as Finance

Director.

Outlook

It comes as no surprise to us all that material recovery from

the recent recession remains patchy and volatile. Nonetheless, we

are content that we have a range of activities which all hold much

promise for the Group and are expected to permit continued growth

in the years to come. We intend to continue to concentrate on

exploring opportunities for additional business in all areas of

recruitment covered by our three core business activities, whilst

making the fullest possible use of our premises in Derby both as a

profit centre and as our Head Office.

ATA UK was restructured with effect from 1 January 2013 and we

are currently investing in additional headcount and recruitment

technology. We therefore expect to be approximately break-even for

the first half of the financial year and generate the vast majority

of projected profits in the second half as these staff become fully

effective and we start to see the benefits of the additional

investment in the new structure. We believe this longer term

strategy will permit sustainable and profitable growth in the years

to come.

We remain committed to our goal of building a focused group with

both sustainability and profitability which will deliver increased

earnings per share for our investors and we intend to continue to

use free cash flow to enhance our balance sheet, to provide working

capital for expansion and to invest in the future wherever

necessary.

Staff

I should like to thank our staff at all levels for their

loyalty, hard work and enthusiasm.

W J C Douie 26 March 2013

Chairman

Chief Executive's statement

For the year ended 31 December 2012

2012 delivered a much more positive set of results for the

Group. The investments that were made in previous years in

operational systems and procedures alongside the appointment of

additional finance and support staff have paid off and we are now

beginning to capture the profits from the continued growth in sales

revenue and gross profit across all areas of the business.

The shape of our business continues to change and I believe we

have significantly diluted our exposure and risk to the United

Kingdom market place which continues to suffer from sluggish growth

as both bank lending to the small and medium size business

community and public and private sector investment in major

infrastructure projects remain disappointingly slow.

Our international business which comprises of ATA Global

Staffing Solutions (ATA GSS) and ATA India (ATAI) now generates

around 30% of group revenue and some 25% of gross profit. ATA GSS

continues to build on its contract to supply staff to Afghanistan

and we now deploy over 1200 personnel from over 25 countries to

support our clients. ATA GSS is now recognised as the largest

employment business supplying temporary labour to clients in the

region and we remain extremely optimistic about future growth

opportunities on both this and other emerging international

projects.

ATAI, which originated as a strategic partnership to source

international staff for Afghanistan, was formerly launched as part

of RTC during 2012, and continues to establish itself in one of the

world's fastest growing economies. ATAI have already secured some

long term contracts within the domestic Indian market and in

collaboration with our ATA UK business, is sourcing staff for UK

clients diversifying into the Indian market place and sourcing

Indian candidates for placement with clients seeking scarce skills

within the United Kingdom.

Whilst the UK recruitment market remains difficult, ATA UK has

continued to secure new clients across both the SME and blue chip

market sectors. Furthermore, and despite tough pricing conditions

and heavy discounting from much of the competition as new business

opportunities are becoming increasingly harder to find, the

business is steadily growing its client base and net fee

income.

Ganymede Solutions has continued to accelerate its presence in

the blue collar rail sector on both mainline and underground

networks and is now working with a broad range of prime and second

tier contractors. Whilst historically the business has concentrated

activities primarily in the transport sector, new opportunities are

being explored across other blue collar labour intensive

markets.

Our conference and events business, the Derby Conference Centre

(DCC), continues to capture business across all areas of activity

in what remains an extremely crowded and competitive market. In

order to keep the unique edge that the Art Deco styled facility

offers clients, a capital investment plan was approved for the DCC

during the year to ensure the business can continue to attract long

term sustainable revenue.

Chief Executive's statement

For the year ended 31 December 2012

Finally, the significance of the turnaround in profits for 2012

is testament to the quality, commitment and belief of the company's

management team and employees across all areas of the business and

your board of directors is extremely thankful for everybody's

contribution.

