Final Results Embargoed Release: 07:00hrs Monday 10 January 2005

Matrix Communications Group Plc ("Matrix" or "the Company") RESULTS

FOR THE YEAR ENDED 31 OCTOBER 2004 Matrix Communications Group Plc,

the supplier of high performance IT network solutions to the public

and private sectors in the UK, has announced its unaudited results

for the year ended 31 October 2004. Key Points * Turnover up 766%

to �11.1 million (2003 - �1.5 million) * Gross margin up 1,217% to

�4.8 million (2003 - �0.4 million) * Operating profit up to �1.2

million (2003 - �0.4 million loss) * Basic earnings per share of

3.94p (2003 - 3.59p loss) * EBITDA up to �1.9 million (2003 - �0.3

million loss) * Tax charge of �0.15 million, effective tax rate of

13% * Retained profits after tax up to �1.14 million (2003 - �0.6

million loss) * Net assets up 733% to �9.7 million (2003 - �1.3

million) * Cash Balance of �0.3 million (2003 - �0.2 million) *

Acquired and successfully integrated five profitable IT companies

for a total consideration and deferred consideration of �4.2

million cash and � 5.1 million shares during 2004 in line with its

core strategy of building a best of breed IT systems integrator.

Financial Results I am pleased to present my report on the Group's

performance for the year ended 31 October 2004 and on the outlook

for the current year. Group turnover for the year was �11.1 million

(2003: �1.5 million�), an increase of 766 per cent. �3.7 million�

of the Group turnover was achieved in the first half of the year

compared with �7.4 million� in the second six months. Group

operating profit for the year on continuing operations was �1.2

million (2003: �0.0 million loss). The profit on ordinary

activities before tax was �1.2 million (2003 - �0.6 million loss)

producing basic earnings per share of 3.94p (2003 - 3.59p loss).

The group incurred a one-off charge of �0.1 million to improve its

internal IT infrastructure and create the new Matrix Communications

Group plc brand and website. At the year end, under FRS 7, the full

cost including deferred consideration of acquiring Decorum, Norwood

Adam Systems and Bedrock has been accounted for including the

charge for the amortisation of goodwill. Annual income recognised

in the year from service and maintenance contracts rose to �1.7

million (2003 - 0.3 million), and excluded a further �1.9 million

received during the year relating to subsequent periods and treated

as deferred income. The payment of a dividend for the year will not

be proposed. Chairman's Statement Strategy Since publication of the

previous years audited results in March 2004 very considerable

progress has been achieved by your Company now renamed Matrix

Communications Group Plc. Following the disposal of the original

satellite communications business of Offshore Telecom in February

2004, the Group activities are now entirely based on the

consulting, design, implementation and on-going support of IT

networks - often described as "Integration", and on the Partner

Sales of related hardware necessary to support these activities.

Whilst the activities of Integration and Partner Sales target

different customers, it is clear that there are benefits to be

gained from being involved in the entire supply chain from Original

Manufacturer to End Customer. Our customers interest will be best

served if we have direct relationships with these "best of breed"

Manufacturers, and at the same time are able to provide world class

integration and support services across different technologies. Our

Customer's consist of those organisations employing large networks

such as major enterprises in the private sector and Universities

and County Councils in the public sector, but all have in common a

desire to employ leading edge technology to provide them with a

competitive advantage to become a leader in their own marketplace.

