TIDMKDNC

RNS Number : 9148A

Cadence Minerals PLC

28 September 2022

28 September 2022

Cadence Minerals plc

Interim Results for the six months ended 30 June 2022

Cadence Minerals plc (AIM/AQX: KDNC) is pleased to announce its

interim results for the six months ended 30 June 2022.

OVERVIEW

The Company's goals for the six months ended 30 June 2022 were

first to vest our 27% in the Amapa Iron Ore Project ("Amapa

Project"), secondly to progress the development of Amapa and

advance the Pre-Feasibility Study ("PFS") and lastly to create

capital growth in our passive private investments via a sale either

in cash or a swap into liquid equity. I am pleased to report the

Company was successful in all of the above goals.

The first goal was met in the first quarter of this year. After

successfully reaching an agreement to vest its 20% at the end of

December 2021, Cadence increased its stake in the Amapa Project to

27% in March 2022; the consideration for the additional 7% was

US$3.5 million. The funding was used to achieve our second goal,

which was to advance the PFS. Although PFS work commenced in 2021,

the March investment fully funded the remainder of the PFS study.

The current expectation is that in Q4, we will publish an updated

Mineral Resource Estimate ("MRE), followed by an Ore Reserve

Estimate ("ORE") and, finally, the publication of the PFS.

The final goal was achieved via two asset sales; firstly, our

31.5% interests in Lithium Technology Pty Ltd and Lithium Supplies

Pty Ltd ("LT and LS") were sold to Evergreen Lithium and secondly,

our 30% interest in licenses within the Yangibana Rare Earth

Project ("Yangibana Project") were sold to owner/operator Hastings

Technology Metals. In both cases, Cadence agreed to vend these

assets for equity in companies that are either listed or are

expected to be listed.

Cadence has invested approximately GBP1.7 million in these

assets, and our sale price into the equity of the two public

companies was the equivalent of GBP5.5 million, representing a 321%

cumulative return on our investments. The Yangibana sale is not

reflected in the interim financial statements as it has not yet

been completed. However, we expect that both the Yangibana Project

transactions and the IPO of Evergreen Lithium will complete this

year, hopefully further increasing our returns.

In contrast to these accomplishments, the macroeconomic

environment has been generally negative. This has been dominated by

the war in Ukraine and the devastating humanitarian consequences

that have followed. The European war is the most serious crisis in

decades, and food security and energy needs have emerged as

significant concerns. We now live in a world of increased macro

volatility, with central banks battling a problematic trade-off

between soaring inflation and managing a fragile economic recovery

in the aftermath of the COVID-19 pandemic.

Despite this challenging backdrop, the lithium and rare earth

sectors have remained positive, with pricing in both products

remaining robust. This demand continues to be driven by the

electrification of our transport systems and the continued

undersupply of feedstock. Despite some commentators suggesting

otherwise, the oversupply of lithium is not imminent; we still see

a market deficit going forward for the same structural reasons that

we saw in 2018 when some of the same market commentators forecasted

an oversupply of feedstock.

Within the iron ore market, we have seen the impacts of a global

slowdown, with the 62% Fe Platts index dropping from US$125 per dry

metric tonne ("dmt") to circa US$ 100 / dmt. Both short and

longer-term prospects for iron ore are driven by China, given the

nation is the world's biggest steel producer and currently buys

about 70% of global seaborne iron ore. As policy support gains

traction, we expect China to emerge as a source of stability for

iron ore demand. This is contingent on Beijing implementing

successful and timely stimulus measures, limited COVID lockdowns,

and a shallow global slowdown that limits monetary tightening.

The overall negative macro environment weighed down on our

public portfolio, with the AIM Basic Resources Index down some 30%

over the period and European Metals Holdings ("EMH"), our largest

public equity position, decreasing in value by some 47% during the

reporting period.

We are cautiously optimistic despite the macroeconomic

headwinds. Recent indications point to a recovery in China's growth

momentum in the second half of the year, with cities reopening and

government policy stimulus helping. In mined commodity markets,

supply and demand are generally tight, and prices appear well

supported. The transition to net zero carbon emissions will

continue to open up investment opportunities in companies that

serve the associated supply chains.

