TIDMPDL

PETRA DIAMONDS LIMITED

13 September 2022 LSE: PDL

Preliminary Results for FY 2022 (unaudited)

Record results and a significant turnaround in Petra's net debt

Petra announces its preliminary results (unaudited) for the year ended 30 June

2022 (Year or FY 2022). Separate announcement on the 2026 Loan Notes Tender

offer issued today.

Financial highlights

* Revenue up 44% to US$585 million

* Doubling of adjusted EBITDA to US$265 million

* Adjusted basic earnings per share up 219% to USc42.93

* Operational free cash flow up 91% to US$230 million

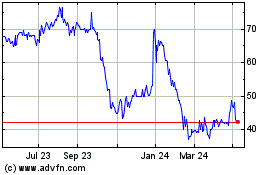

* Consolidated net debt of US$40.6 million, with leverage of 0.15x

Enabling

* Launch of US$150 million tender offer to reduce gross debt

* Announcement of dividend policy

Richard Duffy, Chief Executive Officer of Petra, commented:

"We are delighted with our overall performance, which caps the turnaround begun

three years ago. Our continued focus on safety has supported a 48% improvement

in our LTIFR. Additionally, sustainability is being integrated across our

business through the implementation of our new Sustainability Framework.

Project 2022, now concluded, has delivered US$265 million in net free cash over

its three years, contributing to our record financial results for FY2022.

In addition to Project 2022, the key drivers were our record recovery of

Exceptional Stones[1], the resumption of operations at the Williamson mine, and

a 41.5% increase in like-for-like[2] diamond prices. The diamond market remains

broadly supportive as a result of the prevailing structural supply deficit,

although ongoing macro-economic uncertainties may lead to some volatility in

the short term.

Our strong cash generation in FY 2022 has enabled us to target a further

reduction in our gross debt through a tender offer for US$150 million of our

2nd lien notes, detailed in a separate release today. This will see us saving

up to US$15 million annually in interest expenses.

I am also very pleased to announce that, on the back of our much improved

financial position, the Board has approved a dividend policy."

HIGHLIGHTS

Strong financial performance driving the reduction in consolidated net debt

US$m unless stated otherwise FY 2022 FY 20212 Variance

Revenue 585.2 406.9 +44%

Adjusted EBITDA1 264.9 130.2 +103%

Adjusted EBITDA margin (%)1 45% 32% +44%

Adjusted profit / (loss) before tax1 141.9 (18.3) +875%

Adjusted net profit / (loss) after tax1 102.0 (25.5) +500%

Net profit after tax 88.1 196.6 -55%

Operational free cashflow1 230.0 120.1 +91%

Consolidated net debt1 40.6 228.2 -82%

Unrestricted cash 271.9 147.7 +84%

Consolidated net debt : Adjusted EBITDA1 0.15x 1.75x -91%

Basic earnings per share (USc) 35.53 260.70 -86%

Adjusted basic earnings / (loss) per share1 42.93 (36.20) +219%

(USc)

Note 1: For all non-GAAP measures refer to the Summary of Results table within

the Financial Results section below.

Note 2: For comparative purposes, the FY 2021 income statement figures include

Williamson as it is no longer a discontinued operation - refer to note 2.

Consolidated net debt and cash balances for FY 2021 have not been adjusted.

Note 3: The comparative basic profit per share and adjusted profit per share

have been adjusted to give effect to the share consolidation of one new share

for every 50 existing shares completed on 29 November 2021 with the Company's

resultant issued share capital now consisting of 194,201,785 ordinary shares of

0.05 pence each.

* FY 2022 total revenue of US$585.2 million comprises revenue from rough

diamond sales of US$584.1 million and additional revenue from profit share

agreements on partnership stones of US$1.1 million. The 44% increase in

revenue from rough diamond sales was driven by:

+ A 41.5% increase in year-on-year like-for-like prices

+ The contribution from the sale of a record number of Exceptional Stones

of US$89.1 million; this compares with an average of US$39.2 million

over the last five years

* Adjusted EBITDA rose 103% to US$264.9 million, reflecting the positive

operational leverage from our revenue growth, as well as improved

efficiencies from Project 2022; Adjusted EBITDA margin rose to 45%

* Adjusted net profit after tax rose to US$102.0 million (reversing a US$25.5

million adjusted net loss after tax last year). Net profit after tax fell

55% to US$88.1 million largely driven by a prior year gain of US$213.3

million on the extinguishing of the Notes as part of the Group's capital

restructuring, and unrealised foreign exchange losses of US$34.3 million

net of tax (FY 2021 unrealised gain of US$54.7 million net of tax)

* Adjusted basic earnings per share was USc42.93 up 219%

* Operational free cash flow rose 91% to US$230.0 million driven by increased

EBITDA

* Consolidated net debt reduced 82% to US$40.6 million which is 0.15x EBITDA,

reflecting this strong free cash flow generation

Efficient production with excellent safety performance and a focus on

sustainability

FY 22 FY 211 Variance

LTIFR 0.23 0.44 +48%

LTIs (number) 15 25 +40%

Ore processed (Mt) 11.7 8.1 +44%

Diamonds recovered (carats) 3,353,670 3,240,312 +3%

Rough diamonds sold (carats) 3,536,316 3,960,475 -11%

Revenue from rough diamond sales 584.1 406.9 +44%

(US$m)

Adjusted mining and processing costs 307.1 276.1 +11%

(US$m)

Capital expenditure (US$m) 52.2 22.8 +129%

Note 1: For comparative purposes, the FY 21 production, diamond sales and cost

figures have been restated to include Williamson as it is no longer a

discontinued operation

* LTIFR improved 48% to 0.23, and LTIs improved 40% to 15 including an LTI

which occurred during FY 2022 but was recorded post year-end

* Production increased 3% to 3,353,670 carats, largely owing to the

resumption of mining at Williamson

* Cash-on-mine costs remained within guidance despite inflationary pressures

* Capital expenditure, which comprises expansion and sustaining capex, was

below guidance largely attributable to expenditure of around US$12 million

being deferred from FY 2022 to FY 2023

* Our new Sustainability Framework is being fully integrated into Petra's

operating model. Sustainability targets will be detailed in the FY 2022

Sustainability Report in October

* Petra is targeting zero greenhouse gasses (GHG) emissions on a net basis by

2050. This commitment includes an aspirational goal to reach net-zero

emissions for Scope 1 and 2 GHG by 2040 or earlier. Additional details will

be provided in the Annual Report and Sustainability Report in October

Key operational guidance maintained

FY 23E FY 24E FY 25E

Total carats recovered (Mcts) 3.3 - 3.6 3.3 - 3.6 3.6 - 3.9

Cash on-mine costs and G&A1 (US$m) 300 - 320 300 - 320 300 - 320

Expansion capex1(US$m) 115 - 125 125 - 135 115 - 120

Sustaining capex1(US$m) 33 - 36 30 - 32 26 - 28

Note 1: Opex and capex guidance is stated in FY 22 real terms and based on an

exchange rate of ZAR15 / USD1.

More detailed guidance is available on Petra's website at https://

www.petradiamonds.com/investors/analysts/analyst-guidance/

Petra reaffirms its operational guidance provided for the FY 2023 to FY 2025

period, noting the following:

* While Cullinan Mine recorded lower grades towards the end of the Year, a

study is underway to inform our mine planning as a result of a higher

proportion of ROM tonnes from our more mature drawpoints

* The impact of waste dilution on grades experienced at Finsch in Q4 FY2022

has continued into Q1 of this year, with ongoing monitoring and mitigation

plans to address this

* Options for a responsible exit at Koffiefontein, including the evaluation

of non-binding expressions of interest.

New dividend policy

The Board approved a dividend policy targeting an ordinary dividend within the

range of 15% to 35% of adjusted free cash flows after interest and tax and

having adjusted for any windfall earnings.

The Board would ordinarily look to the annual dividend being paid 1/3 following

its interim results and 2/3 after its full year results. The dividend policy

will take effect from 1 July 2022 and the Board will consider whether to pay a

maiden dividend under this policy following publication of Petra's interim

results for the six months ending 31 December 2022. In a year where Petra

generates windfall earnings, the Board may consider paying a special dividend.