Our business, therefore is now based on proposing and implementing

bespoke network designs which employ the `best of breed'

technologies to service their Voice and Data requirements,

including LAN/WAN integration, Voice over IP (VOIP), Network

security and Support Services including Maintenance on a 24/7

basis. Best of breed implies that we are not linked to a single

hardware manufacturer but have supply arrangements with a number of

leading edge companies allowing us to propose a bespoke solution to

best satisfy our customer's needs. To have created from a start-up

a full range of network services in eighteen months would not have

been feasible. The Board has therefore sought to supplement the

original systems integration business of Matrix Network Solutions

Ltd by making a number of complimentary acquisitions of specialist

companies, substantially enhancing the scope and expertise of the

Group's proposition to customers. During the year five companies

have been acquired at a maximum cost of �9.3 million and, as

announced on 15 November 2004, following the year end, Network

Partners Ltd was acquired for a maximum consideration of �12.0

million. The acquisition policy pursued by the Board has sought to

identify young, growing entrepreneurial businesses which would

enhance the Group's service offering and, following integration,

add significantly to the Group's earnings. The consideration for

all businesses acquired during the year has been based on a mixture

of shares and cash and on an earn-out over 12 to 24 months.

Substantial progress has been achieved in the integration of these

businesses and the Board is greatly encouraged by the level of new

business derived from the successful selling of services across the

rapidly growing customer base. It should also be noted Intrinsic

Networks completed its earnout on 31 October 2004 and the deferred

consideration was paid in full. Also, Decorum reached its first

milestone and, as reported previously, have over performed against

their target. Following the acquisition programme to date the range

of products and services offered by Matrix include:- * LAN

integration * WAN integration * Security * Voice over IP *

Specialist telephony services * Specialist technical support and

maintenance services. There remain a number of products and service

offerings which the Group would like to make available to its

customers, these include data storage and infrastructure software

solutions. The Board will therefore remain alert to suitable

acquisition opportunities in the course of the current year. Major

contract Matrix has also developed a unique content filter

proposition for mobile operator's which enables them to filter

illegal internet content as part of their ethical approach to

content provision for their customers. This has been implemented in

the UK and we have recently been awarded a new global contract for

a similar service for at least the next five years across a number

of countries for an eight figure sum. More specific details will

follow separately. Group Development The following companies were

acquired during the year:- Norwood Adam Technical Services Ltd

("NATS") NATS provides after sales specialist technical support

across the Group's clients through a 24/7 Network Operations Centre

(NOC), co-ordinating a nation-wide network of call-out engineers

capable of giving short notice on-site customer support. The share

capital of NATS was acquired in two tranches; 50 per cent on 10

November 2003 and 50 per cent on 11 August 2004 at a total cash

cost of �100,000. Through NATS the Group is able to build a

substantial level of recurring revenue streams through on-going

service contracts agreed at the point of sale of network hardware

and software solutions. These revenues are currently running at an

annual rate of �4.8 million before taking into account the recent

Network Partners acquisition. Tony Weaver (36), a founder of NATS

in 2002, joined the Board of Matrix on the acquisition in November

2003. Intrinsic Networks Limited ("Intrinsic") Intrinsic provides

integrated high performance network security and application secure

solutions to large corporate enterprise customers, mobile service

providers, financial service providers and various public sector

organisations. It provides customers with a range of integrated

network and application security solutions, planning, consultancy,

project management and support services. Additionally, Intrinsic

has formed strategic partnerships with a select group of US

security manufacturers including Juniper (NetScreen), Sanctum,

CipherTrust, BlueCoat and Cerberian. Intrinsic was acquired on 12

December 2003 for a total consideration of �2m of which �600,000

was in cash and the balance in ordinary shares. The total

consideration only became payable on the achievement of earn-out

targets which were completed on 31 October 2004 and which were over

achieved by 60%. Peter Drinkwater (40) a founder of Intrinsic in

2002 joined the Board of Matrix on the acquisition. Chris Lee (35)

