LONDON MARKETS: British Pound Volatile As U.K. Supreme Court Rules Suspension Of Parliament Was Unlawful

September 24 2019 - 11:49AM

Dow Jones News

By Steve Goldstein, MarketWatch

The British pound veered back and forth Tuesday as the U.K.

Supreme Court ruled that the suspension of Parliament was unlawful

(https://www.supremecourt.uk/cases/docs/uksc-2019-0192-judgment.pdf),

in a development that makes a no-deal Brexit less likely.

The U.K. Supreme Court has ruled unanimously that Prime Minister

Boris Johnson's decision to prorogue Parliament was illegal.

The pound shot up to as high as $1.2489 from $1.2432 on Monday

before falling back to $1.2441, and then re-accelerating to

$1.2464.

The FTSE 100 -- which tends to move in the opposite direction to

the pound --fell 0.5% on the day.

Read: Decision to suspend Parliament ruled unlawful -- live

market reaction

(http://www.marketwatch.com/story/decision-to-suspend-parliament-ruled-unlawful-live-market-reaction-2019-09-24)

The unanimous Supreme Court ruling declared the order to suspend

Parliament "void and of no effect."

Supreme Court President Brenda Hale said the suspension "was

unlawful because it had the effect of frustrating or preventing the

ability of Parliament to carry out its constitutional functions

without reasonable justification."

She said the court's decision means Parliament was never legally

suspended and is technically still sitting.

In this nation without a written constitution, the case marked a

rare confrontation between the prime minister, the courts and

Parliament over their rights and responsibilities.

It revolved around whether Johnson acted lawfully when he

advised the queen to suspend Parliament for five weeks during a

crucial time frame before the Oct. 31 Brexit deadline when Britain

is scheduled to leave the European Union.

Outside of the Supreme Court decision, TUI rose 7%, extending

Monday's rally, as the company said its trading has been

"resilient" and that it reiterates its fiscal year underlying

profit guidance that may fall as much as 26%. The company said it's

assessing the short-term impact of Thomas Cook's insolvency.

Metro Bank (MTRO.LN) shares skidded 35% as the U.K. bank

postponed debt issuance, citing current market conditions. "As a

responsible issuer Metro shall consider future issuance mindful of

all relevant stakeholders," the bank said. Metro Bank had said it

would issue the debt in the second half of 2019 to meet rules

governing minimum requirements for own funds and eligible

liabilities.

-- The Associated Press contributed to this report

(END) Dow Jones Newswires

September 24, 2019 11:34 ET (15:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

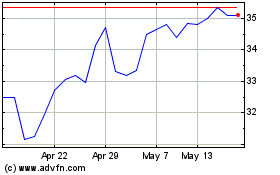

Metro Bank (LSE:MTRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Metro Bank (LSE:MTRO)

Historical Stock Chart

From Jul 2023 to Jul 2024