Prior to declaring or recommending any dividend, the Board will consider the

Group's capital commitments, including, amongst other things, approved

expansion projects and debt servicing and repayment commitments and associated

covenant requirements, to ensure that the Group maintains a healthy balance

sheet and sufficient liquidity and headroom.

Debt tender offer

Petra today also announced its intention to reduce its gross debt through a

tender offer to bondholders to purchase US$150 million of the Senior Secured

Second Lien Notes due in 2026 in line with our stated intent to further

optimise our capital structure through a reduction of gross debt. If

completed, the transaction will see Petra saving up to US$15 million per annum

in interest expenses, while we remain confident that we will continue to fund

our ongoing capital programmes from existing and internally generated cash

resources. Further detail on the tender offer is covered in a separate

announcement which can be found on Petra's website at https://

www.petradiamonds.com/investors/news/

Outlook

FY2023 - 2025 production, cost and capex guidance remains unchanged. We

continue to monitor the evolving macro-economic environment that has seen

higher inflation and interest rates. Our ability to absorb inflationary

pressures is assisted by our disciplined cost management, relatively low fuel

consumption, and any weakening of the South African Rand.

The backdrop of structural changes to the supply and demand fundamentals in the

diamond market remains unchanged and we anticipate that it will continue to be

supportive going forward, notwithstanding possible volatility in the short

term.

The implementation of our new operating model, that formed part of Project

2022, has provided a more stable and resilient operating platform supporting

ongoing cash generation, enabling our self-funded expansion programme, the

US$150 million tender offer for our 2nd lien notes and the potential payment of

dividends under our new dividend policy.

PRESENTATION DETAILS

Richard Duffy, CEO, Jacques Breytenbach, CFO, will present the results to

investors and analysts.

Online and in person at 09.30 BST

In-person: One Heddon Street, London, W1B 4BF

Webcast: To join https://stream.brrmedia.co.uk/broadcast/

630f7aa6da906b287e9a3218

Online only at 16.00 BST

Webcast: To join https://stream.brrmedia.co.uk/broadcast/

630f7c97da906b287e9a335f

Dial in details for both 09:30 BST and 16:00 BST

* Johannesburg, toll/tollfree: +27 (0) 11 589 8302 / 0800 980 512

* UK: +44 (0)33 0551 0200

* New York: +1 212 999 6659

Password: Quote PetraDiamonds when prompted by the operator

Recording of presentation

A recording of the webcast will be available later today on Petra's website at

https://www.petradiamonds.com/investors/presentations

Investor Meet company presentation 11.30 BST

Petra will present the results on the Investor Meet company platform,

predominantly aimed at retail investors. To join: https://

www.investormeetcompany.com/petra-diamonds-limited/register-investor

FURTHER INFORMATION

Petra Diamonds, London +44 207 494

8203

Patrick Pittaway

investorrelations@petradiamonds.com

Jill Sherratt

Julia Stone

This announcement includes inside information as defined in Article 7 of the

Market Abuse Regulation No. 596/2014 and is being released on behalf of Petra

by the Company Secretary.

ABOUT PETRA DIAMONDS

Petra Diamonds Limited is a leading independent diamond mining group and a

consistent supplier of gem quality rough diamonds to the international market.

The Company has a diversified portfolio incorporating interests in three

underground producing mines in South Africa (the Finsch, Cullinan and

Koffiefontein Mines) and one open pit mine in Tanzania (Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of 226.6 million carats, which supports the potential for long-life operations.

Petra strives to conduct all operations according to the highest ethical

standards and will only operate in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's US$336.7 million Senior Secured

Second Lien Notes due in 2026 are listed on the Irish Stock Exchange and

admitted to trading on the Global Exchange Market. For more information, visit

www.petradiamonds.com

CEO'S REVIEW

Strong revenue growth, profitability and cash generation in a robust diamond

market

US$m unless otherwise stated FY 22 FY 21 Variance

Sales

Rough diamonds sold (carats) 3,536,316 3,960,475 -11%

Revenue from rough diamond and partnership 585.2 406.9 +44%

sales

Contribution to rough revenue from Exceptional 89.1 62.0 +44%

Stones

Profitability

Adjusted EBITDA1 264.9 130.2 +103%

Adjusted EBITDA margin (%) 45 32 +44%

Cash generation

Operational free cash flow1 230.0 120.1 +91%

Consolidated net debt1 40.6 228.2 -82%

Unrestricted cash 271.9 147.7 +84%

Note 1: For all non-GAAP measures refer to the Summary of Results table within

the Financial Results section below.

Note 2: For comparative purposes, the FY 2021 income statement figures include

Williamson as it is no longer a discontinued operation - refer to note 2.

Consolidated net debt and cash balances for FY 2021 have not been adjusted.

Overall revenue increased 44% to US$585.2 million, comprising US$584.1 million

from rough diamond sales and an additional US$1.1 million from our first

partnership stone sale. The drivers of this revenue growth were the

year-on-year 41.5% increase in like-for-like diamond prices and record recovery

and sale of Exceptional Stones, totalling US$89.1 million (FY 2021: US$62.0

million).

The 11% reduction in rough diamonds sold reflects the particularly high volumes

sold in FY 2021, mostly off-tender, as the inventory build-up after the initial

COVID-19 outbreak was released.

Adjusted EBITDA rose 103% to US$264.9 million with an Adjusted EBITDA margin of

45% reflecting the strong revenue growth and positive operational leverage,

supported by the recovery of Exceptional Stones.

The 91% improvement in operating free cash flow generation has been supported

by the Project 2022 initiatives. Over the three years since its commencement

the Project has contributed US$265.4 million of net free cash flow benefits,

exceeding our revised target of delivering net free cash flow of between US$100

million and US$150 million.

This cash generation means that we lowered our consolidated net debt to US$40.6

million as at 30 June 2022, down from US$228.2 million as at 30 June 2021.

Safe and efficient production

FY 22 FY 211 Variance

LTIFR 0.23 0.44 -48%

LTIs 15 25 -40%

Ore processed (Mt) 11.7 8.1 +44%

Diamonds recovered (carats) 3,353,670 3,240,312 +3%

Adjusted mining and processing costs 307.1 276.1 +11%

(US$m)

Capital expenditure (US$m) 52.2 22.8 +129%

Note1: For comparative purposes, the FY 21 production and cost figures have

been restated to include Williamson as it is no longer a discontinued operation

We strive to achieve a zero-harm working environment. Petra has focused on

improving safety performance through remedial actions and behaviour-based

intervention programmes. As a result, we have improved the Lost Time Injury

Frequency Rate (LTIFR) by 48% to pre-pandemic levels, and Lost Time Injuries

(LTIs) by 40% which were of low severity and mostly behavioural in nature. We

continue the roll-out of COVID-19 vaccinations for employees and 64% of the

workforce in South Africa and 15% of the workforce in Tanzania have been

vaccinated. The vaccination rate in South Africa is well ahead of the national

average of 51%.

The vast majority of the 44% increase in ore processed is attributable to

Williamson recommencing operations in August 2021 following a 17-month period

of care and maintenance. Williamson ore is lower grade in comparison to our

South African mines and this translated into a 3% increase in diamonds

recovered, within our guidance range.

Project 2022 has, as part of the focus on cash generation, been highly

effective in addressing both operational efficiencies as well as the efficiency

of our operational and capital expenditure. We have created a Business

Improvement function to ensure that the systems and processes developed as part

of Project 2022, which concluded this Year, will continue to deliver benefits

and seek out further improvement opportunities. Supporting this culture of

continuous improvement, our new operating model has clarified lines of

accountability and further empowers our people.

Cash on-mine costs and G&A costs were in line with guidance. The 11% increase

in adjusted mining and processing costs was principally due to the resumption

of operations at Williamson during the first quarter of the Year, the stronger

average ZAR/USD exchange rate and inflationary increases.

Group capex of US$52.2 million was below guidance following delayed delivery of

certain capital items planned for FY 2022 due to increased lead-times. As a

result, around US$12 million of capex that was due to be incurred in FY 2022 is

now expected to be incurred in FY 2023. US$34.5 million of the FY 2022 capital

spend was expansionary capex and the vast majority of total capex was invested

at the Cullinan and Finsch Mines (US$35.0 million and US$12.0 million

respectively).