became Group Finance Director in June 2004. Decorum Networks Ltd

("Decorum") Decorum is a specialist provider of Voice over IP

solutions for the public and private sectors including

organisations such as Swiss Life, Guardian Newspapers and the City

of London Police. Decorum provides large organisations with a range

of services including convergence, IP telephony, unified messaging,

call centre technology, computer telephony integration and

additional data and telephony services. On completion on 26 April

2004 Matrix paid �1.195m of which �695,000 was in cash and the

balance in ordinary shares in Matrix and will pay a total

consideration of up to �2.26m in three steps subject to Decorum

achieving �3 million of turnover and �500,000 net profit for the

period 1st May 2004 to 30th April 2005. Up to �995,000 is payable

in cash and the balance of �1.265m in ordinary shares in the

Company. To date Decorum has exceeded its performance target to 31

October 2004 and is ahead of budget to achieve its final

performance target to 30 April 2005. Neil Sturgess (45) joined the

Board of Matrix on the acquisition. Bedrock Networks Ltd

("Bedrock") Bedrock was founded in 2001 by the former UK Managing

Director of Extreme NetworksTM, David Grant and Debbie Casey. A

Premier partner of Extreme NetworksTM Bedrock, is a leading network

integrator and just prior to acquisition won contracts with

Exchange Point and the London Internet Exchange, both of which work

extensively with Matrix. On completion on 2 August 2004 Matrix paid

�1.1m of which �500,000 was in cash and the balance in ordinary

shares in Matrix and will pay up to a total of � 2.42m in three

stages subject to Bedrock achieving �3.6m of turnover and � 500,000

of net profit for the period 1 August 2004 to 31 July 2005. Up to �

1.03m is payable in cash and �1.385m in ordinary shares. To date

Bedrock is trading well ahead of the levels required to achieve its

earnout performance targets. On completion, David Grant (43) joined

the Board of Matrix. Norwood Adam Systems Ltd ("NAD") Norwood Adam

Systems Ltd, trading as Norwood Adam Distribution, is the foremost

value-added distributor to the UK channel for convergence

technologies, providing voice, data, LAN and WAN solutions. On

completion 2 August 2004 Matrix paid an initial consideration of

�750,000 cash. Subject to the achievement of agreed performance

targets, a further payment of �750,000 cash may be made after 31st

January 2005 and final payment of �1m in new ordinary shares in

Matrix, after 31st July 2005. In order, for the vendors to receive

the maximum earn-out consideration of �2.5m, NAD will need to

achieve revenues of �5m and net profits of �500,000 for the period

1st August 2004 to 31st July 2005. It is anticipated that NAD will

achieve its earnout performance targets. Sale of assets of Offshore

Telecom As reported in February 2004 the remaining satellite

communications assets of Offshore Telecom were sold for a

consideration of �30,000. Matrix is now no longer involved in this

business and the Board are confident that no further related costs

will arise. Institutional Placing On 9 March 2004, 100,000,000 new

ordinary shares (representing 9.3% per cent of the enhanced equity)