A M Pendlebury 26 March 2013

Group Chief Executive

Consolidated statement of comprehensive income

For the year ended 31 December 2012

2012 2011

Notes GBP'000 GBP'000

Revenue 42,963 30,670 *

Cost of sales (37,735) (26,668) *

---------------------------------------------- ----------- --- ----------------- ---------------------

Gross Profit 5,228 4,002

Administrative expenses (4,636) (4,467)

---------------------------------------------- ----------- --- ----------------- ---------------------

Operating profit/(loss) 592 (465)

---------------------------------------------- ----------- --- ----------------- ---------------------

Analysed as:

Operating profit/(loss) before exceptional

items 592 (87)

Exceptional administrative expense 5 - (378)

---------------------------------------------- ----------- --- ----------------- ---------------------

Operating profit/(loss) after exceptional

items 592 (465)

---------------------------------------------- ----------- --- ----------------- ---------------------

Financing expense (118) (96)

---------------------------------------------- ----------- --- ----------------- ---------------------

Profit/(loss) before tax 474 (561)

Income tax 6 101 62

---------------------------------------------- ----------- --- ----------------- ---------------------

Net profit/(loss) from continuing

operations 575 (499)

(Loss) from discontinued operations 5 - (112)

---------------------------------------------- ----------- --- ----------------- ---------------------

Loss from discontinued operations - (112)

---------------------------------------------- ----------- --- ----------------- ---------------------

Net profit/(loss) and total comprehensive

income for the year 575 (611)

---------------------------------------------- ----------- --- ----------------- ---------------------

Basic and diluted:

Profit/(loss) per share - continuing

operations (pence) 3 3.51 ((4.17)

Profit/(loss) per share - discontinued

operations (pence) 3 - (0.93)

---------------------------------------------- ----------- --- ----------------- --- ----------------

Profit/(loss) per share - continuing

and discontinued operations (pence) 3.51 (5.10)

---------------------------------------------- ----------- --- ----------------- --- ----------------

There is no dilutive effect of share options.

* The 2011 results have been restated. Recruitment revenue and

cost of sales have been grossed up in respect of billable travel

expenses previously netted off in error (see note 4).

Consolidated statement of changes in equity

For the year ended 31 December 2012

Share Share Capital Share Accumulated Total

capital premium redemption based losses equity

account reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2012 135 2,468 50 33 (2,049) 637

Net profit and total

comprehensive income

for the year - - - - 575 575

Share acquisition - - - - (41) (41)

Share based payment

reserve - - - (33) 33 -

At 31 December 2012 135 2,468 50 - (1,482) 1,171

----------------------- --------- --------- ------------ --------- ------------ --------

Share Share Capital Share Accumulated Total

capital premium redemption based losses equity

account reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2011 90 2,117 50 30 (1,438) 849

Net loss and total

comprehensive income

for the year - - - - (611) (611)

Share issue (net

of expenses) 45 351 - - - 396

Share based payment

reserve - - - 3 - 3

At 31 December 2011 135 2,468 50 33 (2,049) 637

----------------------- --------- --------- ------------ --------- ------------ --------

The share based payment reserve comprises the cumulative share

option charge under IFRS 2 less the value of any share options that

have been exercised or have lapsed.

Consolidated statement of financial position

As at 31 December 2012

2012 2011

GBP'000 GBP'000 GBP'000 GBP'000

Assets

Assets

Non-current

Property, plant and equipment 403 292

Deferred tax asset 239 132

-------------------------------

642 424

Current

Inventories 13 14

Trade and other receivables 8,059 6,444

8,072 6,458

------------------------------- -------- -------- -------- --------

Total assets 8,714 6,882

------------------------------- -------- -------- -------- --------

Liabilities

Current

Trade and other payables (4,034) (3,096)

Current borrowings (3,509) (3,149)

Total liabilities (7,543) (6,245)

Net assets 1,171 637

------------------------------- -------- -------- -------- --------

Equity

Share capital 135 135

Share premium 2,468 2,468

Capital redemption reserve 50 50

Share based payment reserve - 33

Accumulated losses (1,482) (2,049)

------------------------------- -------- -------- -------- --------

Total equity 1,171 637

------------------------------- -------- -------- -------- --------

Consolidated statement of cash flows

For the year ended 31 December 2012

2012 2011

------------------------------------------- -------- --------

GBP'000 GBP'000

Cash flows from operating activities

Operating result from continuing

operations 592 (465)

Adjustments for:

Employee equity settled share options - 3

Depreciation 149 156

Loss on sale of property, plant

and equipment - 5

Change in inventories 1 (4)

Change in trade and other receivables (1,621) (1,657)

Change in trade and other payables 938 1,030

Cash movement from discontinued

operations - (112)

------------------------------------------- -------- --------

Cash generated from operations 59 (1,044)

Interest paid (118) (96)

Net cash from/(used in) operating

activities (59) (1,140)

------------------------------------------- -------- --------

Cash flows from investing activities

Purchases of property, plant and

equipment (260) (174)

Purchase of shares in subsidiary

companies (41) -

Net cash from/(used in) investing

activities (360) (174)