Load shedding and energy reform in South Africa

The recent increase in load shedding in South Africa is currently having

minimal impact on our operations. Our excess processing capacity at both

Cullinan Mine and Finsch allows us to reduce our processing energy draw to meet

the prescribed load curtailment requirements whilst maintaining mining at full

production and catching up on processing when conditions return to normal.

The regulator in South Africa has increased the allowance for self-generation

without requiring a generation licence to a maximum of 100 MW. This has opened

up opportunities for high energy-users to integrate renewables on their own

sites and Petra is actively looking at options that are optimal from a

financing and partnering perspective that would enable us to integrate

renewables into our energy mix, lower our cost of energy, secure our energy

supply and support our target of achieving net zero GHG emissions by 2050 or

earlier.

Extending our mine plans

Resources

Petra manages one of the world's largest gross diamond resources (inclusive of

reserves) of 226.6 Mcts, supporting a potential mine life well beyond the

current mine plans. The 2% reduction compared to 230.64 Mcts in 30 June 2021,

was predominantly due to depletions resulting from mining at all our assets in

FY 2022.

Petra's gross diamond reserves decreased 10% to 29.97 Mcts (30 June 2021: 33.33

Mcts) primarily due to mining depletions with minor changes in mine plans and

Williamson remaining on care and maintenance until August 2021.

Life extension projects approved during the Year

As announced previously, the Board approved extension projects at our major

South African mines, the Cullinan and Finsch Mines, during the Year.

* At the Cullinan Mine we will establish a CC1 East sub-level cave, on the

same level as the current C-Cut operation, extending the mine plan to 2031.

The capital investment is estimated at US$173 million over the life of the

project and is expected to deliver a project internal rate of return (IRR)

of more than 30% and incremental project NPV of more than US$70 million.

Capital expenditure began during the Year and production is expected to

begin in FY 2024, ramping up to a steady state in FY 2026.

* At Finsch, we will extend the mine below the current area, creating a Lower

Block 5 3-level sub-level cave, extending the mine plan to 2030. The

capital investment is estimated at US$216 million and the IRR is also

expected to be in excess of 30% with incremental NPV of more than US$90

million. Capital expenditure for this project will commence during FY 2023

and we expect production to commence in FY 2025.

* The capex involved in these projects is expected to be self-funded.

There are further opportunities beyond these mine extension plans, given the

significant scale of the orebodies at the Cullinan, Williamson and Finsch

Mines.

Diamond market remains buoyant despite uncertainties

Despite significant global economic uncertainties resulting from the war in

Ukraine, like-for-like rough diamond prices increased 41.5% for the Year,

driven in particular by record jewellery retail demand in the US. Overall we

saw strength of demand across our product mix, both in white and coloured

gem-quality stones, with some increased demand for smaller diamonds in the

final tender of the Year in June.

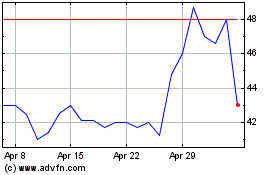

Tender 1 FY 2023, announced today

We have achieved strong sales in the first tender of FY 2023, realising

US$102.9 million due to a high proportion of high-value gem-quality single

stones particularly from the Cullinan Mine. This has resulted in a 21% increase

in our average realised price against Tender 6 in FY 2022, more than offsetting

the 4.5% softening of like-for-like prices.

The supportive structural supply deficit in the diamond market

Growth in demand was driven by mid-stream inventory restocking and continued

strong jewellery retail sales associated with a delayed wedding boom and a

growing trend in diamonds being given as meaningful gifts post COVID-19. While

the diamond market is strong, macroeconomic uncertainties caused by the rise in

inflation are a potential dampener of demand.

Global supply is expected to remain broadly flat for the next ten years at

between 115 and 125 Mcts. This is driven by the reduction in the number of

producing mines, the long lead-times for open-pit mines to transition to

underground mining, as well as the very limited investment in exploration.

Given that less than 1% of kimberlites discovered are economic, we do not

expect this to change in the medium term.

Sustainability performance to benefit from new Sustainability Framework

FY 22 FY 211 Variance

Carbon intensity (tCO2-e/ct) 0.139 0.126 +10%

Energy intensity (kWh/t) 38.1 46.1 -17%

Water intensity (M3/t) 1.0 0.55 +82%

Women in the workforce (%) 20 20 flat

Staff turnover (%) 9.8 9.6 +2%

Training spend (US$m) 6.1 5.8 +5%

Social spend (US$m) 0.9 0.7 +29%

Note 1: FY 21 metrics are affected by Williamson being on care and maintenance

The comparability of FY 2022 and FY 2021 performance is distorted by the

resumption of the open-pit operations at Williamson in August 2021.

Petra is embedding its new Sustainability Framework so that environmental,

social and governance improvements are further integrated throughout our

operations. Targets will be published in our FY 2022 Sustainability Report in

October.

Petra remains committed to reducing our GHG profile and to generate zero

emissions on a net basis for Scopes 1 and 2 (emissions from sources we own and

control directly and those through the energy we purchase) by 2050, although we

aspire to reach this goal by 2040 or earlier. Our emissions profile is heavily

weighted to our Scope 2 emissions which comprise 97% of total emissions in

South Africa, and 92% including Tanzania. We will announce targets for 2030 in

the FY 2022 Annual and Sustainability Reports to be published in October. Our

Scope 3 reductions will be pursued once our Scope 1 and 2 roadmap has been

developed. Our Climate Change Adaptation Strategy is being updated in

accordance with TCFD requirements.

Framework Agreement with the Government of Tanzania and MOU with Caspian

In December 2021, Petra announced that it had entered into two agreements with

the objective of reducing its exposure to Tanzania while still retaining

control of Williamson.

The Framework Agreement between Petra and the Government of Tanzania will

become effective after a number of conditions are satisfied, including

obtaining various government approvals. The agreement, which will result in the

reduction of Petra's indirect shareholding in Williamson Diamonds Limited (WDL)

from 75% to 63% and establish a sustainable future for Williamson, is

progressing and is now expected to become effective in the first half of FY

2023.

Petra expects to further reduce its indirect shareholding in WDL from 63% to

31.5% via a sale to Caspian Limited but with Petra retaining a controlling

interest in WDL as Petra have the controlling vote on the WDL Board via its

controlling interest in the intermediate holding company. The transaction

remains subject to the parties first agreeing definitive transaction agreements

and then obtaining all necessary government, regulatory and lender approvals

which are also expected to be obtained in the first half of FY 2023.

Independent Grievance Mechanism and community projects at Williamson

Petra has implemented remedial programmes and initiatives and is establishing

the Independent Grievance Mechanism (IGM) to address the historical allegations

of human rights abuses at Williamson. The second phase of engagements with the

Government of Tanzania and local stakeholders on the IGM has been completed and

the focus is now on updating the IGM processes and appointing the various

organs that will make up the IGM, with the current target for the IGM to become

operational remaining Q4 of CY 2022.

While the IGM is still being finalised, a mechanism has been set up to enable

community members to confidentially and securely register alleged historical

human rights grievances. This mechanism continues to receive grievances, with a

significant amount of grievances having been registered to date. As the IGM is

not yet operational (and therefore unable to start investigating these

grievances), it is too early to evaluate the merits of these grievances.

A number of other initiatives are being put in place to provide sustainable

benefits to the communities located close to the mine, funded by the £1 million

Escrow account established by Petra. Having completed all planned activities in

Q1 CY 2022, the Gender Based Violence initiative is now training young men as

champions and first responders and setting up survivor self-help groups within

the surrounding communities. The medical services project has been expanded to

provide further services, including surgery, medication and psychological

support. Feasibility studies for income generating projects (agriculture

businesses and artisanal mining) are also progressing and a radio programme to

improve awareness and understanding of the IGM and community projects amongst

the local community has been set up.

More information on the IGM, the community projects and illegal incursions into

the Williamson mine lease area can be found on Petra's website at: https://

www.petradiamonds.com/our-operations/our-mines/williamson/

allegations-of-human-rights-abuses-at-the-williamson-mine/.

The Board

As previously announced, Jon Dudas joined the Board as an independent

Non-Executive Director effective from 1 March 2022, further strengthening the

Board through his broad experience across the mining and resources sectors, in

operations, general management, information technology, finance and strategy.

