TIDMRTC

RNS Number : 8726P

RTC Group PLC

10 October 2011

The following amendments have been made to the "Half Yearly

Report" announcement released on 9 September 2011 at 07:00 under

RNS No 8924N:

There was an error in the allocation of costs between cost of

sales and administrative expenses. The resultant adjustment

increases the Recruitment division cost of sales by GBP1.4 million

with a corresponding decrease in administrative expenses.

All other details remain unchanged.

The full amended text is shown below.

CHAIRMAN'S STATEMENT

RTC Group Plc

CHAIRMAN'S STATEMENT

I am pleased to present the interim report of the Company for

the six months to 30 June 2011.

Group

The period has been one of continuing recovery. Throughout the

difficult trading conditions experienced in 2008 to 2010 a

programme to simplify the Group and to focus on recruitment has

been pursued which included the termination of our Railway Training

activities. Over the same period significant changes have been made

at The Derby Conference Centre which have changed the emphasis of

that company towards a more satisfactory balance between long term

sublets and short term conferencing and event activities.

These initiatives have served to eliminate the trading losses

incurred in training and conferencing permitting the recruitment

businesses, consistently profitable at trading level, to expand in

both volume and operating profit levels, both in the UK and

overseas.

Trading

Recruitment

As presaged in our Report and Accounts in March, trading

conditions have continued to improve. We have therefore succeeded

in moving forward on all fronts in recruitment but particular

mention is appropriate in connection with our rapidly expanding

business in India, serving a variety of locations in support of

NATO activities and our contract and permanent business in the

Railway and other technical Industries. Accordingly, during the

first six months of 2011, gross profits in this sector have

advanced at a most pleasing rate.

The Derby Conference Centre

We have concluded new arrangements with our Landlord and have

secured significant sublet agreements, both commencing in the first

half of this year. Normal conferencing and event business continues

to be hard to achieve but we have succeeded in utilising space at

similar levels to 2010. The result of both these factors has all

but eliminated losses in the division which is now making a

satisfactory contribution to Group results.

Central costs

In response to the changing shape of the Group's business

portfolio, major efficiencies have been achieved in administration

and finance. Improving cash flows both actual and in prospect are

permitting a review of systems and hardware and we expect to make

material updates in both over the months to come.

Non - recurring item

Towards the end of 2010, Ganymede Solutions diversified into a

new area of telecommunications providing contract recruitment, to

the telecoms industry, with particular emphasis on installation and

test. Although the ultimate clients were of undoubted quality, the

business was arranged through a third party agent. After an initial

modest and successful start, demand from this agent accelerated

sharply and payment of our invoices deteriorated. This has resulted

in a GBP370,000 write off including bad debt provision and an

element for potential fraud pending the outcome of documentation

submitted to the authorities. Without this the Group would have

posted a profit in the first half of GBP286,000

Capital Raising

During the period fast expansion of our trading volumes caused

strains on our working capital resources. In order to deal with

those and to provide further room for growth, we decided to avail

ourselves of the Authority granted at the Annual General Meeting in

2010 and completed an issue of shares to raise GBP396,000 after

costs. A material number of the shares issued were taken up by

directors and management of the Group.

Dividends

Your Directors consider that it would be inappropriate to

declare an interim dividend.

Outlook & Strategy

Notwithstanding the unfortunate exceptional factor mentioned

above, prospects for the Group are encouraging. Although progress

is expected to continue in the second half, the Global economic

landscape remains challenging. It continues to be my view that

there is still a way to go before the present debt problems, both

Sovereign and domestic, are finally solved. Although I cannot be

optimistic about the Global situation I am convinced that we are

servicing the less vulnerable industrial and commercial areas both

in the UK and overseas which can be expected to give us strengths

which others may be lacking.

W.J.C.Douie, Chairman. 8th September 2011

CONSOLIDATED CONDENSED STATEMENT OF COMPREHENSIVE INCOME

6 Months 6 Months 12 Months

to 30 Jun to 30 Jun to 31 Dec

2011 2010 2010

(unaudited) (unaudited)

Notes GBP'000 GBP'000 GBP'000

Revenue 2 14,235 8,541 19,959

Cost of sales (12,117) (7,416) (17,001)

------------- ------------ ----------

Gross Profit 2 2,118 1,125 2,958

Administrative

expenses - normal (1,832) (1,500) (3,448)

------------- ------------ ----------

Operating

profit/(loss) before

exceptional items 2 286 (375) (490)

