TIDMPET

RNS Number : 2882A

Petrel Resources PLC

28 September 2015

28(th) September 2015

Petrel Resources plc

("Petrel" or "the Company")

Interim Statement for the period ended 30 June 2015

In a world where listed junior oil companies have seen their

share prices hammered Petrel is stable with cash and ongoing

activities. In two current projects, Offshore Ireland and in Iraq

we are fully carried by our partners so there is negligible cost to

Petrel. In our Ghanaian venture we await the outcome of a licence

application so costs are low. We have submitted a strong

application for licences in the recent Irish Offshore licencing

round and are hopeful of success. On current plans we are funded

through 2017.

Offshore Ireland

Offshore Ireland is our main focus of activity. We have a joint

venture with Woodside Energy of Australia who farmed into our two

offshore Irish blocks, Frontier Exploration Licences 3/14 and 4/14

in the Porcupine Basin, covering 1,050 sq km with plays in about

600-800 m of water. Petrel holds a 15% interest and is

substantially carried by Woodside through the initial exploration

programmes. Significant work has been done and Woodside is ready to

undertake a 3D seismic acquisition programme which will better

identify and outline potential hydrocarbon bearing structures. The

programme is expected to be undertaken in 2016. The targets are

large.

As announced, Petrel has, in recent days, applied for 3 packages

of acreage in the Irish Atlantic Margin Licensing Round which

closed in mid-September 2015. Our experienced geological team used

our own data bank plus currently available data to identify

priority areas. We anticipate early discussions with the

authorities on our proposals and are confident that our record to

date, both in developing new plays and attracting world-class

partners, will strengthen our applications. We are hopeful of an

award.

Ghana

In Ghana we hold a 30% interest in Pan Andean Resources Limited

(Clontarf 60%, local interest 10%). The current position is that

the Ghanaian National Petroleum Commission are actively considering

the current re-application by Pan Andean Resources Limited over

circa 1,500 sq km plus of the shallow-to-medium depth part of the

prospective Tano Basin. A year ago we withdrew a court case to

force the Ghanaian authorities to process our 2010 application.

There was a dispute over part of what we believed to be our

acreage. In discussions with the Ghanaian authorities, we

eventually agreed new co-ordinates and a speedy ratification

process. Little has happened so far. We threatened to recommence

court proceedings. Once more a compromise was agreed under which

the local company, Pan Andean, agreed, without prejudice, to

re-submit a fresh proposal over acreage defined by the revised

coordinates. This has been done and that re-application is now

being considered. We were reluctant to re-apply as it might weaken

our strong legal position. We took advice and lodged a new

application. We are told that this is under active

consideration.

Iraq

Our third theatre of activities is Iraq, where we have had a

presence for 18 years. The original Petrel interest was in Block 6

in the Western Desert between Baghdad and the Jordanian border.

That is, and is likely to remain, a no-go area.

Two years ago we established a close relationship with a

well-connected Iraqi family by acquiring a 20 per cent interest in

Amira Hydrocarbons Wasit. Amira has a joint venture with a Canadian

company, Oryx Petroleum, in the Wasit province. We bought, for cash

and shares, an effective 5% free carry through exploration on any

Oryx activities in Wasit. The acquisition refocused our efforts on

one of the world's premier hydrocarbon basins and provides our

shareholders with greater exposure to the world class hydrocarbon

potential in Iraq. The Wasit Governorate is a Shia controlled

province between Baghdad and the Iranian border, and is relatively

stable. Like most of Iraq, it is very prospective for oil yet only

lightly explored. Our belief was, and is, that a federal system

would evolve in Iraq. This belief was based on events in Kurdistan.

Should this happen, governors can sanction exploration in their own

provinces. To date this has not happened. The shares in Petrel,

given to Amira, will be extinguished if exploration does not happen

by 2018. Nothing is happening at present. Petrel incurs no

costs.

Future

The immediate future for Petrel is tied to Offshore Ireland. Our

current partner is likely to be active in the Atlantic over the

next two years. We are hopeful of obtaining additional acreage in

the recent Irish Atlantic licensing round.

There will be developments in Ghana in the coming months but,

based on experience, it is very difficult to predict.

Overriding all of the above is the price of oil. Should it stay

weak or even fall further then exploration will fade away, only to

return stronger when prices rise. Petrel has the resources to

operate through this cycle.

John Teeling

Chairman

25(th) September 2015

Enquiries:

Petrel Resources Plc

John Teeling, Chairman +353 (0) 1 833 2833

David Horgan, Director

Nominated Adviser and Broker

Northland Capital Partners Limited

Edward Hutton / Gerry Beaney +44 (0)20 7382 1100

John Howes/Mark Treharne (Broking)

Public Relations

Blytheweigh +44 (0)20 7138 3204

Tim Blythe +44 (0) 7816 924 626

Camilla Horsfall +44 (0) 7871 841 793

PSG Plus

Aoife Ross +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

www.petrelresources.com

Petrel Resources plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six Months Ended Year Ended

30 June 15 30 June 14 31 Dec 14

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CONTINUING OPERATIONS

Administrative

expenses (148) (229) (431)

Impairment of evaluation and

exploration assets - - (2,529)