Also, as previously announced, Matthew Glowasky stepped down from the Board as

a non-independent, Non-Executive Director on 17 May. His appointment became

effective in March 2021, following completion of the Restructuring pursuant to

a Nomination Agreement between Petra and Monarch. While Monarch does not

currently intend to nominate a director to replace Mr Glowasky, it retains its

right to do so.

OPERATIONS REVIEW

Cullinan Mine - strong performance and extension work under way

Cullinan Mine - South Africa FY 22 FY 21 Variance

Sales

Revenue (US$m) 322.4 250.6 +29%

Diamonds sold (carats) 1,899,011 2,261,058 -16%

Average price per carat (US$) 169 111 +52%

Total production

Tonnes treated (tonnes) 4,865,065 5,060,339 -4%

Diamonds produced (carats) 1,814,975 1,943,942 -7%

Grade1

ROM (cpht) 36.2 38.2 -5%

Tailings (cpht) 49.6 41.0 +21%

Segment result2 (US$m) 154.4 76.8 +101%

Costs and capex

On-mine cash cost per total tonne treated 312 260 +20%

(ZAR/t)

Total capex (US$m) 35.0 16.8 +108%

1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the

Company therefore back-calculates the grade with reference to resource

grades

2. The segment result includes depreciation of US$52.5 million

At the Cullinan Mine we came in at the upper end of our production guidance

ranges on all criteria except tailings. Diamonds produced were 7% below last

year's, largely as a result of the convergence in Tunnel 41 early in the Year,

and the planned depletion of a mining block which had contributed to production

in FY 2021. The convergence has now been effectively mitigated and factored

into our guidance.

The Cullinan Mine's revenue increased 29% to US$322.4 million due to a 52%

increase in the average price achieved per carat and the US$75.2 million

realised for Exceptional Stones. Together, these more than offset the 16%

reduction in diamonds sold, which was mainly the result of a higher volume of

sales in FY 2021 caused by the release of the inventory build-up during the

COVID-19 crisis into the market. Additional revenue of US$1.1 million was

generated from Petra's 50% share of profit from the sale of polished stones cut

from the 18.30ct Type II blue diamond sold as a partnership stone in August

2021.

The convergence of Tunnel 41 in the C-Cut impacted 18 of a total of 187 draw

points. Remedial action was focused on arresting convergence by reinforcing the

affected pillars and protecting the tunnel, so that access can be

re-established once the area has been stabilised. We continue to monitor it to

determine when we will be able to re-access this tunnel.

Grade was in line with guidance, notwithstanding the decline towards the end of

the Year due to a change in the composition of ore within the C-Cut block cave

resulting in a higher proportion of lower-grade and greater-density ore. We are

monitoring these changes together with options to mitigate the grade

differential.

During the Year, the efficiency of the X-Ray Luminescence technology (XRL),

introduced in FY 2021, to reduce the risk of damage to larger stones in our

processing circuit, was tested through the addition of a modular X-Ray

Transmission (XRT) unit. This unit recovered only 11 additional diamonds of low

value, validating the decision to use XRL technology in the recovery process.

The on-mine unit cash cost per total tonne treated increased to ZAR312/t due to

inflationary increases, increased social expenditure and direct costs

previously included under Group G&A costs. FY 2022 capex was US$35.0 million,

the majority of which was spent on the commencement of the newly approved CC1

East mine extension project. The balance included spend on the projects already

underway in the current mining area, development of a crusher, and improved

long-term accessibility in an area of the C-Cut.

Guidance

FY 2023 to FY 2025 production, cost and capex guidance for the Cullinan Mine

remain unchanged.

* Our production guidance for FY 2023 is between 4.1 and 4.3 Mt ROM material

to be treated, and ROM grade of between 36.5 and 38.5cpht, including the

ore from the portions of the current mining area, the C-Cut, that is lower

grade and higher in density.

* Tailings production is expected to increase to between 0.56 and 0.59 Mt

material treated. ROM production will be prioritised, supplemented by low

volumes of recovery tailings. The economic evaluation of the Cullinan

Mine's substantial tailings resource will be monitored continuously and

could be included in future mine plans dependent on market conditions and

the pricing of smaller diamonds.

* The on-mine cash cost for FY 2023 guidance is between ZAR1,413 and ZAR1,486

million in real terms.

* We are guiding FY 2023 capex of between US$72 and US$79 million. In

addition to sustaining capex, it primarily relates to underground

development of the new CC1 East production areas of our extension project,

explained above.

* We expect to commence mining from the higher grade CC1 East section from FY

2024.

Finsch - managing cost and production profile

Finsch - South Africa FY 22 FY 21 Variance

Sales

Revenue (US$m) 165.7 123.4 +34%

Diamonds sold (carats) 1,402,654 1,602,312 -12%

Average price per carat (US$) 118 77 +53%

Total production

Tonnes treated (tonnes) 2,732,982 2,311,195 +18%

Grade - ROM1 (cpht) 46.7 53.5 -13%

Diamonds produced (carats) 1,275,323 1,237,219 +3%

Segment result1 (US$m) 34.8 (0.5) +7060%

Costs and capex

On-mine cash cost per total tonne treated 493 536 -8%

(ZAR/t)

Total capex (US$m) 12.0 4.0 +200%

1 The segment result includes depreciation of US$24.4 million

While the previously reported waste ingress at Finsch has been largely

mitigated through the implementation of enhanced drill and blast and draw

controls, this requires continuous management.

We saw steady production in the final quarter of the Year leading to an overall

increase of 3%, just below guidance.

Finsch revenue increased 34% to US$165.7 million due to a 53% increase in the

average price per carat which more than offset a 12% reduction in diamonds

sold. As with the Cullinan Mine, this reduction was mainly the result of a

higher volume of sales in FY 2021 which was caused by the inventory build-up

during the COVID-19 pandemic being released into the market.

The Business Re-engineering (BRE) project recommendations being implemented at

Finsch are designed to match its cost base to the revised production levels,

taking into account waste ingress issues.

Finsch has already reduced on-mine cash unit costs by 8% to ZAR493/t due to the

cost curtailment measures undertaken as part of the BRE project and increased

production volumes.

FY 2022 capex was US$12.0 million which was mainly spent on underground

projects. The expansion to the new 78 Level Phase 2 project has commenced, with

ramp-up to full production in progress. In addition, capital has been spent on

early mobilisation to de-risk the new Lower Block 5 3-Level sub-level cave

project.

Guidance

FY 2023 to FY 2025 production, cost and capex guidance for Finsch remain

unchanged , although

lower grades experienced at Finsch in Q4 FY 2022 have continued into Q1 of this

year, with ongoing monitoring and mitigation plans to address this waste

dilution. We will continue to implement the BRE project recommendations to

align costs with production.

* FY 2023 production is planned at between 2.9 and 3.0 Mt ROM including

tonnage from the new section and with waste ingress being continually

monitored. Tailings production is expected to be c.0.6 Mt of treated

material.

* Finsch's underground ROM grade is expected to remain within guidance of

between 43.6 and 46.0 cpht. While tailings production after FY 2023 does

not form part of the current mine plan, lower grade tailings material

remains available to supplement Finsch's underground operations in the

future. The total on-mine cash cost for FY 2023 is guided at between

ZAR1,293 and ZAR1,359 million in real terms. We are continuing to implement

the BRE project outcomes to enhance margins at Finsch.

* FY 2023 capex is guided at between US$65 and US$71 million, primarily

relating to the new Lower Block 5 3-Level sub-level cave project which was

approved during the Year.

* We expect underground development to commence during FY 2023 with

production from the new Sub-Level Cave in FY 2025.

Williamson - resumed production in Q1 FY 2022

Williamson - Tanzania FY 22 FY 211

Sales

Revenue (US$m) 75.9 4.6

Diamonds sold (US$m) 197,756 30,339

Average price per carat (US$) 384 150

Total production

Tonnes treated (tonnes) 3,591,099 0

Grade (cpht) 6.4 0

Diamonds produced (carats) 228,070 0

Segment result2 (US$m) 22.2 (14.3)

Costs and capex

On-mine cash cost per total tonne 13.9 0

treated (US$/t)

Total capex (US$m) 3.3 0.3

Note 1: Williamson was on care and maintenance during FY 2021

2 The segment result includes depreciation of US$5.0 million

Operations at Williamson recommenced in August 2021, having been on care and

maintenance from April 2020. FY 2022 was a year of improving the performance of

the mine after this 17-month period of shutdown and the operations are now

fully ramped up.