As outlined in our annual report and accounts, Cadence operates

an investment strategy that includes investments in private

projects via a private equity model and investments in public

equity. In both investment classes, we take either an active or

passive role. We have reported on each category below.

PRIVATE INVESTMENTS, ACTIVE

The Amapa Iron Ore Project, Brazil

Interest - 27% at 30/06/2022

The Amapa Project is a large-scale iron open pit ore mine with

associated rail, port and beneficiation facilities that commenced

operations in December 2007. Production increased to 4.8 Mt and 6.1

Mt of iron ore concentrate product in 2011 and 2012, respectively.

Before its sale in 2012, Anglo American valued its 70% stake in the

Amapa Project at US$462m (100% US $660m).

In 2019 Cadence entered into a binding investment agreement to

invest in and acquire up to 27% in the Amapa iron ore mine,

beneficiation plant, railway and private port owned by DEV ("The

Agreement"). The Agreement also gave Cadence a first right of

refusal to increase its stake to 49%. To acquire its 27% interest,

Cadence invested US$6 million over two stages in a joint venture

company ("JV"). The first stage is for 20% of the JV, the

consideration for which was US$2.5 million. The second stage was

completed in March 2022 for a further 7% of the JV for a

consideration of US$3.5 million.

During the reporting period, the two key operational priorities

were:

1. Progressing the permitting pathway, including the

regularisation of the mining concessions, tailing storage

facilities and the environmental permits.

2. Advancing the PFS, which commenced in 2021, and progressed in

earnest once the second stage funding from Cadence vested.

At the time of writing, the PFS is progressing well with all the

mineral processing and logistic studies completed and costed. The

updated MRE and ORE are both due for completion in October

2022.

The PFS contemplates refurbishing and rehabilitating the

existing port, rail and plant with modifications being made to the

beneficiation plant to achieve a larger portion of 65% iron

concentrate (4.9 Mt). The PFS is based on producing 5.3 Mt of iron

ore concentrate per annum. The PFS, once complete, will outline

more fully the development timelines and capital required to

achieve the stated project aims. After the publication of an

economic PFS, we expect DEV will seek to commission a Definitive

Study ("DFS"). The DFS is required to seek project debt and equity

finance, which will be sought once the DFS is complete.

PRIVATE INVESTMENTS, PASSIVE

Evergreen Lithium Limited

Interest - 13.16% at 30/06/2022

During the reporting period, Cadence and the shareholders of LT

and LS completed the sale of 100% of LT and LS to Evergreen PTY Ltd

("Evergreen"). Evergreen is an unlisted public company in Australia

that has been incorporated explicitly to acquire lithium assets.

The acquisition of LT and LS is its first acquisition. Evergreen

raised AS$ 6 million to pursue this strategy and now plans to list

on the Australian Stock Exchange.

The consideration for LT and LS is up to A$ 21.05 million

(GBP12.79 million). Cadence had 31.5% of LT and LS and will receive

up to A$ 6.63 million (GBP4.02 million). The initial consideration

that has been paid is AS$3.16 million (GBP1.92 million) in

Evergreen shares, or 15,830,136 shares at A$0.20 per share,

representing 13.16% of Evergreen.

Subject to performance milestones being achieved (found here ),

an additional AS$3.47 million (GBP2.10 million) will be paid in

Evergreen shares. If the performance targets are met, the total

consideration for Cadence's equity stake in LT and LS would be

AS$6.63 million (GBP3.80 million).

As a result of the acquisition, Evergreen, through its

subsidiaries, are the holder of two exploration licenses in the

Northern Territory, one granted and one in the application phase.

LT and LS further hold seven exploration license applications in

Argentina.

All of the licenses and applications target potential hard rock

lithium deposits. The most significant of these is the Litchfield

lithium prospect, which is contiguous to Core Lithium's (ASX: CXO)

strategic Finniss Lithium Project (JORC compliant ore reserves:

7.4Mt @ 1.3% Li2O). Evergreen has committed to spending at least

A$4 million on the exploration of Litchfield during the three years

post the completion of the sale.

Cadence's total investment in the LT & LS was GBP0.81

million. The Company has received GBP1.92 million as an initial

consideration and, subject to project milestones, will receive a

further GBP2.1 million. This represents a 159% return on the

initial consideration and a 395% return on the cumulative

consideration.