were placed with investment institutions at a price of 2.25p

(equivalent to 90p) and raised a total of �2,250,000 to provide

working capital for the group and to assist in financing the cash

element of the acquisition programme. These funds have been

successfully employed, as anticipated, in the acquisitions already

referred to. Share Consolidation At an EGM convened on Friday 29

October 2004, the decision was taken to consolidate the Ordinary

Shares in the Group at a ratio of 40 to 1 to encourage further

institutional investment in Matrix in 2005. Management and

employees During the year and as a result of the completed

acquisitions we welcomed five new executive directors to the Board,

namely Tony Weaver, Peter Drinkwater, Chris Lee, Neil Sturgess and

David Grant and one new non-executive director Matthew Darling, a

partner in Beachcroft Wansbroughs, legal advisors to Matrix. Since

the year end Ron Sandison has joined the Board as a result of the

acquisition in November 2004 of Network Partners Ltd. I was

appointed Chairman in March 2004, replacing Michael Frank who

became Deputy Chairman. At the 31 October 2004, Matrix employed 88

people compared with 6 employees a year ago. I would like to

welcome all new employees to our Group and thank them for their

contribution to our success. Re-organisation With effect from 1

November 2004 a major re-organisation of our business was put into

effect. The Group's business has now been divided into two

divisions namely Integration and Partner Sales, linked to a

re-branding exercise designed to lift the name of Matrix and to

phase out the proliferation of trading names resulting from the

acquisition programme. I am pleased to report that this has been

well received by both our customers and staff and will undoubtedly

simplify our message to the market and new customers. Despite the

re-branding and re-organisation it is intended to maintain the

specialist expertise and integrity of the original trading units,

as being able to deliver these unique skills goes to the heart of

what we offer our customers. Peter Drinkwater and Ron Sandison have

been appointed Managing Director of the Integration Division and

Partner Sales Division respectively. It is also proposed to

re-organise the Group Board. With effect from 10 March 2005 a

separate Management Board will be created with the remit to manage

the business on a day to day basis, consisting of:- Integration

Division Peter Drinkwater, - Managing Director Peter Baker - Data

Division Andy Mills - Security Division Neil Sturgess - Voice

Division David Grant - Bedrock Partner Sales Division Ron Sandison

- Managing Director Manny Pinon - Norwood Adam Kevin Cheston -

Network Partners Following the re-organisation, the Matrix

Communications Group Board will comprise Alan Watkins - Non

Executive Chairman Ian Smith - Group Chief Executive Tony Weaver -

Group Chief Operating Officer Chris Lee - Group Finance Director

Peter Drinkwater - Managing Director - Integration Ron Sandison -

Managing Director - Partner Sales Michael Frank - Non Executive

Deputy Chairman Keith Mills - Non Executive Matthew Darling - Non

Executive These proposals will be effected on 10 March 2005 and

will result in Neil Sturgess and David Grant stepping down from the

Board to take up their respective positions on the new Management

Board. Post Balance Sheet Events Following the year end there are

three events which have occurred to which I should draw

shareholders attention. Firstly, the acquisition of Network

Partners Ltd took place on 12 November 2004, an acquisition which

the Board considers to be the Group's most strategic to date.

Established in 1999, Network Partners is an independent provider of

value added telecommunications services. It manages significant

relationships with all of the UK's major operators including BT,

Cable & Wireless, Global Crossing, Thus and Energis. Following

the completion of the acquisition the Group will be the single

largest BT premier partner and moreover will be strategically

placed for entry into the `Managed Services' sector of the IT

industry. Network Partners has been acquired for a total

consideration of �12m. It reported audited profits of �1m PBT on

revenues of �7.5m in the year ended 30th September 2003 and has to

date booked circa �10m of recurring contract revenues for the

Group's year ended 31 October 2005. Matrix paid an initial cash

consideration of �5m and up to a further �7m in equity over the

next 24 months, subject to agreed targets being met, to be issued

at mid-market price as at close of business on the last day of the

related earn-out period. Earn-out performance will be evaluated at

two stages during the 24-month period, being at 12 and 24 months.

Following the acquisition the founder of Network Partners, Ron

Sandison (42) joined the Matrix Board and has been appointed

Managing Director of Partner Sales. Secondly, shareholders may have

seen an announcement, dated 13 December 2004�, to effect that the

Board of Matrix were in preliminary discussions with Harrier Group

Plc that may or may not lead to an offer that would be subject to

the satisfactory outcome of a due diligence review. Harrier Group

is involved in IT security and electronic data storage both areas

of interest to your Company. Thirdly, it was announced on the 20

December 2004 that Matrix has signed heads of agreement with Equip

Technology Ltd which may lead to this being acquired and integrated

with the existing IT distribution business, further enhancing the

Group's growing Partner Sales business. Outlook The Group has now

successfully completed the initial stage of its acquisition

strategy, namely to establish a complete platform of IT services

and products from which it could competently service its customer

base. Through acquisition and strong organic growth the Group now

has more than 600 end user customers and perhaps the greatest

opportunity in 2005 and beyond will be our ability to cross sell

within this customer base. There have already been some notable

successes in this regard but the Board will be working hard to

ensure that we see more of the same. As the Group enjoys more

success through cross selling the natural progression will be to

migrate these customers into managed services contracts that will

extend their term of commitment to the Group and allow the Group to

provide further economies of scale and higher levels of service.