Williamson's production and grade were in line with guidance. Revenue was

US$75.9 million, compared with US$4.6 million in FY 2021 when the only diamond

sales were the final parcel recovered prior to the mine being placed on care

and maintenance. We benefitted from the recovery of an exceptional 32.32 carat

pink diamond which was sold for US$13.8 million in the December 2021 tender.

The on-mine cash unit cost of US$13.9/t was in line with guidance. FY 2022

capex was US$3.3 million, which included the costs of preparing the mine for

reopening and sustaining the operations.

Guidance

The focus will be the continued stabilisation of operations following the

period of care and maintenance, including increasing throughput and diamond

recovery, while ensuring waste-stripping is undertaken at the required rate.

FY 2023 to FY 2025 production, cost and capex guidance remain unchanged for

Williamson.

* We are guiding between 5.2 and 5.5 Mt of ROM material to be treated during

FY 2023 which reflects the fully ramped up production.

* The total on-mine cash cost for FY 2023 is guided at between US$66 and

US$69 million in real terms.

* Capex guidance for FY 2023 is approximately US$9 million and relates to

sustaining capital largely associated with waste stripping and

fines-residue infrastructure.

Koffiefontein - approaching the end of its mine plan

Koffiefontein - South Africa FY 22 FY 21 Variance

Sales

Revenue (US$m) 21.5 27.9 -23%

Diamonds sold (carats) 36,950 66,650 -45%

Average price per carat (US$) 581 419 +39%

Total production

Tonnes treated (tonnes) 466,957 754,369 -38%

Diamonds produced (carats) 35,302 59,151 -40%

Grade (cpht)1 7.6 7.8 -3%

Segment result1 (US$m) (13.8) (8.1) -70%

Costs and capex

On-mine cash cost per total tonne treated 1,106 651 +70%

(ZAR/t)

Total capex (US$m) 0.6 1.7 -65%

1 Segment result includes depreciation US$0.3 million, Williamson US$5.0

million

Koffiefontein's production metrics, except grade, were below guidance. Revenue

decreased 23% to US$21.5 million as the 39% increase in the average price per

carat was more than offset by the 45% decline in the number of diamonds sold.

As Koffiefontein approaches the end of its mine plan in 2025, Petra is

exploring options for a responsible exit. We are evaluating non-binding

expressions of interest, received post year-end for the mine. If a sales

transaction does not eventuate, Petra will evaluate its options and continue to

operate the mine responsibly.

The BRE project at Koffiefontein, which is independent of the disposal process,

aims to provide for sustainable operations until the mine's closure and has

resulted in a labour reduction process to align the operation with the reduced

tonnage profile. This process was concluded and the mine started on a new shift

configuration with the reduced labour structure on 30 June 2022.

The on-mine cash unit cost increased to ZAR1,106/t, mainly due to decreased

tonnages and inflationary increases. FY 2022 capex was US$0.6 million and this

was spent mainly on the completion of a workshop underground.

Guidance

FY 2023 to FY 2025 production, cost and capex guidance is maintained and takes

into account the lower production and cost profile we have put in place.

* The total on-mine cash cost for FY 2023 is guided at between ZAR415 and

ZAR437 million in real terms.

* FY 2023 capex guidance is between c.US$1 and US$2 million, primarily

relating to sustaining costs.

FINANCIAL RESULTS

SUMMARY RESULTS (unaudited)

Year ended 30 Restated

June 2022 Year ended 30

("FY 2022") June 2021

("FY 2021") 15

US$ million US$ million

Revenue 585.2 406.9

Adjusted mining and processing costs1 (307.1) (276.1)

Other direct income (0.8) 6.8

Profit from mining activity2 277.3 137.6

Other corporate income 0.6 -

Adjusted corporate overhead (13.0) (7.4)

Adjusted EBITDA3 264.9 130.2

Depreciation and Amortisation (85.3) (80.8)

Share-based expense (1.1) (0.5)

Net finance expense (36.6) (67.2)

Adjusted profit/(loss) before tax 141.9 (18.3)

Tax expense (excluding taxation credit / charge on (39.9) (7.2)

impairment charge and unrealised foreign exchange

gain / (loss))12

Adjusted net profit/(loss) after tax4 102.0 (25.5)

Impairment reversal / (charge) - operations and 19.6 (38.4)

other receivables5

Impairment of BEE loans receivable - expected credit - 5.8

loss release 6

Gain on extinguishment of Notes net of unamortised - 213.3

costs

Profit on disposal of subsidiary7 - 14.7

Recovery / (costs) and fees relating to 0.8 (12.7)

investigation and settlement of human rights abuse

claims

Provision for unsettled and disputed tax claims - (19.5)

Net unrealised foreign exchange (loss) / gain (36.5) 74.6

Taxation credit / (charge) on unrealised foreign 2.2 (19.9)

exchange (loss) / gain12

Taxation credit on impairment charge - 4.2

Net profit after tax 88.1 196.6

Earnings per share attributable to equity holders of

the Company -

USc

Basic profit per share 35.53 260.70

Adjusted profit / (loss) per share8 42.93 (36.20)

As at

30 June 2022 As at

30 June 2021

(US$ million)

Unit (US$

million)

Cash at bank - (including restricted US$m 288.2 173.0

amounts)

Diamond debtors US$m 37.4 38.3

Diamond inventories13 US$m 52.7 56.5

/Cts 453,380 637,676

US$336.7m loan notes (issued March 2021)9 US$m 366.2 327.3

Bank loans and borrowings10 US$m - 103.0

Consolidated Net debt11 US$m 40.6 228.2

Bank facilities undrawn and available10 US$m 61.5 7.7

Consolidated net debt : Adjusted EBITDA 0.15x 1.75x

The following exchange rates have been used for this announcement: average for

FY 2022 US$1:ZAR15.22 (FY 2021: US$1:ZAR15.41); closing rate as at 30 June 2022

US$1:ZAR16.27 (30 June 2021: US$1:ZAR14.27).

Notes:

The Group uses several non-GAAP measures above and throughout this report to

focus on actual trading activity by removing certain non-cash or non-recurring

items. These measures include adjusted mining and processing costs, profit from

mining activities, adjusted EBITDA, adjusted net profit after tax, adjusted

earnings per share, adjusted US$ loan note, net debt and consolidated net debt

for covenant measurement purposes. As these are non-GAAP measures, they should

not be considered as replacements for IFRS measures. The Group's definition of

these non-GAAP measures may not be comparable to other similarly titled

measures reported by other companies. The Board believes that such alternative

measures are useful as they exclude one-off items such as the impairment

charges and non-cash items to provide a clearer understanding of the underlying

trading performance of the Group.

1. Adjusted mining and processing costs are mining and processing costs stated

before depreciation.

2. Profit from mining activities is revenue less adjusted mining and

processing costs plus other direct income.

3. Adjusted EBITDA is stated before depreciation, amortisation of right-of-use

asset, share-based expense, net finance expense, tax expense, impairment

reversal/charges, expected credit loss release/ (charge), gain on

extinguishment of Notes net of unamortised costs, profit on disposal of

subsidiary, costs and fees relating to investigation and settlement of

human rights abuse claims, provision for unsettled and disputed tax claims

and net unrealised foreign exchange gains and losses.

4. Adjusted net profit/(loss) after tax is net profit/(loss) after tax stated

before impairment reversal/charge, expected credit release (loss)

provision, gain on extinguishment of Notes net of unamortised costs, costs

and fees relating to investigation and settlement of human rights abuse

claims, profit on disposal net unrealised foreign exchange gains and

losses, and excluding taxation (charge) credit on net unrealised foreign

exchange gains and losses and excluding taxation credit on impairment

charge.

5. Impairment reversal of US$19.6 million (30 June 2021: US$38.4 million

charge) was due to the Group's impairment review of its operations and

other receivables. Refer to note 15 below for further details.

