TIDMREDX

RNS Number : 0410V

Jounce Therapeutics, Inc.

03 April 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN ANY JURISDICTION WHERE TO DO SO

WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION.

Termination of Proposed Business Combination of Jounce

Therapeutics, Inc. and Redx Pharma plc

CAMBRIDGE, Mass., April 3, 2023 - Jounce Therapeutics, Inc.

("Jounce" or the "Company") and Redx Pharma plc ("Redx") have

agreed to terminate their proposed business combination following

the decision by Jounce's Board of Directors to withdraw the

recommendation for the all-share merger transaction with Redx (the

"Redx Business Combination").

Jounce's decision was based upon the receipt of an unsolicited

proposal from Concentra Biosciences, LLC ("Concentra"), which led

to Jounce entering into a merger agreement whereby Concentra will

acquire Jounce through a cash tender offer for all of Jounce's

outstanding shares for $1.85 in cash per share plus a non-tradeable

contingent value right (the "CVR"). The $1.85 per share upfront

consideration represents a premium of approximately 75% to Jounce's

closing share price immediately prior to the March 14, 2023, public

disclosure of Concentra's acquisition proposal.

Jounce conducted a thorough review of both the proposed

transaction with Concentra and the proposed Redx Business

Combination, with the assistance of its legal and financial

advisers, and Jounce's Board of Directors ultimately concluded that

the proposed transaction with Concentra is in the best interest of

Jounce stockholders, and therefore, unanimously approved the merger

agreement with Concentra and withdrew its recommendation of the

Redx Business Combination. On March 27, 2023, Jounce notified Redx

of the withdrawal of its recommendation in favor of the Redx

Business Combination and termination of the co-operation agreement

dated February 23, 2023 between Jounce and Redx.

Given that Jounce's Board of Directors has withdrawn its

recommendation to proceed with the Redx Business Combination,

Jounce believes it is unlikely that Jounce stockholders would

support the Redx Business Combination, which is a condition to

closing the transaction. Accordingly, Jounce and Redx have agreed

not to proceed with the proposed scheme of arrangement. In

addition, Jounce has confirmed that it does not wish to switch to a

contractual takeover offer. As a result, the U.K. Takeover Panel

has confirmed that upon Redx announcing:

1. its withdrawal of its recommendation;

2. that it will not proceed with the scheme of arrangement; and

3. it has agreed to the release of Jounce from its obligation to proceed with the offer,

the offer period in respect of the Redx Business Combination

will end with effect from the publication of Redx's announcement,

and the transaction will lapse.

As a result, Jounce will not be convening a Jounce meeting of

stockholders to consider the Redx Business Combination. Under the

U.K. Takeover Code, except with consent of the U.K. Takeover Panel,

Jounce must not, among other things, announce a further offer for

Redx within 12 months from the date of this announcement.

About Jounce Therapeutics

Jounce Therapeutics, Inc. is a clinical-stage immunotherapy

company dedicated to transforming the treatment of cancer by

developing therapies that enable the immune system to attack tumors

and provide long-lasting benefits to patients through a

biomarker-driven approach. Jounce currently has multiple

development stage programs ongoing while simultaneously advancing

additional early-stage assets from its robust discovery engine

based on its Translational Science Platform. For more information,

please visit www.jouncetx.com.

For further information, please contact:

Jounce Therapeutics, Inc.

Kim Drapkin

ir@jouncetx.com T: +1-857-259-3840

Cowen (Financial Adviser to Jounce) T: +1-646-562-1010

Tanya Joseph / Erik Schuchard / Giles Roshier T: +44 (0)203 011

0460

Stern Investor Relations (Adviser to Jounce)

Julie Seidel T: +1-212-362-1200

Longacre Square Partners (Adviser to Jounce)