Yangibana Project, Australia

Interest - 30% at 30/06/2022

The Yangibana Project is a significant Australian Rare Earths

Project, containing substantial Neodymium and Praseodymium

resources. The Yangibana Project currently covers approximately 650

square kilometres containing some 9 Mining Leases, 2 Prospecting

Licenses and 19 Exploration Licenses. Cadence holds a 30% interest

in 3 Mining Leases and 6 Exploration licenses. These tenements

contain 0.70 million tonnes of Ore Reserves, which can increase the

expected mine life of the Yangibana Project by approximately one

year to a total of 16 years.

In June 2022, Cadence entered into a binding agreement to sell

its working interest in the leases to Hastings Technology Metals

(ASX: HAS) ("Hastings"), the current owner and operator of the

Yangibana Project.

The interests will be sold for A$9.0 million (GBP5.45 million)

to be settled by the issue of fully paid ordinary shares in

Hastings at a price to be determined based on 30 days VWAP before

completion, which is set at six months from the date of signing of

this agreement.

Hastings has commenced site construction and is planning to

begin commissioning the beneficiation plant in late 2023,

delivering maiden production to key customers in 2024.

In February of this year, Hastings published a revised NPV

calculation, which increased the NPV by 84% to AS$ 1 billion.

Hastings's current market capitalisation is circa A$ 415 million.

Also, in February, the Australian Government's Northern Australia

Infrastructure Facility (NAIF) approved a $140 million loan

facility to Hastings and Yangibana, making it the first Australian

rare earth project to receive NAIF funding.

Cadence's total investment in the Leases was GBP0.90 million.

Subject to the completion of the sale, we will receive

approximately GBP5.45 million in Hasting shares, representing a

502% return on our investment.

Sonora Lithium Project, Mexico

Interest - 30% at 30/06/2022

Cadence holds an interest in the Sonora Lithium Project via a

30% stake in the joint venture interests in each of Mexalit S.A. de

CV ("Mexalit") and Megalit S.A. de CV ("Megalit").

Mexalit forms part of the Sonora Lithium Project. The Sonora

Lithium Project consists of ten contiguous concessions covering

97,389 hectares. Two of the concessions (La Ventana, La Ventana 1)

are owned, as of the date, 100% by subsidiaries of Gangfeng Lithium

Co., Ltd ("Gangfeng"). El Sauz, El Sauz 1, El Sauz 2, Fleur and

Fleur 1 concessions are owned by Mexalit S.A. de C.V. ("Mexalit"),

which is owned 70% by Gangfeng and 30% by Cadence.

The Sonora Project holds one of the world's largest lithium

resources and benefits from being both high-grade and scalable. The

current lithium resources and reserves for the Sonora Lithium

Project and the amounts attributable to Cadence are available on

our website here:

https://www.cadenceminerals.com/projects/sonora-lithium-project/.

A feasibility study report was published in January 2018. The

report estimated a pre-tax project net present value of US$1.253

billion at an 8% discount rate, an Internal Rate of Return of 26.1%

and Life of Mine operating costs of US$3,910/t of lithium

carbonate. It should be noted that under the published feasibility

study, the concession owned by Mexalit will be mined starting in

year 9 of the mine plan, ceasing at the end of the mine life in

year 19.

In 2021, Mexican politicians from the MORENA party tabled a

draught bill to reform Mexico's energy sector, including statements

that lithium would be included among the minerals considered

strategic for the energy transition and that no new concessions for

lithium exploitation by private companies could be granted.

Subsequent to the year-end, the Mexican senate elevated lithium

deposits to the category of "strategic minerals", declaring

lithium's exploration, exploitation, and use as the state's

exclusive right.

We are constantly examining possible legislative changes, and

Gangfeng is ensuring that the mineral concessions remain

legitimate. It is our current view that the Decree passed by the

senate only impacts licenses, concessions, or contracts to be

granted, NOT already those already granted, as is the case for the

Sonora Lithium Project. Therefore, at this point, we do not believe

there is a material impact on our joint venture areas.