6. Reversal of impairment of BEE loans receivable of US$nil (30 June 2021:

US$5.8 million) is due to the Group's expected credit loss assessment of

its BEE loans receivable. Refer to note 11 below for further details.

7. The profit on disposal of subsidiary of US$14.7 million in FY2021 includes

the reclassification of foreign currency translation reserve, net of tax of

Sekaka Diamonds (Pty) Ltd.

8. Adjusted EPS is stated before impairment charge, expected credit release

(loss) provision, gain on extinguishment of Notes net of unamortised costs,

profit on disposal of subsidiary, acceleration of unamortised costs on

restructured loans and borrowings, costs and fees relating to investigation

and settlement of human rights abuse claims, provision for unsettled and

disputed tax claims, net unrealised foreign exchange gains and losses, and

excluding taxation (charge) credit on net unrealised foreign exchange gains

and losses and excluding taxation credit/charge on impairment reversal/

charge.

The comparative basic profit per share and adjusted profit per share have been

adjusted to give effect to the share consolidation of one new share for every

50 existing shares completed on 29 November 2021 with the Company's resultant

issued share capital now consisting of 194,201,785 ordinary shares of 0.05

pence each.

1. The US$336.7 million loan notes have a carrying value of US$366.2 million

(FY2021: US$327.3 million) which represents the gross capital of US$336.7

million of notes, plus accrued interest and net of unamortised transaction

costs capitalised, issued following the capital restructuring (the

"Restructuring") completed during March 2021. Refer to detailed Debt

Restructuring Note 18.

2. Bank loans and borrowings represent amounts drawn under the Group's

refinanced South African banking facility with ABSA, completed in June

2022. As at 30 June 2022 the new facility with ABSA comprises a ZAR1

billion (US$61.5 million) revolving credit facility which remains undrawn

and available.

During the Year, the South African banking facilities held with the Group's

previous consortium of South African lenders were settled and cancelled,

comprising of the revolving credit facility of ZAR404.6 million (US$24.9

million) (capital plus interest) and the term loan of ZAR893.2 million (US$54.9

million) (capital plus interest).

1. Consolidated Net Debt is bank loans and borrowings plus loan notes, less

cash, less diamond debtors plus BEE partner bank facilities. In FY2021

Williamson was classified as held for sale, if Williamson was consolidated

as at 30 June 2021 consolidated net debt would have reduced by cash and

cash equivalents held by Williamson of US$9.2 million to US$219.0 million.

2. Tax (expense) / credit is the tax (expense) / credit for the Period

excluding taxation credit / (charge) on impairment charge and unrealised

foreign exchange gain / (loss) generated during the Period, such exclusion

more accurately reflects resultant Adjusted net profit / (loss).

3. Williamson's diamond inventory includes the 71,654.45 carat parcel of

diamonds blocked for export during August 2017, with a carrying value of

US$12.5 million. In terms of the framework agreement reached with the

Government of Tanzania, as announced on 13 December 2021, the proceeds from

the sale of this parcel will be allocated to Williamson.

4. Operational free cashflow is defined as cash generated from operations less

acquisition of property, plant and equipment.

5. The results for FY2021 has been restated with the operating results of

Williamson which were previously classified under loss on discontinued

operations, for further detail refer to note 17.

Revenue

Total revenue for FY 2022 amounted to US$585.2 million (FY 2021: US$406.9

million), comprising revenue from rough diamond sales of US$584.1 million (FY

2021: US$406.9 million) and additional revenue from profit share agreements of

US$1.1 million (FY 2021: nil).

FY 2022 revenue from rough diamond sales increased 44% to US$584.1 million (FY

2021: US$406.9 million) driven by sales from a higher than average number of

Exceptional Stones contributing US$89.1 million during the Year (FY 2021:

US$62.0 million); supported by the strong diamond market, and a 41.5% increase

in like-for-like diamond prices.

Mining and processing costs

The mining and processing costs for FY 2022 comprised on-mine cash costs as

well as other operational expenses. A breakdown of the total mining and

processing costs for the Year is set out below.

On-mine Diamond Diamond Group Adjusted Depreciation3 Total

cash royalties inventory technical, mining and mining and

costs1 and support processing US$m processing

US$m stockpile and costs costs

US$m movement marketing (IFRS)

costs2 US$m

US$m US$m

US$m

FY 2022 272.3 14.6 0.5 19.7 307.1 84.4 391.5

FY 20214 208.9 3.2 42.2 21.8 276.1 80.0 356.1

Notes:

1. Includes all direct cash operating expenditure at operational level, i.e.

labour, contractors, consumables, utilities and on-mine overheads.

2. Certain technical, support and marketing activities are conducted on a

centralised basis.

3. Includes amortisation of right-of-use assets under IFRS 16 of US$2.3

million (FY 2021: US$0.6 million) and excludes exploration and corporate /

administration.

4. For comparative purposes, the FY 2021 figures include Williamson as it is

no longer held for sale at 30 June 2022.

Absolute on-mine cash costs in FY 2022 increased by c.30% compared to FY 2021

and in line with expectations, due to:

* The effect of translating ZAR denominated costs at the South African

operations at a stronger ZAR/USD average exchange rate (1.4% increase)

* Williamson mine resuming production in FY 2022 after being on care and

maintenance throughout FY 2021 and changes in volumes at South-African

operations (18.3% increase);

* Other cost movements, due to increased social expenditure and costs

previously included under Group technical, support and marketing costs

(1.2% increase)

* Inflationary increases (c.6.8% increase), the impact of electricity costs

(0.9% increase) and annual labour increases and voluntary separation

pay-outs (1.4% increase)

Royalties increased to US$14.6 million (FY 2021: US$3.2 million) due to

increased profits net of capex across the SA operations resulting in higher

royalty percentages, as defined in the royalty legislation of South Africa and

Williamson recommencing operations during the Year.

Profit from mining activities

Profit from mining activities increased 102% to US$277.3 million (FY 2021:

US$137.6 million), mainly due to improved diamond pricing and the contributions

from Exceptional Stones.

Adjusted corporate overhead - general and administration

Corporate overhead (before depreciation and share based payments) increased to

US$13.0 million for the Year (FY 2021: US$7.4 million) mainly attributable to

the increase in corporate governance structures, strategic developments and

Board appointments introduced during the Year.

Adjusted EBITDA

Adjusted EBITDA, being profit from mining activities less adjusted corporate

overhead, increased 103% to US$264.9 million (FY 2021: US$130.2 million),

representing an adjusted EBITDA margin of 45% (FY 2021: 32%) driven by the

stronger diamond market and resultant improved diamond pricing coupled with the

contribution from Exceptional Stones.

Depreciation and amortisation

Depreciation and amortisation for the Period increased to US$85.3 million (FY

2021: US$80.8 million), mainly due to production recommencing at Williamson.

Impairment reversal / charge

As a result of the impairment reviews carried out at the Cullinan, Finsch,

Koffiefontein and Williamson Mines, and the Group's other receivables during

the Year, the Board recognised an overall net impairment reversal of US$19.6

million (FY 2021: US$38.4 million impairment charge), comprising:

US$ million FY 2022 FY 2021

Asset class

Reversal of impairment - property, plant & equipment (Refer 21.4 -

note 15)

Impairment - property, plant & equipment (Refer note 15) (0.3) (38.7)

Impairment (charge)/reversal - other current receivables (1.5) 0.3

(refer note 15)

19.6 (38.4)

Impairment reviews carried out at the Cullinan, Finsch, and Williamson Mines'

operational assets did not result in an impairment charge or reversal during

the Year (FY 2021: US$38.7 million). Asset level impairments at Koffiefontein

amount to US$0.3 million (FY 2021: US$38.7 million in respect of Finsch,

Koffiefontein and Williamson), of the Group's carrying value of property, plant

and equipment of US$608.2 million (FY 2021: US$764.5 million) pre-impairment.

There was an impairment reversal of US$21.4 million relating to an IFRS 5

impairment adjustment for Williamson as the results for Williamson have been

re-consolidated.