The natural by-product of this is additional clarity of revenue

streams for the Group by way of long term recurring contracts and

annuity revenues. Indeed, as we entered 2005 following the

acquisition of Network Partners, the Group already has almost �17m

of recurring revenues on an annual basis and will look to build

upon this each and every year. The outlook for the future will be

to continue to build upon this strong base with an absolute focus

on best of breed technologies. The goal of the Group is to become

the largest independent integrator in the UK. We can only achieve

this by remaining vendor independent, and outside of a "telco" or

Professional Services environment, to enable us to continue

providing the very best technical and cost competitive solutions

for our customers. The Group believes that the general outlook for

IT service providers has improved in the last 12 months and will

continue to benefit those companies that can distinguish themselves

from the mass. The fixed line operators will continue to look for

ways to differentiate themselves from each other while fighting on

price, and the large scale "Cisco" integrators will continue to

struggle to generate profitability from product that is largely

commoditised at a retail level. All of this will inevitably lead to

more consolidation within our industry, which has already started

during 2004. Throughout this period your company will continue to

focus on building a strong organic sales performance, coupled with

strategic acquisitions and, as a result, continue to deliver market

leading financial performance. It is the Board's intention to

propose a dividend payment at the end of 31 October 2005. Finally,

we have entered 2005 in a positive manner with the announcement of

two further acquisitions, the announcement of a global contract

with a wireless operator and a strong sales pipeline. For Further

Information: Chris Lee Matrix Communications 08707375000 Group plc

Group Finance Director Andrew Tan Hansard Communications 020 7245

1100 Account Director Matrix Communications Group plc Profit and

Loss Account Year ended 31 October 2004 2004 2003 As restated � �

Group turnover 11,134,827 1,452,048 Cost of sales 6,322,870

1,056,855 -------------------- --------------------- Gross profit

4,811,957 395,193 Administrative expenses 3,654,325 835,907 Other

operating income (63,731) (51,169) ------------------------

------------------------ Operating profit/(loss) 1,221,363

(389,545) Interest receivable 13,084 1,367 Amounts written off

investments - (174,250) Interest payable (22,024) (1,022)

