TIDMPET

RNS Number : 2621S

Petrel Resources PLC

22 June 2018

22(nd) June 2018

Petrel Resources plc

("Petrel" or "the Company")

Preliminary Results for the Year Ended 31(st) December 2017

Petrel announces its results for the year ended 31(st) December

2017.

A copy of the Company's Annual Report and Accounts for 2017 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise shareholders will be notified that the Annual

Report will be available on the website at www.petrelresources.com.

Copies of the Annual Report will also be available for collection

from the Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

The Company's Annual General Meeting will be held on 25(th) July

2018 in the Gresham Hotel, 23 O'Connell Street Upper, Dublin 1, D01

C3W7 at 10:30 am.

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014.

S

For further information please visit

http://www.petrelresources.com/ or contact:

Enquiries:

Petrel Resources

John Teeling, Chairman +353 (0) 1 833 2833

David Horgan, Director

Nominated Adviser and Broker

Northland Capital Partners Limited

David Hignell / Edward Hutton (Corporate

Finance) +44 (0) 203 861 6625

John Howes

Joint Broker

Novum Securities Limited

Colin Rowbury +44 (0) 207 399 9400

Public Relations

Blytheweigh +44 (0) 207 138 3204

Tim Blythe +44 (0) 781 692 4626

Simon Woods +44 (0) 746 643 9633

Teneo PSG

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Statement Accompanying the Preliminary Results

The headline figures of a loss for the year of some EUR4.4

million is likely to be newsworthy, but mostly reflects the EUR4.1

million impairment of our investment in Iraq. The underlying loss

is roughly EUR300,000.

Iraq

In August 2013, Petrel did a deal with Amira in Iraq whereby,

for US$500,000 in cash plus 18,947,368 initial consideration shares

(which were to be locked-in until spudding of the first oil well by

our partners), Petrel acquired a 5% full free carry in Amira's

activities in the Wasit province in Iraq which was then, and still

is, a relatively stable Shia dominated province. The expectation

was that provinces in Iraq would offer licences in their own right

rather than solely through the central government in Baghdad. This

did not happen. In fact, nothing happened. As mentioned above, we

have therefore impaired our investment.

Proposed buy back and cancellation of shares

We have also reached agreement to buy back the initial

consideration shares for a nominal consideration although, as we

reported on 15 December 2017, 2.2 million of the shares had been

sold in breach of the lock-in agreement. Permission is being sought

at the forthcoming AGM to buy back and cancel the remaining

16,747,368 shares. Cancellation of these shares would reduce the

number of shares in issue by approximately 17%.

Iraq remains one of the very best oil provinces in the world.

The oil exploration potential is outstanding. The improving

political situation in Iraq has resulted in Petrel re-awakening an

interest. We have been there since 1999 and like the country. We

are discussing with Amira, our partner, how best to declare an

interest in certain fields. We are also re-establishing contacts in

the administration. It is very early days, but it does look as if

Iraq is slowly re-opening for business, and we want to be

there.

Offshore Ireland

Our main focus in recent times has been the Atlantic Offshore

Ireland, particularly the Porcupine Basin. Results are mixed. We

did very well in recent licencing rounds, winning two licences

seven years ago and another two in 2016. In 2013, we joint ventured

our two 2011 licences with Woodside Energy of Australia, recovering

our cash investment and getting a carry. They did extensive work

including, in 2016, a multi-million euro 3D seismic campaign. Their

ongoing work led them to relinquish FEL 4/14 in 2016. The review of

the latest seismic has led them to surrender their FEL 3/14

interest as of end August 2018. FEL 3/14 could revert 100% to

Petrel if an extension can be negotiated with the authorities. We

believe that the ground has potential not recognised by Woodside,

and that we can bring in a partner.

In the meantime, as we reported on 27 February 2018, Woodside

have offered and Petrel have accepted a 10% participating interest

in licence FEL 11/18, thus satisfactorily resolving the prior

issues under arbitration in relation to FEL 4/14. Work on FEL 11/18

has identified targets, which are being tested by the

state-of-the-art 3D seismic which has recently been acquired.

The two licence options acquired in 2016 (LO 16/24 and LO 16/25)

have been analysed and worked up, and potential opportunities

identified. Despite extensive work by Petrel, we found no interest

from likely partners in joint venturing the two options.

On a wider industry front, oil prices have recovered and majors

are making money. It was expected that the results of the 2017

drilling in the Porcupine would have ignited interest but there is

little sign of it to date.