PUBLIC EQUITY

The public equity investment segment includes active and passive

investments as part of our trading portfolio. The trading portfolio

consists of investments in listed mining entities that the board

believes possess attractive underlying assets. The focus is to

invest in mining companies that are significantly undervalued by

the market and where there is substantial upside potential through

exploration success and/or the development of mining projects for

commercial production. Ultimately, the aim is to make capital gains

in the short to medium term. Investments are considered

individually based on various criteria and are typically traded on

the TSX, ASX, AIM or LSE.

During the period, our public equity investments generated an

unrealised loss of GBP5.26 million (6 months ended 30 June 2021: a

profit of GBP3.12 million) and a realised gain of GBP1.11 million

(6 months ended 30 June 2021: GBP0.42 million). The majority of

these profits were derived from the sale of European Metals

Holdings shares. The total return on investment for the Cadence

equity portfolio as of 28 September 2022 was 407%, or GBP9.95

million.

As of 30 June 2022, our public equity stakes consisted of the

following:

Company Business Summary 30-Jun-22 31-Dec-21 30-Jun-21 31-Dec-20

GBP,000 GBP,000 GBP,000 GBP,000

----------------------------- ---------- ---------- ---------- ----------

European Metals Holding Ltd Lithium mine development 5,357 11,287 14,180 13,426

----------------------------- ---------- ---------- ---------- ----------

Charger Metals NL Lithium exploration 196 342 109 -

----------------------------- ---------- ---------- ---------- ----------

Macarthur Minerals Ltd Iron Ore mine development 103 181 327 329

----------------------------- ---------- ---------- ---------- ----------

Eagle Mountain Mining Ltd Copper exploration 47 122 153 -

----------------------------- ---------- ---------- ---------- ----------

Mont-Royal Resources Ltd Gold and Copper exploration 39 35 - -

----------------------------- ---------- ---------- ---------- ----------

Celsius Resources Ltd Gold and Copper exploration - - 103 -

----------------------------- ---------- ---------- ---------- ----------

Miscellaneous Various 5 7 6 6

----------------------------- ---------- ---------- ---------- ----------

Total 5,747 11,974 14,878 13,761

---------- ---------- ---------- ----------

FINANCIAL RESULTS:

During the period, the Group made a loss before taxation of

GBP5.05 million (6 months ended 30 June 2021: profit of GBP2.84

million, year ended 31 December 2021: loss of GBP0.14 million).

There was a weighted basic loss per share of 3.136p (30 June 2021:

profit 2.009p, 31 December 2021: loss 0.102p). During the second

half of the year, the Directors expect the results to reflect the

approximately GBP4.2m profit from the sale of the Group's Yangibana

Joint Venture Interest.

The total assets of the Group decreased from GBP23.01 million at

31 December 2021 to GBP21.93 million. Of this amount, the decrease

of GBP6.23 million represents the market value of our current

investments at the period end, plus there was an increase in our

non-current investments of GBP3.30m.

During the period our net cash outflow from operating activities

was GBP1.65 million, gross proceeds of GBP4.9m were raised through

the issue of new shares and our net cash position ended the period

up GBP1.66 million at GBP1.99 million.

Kiran Morzaria

Director

28 September 2022

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information:

Cadence Minerals plc +44 (0) 20 3582 6636

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD & Broker) +44 (0) 20 7220 1666

James Joyce

Darshan Patel

CADENCE MINERALS PLC

STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2022

Unaudited Period ended Unaudited Period ended Audited

Year ended

30 June 30 June 31 December 2021

2022 2021

Notes GBP'000 GBP'000 GBP'000

Income

Unrealised (loss)/profit on

financial investments (5,259) 3,116 577

Realised profit on financial

investments 1,110 423 593

(4,149) 3,539 1,170

Share-based payments - (197) (197)

Other administrative expenses (906) (505) (1,604)

Total administrative expenses (906) (702) (1,801)

Operating (loss)/profit (5,055) 2,837 (631)

Finance income - 29 35

Finance cost - (4) (3)

Foreign exchange gains/(losses) 10 (21) 455

(Loss)/profit before taxation (5,045) 2,841 (144)

Taxation - - -

----------------------- ----------------------- ------------------

(Loss)/profit attributable to the

equity holders of the Company (5,045) 2,841 (144)

Total comprehensive (loss)/profit

for the period, attributable to

the equity holders of the

Company (5,045) 2,841 (144)