Administrative

expenses -

exceptional 3 (370) - 58

------------- ------------ ----------

Operating loss after

exceptional items (84) (375) (432)

Financing expense (45) (6) (18)

------------- ------------ ----------

Loss on ordinary

activities before

taxation (129) (381) (450)

Income tax expense 4 - - 18

------------- ------------ ----------

Net loss from

continuing

operations (129) (381) (432)

Loss from discontinued

operations - loss

from the period 5 - (526) (526)

Loss for the period (129) (907) (958)

Other elements of

comprehensive income /

expense for the

period - - -

------------- ------------ ----------

Total comprehensive

expense for the

period (129) (907) (958)

------------- ------------ ----------

Loss per share -

continuing operations

(pence) 7 (1.24) (4.22) (4.79)

Loss per share -

discontinued

operations (pence) 7 - (5.83) (5.83)

Loss per share -

continuing and

discontinued

operations (pence) 7 (1.24) (10.05) (10.62)

There is no dilutive impact of share options.

CONSOLIDATED CONDENSED STATEMENT OF FINANCIAL POSITION

As at As at

30 Jun 30 Jun

2011 2010 As at

(unaudited) (unaudited) 31 Dec 2010

GBP'000 GBP'000 GBP'000

Assets

Non current

Property, plant & equipment 217 361 279

Deferred tax asset 70 70 70

------------- ------------- -------------

287 431 349

------------- ------------- -------------

Current

Inventories 8 10 10

Trade and other receivables 6,895 3,312 4,787

Cash and cash equivalents 469 194 -

------------- ------------- -------------

7,372 3,516 4,797

------------- ------------- -------------

Total assets 7,659 3,947 5,146

------------- ------------- -------------

Liabilities

Current

Trade and other payables (1,788) (1,755) (2,066)

Current borrowings (4,755) (1,271) (2,231)

Tax liabilities - (13) -

------------- ------------- -------------

Total Liabilities (6,543) (3,039) (4,297)

------------- ------------- -------------

Net Assets 1,116 908 849

------------- ------------- -------------

Equity

Called up share capital 135 90 90

Share premium account 2,468 2,117 2,117

Capital redemption reserve 50 50 50

Share based payment reserve 30 38 30

Retained earnings (1,567) (1,387) (1,438)

------------- ------------- -------------

Total equity 1,116 908 849

------------- ------------- -------------

CONSOLIDATED CONDENSED STATEMENT OF CASHFLOWS

6 Months 6 Months

to to 12 Months

30 Jun 30 Jun to

2011 2010 31 Dec

Notes (unaudited) (unaudited) 2010

GBP'000 GBP'000 GBP'000

Operating activities

Operating loss (84) (375) (432)

Employee equity settled

share options - - (8)

Depreciation of property,

plant & equipment 82 100 153

Change in inventories 2 1 1

Change in trade and other

receivables (2,108) (300) (2,400)

Change in trade and other

payables (278) (299) 652

Taxes received - 107 97

Interest paid (45) (6) (18)

------------- ------------- ----------

Net cash (outflow) from

operating activities (2,431) (772) (1,955)

------------- ------------- ----------

Investing activities

Purchases of property,

plant & equipment (20) (13) (24)

Proceeds from sale of

property, plant &

equipment - - 40

------------- ------------- ----------

Net cash used in investing

activities (20) (13) 16

------------- ------------- ----------

Cash (outflow) before

financing (2,451) (785) (1,939)

------------- ------------- ----------

Financing activities

Issue of ordinary share

capital net of associated

expenses 396 - -

Net cash from/(used) from

financing activities 396 - -

------------- ------------- ----------

Net (decrease)/increase in

cash and cash equivalents

from continuing

operations (2,055) (785) (1,939)

------------- ------------- ----------

Cash movement from

discontinued operations

operating activities - (130) (130)

Cash movement from

discontinued operations

investing activities - (14) (14)

------------- ------------- ----------

Net (decrease)/increase in

cash and cash equivalents

from discontinued

operations - (144) (144)

------------- ------------- ----------

Total net

(decrease)/increase in

cash and cash equivalents (2,055) (929) (2,083)

------------- ------------- ----------

Cash and cash equivalents

at the beginning of the

period 8 (2,231) (148) (148)

------------- ------------- ----------

Cash and cash equivalents

at the end of the period 8 (4,286) (1,077) (2,231)

------------- ------------- ----------

NOTES TO THE INTERIM STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2011

1. ACCOUNTING POLICIES

a) General information

RTC Group Plc is a public limited company incorporated and

domiciled in England whose shares are publicly traded on AIM. The

registered office address is The Derby Conference Centre, London

Road, Derby, DE24 8UX. The company's registered number is 02558971.

