Mercia Asset Management PLC Transaction in Own Shares (6307X)

December 21 2023 - 6:03AM

UK Regulatory

TIDMMERC

RNS Number : 6307X

Mercia Asset Management PLC

21 December 2023

RNS 21 December 2023

Mercia Asset Management PLC

("Mercia", the "Company" or the "Group")

Transaction in Own Shares

Mercia Asset Management PLC (AIM: MERC), the proactive,

regionally focused specialist asset manager with c.GBP1.5billion of

assets under management, announces that it has made the following

purchases of Ordinary shares in the capital of the Company ( "

Ordinary shares " ) on the London Stock Exchange, pursuant to the

Share Buyback Programme announced on 28 November 2023.

Date of purchase 20 December 2023

Number of Ordinary shares purchased (aggregated

volume): 264,000

Highest price paid per Ordinary share (pence): 29.70

Lowest price paid per Ordinary share (pence): 29.70

Volume weighted average price paid per

Ordinary share (pence): 29.70

Venue where Ordinary shares are traded London Stock Exchange

(AIM)

The Company will hold the repurchased shares in treasury.

Following the purchase, the number of Ordinary shares in issue and

admitted to trading on AIM will be 444,309,454 (excluding treasury

shares), and the Company will hold 2,370,069 Ordinary shares in

treasury.

This figure of 444,309,454 Ordinary shares may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in their interest in, the share capital of

the Company under the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

The Company will make further announcements in due course

following the completion of any further purchases pursuant to the

Share Buyback Programme.

In accordance with Article 5(1)(b) of Regulation (EU) No

596/2014 (the Market Abuse Regulation), the schedule below contains

detailed information about the purchases made by Canaccord Genuity

Limited on behalf of the Company.

Individual transactions:

Number of shares Transaction price Time of transaction Trading venue

purchased (pence per share)

London Stock Exchange

10,000 29.70 11:01:06 (AIM)

------------------- -------------------- ----------------------

London Stock Exchange

50,000 29.70 12:37:20 (AIM)

------------------- -------------------- ----------------------

London Stock Exchange

100,000 29.70 12:42:17 (AIM)

------------------- -------------------- ----------------------

London Stock Exchange

104,000 29.70 16:03:22 (AIM)

------------------- -------------------- ----------------------

- Ends -

For further information, please contact:

Mercia Asset Management PLC

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial Officer +44 (0)330 223

www.mercia.co.uk 1430

Canaccord Genuity Limited (NOMAD and Joint +44 (0)20 7523

Broker) 8000

Simon Bridges, Emma Gabriel

+44 (0)20 7496

Singer Capital Markets (Joint Broker) 3000

Harry Gooden, James Moat

+44 (0)20 3727

FTI Consulting 1051

Tom Blackwell, Jenny Boyd

mercia@fticonsulting.com

About Mercia Asset Management PLC

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of venture,

private equity, debt and proprietary capital: the Group's 'Complete

Connected Capital'. The Group initially nurtures businesses via its

third-party funds under management, then over time Mercia can

provide further funding to the most promising companies, by

deploying direct investment follow-on capital from its own balance

sheet.

The Group has a strong UK footprint through its regional

offices, university partnerships and extensive personal networks,

providing it with access to high-quality deal flow.

Mercia Asset Management PLC is quoted on AIM with the EPIC

"MERC".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSFFLFLXLLBFBF

(END) Dow Jones Newswires

December 21, 2023 06:03 ET (11:03 GMT)

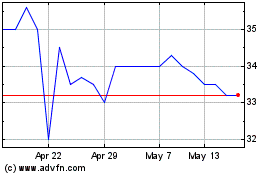

Mercia Asset Management (LSE:MERC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mercia Asset Management (LSE:MERC)

Historical Stock Chart

From Jul 2023 to Jul 2024