------------------------- ----------------------- Profit/(loss) on

ordinary activities 1,212,423 (563,450) before taxation Tax on

profit/(loss) on ordinary 153,414 21,293 activities

------------------------- ---------------------- Profit/(loss) on

ordinary activities 1,059,009 (584,743) after taxation Minority

interests (85,910) - -------------------------

------------------------- Profit/(loss) attributable to members

1,144,919 (584,743) of the parent company -------------------------

------------------------ Retained profit/(loss) for the �1,144,919

�(584,743) financial year ================= ===============

Earnings per share (pence) 3.94 (3.59) =================

============ The group has no recognised gains or losses other than

the results for the year as set out above. The company has taken

advantage of Section 230 of the Companies Act 1985 not to publish

its own Profit and Loss Account. Matrix Communications Group plc

Group Balance Sheet 31 October 2004 2004 2004 2003 � � As restated

Fixed assets Intangible assets 10,857,547 1,155,627 Tangible assets

689,047 6,809 ------------- ---------------- 11,546,594 1,162,436

------------- ------------- Current assets Stocks 464,785 33,987

Debtors 4,399,867 870,970 Cash at bank 312,680 161,065 ------------

------------ 5,177,332 1,066,022 Creditors: Amounts flling due

6,994,884 901,749 within one year ------------ --------------- Net

current (liabilities)/assets (1,817,552) 164,273 --------------

-------------- �9,729,042 �1,326,709 ======== ========== Capital

and reserves Called-up equity share capital 6,205,254 2,303,917

Share premium account 4,751,888 1,395,811 Profit and loss account

(1,228,100) (2,373,019) ----------------- ---------------

Shareholders' funds �9,729,042 �1,326,709 ============ ===========

Matrix Communications Group plc Group Cash Flow Cash Flow Statement

Year ended 31 October 2004 2004 2004 2003 � � As restated Net

cashflow from (696,564) (474,163) operating activities Returns on

investments and servicing of finance Interest received 13,083 1,367

Interest paid (16,007) (1,022) Interest element of hire (8,543) -

purchase and finance lease -------------- --------------- Net cash

(outflow)/inflow (11,467) 345 from returns on investments and

servicing of finance Taxation (33,538) - Capital expenditure and

financial investment Receipts from sale of - 62,000 current asset

investments Payments to acquire (182,527) (5,069) tangible fixed

assets Receipts from sale of - 11,750 fixed assets ----------------

----------------------- Net cash (outflow)/inflow (182,527) 68,681

for capital expenditure and financial investment Acquisition and

disposals Purchase of subsidiary (2,703,433) - undertakings Net

cash acquired with 887,300 - subsidiaries Sale of business 7,500 -

------------------- ------------------ Net cash outflow for

(1,808,633) - acquisitions and disposals --------------------

------------------ Cash outflow before (2,732,729) (405,137)

financing Financing Issue of equity share 267,857 320,832 capital

Share premium on issue of 1,939,471 180,418 equity share capital

New loans advanced - 62,000 Capital element of hire (33,695) -

purchase and finance lease ----------------------

---------------------- Net cash inflow from 2,173,633 563,250

financing -------------------- ----------------------

(Decrease)/increase in �(559,096) �158,113 cash ==============

============= Reconciliation of operating profit/(loss) to net cash

inflow/(outflow) from operating activities 2004 2003 � As restated

Operating profit/(loss) 1,221,363 (389,545) Amortisation 370,320

29,631 Depreciation 262,711 10,374 Profit on disposal of fixed

(23,185) (1,042) assets Decrease/(increase) in stocks 188,320

(20,492) Increase in debtors (1,035,529) (786,399)

(Decrease)/increase in creditors (1,680,564) 683,310

--------------------- ---------------------- Net cash outflow from

operating �(696,564) �(474,163) activities ==============

=============== Reconciliation of net cash flow to movement in net

debt 2004 2004 2003 � � As restated (Decrease)/increase in cash

(559,096) 158,113 in the period Cash outflow in respect of 33,695 -

hire purchase and finance lease -----------------

-------------------- Change in net debt resulting (525,401) 158,113

from cash flows New finance leases (91,100) - ---------------------

--------------------- Change in net debt (616,501) 158,113

============== ================ Analysis of changes in net debt At

1 Nov 2003 Cash flows Other Changes At 31 Oct 2004 � � � � Net

cash: Cash in hand and at bank 161,065 151,615 - 312,680 Overdrafts

- (710,711) - (710,711) -------------------- (559,096) Debt: Hire

purchase and finance - 33,695 (91,100) (57,405) lease agreements

------------------- -------------------- --------------------

--------------------- Net debt �161,065 �(525,401) �(91,100)

�(455,436) ============== ================== ===============

================ Basis of derivation The financial information

contained in these preliminary results is abridged and does not

constitute the company's statutory financial statements for the

year ended 31 October 2004 or the year ended 31 October 2003.

Statutory financial statements for the period ended 31 October 2003

have been reported on by the company's auditor and delivered to the

Registrar of Companies. The report of the auditor for the year

ended 31 October 2003 was unqualified and did not contain a

statement under section 237(2) or (3) of the Companies Act 1995.

The statutory financial statements for the year ended 31 October

2004 will be posted to shareholders shortly and will be delivered

to the Registrar of Companies after they have been laid before the

company in General Meeting. END

Copyright

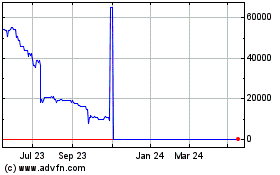

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Jul 2023 to Jul 2024