RM Infrastructure Income PLC Net Asset Value(s)

December 20 2024 - 2:00AM

RNS Regulatory News

RNS Number : 8320Q

RM Infrastructure Income PLC

20 December 2024

|

RM Infrastructure Income

Plc

|

|

|

|

("RMII" or the

"Company")

|

|

|

|

LEI:

213800RBRIYICC2QC958

|

|

|

|

Net Asset

Value

|

NAV Performance

The NAV % Total Return for November

2024 was 0.52%, which takes the NAV % Total Return to 0.66% over

the past six months, and 4.18% over the past 12 months.

The NAV as at 30th

November 2024 was 85.87 pence per Ordinary Share, which was 1.17

pence lower than at 31st October 2024. This reduction in

NAV was predominantly driven by the Company's Q3 dividend of 1.625

pence per share, announced in October 2024 and paid in November

2024. This was balanced by (1) a positive net interest income of

0.243 pence per share, slightly lower than forecasted due to a

number of pre-year-end accounting adjustments regarding the

Company's run-rate expenses; (2) a small valuation uplift of 0.481

pence per share primarily driven by discount rate movements; and

(3) incentive fee buybacks13 which resulted in a NAV

reduction of 0.27 pence per share.

|

Summary

for November 2024 (pence per share)

|

|

Net interest income

|

+0.243p

|

|

Change in portfolio

valuations

|

+0.481p

|

|

Incentive fee

buybacks13

|

-0.270p

|

|

Dividend

|

-1.625p

|

|

Net NAV Movement

|

-1.170p

|

Portfolio Activity

As at 30th November 2024,

the Company's invested portfolio had an aggregate nominal

outstanding of circa £79 million across 18 investments. The average

yield was 12.08%, with a weighted average loan life remaining of

circa 0.81 years10. Overall, the portfolio is 94%

invested in private market assets and 6% in public

bonds.

During the reporting period, RM

successfully recovered c.£6m for investment loans Ref #80 and Ref

#92, in line with previous assumptions shared with Shareholders and

slightly ahead of the book value.

Cash balances at end of November

2024 stood at circa £8.5m of which circa £1.5m will be retained by

the Company largely to fund remaining committed facilities which

have yet to be drawn as well as to hold sufficient funds for

corporate purposes.

|

|

|

|

The Company also announces that the

Monthly Report for the period to 30th November 2024 is

now available to be viewed on the Company website:

|

|

https://rm-funds.co.uk/rm-infrastructure-income/rm-funds-investor-monthly-fact-sheets-2/

|

|

|

|

END

|

|

|

|

For further information, please

contact:

|

|

RM

Capital Markets Limited - Investment

Manager

|

|

James Robson

|

|

Thomas Le Grix De La

Salle

|

|

Tel: 0131 603 7060

|

|

|

|

FundRock Management Company (Guernsey) Limited

- AIFM

|

|

Chris Hickling

|

|

Dave Taylor

|

|

Tel: 01481 737600

|

|

|

|

Apex Listed Companies Services (UK) Ltd

- Administrator and Company Secretary

|

|

Jenny Thompson

|

|

|

|

Tel: 07767102572

|

|

|

|

Singer Capital Markers Advisory LLP - Financial Adviser and Broker

|

|

James Maxwell

|

|

Asha Chotai

|

|

Tel: 020 7496 3000

|

|

|

|

|

|

About RM Infrastructure Income

|

|

|

|

RM Infrastructure Income Plc ("RMII"

or the "Company") is a closed-ended investment trust established to

invest in a portfolio of secured debt instruments.

|

|

|

|

The Company aims to generate

attractive and regular dividends through loans sourced or

originated by the Investment Manager with a degree of inflation

protection through index-linked returns where appropriate. Loans in

which the Company invests are predominantly secured against assets

such as real estate or plant and machinery and/or income streams

such as account receivables.

On 20 December 2023, shareholders

approved the implementation of the Managed Wind-down of the

Company. Accordingly, the Company's investment objective was

restated as follows: "The Company

aims to conduct an orderly realisation of the assets of the

Company, to be effected in a manner that seeks to achieve a balance

between returning cash to Shareholders promptly and maximising

value."

|

|

|

|

For more information, please

see

|

|

https://rm-funds.co.uk/rm-infrastructure-income/

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NAVDKLFFZLLFFBD

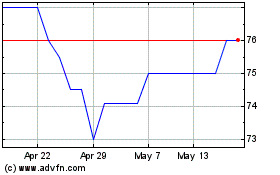

Rm Infrastructure Income (LSE:RMII)

Historical Stock Chart

From Dec 2024 to Jan 2025

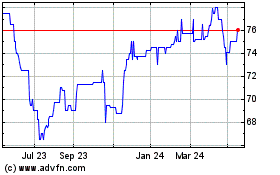

Rm Infrastructure Income (LSE:RMII)

Historical Stock Chart

From Jan 2024 to Jan 2025