Panther Securities Interim Management Statement

November 16 2012 - 4:46AM

UK Regulatory

TIDMPNS

16 November 2012

Panther Securities PLC

("Panther" or "Group")

Interim management statement for the three month period ended 30 September 2012

Panther is pleased to publish its Interim Management Statement for the three

month period ended 30 September 2012. The results for the six months ended 30

June 2012 were announced on 28 August 2012.

The main highlights of the period have been:

* Towards the end of July 2012 the Group disposed of a factory ground rent in

Newton Abbot to the occupying tenant for GBP300,000 this resulted in a GBP

100,000 profit. This was a freehold ground rent investment only producing GBP

375 income per annum.

* The Group has recently completed the letting of 4,000 sq ft at 49-61 High

Street Croydon to Sainsbury's Supermarkets Limited for 15 years from 24

July 2012 at a rent of GBP55,700 per annum. The remaining ground floor space

of 3,000 sq ft should be significantly easier to let with Sainsbury's in

occupation. The upper part of the parade has recently received planning

permission for seven large flats.

* In August 2012 the Group purchased a freehold vacant double shop unit in

Scunthorpe for GBP247,500 (excluding stamp duty). This property is situated

in a prime corner position in the High Street, half the unit is under offer

to let to a household name tenant and when fully let we anticipate a high

return and an increased capital value.

* Towards the end of the period the Group purchased the freehold of 26 Darley

Street, Bradford for GBP475,000 (excluding stamp duty). This unit (1,900 sq

ft ground floor sales and a total of 7,700 sq ft) is let to Textiles Direct

Limited at a rent of GBP35,000 per annum and is located in a prime location

in Bradford adjoining M&S and gives us enhanced synergies on management

being next to an existing large investment block.

* There has been an increase in our financial derivatives combined liability

by GBP1.6 million to GBP21.8 million as at 28 September 2012. This has worsened

slightly compared to the combined liability of GBP20.2 million as at 31 June

2012.

Significant transactions post period end:

* In October 2012 the Group exchanged contracts to purchase 14-21 Williamson

Street, Liverpool for GBP1,060,000 (excluding stamp duty). This is a long

leasehold investment at a fixed nominal ground rent. The property is

located in a prime central pedestrianised retail district of Liverpool. The

current rental income is GBP214,250 from the two retail tenants.

* Also in October 2012 the Group exchanged contracts to purchase a feuhold

(Scottish equivalent of freehold) office and industrial 2.25 acres site,

with 8 tenancies, a number of buildings and 88 parking spaces for GBP485,000

(excluding stamp duty) with income of GBP271,000 per annum. This high return

is due to the fact that there are 6 leases due to expire by March 2013, but

the Group has taken the view and hope that it can negotiate lease

extensions with enough of these tenants to provide a decent return (or find

suitable replacements).

* The Group has exchanged contracts to purchase in November 2012 the long

leasehold interest of 18-80 & 104-106 Main Street, Coatbridge for GBP5.5

million. The two neighbouring well located and prominent parades are key

retail hubs within Coatbridge, near Glasgow. Together the parades provide

88,000 sq ft across 42 retail units and current tenants include,

Specsavers, Boots, Co-op Travel, Superdrug, Phones 4U and The Royal Bank of

Scotland. The parade currently produces a gross income of approximately GBP

1,150,000 per annum with ground rent payable as a proportion of rents

collected our initial net income after all costs will be approximately GBP

730,000. This investment offers strong returns as well as opportunities for

asset management through letting of vacant units and further development.

* Panther has also agreed terms and has instructed solicitors for the

freehold property of a multi-let high street retail parade investment for

circa GBP4 million. The property comprises of 16 retail units and vacant

offices. 90% of the total current rental income of GBP770,000 per annum is

secured against national multiples. This scheme offers excellent

opportunities for long term income, value enhancement and potential longer

term redevelopment.

General trading update

With financing in place the Group has continued to invest substantially during

the period and after. The funds left to invest following the purchases and if

the proposed above acquisitions complete will be almost fully utilised, other

than GBP2 million. However, the management team have numerous opportunities to

improve income and value with all the recent purchases and across our existing

portfolio.

We are still seeing significant value in properties currently on the market and

we may consider raising new finance via bank loans or possibly issue of bonds,

or disposing of some of our properties where we can obtain good prices from

special purchasers.

As ever we remain upbeat about Panther's future prospects.

Other than as stated above, there has been no significant change in the Group's

financial position since 30 June 2012.

Andrew Perloff

Chairman

For further information contact:

Panther Securities PLC 01707 667 300

Andrew Perloff - Chairman

Simon Peters - Finance Director

END

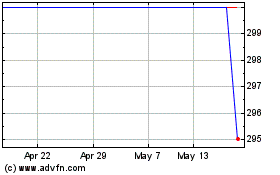

Panther Securities (LSE:PNS)

Historical Stock Chart

From Sep 2024 to Oct 2024

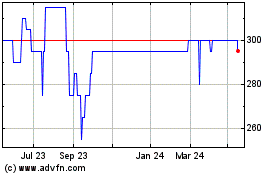

Panther Securities (LSE:PNS)

Historical Stock Chart

From Oct 2023 to Oct 2024