------------------------------------------- -------- --------

Cash flows from financing activities

------------------------------------------- -------- --------

Proceeds from issue of share capital - 396

------------------------------------------- -------- --------

Net cash inflow from financing activities - 396

------------------------------------------- -------- --------

Net (decrease)/increase in cash

and cash equivalents from continuing

operation (360) (918)

------------------------------------------- -------- --------

Total net (decrease) in cash and

cash equivalents (360) (918)

------------------------------------------- -------- --------

Cash and cash equivalents at the

beginning of the year (3,149) (2,231)

------------------------------------------- -------- --------

Cash and cash equivalents at the

end of the year (3,509) (3,149)

------------------------------------------- -------- --------

1. Corporate information and basis of preparation

RTC Group Plc is a public limited company incorporated and

domiciled in England whose shares are publicly traded. The

principal activities of the Group are described in note 4.

The announcement of results of the Group for the year ended 31

December 2012 was authorised for issue in accordance with a

resolution of the directors on 26 March 2013.

The financial information included in this announcement has been

compiled in accordance with the recognition and measurement

criteria of International Financial Reporting Standards ("IFRS"),

including International Accounting Standards ("IAS") and

interpretations issued by the International Accounting Standards

Board ("IASB") and its committees, and as adopted by the EU. This

announcement does not itself however contain sufficient information

to comply with IFRS.

The accounting policies adopted are consistent with those

described in the annual financial statements for the year ended 31

December 2012. There have been no significant changes in the basis

upon which estimates have been determined, compared to those

applied at 31 December 2011 and no change in estimate has had a

material effect on the current period.

2. Dividends

The Board do not recommend the payment of a final dividend for

the year.

3. Earnings per share

The calculation of basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

The calculation of diluted earnings per share is based on the

basic earnings per share adjusted to allow for all dilutive

potential ordinary shares.

The outstanding share options were not considered to be dilutive

in 2012 or 2011.

Basic Basic Diluted Diluted

2012 2011 2012 2011

Continuing operations

Earnings/(loss) GBP'000 474 (499) 474 (499)

Weighted average number

of shares 13,511,626 11,974,276 13,511,626 11,974,276

Earnings/(loss) per share

(pence) 3.51p (4.17p) 3.51p (4.17p)

Discontinued operations

Earnings/(loss) GBP'000 - (112) - (112)

Weighted average number

of shares - 11,974,276 - 11,974,276

Earnings/(loss) per share

(pence) - (0.93p) - (0.93p)

Continuing and discontinued operations

Earnings/(loss) GBP'000 474 (611) 474 (611)

Weighted average number

of shares 13,511,626 11,974,276 13,511,626 11,974,276

Earnings/(loss) per share

(pence) 3.51p (5.10p) 3.51p (5.10p)

4. Segment analysis

The Group is a provider of recruitment and conferencing services

and operates a division for each. The recruitment division

comprises three distinct business units - ATA Recruitment UK (ATA

UK) servicing the UK SME engineering market and a number of

vertical markets; ATA Global Supply Solutions (ATA GSS) servicing

the international market and Ganymede Solutions (GSL) supplying

blue collar labour into rail, trades and labour and other

markets.

Segmental information is provided below in respect of ATA UK,

ATA GSS, GSL and conferencing.

The Group manages the trading performance of each segment by

monitoring operating profit before exceptional items and centrally

manages working capital, borrowings and equity.

The Conferencing division services are wholly provided in the

UK. A growing proportion of the Recruitment division revenues now

derive from overseas activity.

Revenues are generated from permanent and temporary recruitment

in the Recruitment division and from the provision of a

conferencing and hotel facility in Derby for the Conferencing

division.

All revenues have been invoiced to external customers other than

GBP126,000 (2011: GBP90,000) within the Derby Conference Centre

which comprised rental income from other Group segments. During

2012, one customer in the ATA GSS segment contributed greater than

10% of that segment's revenues being GBP13.7m (2011: GBP8.2m).