Unfortunately there is growing political uncertainty in Ireland

in relation to resources. Oil exploration dollars are nomadic. They

will go where they are welcome. Ireland is no longer welcoming. A

ban on onshore fracking and a bill to outlaw new offshore oil

exploration licences currently in the Dáil sends out bad messages.

Combine these with the increases in taxation and royalties

introduced in 2015 and you have a toxic cocktail.

Exploration in deep hostile expensive waters with unknown

potential is high risk. Add political uncertainty to this and the

inevitable consequence is reduced interest. The farm out market for

early stage projects, whereby junior explorers do the initial work

and de-risk the geology, then bring in majors to do the drilling,

has thinned out. We are seeking to convert LO 16/24 into a Frontier

Exploration Licence as we believe there is potential on the

acreage. LO 16/25 was too limited in acreage and structure size to

be worth converting.

Ghana

We have been in Ghana since 2008. We signed an oil exploration

agreement in 2010. But to date it has not been ratified by cabinet

or parliament. Petrel holds a 30% interest in the agreement (held

through its interest in Pan Andean Resources Limited), Clontarf

Energy, a sister company holds 60% and local interests hold

10%.

Since 2010, there has been a series of obstacles placed in the

way of ratification. We believed a court settlement in 2014 would

expedite the decision. It has not. Recent changes in government has

returned to power the party who first made the agreement with us.

There is now renewed energy to attempt to finalise a deal. While

there is goodwill on both sides, actually concluding a deal has

been difficult.

Future

Petrel is a small tightly held listed company. Shareholders over

many years have not been asked to invest new money. In recent

years, we have been investing the proceeds of an Iraqi exit in 2009

into Iraq, Offshore Ireland and Ghana. In Ireland, we recovered

most of our investment with the Woodside joint venture. Ghana,

where we hold 30%, is not a big drain on resources.

Once again, it is time to reassess our strategy. We will

continue to work with Woodside in the Atlantic and with our

partners in Ghana. We will once more dip our toe into opportunities

in the Middle East.

John Teeling

Chairman

22(nd) June 2018

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE FINANCIAL YEARED 31 DECEMBER 2017

2017 2016

EUR EUR

CONTINUING OPERATIONS

Administrative expenses (297,381) (257,675)

Impairment of investments (4,094,804) -

OPERATING LOSS (4,392,185) (257,675)

Investment revenue - 1,170

LOSS BEFORE TAXATION (4,392,185) (256,505)

Income tax expense - -

LOSS FOR THE FINANCIAL YEAR: all attributable

to equity holders of the parent (4,392,185) (256,505)

Other comprehensive (expense)/income - -

Items that are or may be reclassified

subsequently to profit or loss - -

Exchange differences (321,858) 66,830

TOTAL COMPREHENSIVE LOSS FOR THE FINANCIAL

YEAR (4,714,043) (189,675)

Loss per share - basic and diluted (4.40c) (0.26c)

PETREL RESOURCES PLC

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER 2017

2017 2016

EUR EUR

Assets

Non-Current Assets

Financial asset - 4,211,123

Intangible assets 2,179,283 2,138,159

2,179,283 6,349,282

Current Assets

Trade and other receivables 27,573 23,003

Cash and cash equivalents 371,380 745,195

398,953 768,198

Total Assets 2,578,236 7,117,480

Current Liabilities

Trade and other payables (584,693) (409,894)

Net Current (Liabilities)/Assets (185,740) 358,304

NET ASSETS 1,993,543 6,707,586

Equity

Called-up share capital 1,246,025 1,246,025

Capital conversion reserve fund 7,694 7,694

Share premium 21,416,085 21,416,085

Share based payment reserve 26,871 26,871

Translation reserve 399,461 721,319

Retained deficit (21,102,593) (16,710,408)

TOTAL EQUITY 1,993,543 6,707,586

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEARED 31 DECEMBER 2017

Capital Share

Conversion Based

Share Share Reserve Payment Translation Retained

Capital Premium fund Reserve Reserve Deficit Total

EUR EUR EUR EUR EUR EUR EUR

At 1 January

2016 1,246,025 21,416,085 7,694 26,871 654,489 (16,453,903) 6,897,261

Total comprehensive

income for

the financial

year - - - - 66,830 (256,505) (189,675)

---------- ----------- ------------ --------- ------------ ------------- ------------

At 31 December

2016 1,246,025 21,416,085 7,694 26,871 721,319 (16,710,408) 6,707,586

Total comprehensive

income for

the financial

year - - - - (321,858) (4,392,185) (4,714,043)

---------- ----------- ------------ --------- ------------ ------------- ------------

At 31 December

2017 1,246,025 21,416,085 7,694 26,871 399,461 (21,102,593) 1,993,543

========== =========== ============ ========= ============ ============= ============

Share premium

Share premium comprises of the excess of monies received in

respect of the issue of share capital over the nominal value of

shares issued.