Dan Zacchei / Rebecca Kral

Jounce@longacresquare.com

Important notices

Cowen Execution Services Limited ("Cowen"), which is authorised

and regulated in the United Kingdom by the FCA, is acting

exclusively as financial adviser to Jounce and no one else in

connection with the Redx Business Combination and/or the proposed

transaction with Concentra and will not be responsible to anyone

other than Jounce for providing the protections afforded to clients

of Cowen nor for providing advice in relation to the Redx Business

Combination, the proposed transaction with Concentra , the contents

of this press release or any other matters referred to in this

press release. Neither Cowen nor any of its affiliates, nor any of

Cowen's and such affiliates' respective members, directors,

officers, controlling persons or employees owes or accepts any

duty, liability or responsibility whatsoever (whether direct or

indirect, consequential, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of Cowen in

connection with the Redx Business Combination, the proposed

transaction with Concentra , this press release, any statement

contained herein or otherwise.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws, including, without

limitation, statements regarding Jounce's expectations of the

outcome of a meeting of stockholders to consider the Redx Business

Combination and its resulting plans not to hold a meeting of

stockholders to consider the Redx Business Combination, the

expected end of the offer period in respect of the Redx Business

Combination and the lapsing of such transaction. The words

"believes," "expects," "plans," "may," "will," "would," "could,"

"should," and "effort" and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Any

forward-looking statements in this press release are based on

management's current expectations and beliefs and are subject to a

number of risks, uncertainties and important factors that may cause

actual events or results to differ materially from those expressed

or implied by any forward-looking statements contained in this

press release, including, without limitation, risks related to the

impact of actions of other parties with respect to the proposed

transaction with Concentra; the possibility that offer period in

respect of the Redx Business Combination does not end and the

transaction does not lapse as anticipated; general economic and

market conditions and the other risks identified in the Company's

filings with the U.S. Securities and Exchange Commission ("SEC"),

including its most recent Annual Report on Form 10-K for the year

ended December 31, 2022, filed with the SEC on March 10, 2023 and

subsequent filings with the SEC. Should any risks and uncertainties

develop into actual events, these developments could have a

material adverse effect on the proposed transaction and/or Jounce

and Jounce's ability to successfully complete the proposed

transaction. Jounce cautions investors not to place undue reliance

on any forward-looking statements, which speak only as of the date

they are made. Jounce disclaims any obligation to publicly update

or revise any such statements to reflect any change in expectations

or in events, conditions or circumstances on which any such

statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in the

forward-looking statements. Any forward-looking statements

contained in this press release represent Jounce's views only as of

the date hereof and should not be relied upon as representing its

views as of any subsequent date.

Additional Information and Where to Find It

The tender offer for the outstanding shares of the Company

referenced in this press release has not yet commenced. This press

release is for informational purposes only and is neither an offer

to purchase nor a solicitation of an offer to sell shares, nor is

it a substitute for the tender offer materials that Concentra and

its subsidiary will file with the SEC. At the time the tender offer

is commenced, Concentra and its subsidiary will file tender offer

materials on Schedule TO, and, thereafter, the Company will file a

Solicitation/Recommendation Statement on Schedule 14D-9 with the

SEC with respect to the tender offer.

THE TER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A

RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TER OFFER

DOCUMENTS) AND THE SOLICITATION/RECOMMATION STATEMENT WILL CONTAIN

IMPORTANT INFORMATION. HOLDERS OF SHARES OF JOUNCE COMMON STOCK ARE

URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE

(AS EACH MAY BE AMED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF SHARES OF

JOUNCE COMMON STOCK SHOULD CONSIDER BEFORE MAKING ANY DECISION

REGARDING TERING THEIR SHARES.

The Offer to Purchase, the related Letter of Transmittal and

certain other tender offer documents, as well as the

Solicitation/Recommendation Statement, will be made available to

all holders of shares of the Company's common stock at no expense

to them. The tender offer materials and the

Solicitation/Recommendation Statement will be made available for

free at the SEC's website at www.sec.gov or by accessing the

Investor Relations section of the Company's website at

https://www.jouncetx.com .

Publication on website

A copy of this Announcement shall be made available subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions on Jounce's website at

https://jouncetx.com/recommended-offer/ by no later than 12 noon

(London time) on the Business Day following the date of this press

release. For the avoidance of doubt, the contents of the website

are not incorporated into and do not form part of this press

release.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OUPSSAFEEEDSEEL

(END) Dow Jones Newswires

April 03, 2023 02:00 ET (06:00 GMT)

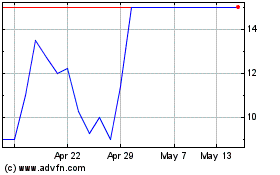

Redx Pharma (LSE:REDX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Redx Pharma (LSE:REDX)

Historical Stock Chart

From Nov 2023 to Nov 2024