Impairment of BEE loans receivable - expected credit loss provision

The Group has applied the expected credit loss impairment model to its BEE

loans receivable. In determining the extent to which expected credit losses may

apply, the Group assessed the future free cashflows to be generated by the

mining operations based on the current mine plans. This assessment indicated a

net credit loss reversal / charge of US$nil (FY 2021: US$5.8 million expected

credit loss reversal); refer to note 2 for further detail.

Net financial (expense)/income

Net financial expense of US$73.1 million (FY 2021: US$220.7 million income)

comprises:

US$ million FY 2022 FY 2021

Net realised foreign exchange gain / (loss) on 12.6 (6.1)

settlement of forward exchange contracts

Interest received on bank deposits 1.3 0.7

Net interest receivable / (payable) on the BEE partner 1.8 (3.0)

loans and amortisation of lease liabilities in

accordance with IFRS 16

Net gain on extinguishment of Notes - 213.3

Offset by:

Interest on the Group's debt and working capital (45.3) (51.5)

facilities

Unwinding of the present value adjustment for Group (5.4) (4.6)

rehabilitation costs

Acceleration of unamortised bank facility and Notes (1.6) (2.7)

costs

Net unrealised foreign exchange (losses) / gains (36.5) 74.6

Net financial (expense) / income (73.1) 220.7

Tax credit / charge

The tax charge of US$37.8 million (FY 2021: US$23.0 million) comprising

deferred tax charge of US$30.4 million (FY 2021: US$22.7 million) and a net

current tax charge of US$7.4 million (FY 2021: US$0.3 million).

The Consolidated Income Statement deferred tax charge for the Year reflects

movements in deferred tax of US$35.5 million (30 June 2021: US$3.4 million) in

respect of property, plant and equipment and associated capital allowances,

US$2.5 million deferred tax credit (30 June 2021: US$2.8 million) relating to

provisions and a US$2.6 million deferred tax credit (30 June 2021: US$nil) due

to the change in the South African corporate tax rate from 28% to 27% reducing

the deferred tax liabilities recognised at the Finsch and Cullinan Mines at

Year end.

The net current tax charge of US$7.4 million (30 June 2021: US$0.3 million

includes a current tax charge of US$7.6 million at Finsch for the Year (FY

2021: US$nil million).

Profit on disposal of subsidiary including associated impairment, net of tax

In FY 2021, the profit on disposal of subsidiary including associated

impairment, net of tax of US$14.7 million relates to the Group's disposal of

its interests in Sekaka, its exploration operations in Botswana, and is made up

of a US$0.3 million disposal consideration, net profit of US$1.3 million for

the Period 1 July 2020 to the 30 November 2020 disposal date and the recycling

of the foreign currency translation reserve of US$13.3 million, offset by a net

asset disposal amount of US$0.2 million. Refer to Note 16 for further detail.

Williamson

At the end of FY 2021, the Board had decided to review its strategic options at

Williamson and the asset was classified as an asset held for sale.

In terms of the IFRS requirements to measure the assets of a disposal group at

the lower of carrying amount and fair value less costs to sell, the

determination of the fair value is complex and subject to considerable

judgement. Based on management's best estimate of the fair value at 30 June

2021, the following amounts were recognised as a result of that

reclassification:

* An impairment charge of US$21.4 million in respect of property, plant and

equipment

* A US$11.2 million charge attributable to Williamson's net loss for FY 2021

* A US$19.5 million provision for unsettled and disputed tax claims arising

from the ordinary course of business

During H1 FY 2022, the Group entered into a Framework Agreement with the

Government of Tanzania regarding the Williamson mine which will reduce Petra's

indirect shareholding from 75% to 63%. Petra also entered into a non-binding

Memorandum of Understanding ("MoU") to sell 50% less one share of the entity

that holds Petra's shareholding in Williamson ("WDL") to Caspian Limited. Upon

completion of the transactions contemplated by the MoU and the capital

restructuring in the Framework Agreement becoming effective (expected in H1 FY

2023), Petra and Caspian will each indirectly hold a 31.5% stake in WDL, but

with Petra retaining a controlling interest in WDL, and the Government of

Tanzania holding the remaining 37%. These agreements are in line with Petra's

objective of reducing its exposure in Tanzania while retaining control, through

its controlling interest in the entity that holds Petra's shares in WDL. The

Williamson mine is therefore no longer classified as an asset held for sale in

FY 2022 and was reconsolidated into the Group results for FY 2022. As a result

the Group also reversed a Group level impairment charge relating to Williamson,

previously recognised under IFRS 5, of US$21.4 million. Refer to Note 17 for

additional detail.

Earnings per share

Basic profit per share from continuing operations of USc35.53 was recorded (FY

2021: USc260.70, including gain on extinguishment of Notes).

Adjusted profit per share from continuing operations (adjusted for impairment

charges, taxation credit on net unrealised foreign exchange losses and net

unrealised foreign exchange gains and losses) of USc42.93 was recorded (FY

2021: USc36.20 loss (adjusted for impairment charges, taxation charge on net

unrealised foreign exchange gains and net unrealised foreign exchange gains and

losses)).

The comparative basic profit per share and adjusted profit per share have been

adjusted to give effect to the share consolidation of one new share for every

50 existing shares completed on 29 November 2021, with the Company's resultant

issued share capital now consisting of 194,201,785 ordinary shares of 0.05

pence each.

Operational free cash flow

During the Year, operational free cash flow of US$230.0 million (FY 2021:

US$120.1 million before restructuring fees of US$15.5 million) reflects the

impact from the sale of a high number of Exceptional Stones and stronger

diamond prices. This strong cash flow performance was positively impacted by:

* US$7.6 million inflow (FY 2021: US$12.1 million outflow) cash finance

expenses net of finance income and net realised foreign exchange gains/

(losses).

This was offset by:

* Restructuring fees settled during the Year of US$nil (FY 2021 US$29.9

million)

* Income tax paid of US$7.8 million (FY 2021: US$0.3 million inflow)

* US$3.5 million dividend paid to BEE partners (FY 2021: US$7.0 million

advances to BEE partners, largely related to servicing of BEE bank debt,

with the advances recoverable against future BEE partner distributions)

Cash and Diamond Debtors

As at 30 June 2022, Petra had cash at bank of US$288.2 million (FY 2021:

US$163.9 million). Of these cash balances, US$271.9 million was held as

unrestricted cash (FY 2021: US$147.8 million), US$15.5 million was held by

Petra's reinsurers as security deposits on the Group's cell captive insurance

structure (with regards to the Group's environmental guarantees) (FY 2021:

US$15.3 million) and US$0.8 million was held by Petra's bankers as security for

other environmental rehabilitation bonds lodged with the Department of Mineral

Resources and Energy in South Africa (FY 2021: US$0.8 million).

Diamond debtors at 30 June 2022 were US$37.4 million (FY 2021: US$38.3

million).

Loans and Borrowings

The Group had loans and borrowings (measured under IFRS) at Year end of

US$366.2 million (FY 2021: US$430.3 million) comprised of US$366.2 million

Notes (includes US$50.3 million accrued interest and unamortised transaction

costs of US$15.2 million), bank loans and borrowings of US$nil (FY 2021:

US$103.0 million). Bank debt facilities undrawn and available to the Group at

30 June 2022 were US$61.5 million (FY 2021: US$7.7 million).

Consolidated net debt at 30 June 2022 was US$40.6 million (FY2021: US$228.2

million).

Covenant Measurements attached to banking facilities

The Company's revised EBITDA-related covenants associated with its restructured

banking facilities are as outlined below:

* To maintain a net debt : EBITDA ratio tested semi-annually on a rolling

12-month basis

* To maintain an Interest Cover Ratio (ICR) tested semi-annually on a rolling

12-month basis

* To maintain minimum 12 month forward looking liquidity requirement that

consolidated cash and cash equivalents (excluding diamond debtors) shall

not fall below US$20.0 million

The Company's new covenant levels for the respective measurement periods are

outlined below:

FY22 H2 FY23 H1 FY23 H2 FY24 H1 FY24 H2 FY25 H1 FY25 H2 FY26 H1

Consolidated net debt :

EBITDA Leverage ratio 4.00 4.00 3.50 3.50 3.25 3.25 3.00 3.00

(maximum)

Interest Cover Ratio 1.85 1.85 2.50 2.50 2.75 2.75 3.00 3.00

(minimum)

For further detail on the restructuring of the SA Lender facilities refer to

Note 8 below.