----------------------- ----------------------- ------------------

Earnings per ordinary share

Basic (pence per share) 3 (3.136) 2.009 (0.102)

----------------------- ----------------------- ------------------

Diluted (pence per share) 3 n/a 1.899 n/a

----------------------- ----------------------- ------------------

CADENCE MINERALS PLC

STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2022

Share capital Share premium Share-based Investment in Retained Total equity

account payment own shares earnings

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2021 1,896 33,159 39 - (13,001) 22,093

Share based

payments - - 197 - - 197

Transfer on

exercise of

options - - (9) - 9 -

Issue of share

capital 7 50 - - - 57

Costs of share

issue - (1) - - - (1)

Transactions

with owners 7 49 188 - 9 253

-------------- ---------------- --------------- ---------------- ---------------- -------------

Profit for the

period - - - - 2,841 2,841

Total

comprehensive

profit for the

period - - - - 2,841 2,841

-------------- ---------------- --------------- ---------------- ---------------- -------------

Balance at 30

June 2021

(unaudited) 1,903 33,208 227 - (10,151) 25,187

-------------- ---------------- --------------- ---------------- ---------------- -------------

Payment made in

warrants - - 22 - - 22

Adjustment for

shares held in

Trust - - - (70) - (70)

Costs of share

issue - (1) - - - (1)

Transactions

with owners - (1) 22 (70) - (49)

-------------- ---------------- --------------- ---------------- ---------------- -------------

Loss for the

period - - - - (2,985) (2,985)

Total

comprehensive

loss for the

period - - - - (2,985) (2,985)

-------------- ---------------- --------------- ---------------- ---------------- -------------

Balance at 31

December 2021 1,903 33,207 249 (70) (13,136) 22,153

-------------- ---------------- --------------- ---------------- ---------------- -------------

Transfer on

exercise of

warrants - - (10) - 10 -

Issue of share

capital 241 4,670 - - - 4,911

Issue of shares

held in Trust - 111 - 6 - 117

Costs of share

issue - (376) - - - (376)

Transactions

with owners 241 4,405 (10) 6 10 4,652

-------------- ---------------- --------------- ---------------- ---------------- -------------

Loss for the

period - - - - (5,045) (5,045)

Total

comprehensive

loss for the

period - - - - (5,045) (5,045)

-------------- ---------------- --------------- ---------------- ---------------- -------------

Balance at 30

June 2022

(unaudited) 2,144 37,612 239 (64) (18,171) 21,760

-------------- ---------------- --------------- ---------------- ---------------- -------------

CADENCE MINERALS PLC

STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current

Financial Assets 8,963 3,203 5,660

---------- ---------- -------------

8,963 3,203 5,660

Current assets

Trade and other receivables 5,222 5,901 5,048

Financial Assets 5,747 14,878 11,974

Cash and cash equivalents 1,994 1,387 324

---------- ---------- -------------

Total current assets 12,963 22,166 17,346

Total assets 21,926 25,369 23,006

========== ========== =============

EQUITY AND LIABILITIES

Current liabilities

Trade and other payables 166 182 853

---------- ---------- -------------

Total current liabilities 166 182 853

Equity

Share capital 4 2,144 1,903 1,903

Share premium 37,612 33,208 33,207

Share based payment reserve 239 227 249

Investment in own shares (64) - (70)

Retained earnings (18,171) (10,151) (13,136)

---------- ---------- -------------

Equity attributable 21,760 25,187 22,153

to equity holders of the Company

---------- ---------- -------------

Total equity and liabilities 21,926 25,369 23,006

========== ========== =============

CADENCE MINERALS PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD 30 JUNE 2022

Unaudited Period ended Unaudited Period ended Audited

Year ended

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Operating (loss)/profit (5,055) 2,837 (631)

Net realised/unrealised loss/(profit) on

financial investments 4,149 (3,539) (1,170)

Equity settled share-based payments - 197 197

Adjustment for issue of own shares 117 - (70)

Payments made through issue of warrants - - 22

(Increase)/decrease in trade and other

receivables (170) (536) 346

(Decrease)/increase in trade and other

payables (687) (113) 555

Net cash outflow from operating activities (1,646) (1,154) (751)