The segmental information for the reporting period is as

follows:

ATA UK ATA GSS GSL DCC Total

Group

2012 2012 2012 2012 2012

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segment continuing operations

Sales from external

customers 20,601 13,736 6,885 1,741 42,963

Cost of sales (18,292) (12,472) (6,228) (743) (37,735)

--------- --------- -------- -------- ---------

Segment gross profit 2,309 1,264 657 998 5,228

Administrative expenses (1,982) (1,141) (442) (922) (4,487)

Depreciation (75) - (14) (60) (149)

--------- --------- -------- -------- ---------

Segment operating profit 252 123 201 16 592

--------- --------- -------- -------- ---------

ATA UK ATA GSS GSL DCC Total

Group

2011 2011 2011 2011 2011

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segment continuing operations

Sales from external

customers 15,825 8,239 4,843 1,763 30,670

Cost of sales (14,321) (7,537) (4,085) (725) (26,668)

--------- -------- -------- -------- ---------

Segment gross profit 1,504 702 758 1,038 4,002

Administrative expenses (1,651) (789) (578) (915) (3,933)

Depreciation (59) - (9) (88) (156)

--------- -------- -------- -------- ---------

Segment operating (loss)/profit

before exceptional items (206) (87) 171 35 (87)

Exceptional administrative

expense - - (378) - (378)

--------- -------- -------- -------- ---------

Segment operating (loss)/profit (206) (87) (207) 35 (465)

--------- -------- -------- -------- ---------

Certain 2011 figures have been restated. Recruitment revenue and

cost of sales have been grossed up in respect of billable travel

expenses of GBP1.15m in ATA GSS previously netted off. The

previously reported gross profit figure remains unchanged.

All assets and liabilities are held in the United Kingdom.

5. Exceptional administrative costs

2012 2011

GBP'000 GBP'000

Provision for bad debt - 378

--------- --------

- 378

---------------------------------- --------

During 2011 the Group experienced a non-recurring exceptional

bad debt of GBP378,000 including legal fees, from an isolated

customer and relating to the Group's entry into the Telecoms

sector. This business area was discontinued in 2011.

6. Income tax

Continuing operations 2012 2011

GBP'000 GBP'000

Analysis of tax :-

Current tax

UK corporation tax - -

Adjustment in respect of previous - -

periods

- -

Deferred tax

Origination and reversal of temporary

differences (107) (62)

Adjustment in respect of previous 6 -

periods

--------------------------------------- -------- --------

Tax (101) (62)

--------------------------------------- -------- --------

Factors affecting the tax expense

The tax assessed for the year is greater than would be expected

by multiplying profit on ordinary activities by the standard rate

of corporation tax in the UK of 24.5 % (2011: 26.5%). The

differences are explained below:-

2012 2011

GBP'000 GBP'000

Profit/(loss) on ordinary activities

before tax 474 (561)

Profit/(loss) multiplied by standard

rate of tax 116 (149)

Non-deductible expenses 17 21

Losses carried forward - 66

Utilisation of losses (240) -

Adjustment in respect of previous 6 -

periods

-------------------------------------- ------

Income Tax (credit) / charge

for the year (101) (62)

------------------------------------------------------ ----------------------- ------------------

Factors that may affect future tax charges

Estimated losses available to offset against future taxable

profits on continuing operations in the UK amount to approximately

GBP813,000 (2011: GBP1,329,000). The Chancellor of the Exchequer

has announced that the rate of corporation tax will be reduced each

year until 2015 when it will remain at 20%. In accordance with

relevant accounting standards, calculation of the deferred tax

asset is based on a tax rate of 23%, being the rate which was

enacted at the year-end date.

7. Report and accounts

The above financial information does not constitute the

Company's statutory accounts for the years ended 31 December 2012

or 2011 but is derived from those accounts. The auditor has

reported on these accounts; their report was unqualified, did not

draw any matters by way of emphasis without qualifying their report

and did not contain statements under s498 (2) or (3) Companies Act

2006 or equivalent preceding legislation. The statutory accounts

for 2011 have been filed with the Registrar of Companies.

Full audited accounts of RTC Group plc for the year ended 31

December 2012 will be made available on the Company's website at

www.rtcgroupplc.co.uk later today and will be dispatched to

shareholders week commencing 1 April 2013 and then be available

from the Company's registered office:- The Derby Conference Centre,

London Road, Derby, DE24 8UX.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR GCGDXXSDBGXL

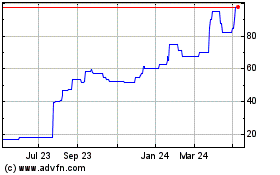

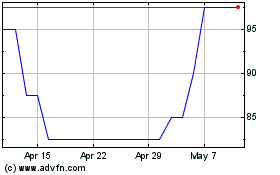

Rtc (LSE:RTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rtc (LSE:RTC)

Historical Stock Chart

From Jul 2023 to Jul 2024