The principal activities of the Group are described in note 2.

The Board consider the principal risks and uncertainties

relating to the Group for the next six months to be the same as

detailed in or last Annual Report and Accounts to 31 December 2010.

The Group's financial risk management objectives and policies are

consistent with those disclosed in the consolidated financial

statements as at and for the year ended 31 December 2010.

b) Basis of preparation

The unaudited interim group financial statements of RTC Group

Plc are for the six months ended 30 June 2011 and do not comprise

statutory accounts within the meaning of S.435 of the Companies Act

2006. The unaudited interim group financial statements have been

prepared in accordance with the AIM rules. This report should be

read in conjunction with the Group's Annual Report and Accounts for

the year ended 31 December 2010, which have been prepared in

accordance with IFRS's as adopted by the European Union.

These unaudited interim group financial statements were approved

for issue on 8 September 2011. No significant events, other than

those disclosed in this document, have occurred between 30 June

2011 and this date.

c) Comparatives

The comparative figures for the year ended 31 December 2010 do

not constitute statutory accounts within the meaning of S.435 of

the Companies Act 2006, but they have been derived from the audited

financial statements for that year, which have been filed with the

Registrar of Companies. The report of the auditors was unqualified

and did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006 nor a reference to any matters which the auditor

drew attention by way of emphasis of matter without qualifying

their report.

d) Accounting policies

The accounting policies adopted are consistent with those

described in the annual financial statements for the year ended 31

December 2010. There have been no significant changes in the basis

upon which estimates have been determined, compared to those

applied at 31 December 2010 and no change in estimate has had a

material effect on the current period.

This interim announcement has been prepared based on IFRS's

which are in issue that are effective or available for early

adoption at the Group's annual reporting date as at 31 December

2011.

2. SEGMENTAL ANALYSIS

The Group's continuing activities relate to Recruitment and

Conferencing business activities. Segmental analysis of business

activity is shown below.

6 Months 6 Months 12 Months

to to to

30 Jun 30 Jun 31 Dec

2011 2010 2010

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

REVENUE

Recruitment 13,421 8,108 18,664

Conferencing 814 433 1,295

----------- ----------- ---------

14,235 8,541 19,959

----------- ----------- ---------

GROSS MARGIN

Recruitment 1,636 1,015 2,395

Conferencing 482 110 563

----------- ----------- ---------

2,118 1,125 2,958

----------- ----------- ---------

OPERATING PROFIT / (LOSS) BEFORE

EXCEPTIONAL ITEMS

Recruitment 449 (30) 212

Conferencing (19) (207) (277)

Group costs (144) (138) (425)

----------- ----------- ---------

286 (375) (490)

----------- ----------- ---------

GBP3.7m of the revenue of the recruitment segment arose to a

single customer.

The exceptional administrative item in the current period

relates to the recruitment segment. In the year to 31 December 2010

the exceptional administrative items relate to the conferencing

division.

In the view of the directors, there is not a seasonal aspect to

the performance of the business.

3. EXCEPTIONAL ADMINSTRATIVE EXPENSE / (INCOME)

6 Months 6 Months 12 Months

to to to

30 Jun 30 Jun 31 Dec

2011 2010 2010

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Provision for doubtful debt 370 - -

Profit on disposal of fixed

assets - - (121)

Restructuring costs - - 63

----------- ----------- ---------

370 - (58)

----------- ----------- ---------

As further explained in the chairman's statement during the

period the Group has experienced a probable bad debt of GBP370,000

from an isolated customer. This has been provided in full in the

interim results and is subject to tax relief.

4. INCOME TAX EXPENSE

No provision has been made for tax in the period, as a result of

the losses incurred. Tax charges in the previous periods were

estimated at the anticipated effective rate.