Going concern considerations

The Board has reviewed the Group's forecasts with various sensitivities

applied, for the 18 months to December 2023, including both forecast liquidity

and covenant measurements. As per the First Lien agreements, the liquidity and

covenant measurements exclude contributions from Williamson's trading results

and only recognises cash distributions payable to Petra upon forecasted

receipt, or Petra's funding obligations towards Williamson upon payment. The

review took into account the Groups intention to purchase up to US$150 million

of the Senior Secured Second Lien Notes due in 2026 through a tender offer to

bondholders.

The Board has given careful consideration to potential risks identified in

meeting the forecasts under the review period. The following sensitivities have

been performed in assessing the Group's ability to operate as a going concern

(in addition to the Base Case) at the date of this report:

* A 10% decrease in forecast rough diamond prices from July 2022 to December

2023

* A 10% strengthening in the forecast South African Rand (ZAR) exchange rate

against the US Dollar from July 2022 to December 2023

* A 10% increase in operating costs from July 2022 to December 2023

* A US$15 million reduction in revenue contribution from Exceptional Stones

* A production disruption sensitivity assuming no carat production across the

Group for two weeks in February 2023 (could be due to extreme weather

conditions or supply chain disruptions or any other unexpected event)

* Combined sensitivity: Prices down 10% and ZAR stronger by 10%, reduced

contribution from Exceptional Stones and operating costs up 5%

Under all the cases, the forecasts indicate that the Group's liquidity outlook

over the 18-month period to December 2023 remains strong, even when applying

the above sensitivities to the base case forecast.

The forward-looking covenant measurements associated with the new First Lien

(1L) facility do not indicate any breaches during the 18-month review period

for the base case as well as all the above sensitivities, except for the

combined sensitivity, which shows a covenant breach for the required ICR in the

December 2023 measurement period. While the ICR is projected to be breached in

this combined sensitivity, neither the Net Debt : EBITDA covenant nor the

liquidity covenant is projected to be breached, while the revolving credit

facility (RCF) remains undrawn. It is therefore assumed that the RCF remains

available on the expectation that the 1L lender will agree to an ICR covenant

waiver given that the Group does not expect to utilise the RCF for servicing of

its Second Lien (2L) interest obligations. Furthermore, this potential ICR

breach may be cured by means of reducing of our gross debt by utilising

existing available cash reserves and/or marginally increasing our projected

EBITDA for the preceding 12-month period.

As a result, the Board concluded that there are no material uncertainties that

would cast doubt on the Company continuing as a going concern. See 'Basis of

preparation including going concern' in the Financial Statements for further

information.

Capex

Total Group capex for the Year increased to US$52.2 million (FY 2021: US$23.8

million), comprising:

* US$34.5 million expansion capex (FY 2021: US$16.9 million)

* US$17.7 million sustaining capex (FY 2021: US$6.9 million).

Capex (US$m) FY 2022 FY 2021

Cullinan 35.0 16.8

Finsch 12.0 4.0

Williamson 3.3 0.3

Koffiefontein 0.6 1.7

Subtotal - capex incurred by operations 50.9 22.8

Corporate 1.3 1.0

Total Group capex 52.2 23.8

Dividend

No dividend was declared for FY 2022 (FY2021: US$nil).

PRINCIPAL BUSINESS RISKS

The Group is exposed to a number of risks and uncertainties which could have a

material impact on its long-term development, and performance and management of

these risks is an integral part of the management of the Group.

A summary of the risks identified as the Group's principal external, operating

and strategic risks (in no order of priority), which may impact the Group over

the next twelve months, is listed below.

Risk Risk Risk Nature Change in FY 2022

appetite rating of risk

External Risks

1. Rough High Medium Long Lower - like for like diamond prices

diamond price term increased 41.5% (FY 2021: 9%) during FY 2022

which was largely attributable to mid-stream

inventory restocking and continued strong

jewellery retail sales. Lower global diamond

production also resulted in a more positive

outlook for the diamond market whilst

macroeconomic uncertainties caused by rising

interest rates and inflation are potential

dampeners of demand.

2. Currency High Medium Long No change - whilst initially stable, the ZAR/

term USD exchange rate experienced significant

volatility during FY 2022, closing the Year

at 16.27 ZAR/USD, compared to 14.27 ZAR/USD

on 30 June 2021. The impact of the war in

Ukraine benefitted the Rand, though over the

longer term the Rand is expected to weaken as

South Africa's inflation rate remains high.

3. Country High Medium Long Lower - while the risk of political

and political term instability remains in South Africa, the

outcomes of the ruling party's policy

conference were positive and markets were

encouraged by party support for the

President's proposals. After the South

African High Court judgement in favour of the

Minerals Council SA, the DMRE has indicated

it will seek legislative amendments of the

Mineral and Petroleum Resources Development

Act which could reverse aspects of the

judgement, in particular the legal status of

the Mining Charter. In Tanzania, the risk of

political instability remains lower under the

new President and following entry by Petra

into a Framework Agreement with the

Government that is yet to become effective

4. COVID-19 Medium Medium Short to Lower COVID-19 restrictions in South Africa

pandemic medium and Tanzania have been gradually lifted

(operational term during the Year due to the decreasing numbers

impact) of individuals contracting the virus which

led, in South Africa, to the termination of

the national state of emergency. The emphasis

has shifted to continuing the promotion of

the administration of vaccinations, including

booster shots, as this remains the best

protection against COVID-19.

Strategic

Risks

5. Group Medium Medium Short to Lower - a combination of higher diamond

Liquidity medium prices, robust production levels in line with

term guidance and record proceeds from the sale of

Exceptional Stones contributed to increased

revenue, strong free cash flow and a

reduction in net debt to US$40.6 million as

at 30 June 2022, thereby significantly

strengthening the balance sheet. The Company

also completed the refinancing of its first

lien debt facility which will deliver some

US$5 million in savings over the next two

years as a result of reduced utilisation and

more favorable terms than the previous

facility.

6. Licence to Medium Medium Long No change - Petra continued to comply in all

operate: term material respects with relevant laws and

regulatory and regulations in the countries in which it

social impact operates. In FY 2022, local operations

& community conducted 451 (FY 21: 658) social engagements

relations which included internal (employees and

committees) and external (Government,

communities, forums and SMMEs) engagements.

Stakeholder engagement plans (SEPs) continue

to be reviewed and updated to increase

value-add engagements at Government and

community levels.

Following the Company's May 2021 announcement

on the alleged human rights breaches in

Tanzania, Petra has continued to progress the

design and implementation of the IGM for

Williamson. This has involved extensive

stakeholder engagements with all levels of

Government and the local community to create

awareness of the IGM process and to obtain

initial feedback on how the IGM is envisaged

to operate. The current target is for the

IGM to become operational during Q2 CY

2023.

The Company has also progressed a number of

projects to provide sustainable benefits to

the communities located close to the

Williamson mine which include (1) a medical

support project, (2) an artisanal and

small-scale mining project, (3) an

agribusiness development initiative, (4)

improved delineation of the Williamson mine

boundaries, including access to the mine

lease area for the collection of firewood and

(5) an awareness initiative in respect of

sexual and gender-based violence.

Operating

Risks

7. Mining and Medium Medium Long Lower - positive throughput improvements

production term supported by Project 2022 (which completed

in June 2022) continued to yield good

results. Group production for FY 2022

increased by 3% in line with guidance,

largely owing to the resumption of mining at

Williamson. Production at the Cullinan Mine

during Q4 FY 2022 was lower due to the

depletion of the current CC1E mining area

and a difference in the make-up of

kimberlite in the C-Cut. When compared with

FY2021, production at the Finsch Mine

stabilised in the second half of FY 2022,

although ROM grade was 13% lower as a result

of waste dilution despite the implementation

of controls which were continuously

monitored. Group production guidance for

FY2023 to FY 2025 remains unchanged at this

stage.

8. ROM grade Medium Medium Short No change - the current mining blocks at the

and product term South African operations are reaching

mix volatility maturity and while the current orebody

footprints are still large enough to deliver

relative consistency and product mix,

increasing levels of variability in terms of

ROM Grade and product mix can be expected

going forwards which will be mitigated by