----------------------- ----------------------- -------------

Taxation - - -

Cash flows from investing activities

Payments for current financial investments (176) (473) (830)

Receipts on sale of current investments 1,256 2,895 3,787

Payments for non-current financial investments (2,305) (318) (2,775)

Net cash (outflow)/inflow from investing

activities (1,225) 2,104 182

----------------------- ----------------------- -------------

Cash flows from financing activities

Proceeds from issue of share capital 4,911 57 57

Share issue costs (376) (1) (2)

Net loan repayments - (219) (220)

Finance cost - (3) (3)

Net cash inflow/(outflow) from financing

activities 4,535 (166) (168)

----------------------- ----------------------- -------------

Net increase/(decrease) in cash and cash

equivalents 1,664 784 (737)

Foreign exchange movements on cash and cash

equivalents 6 7 465

Cash and cash equivalents at beginning of

period 324 596 596

Cash and cash equivalents at end of period 1,994 1,387 324

----------------------- ----------------------- -------------

NOTES TO THE INTERIM REPORT

FOR THE PERIODED 30 JUNE 2022

1 BASIS OF PREPARATION

The interim financial statements have been prepared in

accordance with applicable accounting standards and under the

historical cost convention. The financial information set out in

this interim report does not constitute statutory accounts as

defined in section 434 of the Companies Act 2006. The Group's

statutory financial statements for the year ended 31 December 2021

have been delivered to the Registrar of Companies. The auditor's

report on those financial statements was unqualified.

The principal accounting policies of the Group are consistent

with those detailed in the 31 December 2021 financial statements,

which are prepared under the historical cost convention and in

accordance with UK adopted International Accounting Standards

(IAS).

GOING CONCERN

The Directors have prepared cash flow forecasts for the period

ending 30 September 2023. The forecasts demonstrate that the Group

has sufficient funds to allow it to continue in business for a

period of at least twelve months from the date of approval of these

financial statements. Accordingly, the accounts have been prepared

on a going concern basis.

CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal the related actual results

2 SEGMENTAL REPORTING

The Company operates a single primary activity to invest in

businesses so as to generate a return for the shareholders.

3 EARNINGS PER SHARE

The calculation of the earnings per share is based on the loss

attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2022 30 June 2021 31 December 2021

(restated)

GBP'000 GBP'000 GBP'000

Profit/(loss) on ordinary activities after tax (GBP'000) (5,045) 2,841 (144)

----------------- ----------------- -----------------

Weighted average number of shares for calculating basic

earnings per share 167,656,144 148,420,359 148,535,664

----------------- ----------------- -----------------

Less: shares held by the Employee Benefit Trust

(weighted average) (6,804,309) (7,020,000) (7,020,000)

Weighted average number of shares for calculating basic

earnings per share 160,851,835 141,400,359 141,515,664

Share options and warrants exercisable 8,562,500 8,198,405 8,998,405

Weighted average number of shares for calculating

diluted earnings per share 176,218,644 149,598,764 150,514,069

----------------- ----------------- -----------------

Basic (loss)/profit per share (pence) (3.136) 2.009 (0.102)

----------------- ----------------- -----------------

Diluted profit per share (pence) n/a 1.899 n/a

----------------- ----------------- -----------------

4 SHARE CAPITAL

Unaudited Unaudited Audited

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Allotted, issued and fully paid

172,719,813 ordinary shares of 1p (30 June 2021 148,649,098

ordinary shares of 1p, 31 December

2021: 148,649,098 ordinary shares of 1p) 1,727 1,486 1,486

173,619,050 deferred shares of 0.24p (30 June and 31 December

2021: 173,619,050) 417 417 417

------------- ------------- -----------------

2,144 1,903 1,903

------------- ------------- -----------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAENXADXAEAA

(END) Dow Jones Newswires

September 28, 2022 02:02 ET (06:02 GMT)

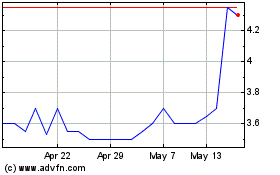

Cadence Minerals (LSE:KDNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cadence Minerals (LSE:KDNC)

Historical Stock Chart

From Nov 2023 to Nov 2024