Capital conversion reserve fund

The ordinary shares of the company were renominalised from

EUR0.0126774 each to EUR0.0125 each in 2001 and the amount by which

the issued share capital of the company was reduced was transferred

to the capital conversion reserve fund.

Share based payment reserve

The share based payment reserve represents share options granted

which are not yet exercised and issued as shares.

Translation Reserve

The translation reserve comprises of foreign exchange movement

on translation from US Dollars (functional currency) to Euro

(presentation currency).

Retained deficit

Retained deficit comprises accumulated losses in the current and

prior financial years.

PETREL RESOURCES PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE FINANCIAL YEARED 31 DECEMBER 2017

2017 2016

EUR EUR

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the financial year (4,392,185) (256,505)

Write off of financial asset 4,094,804 -

Investment revenue recognised in loss - (1,170)

OPERATING CASHFLOW BEFORE

MOVEMENTS IN WORKING CAPITAL (297,381) (257,675)

Movements in working capital:

Increase in trade and other payables 129,799 49,285

Increase in trade and other receivables (4,570) (3,800)

CASH USED IN OPERATIONS (172,152) (212,190)

- 1,170

Investment revenue

(172,152) (211,020)

NET CASH USED IN OPERATING ACTIVITIES

INVESTING ACTIVITIES

Payments for exploration and evaluation assets (259,161) (160,699)

Funds on disposal of financial assets 116,319 -

NET CASH USED IN INVESTING ACTIVITIES (142,842) (160,699)

NET DECREASE IN CASH AND CASH EQUIVALENTS (314,994) (371,719)

Cash and cash equivalents at beginning of

financial year 745,195 1,111,257

Effect of exchange rate changes on cash held

in

foreign currencies (58,821) 5,657

Cash and cash equivalents at end of financial

year 371,380 745,195

NOTES:

1. ACCOUNTING POLICIES

There were no changes in accounting policies from those used to

prepare the Group's Annual Report for financial year ended 31

December 2016. The financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union.

2. LOSS PER SHARE

2017 2016

EUR EUR

Loss per share - basic and diluted (4.40c) (0.26c)

Basic loss per share

The earnings and weighted average number of ordinary shares used

in the calculation of basic loss per share are as follows:

2017 2016

EUR EUR

Loss for the financial year attributable to

equity holders (4,392,185) (256,505)

2017 2016

Number Number

Weighted average number of ordinary shares

for the

purpose of basic earnings per share 99,681,992 99,681,992

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

3. FINANCIAL ASSET

Investment

2017 2016

EUR EUR

At the beginning of the financial year 4,211,123 4,211,123

Additions - -

Disposal (116,319) -

Impairment (4,094,804) -

At the end of the financial year - 4,211,123

The Company's investment in its financial asset, held through

its wholly owned subsidiary Petrel Resources (TCI) Limited,

consisted of a 20 per cent shareholding in Amira Hydrocarbons Wasit

B.V.("Amira") which was acquired from Amira Petroleum N.V. on 14

August 2013. Amira is a special purpose vehicle which holds a 25

per cent carried to production interest in an early stage oil

opportunity in the large, underexplored and underdeveloped province

of Wasit.

The consideration for the acquisition included the issue of

18,947,368 shares in Petrel. The Initial Consideration Shares were

agreed to be locked-in until the date of spudding the first

conventional oil well in respect of Amira's interest in the Wasit

province but that, if the Spudding Date had not occurred by 19

August 2018, Petrel could, amongst other things, elect to

re-acquire the Initial Consideration Shares for a nominal amount.

As part of the agreement with Amira Petroleum, 2.8 million of the

Initial Consideration Shares were, at the direction of Amira

Petroleum, issued to its advisers in satisfaction of fees payable

by Amira Petroleum and were subject to a lock in agreement as

detailed above.