5. DISCONTINUED OPERATIONS

On 25 June 2010, the Board decided to discontinue funding the

Group's Training Division and hence the board of Catalis Limited

put this company into Administration. The loss for the discontinued

operation is stated after charging:

6 Months 6 Months 12 Months

to to to

30 Jun 30 Jun 31 Dec

2011 2010 2010

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Revenue - 1,138 1,138

Cost of sales - (763) (763)

----------- ----------- ---------

Gross Profit - 375 375

Administrative expenses - normal - (657) (657)

----------- ----------- ---------

Operating loss - (282) (282)

Financing income/(expense) - - -

----------- ----------- ---------

Loss on ordinary activities

before taxation - (282) (282)

Attributable income tax expense - - -

Loss on disposal of discontinued

operations - (244) (244)

----------- ----------- ---------

Net loss attributable to discontinued

operations - (526) (526)

----------- ----------- ---------

Details of net assets disposed as a result of the administration

of Catalis Limited and the associated loss for the period resulting

from this are as follows:

6 Months 6 Months 12 Months

to to to

30 Jun 30 Jun 31 Dec

2011 2010 2010

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Non current assets

Property plant and equipment - 202 202

Current assets - 321 321

Current liabilities - (279) (279)

----------- ----------- ---------

Net assets disposed of - 244 244

Consideration - - -

----------- ----------- ---------

Loss on disposal - (244) (244)

----------- ----------- ---------

6. DIVIDENDS

The Board does not propose the payment of an interim

dividend.

7. LOSS PER SHARE

The losses per share have been calculated on both continuing and

discontinued operations after taxation, based on the weighted

average number of shares in issue during the period. The

outstanding share options are not considered to be dilutive in

either the current or comparative periods.

6 Months 6 Months

to to 12 Months

30 Jun 2011 30 Jun 2010 to

(unaudited) (unaudited) 31 Dec 2010

Weighted average

number of shares 10,411,444 9,022,564 9,022,564

Loss from continuing

operations (GBP'000) (129) (381) (432)

Loss per share from

continuing operations

(pence) (1.24) (4.22) (4.79)

Loss from discontinued

operations (GBP'000) - (526) (526)

Loss per share from

discontinued operations

(pence) - (5.83) (5.83)

Loss from continuing

and discontinued

operations (GBP'000) (129) (907) (958)

Loss per share from

continuing and discontinued

operations (pence) (1.24) (10.05) (10.62)

------------- ------------- -------------

8. ANALYSIS OF CHANGES IN NET DEBT

At At

1 Jan Cash Other 30 Jun

2011 Flows Movements 2011

GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank and in

hand - 469 - 469

Bank overdraft (2,231) (2,524) - (4,755)

Finance leases - - - -

-------- -------- ----------- --------

Net debt (2,231) (2,055) - (4,286)

-------- -------- ----------- --------

The Group has a working capital facility with Lloyds TSB plc

that allows it to borrow up to 90% of the invoiced trade debtors of

ATA Recruitment Limited and Ganymede Solutions Limited up to

GBP5.2m and an overdraft facility of GBP50,000.

9. RECONCILIATION OF CONSOLIDATED EQUITY

As at As at As at

30 Jun 30 Jun 31 Dec

2011 2010 2010

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Opening total equity 849 1,815 1,815

Total comprehensive expense

for the period (129) (907) (958)

Dividends - - -

Issue of shares 396 - -

Share based payment - - (8)

----------- ----------- -------

Closing total equity 1,116 908 849

----------- ----------- -------

On 6 May 2011 the Group issued 4,489,062 shares at 9p per share

under the authorisation granted in Resolution 7 of the AGM dated 22

June 2010. The issue raised GBP396,215 net of costs.

10. CONTINGENT LIABILITIES

Included in current borrowings are bank overdrafts and an

invoice discounting facility. During the year the Group has used

its bank overdraft and invoice discounting facility, which is

secured by a cross guarantee and debenture over the Group

companies. There have been no defaults or breaches of interest

payable during the current or prior period.

11. RELATED PARTY TRANSACTIONS

RTC Group Plc is the parent company of the Group that includes

the following entities that have been consolidated which are

related parties:

-- ATA Management Services Limited

-- ATA Recruitment Limited

-- The Derby Conference Centre Limited

-- Ganymede Solutions Limited

-- Global Choice Recruitment Limited

The Group's related parties also include key management

personnel who are the executive directors and non-executive

director.

RTC Group Plc

Registered Office

The Derby Conference Centre

London Road

Derby DE24 8UX

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KBLBFFBFLFBK

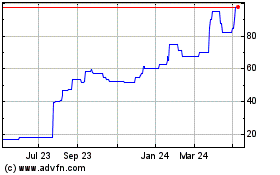

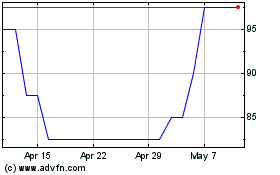

Rtc (LSE:RTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rtc (LSE:RTC)

Historical Stock Chart

From Jul 2023 to Jul 2024