-------------------- ----------------- ----------------

OPERATING

LOSS (148) (229) (2,960)

Investment

revenue 1 1 1

-------------------- ----------------- ----------------

LOSS BEFORE TAXATION (147) (228) (2,959)

Income tax

expense - - -

-------------------- ----------------- ----------------

LOSS FOR THE PERIOD (147) (228) (2,959)

Items that are or may be reclassified subsequently to profit or loss

Exchange

differences 237 40 501

TOTAL COMPREHENSIVE PROFIT/(LOSS) FOR THE PERIOD 90 (188) (2,458)

==================== ================= ================

LOSS PER SHARE - basic and

diluted (0.15c) (0.23c) (2.97c)

==================== ================= ================

CONDENSED CONSOLIDATED BALANCE SHEET 30 June 15 30 June 14 31 Dec 14

unaudited unaudited audited

ASSETS: EUR'000 EUR'000 EUR'000

NON-CURRENT ASSETS

Financial

assets 4,211 4,211 4,211

Intangible

assets 1,767 3,546 1,539

(MORE TO FOLLOW) Dow Jones Newswires

September 28, 2015 02:00 ET (06:00 GMT)

-------------------- ----------------- ----------------

5,978 7,757 5,750

-------------------- ----------------- ----------------

CURRENT

ASSETS

Trade and other

receivables 46 13 45

Cash and cash

equivalents 1,166 1,671 1,331

-------------------- ----------------- ----------------

1,212 1,684 1,376

TOTAL ASSETS 7,190 9,441 7,126

-------------------- ----------------- ----------------

CURRENT

LIABILITIES

Trade and other

payables (281) (352) (307)

-------------------- ----------------- ----------------

(281) (352) (307)

-------------------- ----------------- ----------------

NET CURRENT ASSETS 931 1,332 1,069

NET ASSETS 6,909 9,089 6,819

==================== ================= ================

EQUITY

Share

capital 1,246 1,246 1,246

Share

premium 21,416 21,416 21,416

Reserves (15,753) (13,573) (15,843)

-------------------- ----------------- ----------------

TOTAL EQUITY 6,909 9,089 6,819

==================== ================= ================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital Share based

Share Share Conversion Payment Translation Retained Total

Capital Premium Reserves Reserves Reserves Losses Equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1

January

2014 1,246 21,416 8 26 (152) (13,267) 9,277

Total comprehensive

loss - 40 (228) (188)

---------- ----------- ------------------- -------------------- ----------------- ----------------

As at 30

June 2014 1,246 21,416 8 26 (112) (13,495) 9,089

Total comprehensive

loss - 461 (2,731) (2,270)

---------- ----------- ------------------- -------------------- ----------------- ----------------

At 31

December 14 1,246 21,416 8 26 349 (16,226) 6,819

Total comprehensive

income - 237 (147) 90

----------- ------------------- --------------------

As at 30

June 2015 1,246 21,416 8 26 586 (16,373) 6,909

======== ========== =========== =================== ==================== ================= ================

CONDENSED CONSOLIDATED CASH FLOW Six Months Ended Year Ended

30 June 15 30 June 14 31 Dec 14

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the

period (147) (228) (2,959)

Impairment

charge - - 2,529

Investment revenue recognised in loss (1) (1) (1)

-------------------- ----------------- ----------------

(148) (229) (431)

Movements in Working

Capital (49) (38) (227)

-------------------- ----------------- ----------------

CASH USED IN

OPERATIONS (197) (267) (658)

Investment

revenue 1 1 1

-------------------- ----------------- ----------------

NET CASH USED IN OPERATING ACTIVITIES (196) (266) (657)

-------------------- ----------------- ----------------

INVESTING

ACTIVITIES

Payments for exploration and

evaluation assets (74) (447) (575)

Receipts for exploration and

evaluation assets - 945 945

-------------------- ----------------- ----------------

NET CASH (USED)/GENERATED IN INVESTING ACTIVITIES (74) 498 370

-------------------- ----------------- ----------------

NET (DECREASE)/INCREASE IN CASH AND CASH EQUIVALENTS (270) 232 (287)

Cash and cash equivalents at beginning of the

period 1,331 1,425 1,425

Effect of exchange rate changes on

cash held 105 14 193

CASH AND CASH EQUIVALENT AT THE END OF THE PERIOD 1,166 1,671 1,331

==================== ================= ================

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2015

and the comparative amounts for the six months ended 30 June 2014

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2014.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2014, which are available on the Company's website

www.petrelresources.com

(MORE TO FOLLOW) Dow Jones Newswires

September 28, 2015 02:00 ET (06:00 GMT)

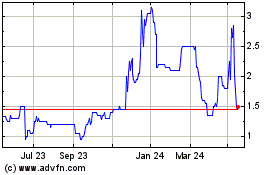

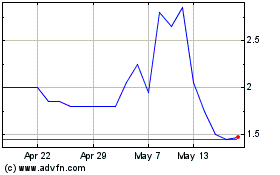

Petrel Resources (LSE:PET)

Historical Stock Chart

From Jun 2024 to Jul 2024

Petrel Resources (LSE:PET)

Historical Stock Chart

From Jul 2023 to Jul 2024