During December 2017, the Directors learnt that 2.2 million of

the Adviser Shares had been sold between March and July 2017,

notwithstanding the lock-in agreement. The parties reached a

settlement and agreed that the vendors of the 2.2 million Adviser

Shares make a payment of GBP100,000 to the Company, which has been

received per year end (representing approximately 4.5p per Adviser

Share sold). The remaining Adviser Shares shall remain subject to

the lock-in agreed in 2013.

As of the date of this announcement, the Spudding Date has not

occurred. Accordingly, the directors have decided to write off the

investment in Amira Hydrocarbons Wasit B.V. and an impairment

charge of EUR4,094,804 was recorded. No further shares will be

issued to Amira and the 16,747,368 shares already issued will be

re-acquired for nominal consideration, subject to shareholder

approval at the AGM and the shares will be cancelled.

4. INTANGIBLE ASSETS

2017 2016

EUR EUR

Exploration and evaluation assets:

Cost:

Opening balance 2,138,159 1,871,288

Additions 304,159 205,699

Exchange translation adjustment (263,035) 61,172

Closing balance 2,179,283 2,138,159

Segmental Analysis

2017 2016

EUR EUR

Ghana 843,988 962,377

Ireland 1,335,295 1,175,782

2,179,283 2,138,159

Exploration and evaluation assets at 31 December 2017 represent

exploration and related expenditure in respect of projects in

Ireland and Ghana. The directors are aware that by its nature there

is an inherent uncertainty in relation to the recoverability of

amounts capitalised on the exploration projects.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below.

The Group's exploration activities are subject to a number of

significant and potential risks including:

-- Licence obligations;

-- Funding requirements;

-- Political and legal risks, including title to licence, profit sharing and taxation;

-- Geological and development risks;

-- Exchange rate risk;

-- Political risk; and

-- Financial risk management.

Directors' remuneration of EUR30,000 (2016: EUR30,000) and

salaries of EUR15,000 (2016: EUR15,000) were capitalised as

exploration and evaluation expenditure during the financial

year.

5. SHARE CAPITAL

2017 2016

EUR EUR

Authorised:

200,000,000 ordinary shares of EUR0.0125 2,500,000 2,500,000

Allotted, called-up and fully

paid:

Number Share Share

Capital Premium

EUR EUR

At 1 January 2016 99,681,992 1,246,025 21,416,085

Issued during the financial - - -

year

At 31 December 2016 99,681,992 1,246,025 21,416,085

At 1 January 2017 99,681,992 1,246,025 21,416,085

Issued during the financial - - -

year

At 31 December 2017 99,681,992 1,246,025 21,416,085

Movements in share capital

There was no movement in share capital in the current year.

6. POST BALANCE SHEET EVENTS

There were no material post balance sheet events affecting the

company or group.

7. ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held on 25(th) July

2018 in the Gresham Hotel, 23 O'Connell Street Upper, Dublin 1 ,

D01 C3W7 at 10:30 am.

8. GENERAL INFORMATION

The financial information set out above does not constitute the

Company's financial statements for the year ended 31 December 2017.

The financial information for 2016 is derived from the financial

statements for 2016 which have been delivered to the Companies

Registration Office. The auditors have reported on 2016 statements;

their report was unqualified with an emphasis of matter in respect

of considering the adequacy of the disclosures made in the

financial statements concerning the valuation of intangible assets,

investment in subsidiaries and amounts due by group undertakings.

The financial statements for 2017 will be delivered to the

Companies Registration Office.

A copy of the Company's Annual Report and Accounts for 2017 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise shareholders will be notified that the Annual

Report will be available on the website at www.petrelresources.com.

Copies of the Annual Report will also be available for collection

from the Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR PGUUWQUPRGUP

(END) Dow Jones Newswires

June 22, 2018 06:37 ET (10:37 GMT)

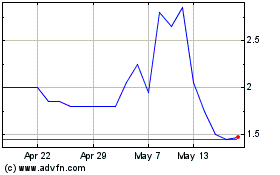

Petrel Resources (LSE:PET)

Historical Stock Chart

From Oct 2024 to Nov 2024

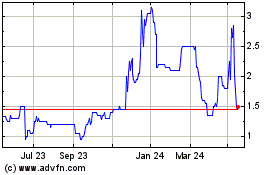

Petrel Resources (LSE:PET)

Historical Stock Chart

From Nov 2023 to Nov 2024